In the age of digital, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use and creative work, or simply to add an element of personalization to your space, Tax Credit On Daycare Expenses have become an invaluable resource. For this piece, we'll dive into the sphere of "Tax Credit On Daycare Expenses," exploring their purpose, where to find them, and what they can do to improve different aspects of your daily life.

Get Latest Tax Credit On Daycare Expenses Below

Tax Credit On Daycare Expenses

Tax Credit On Daycare Expenses -

Verkko 18 lokak 2023 nbsp 0183 32 Topic No 602 Child and Dependent Care Credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses such as day care for a child under 13 a spouse

Tax Credit On Daycare Expenses include a broad range of printable, free materials that are accessible online for free cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and more. The great thing about Tax Credit On Daycare Expenses lies in their versatility as well as accessibility.

More of Tax Credit On Daycare Expenses

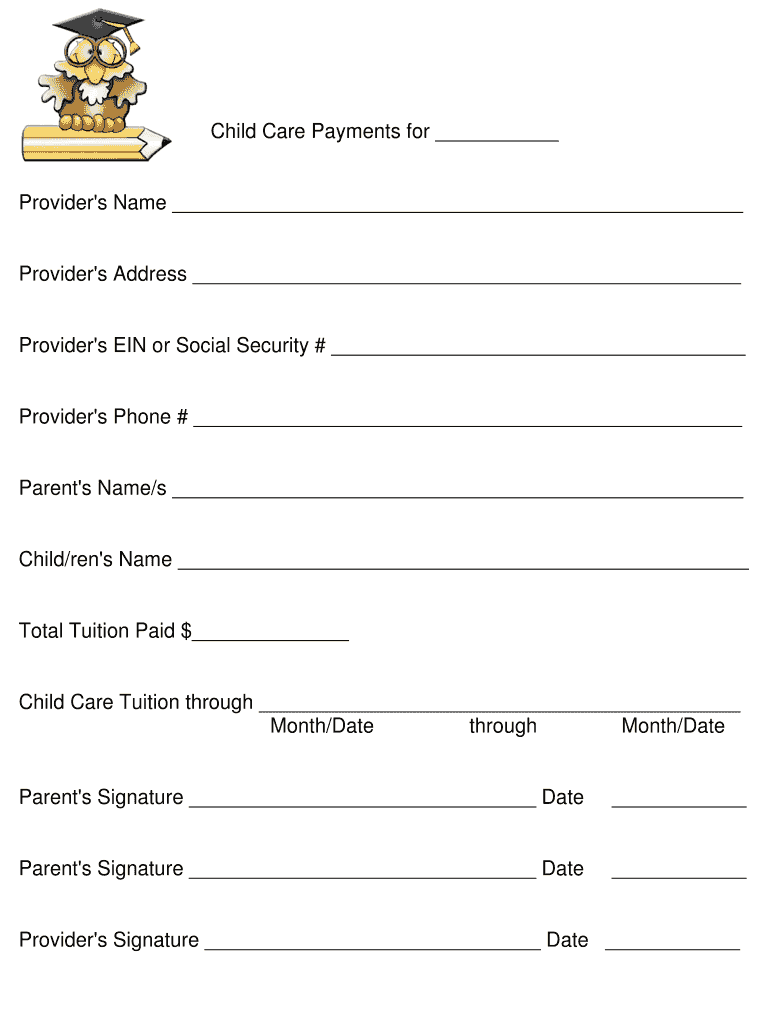

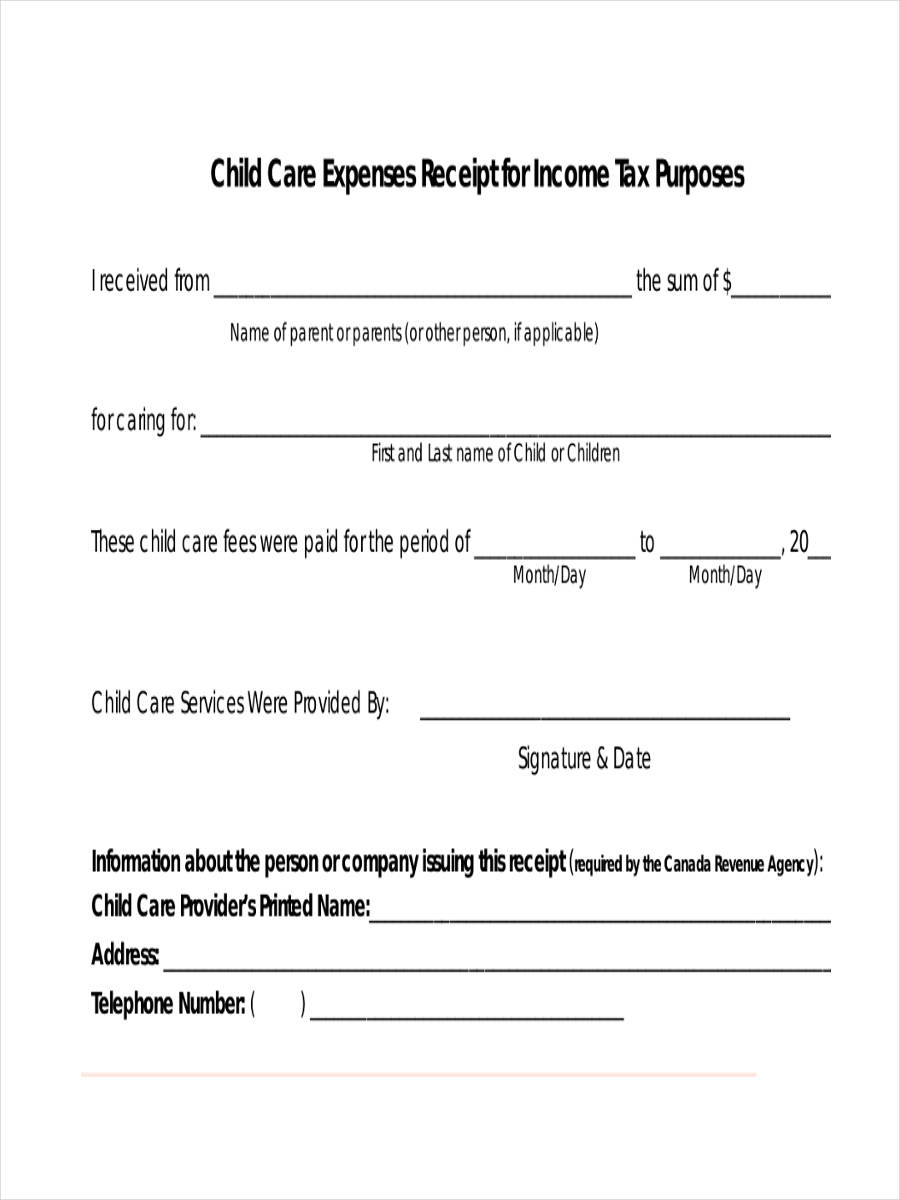

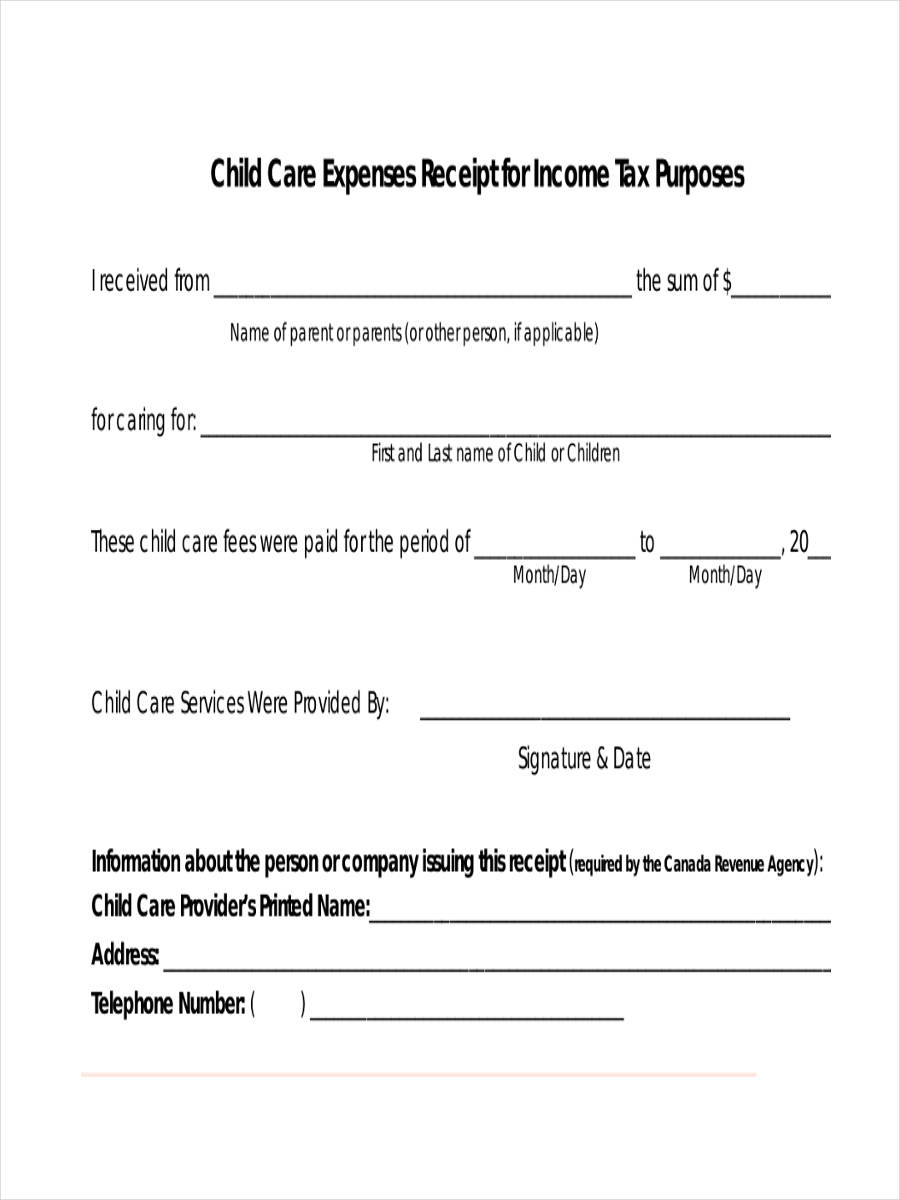

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

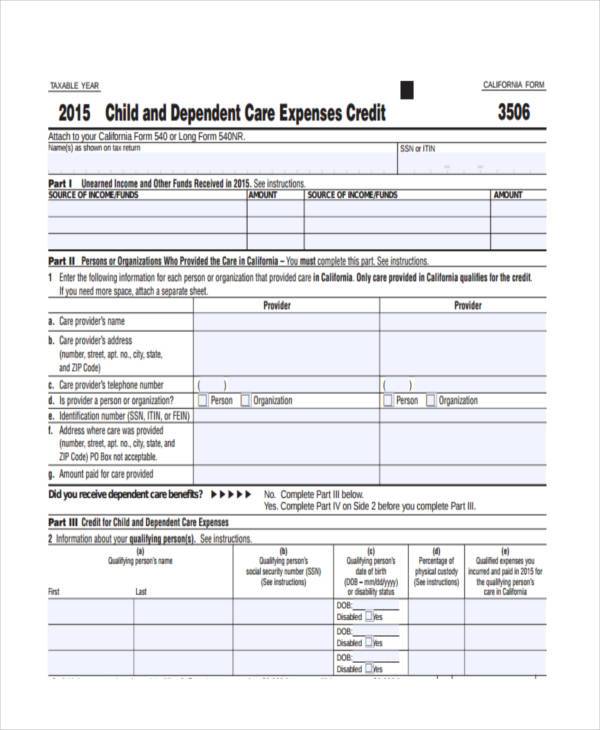

Verkko 11 tammik 2023 nbsp 0183 32 Page Last Reviewed or Updated 11 Jan 2023 Information about Form 2441 Child and Dependent Care Expenses including recent updates related forms and instructions on how to file Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit

Verkko IRS Tax Tip 2020 68 June 10 2020 Childcare or adult dependent care can be a major expense Fortunately the child and dependent care credit can provide some relief Taxpayers who pay for daycare expenses may be eligible to claim up to 35 of what they spend limits apply For the purposes of this credit the IRS defines a qualifying

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization We can customize printables to fit your particular needs in designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: The free educational worksheets cater to learners of all ages, making them a useful tool for parents and teachers.

-

Easy to use: Instant access to various designs and templates helps save time and effort.

Where to Find more Tax Credit On Daycare Expenses

Daycare Business Income And Expense Sheet To File childcare

Daycare Business Income And Expense Sheet To File childcare

Verkko 7 marrask 2023 nbsp 0183 32 The Daycare Tax Credit is based on a percentage of your qualifying childcare expenses ranging from 20 to 35 depending on your adjusted gross income The maximum allowable expenses for the credit are 3 000 for one child and 6 000 for two or more children

Verkko 30 jouluk 2022 nbsp 0183 32 Key Takeaways Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or more dependents Your applicable percentage depends on your adjusted gross income AGI and decreases with the more you earn The credit

After we've peaked your interest in Tax Credit On Daycare Expenses Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of uses.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets including flashcards, learning materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad range of topics, everything from DIY projects to party planning.

Maximizing Tax Credit On Daycare Expenses

Here are some innovative ways to make the most use of Tax Credit On Daycare Expenses:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Credit On Daycare Expenses are a treasure trove filled with creative and practical information which cater to a wide range of needs and preferences. Their accessibility and flexibility make them an essential part of each day life. Explore the endless world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credit On Daycare Expenses truly available for download?

- Yes they are! You can download and print these items for free.

-

Are there any free printables for commercial purposes?

- It's based on specific terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in Tax Credit On Daycare Expenses?

- Some printables may contain restrictions in their usage. Check the conditions and terms of use provided by the designer.

-

How can I print Tax Credit On Daycare Expenses?

- You can print them at home with any printer or head to any local print store for higher quality prints.

-

What software do I require to open printables that are free?

- The majority of printed documents are with PDF formats, which can be opened with free software like Adobe Reader.

Childcare Expenses Abstract Concept Vector Illustration Stock Vector

How To Have A Financially Healthy Marriage CreditLoan

Check more sample of Tax Credit On Daycare Expenses below

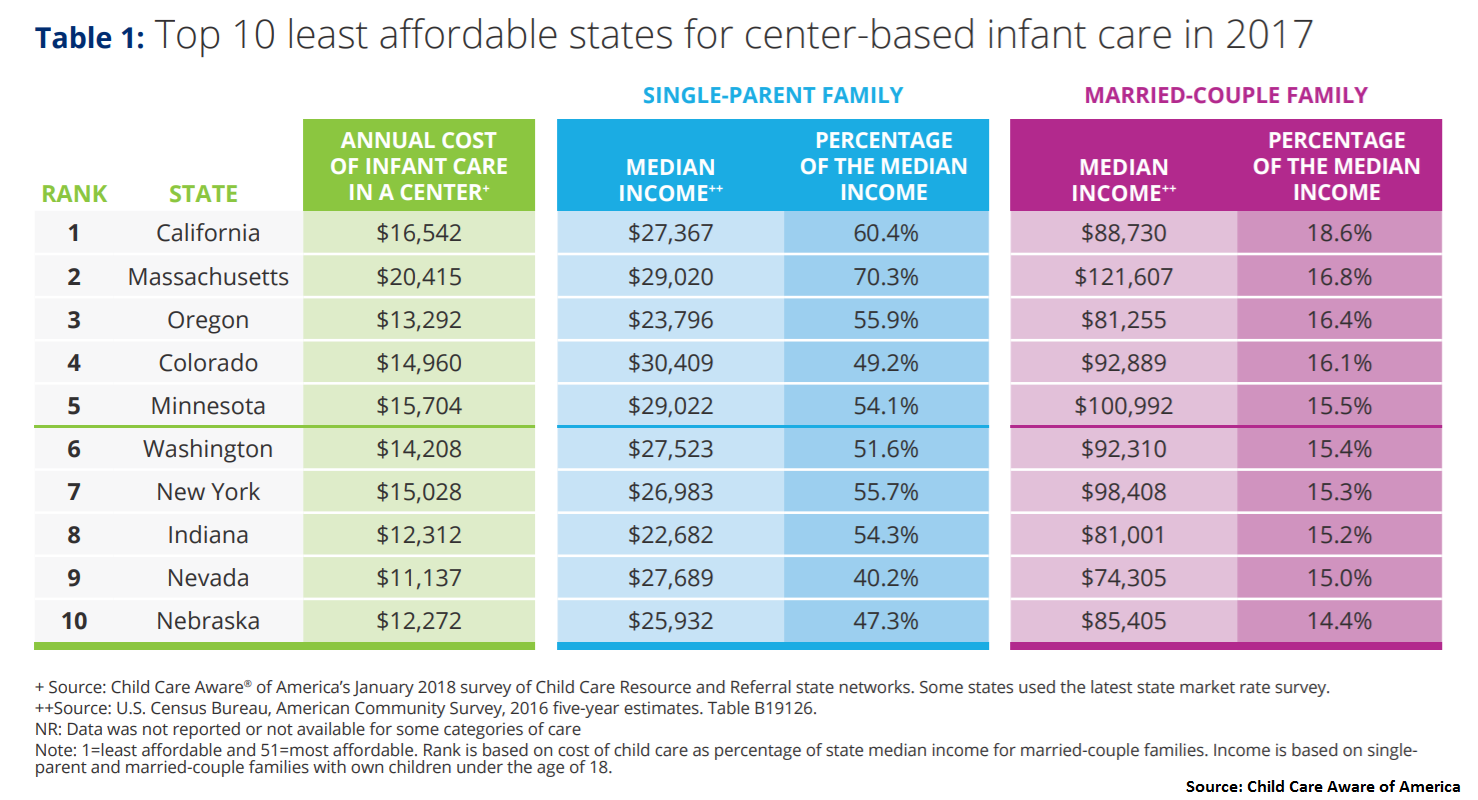

Childcare Costs Hit New Heights How You Can Save 5 000 A Year

Childcare Expenses Abstract Concept Vector Illustration Stock Vector

Military Families May Receive New Daycare Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/OY7UO5EPSVBDPENBCVGDPHINFY.jpg)

Best Credit Cards For Daycare Expenses The Points Guy

Care Credit Printable Application Printable Word Searches

Childcare Expenses Abstract Concept Vector Illustration Stock

https://www.nerdwallet.com/.../taxes/child-and-dependent-care-tax-credit

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses such as day care for a child under 13 a spouse

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

Verkko 11 kes 228 k 2021 nbsp 0183 32 Child and Dependent Care Credit FAQs Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses such as day care for a child under 13 a spouse

Verkko 11 kes 228 k 2021 nbsp 0183 32 Child and Dependent Care Credit FAQs Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage

Best Credit Cards For Daycare Expenses The Points Guy

Childcare Expenses Abstract Concept Vector Illustration Stock Vector

Care Credit Printable Application Printable Word Searches

Childcare Expenses Abstract Concept Vector Illustration Stock

Babysitting Income Tax 2018

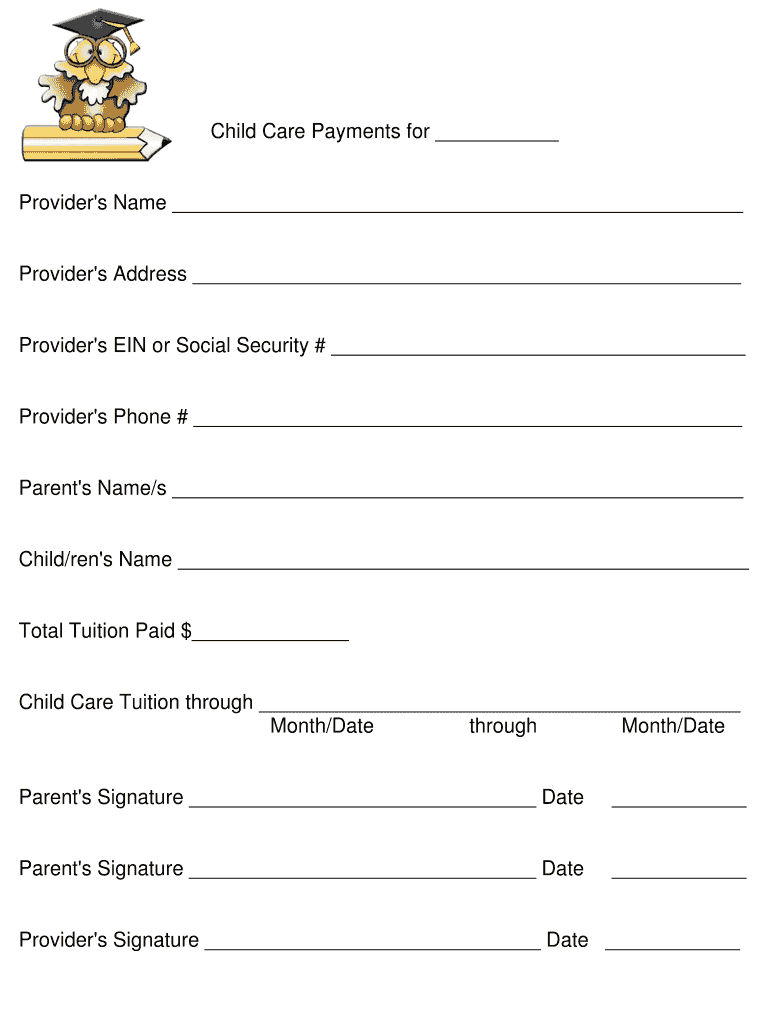

Free Printable Daycare Tax Forms For Parents Printable Forms Free Online

Free Printable Daycare Tax Forms For Parents Printable Forms Free Online

Childcare Expenses Abstract Concept Vector Illustration Stock Vector