In a world when screens dominate our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons as well as creative projects or simply to add an individual touch to the space, Tax Credit On Rental Property are a great source. Here, we'll take a dive through the vast world of "Tax Credit On Rental Property," exploring what they are, how to find them, and ways they can help you improve many aspects of your life.

Get Latest Tax Credit On Rental Property Below

Tax Credit On Rental Property

Tax Credit On Rental Property -

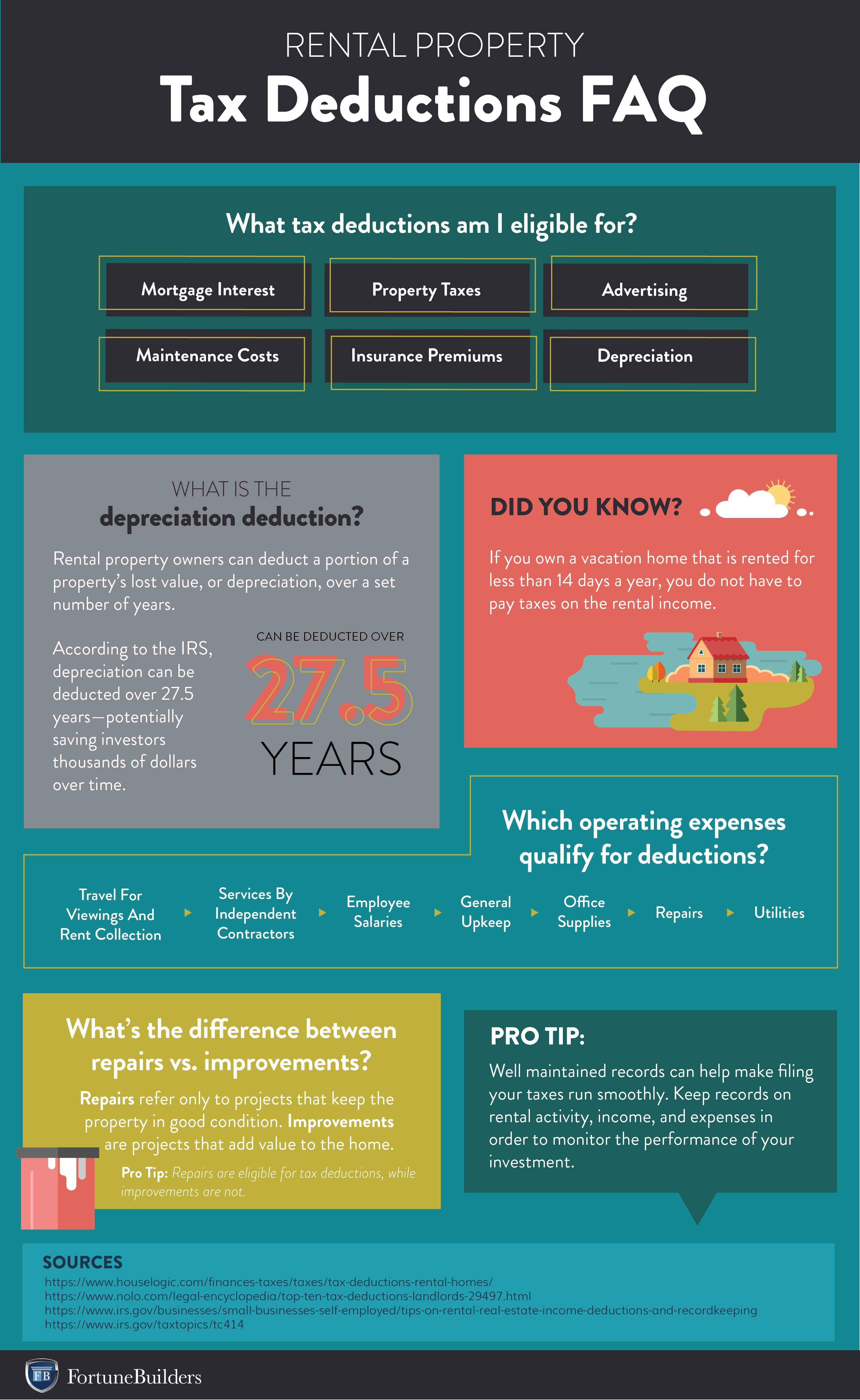

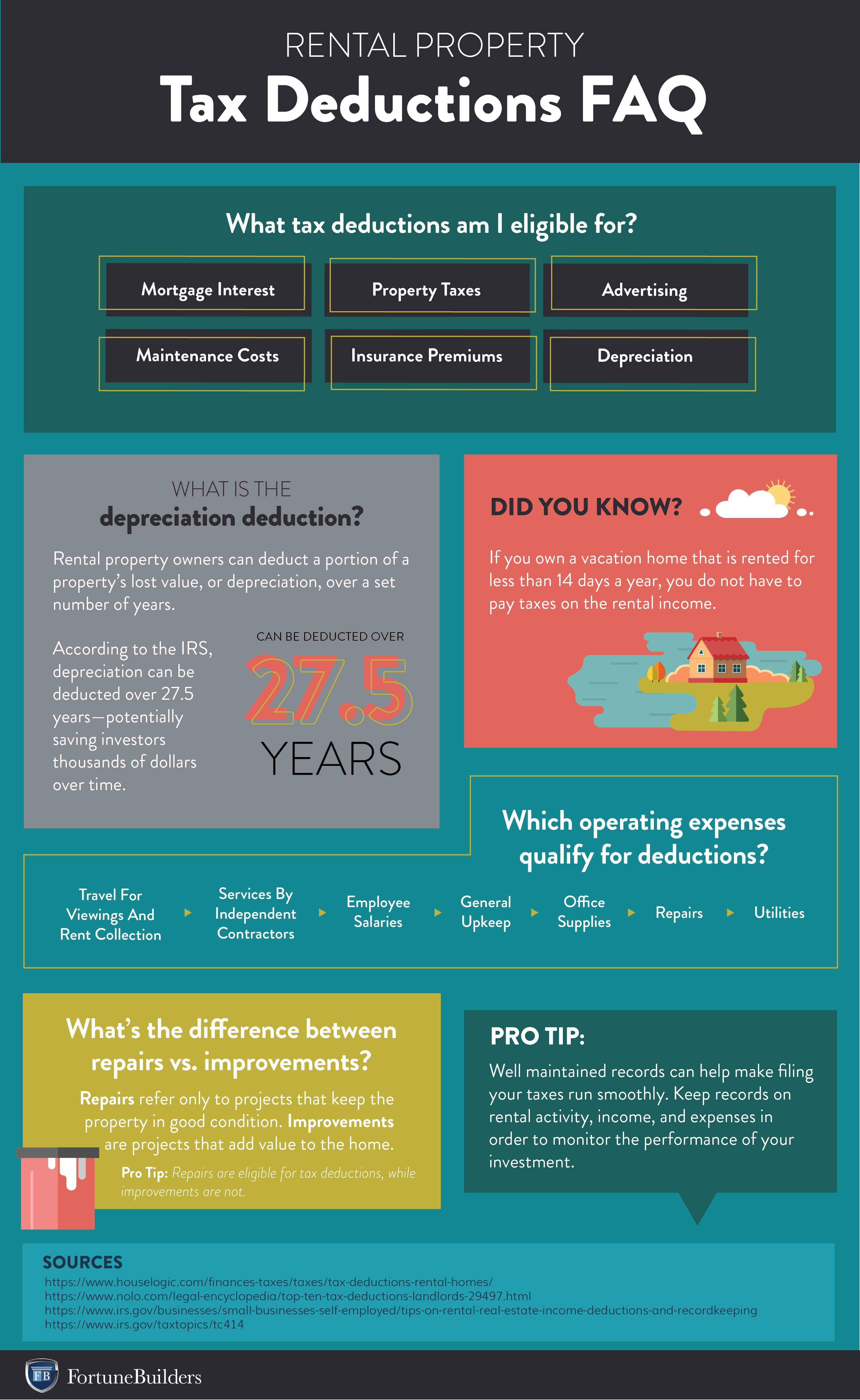

Rental Property Deductions You Can Take at Tax Time Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 April 25 2024 1 44 PM OVERVIEW Rental property often offers larger deductions and tax benefits than most investments Many of these are overlooked by landlords at tax time

The government uses the tax credit to subsidize property owners who acquire construct or rehabilitate affordable rental housing Apartment buildings single family homes townhouses and

Printables for free cover a broad range of printable, free documents that can be downloaded online at no cost. These resources come in various formats, such as worksheets, templates, coloring pages, and much more. The appealingness of Tax Credit On Rental Property is their flexibility and accessibility.

More of Tax Credit On Rental Property

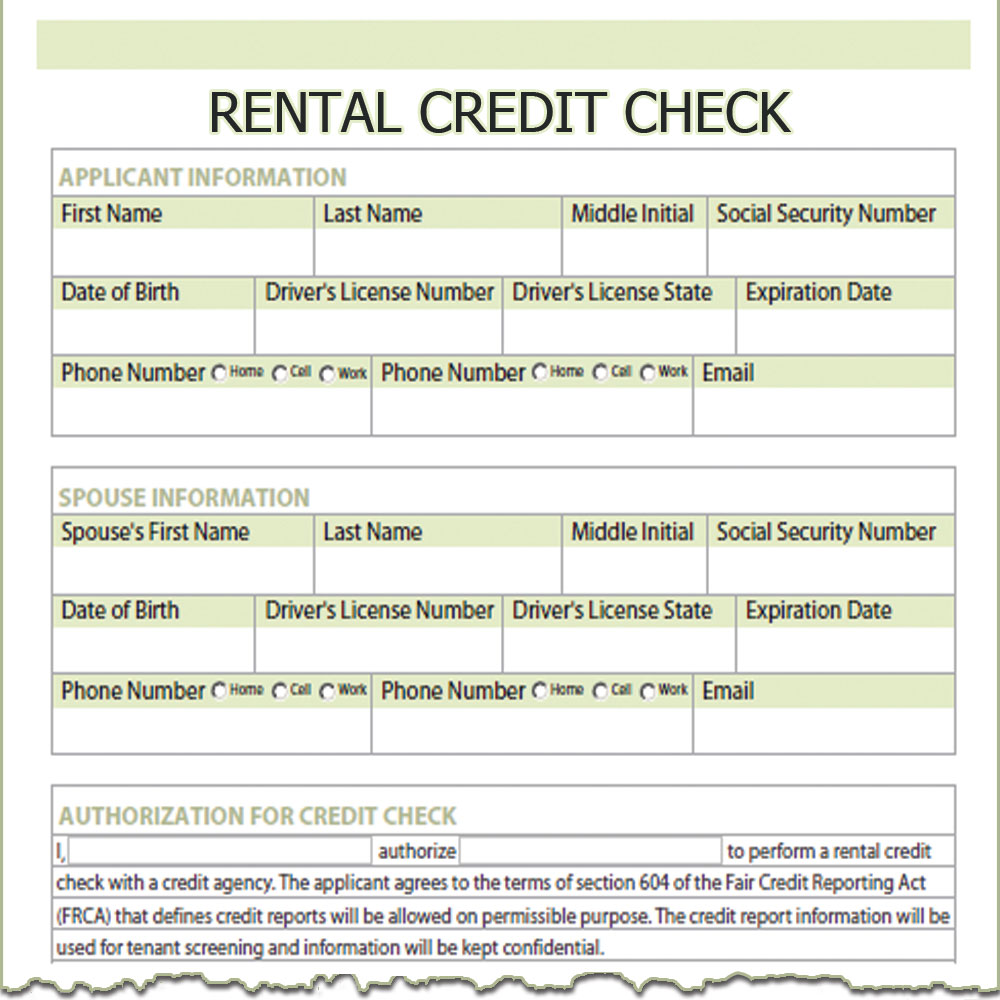

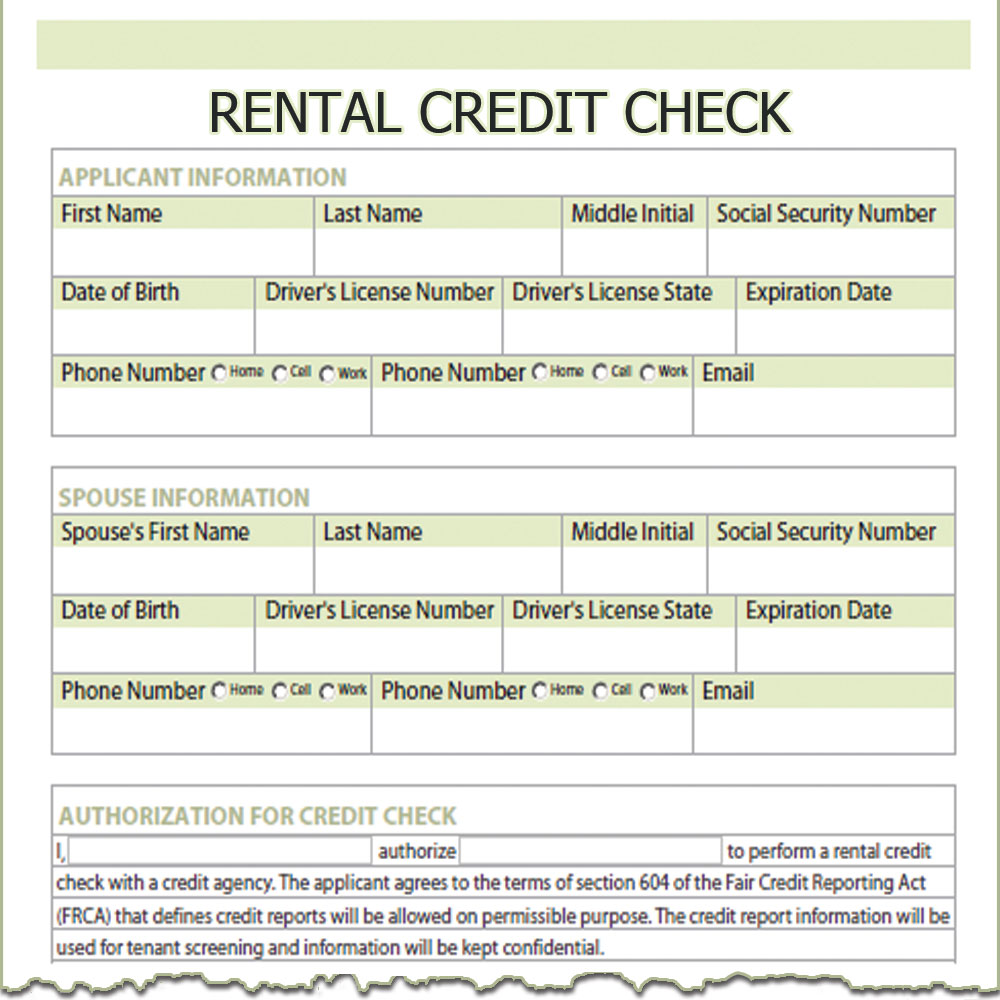

Rental Credit Check

Rental Credit Check

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs You can deduct the ordinary and necessary expenses for managing conserving and maintaining

Key Takeaways Rental income is taxable and you should report your rental income and any qualifying deductions on Schedule E Supplemental Income and Loss You re generally required to report your rental income on the return for the year you actually receive it even if it s credited to your tenant for a different year

The Tax Credit On Rental Property have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor the design to meet your needs be it designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value Printing educational materials for no cost provide for students from all ages, making them a useful tool for parents and educators.

-

The convenience of Quick access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Tax Credit On Rental Property

Calculating Cost Basis On Rental Property Sale RamandhaAde

Calculating Cost Basis On Rental Property Sale RamandhaAde

The most recent real estate tax assessment values the property at 280 000 of which 252 000 is for the home and 28 000 is for the land Therefore you can allocate 90 252 000 280 000 of

Landlord Tax Deduction Basics Deducting Interest on Rental Property Find out a landlord s most common deductible interest payments By Stephen Fishman J D USC Gould School of Law As a general rule you may deduct interest on money you borrow for a business or investment activity including being a landlord

After we've peaked your interest in Tax Credit On Rental Property Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of reasons.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free with flashcards and other teaching tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast variety of topics, starting from DIY projects to party planning.

Maximizing Tax Credit On Rental Property

Here are some creative ways of making the most of Tax Credit On Rental Property:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Credit On Rental Property are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and desires. Their accessibility and versatility make them an essential part of each day life. Explore the endless world of Tax Credit On Rental Property today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printouts for commercial usage?

- It's all dependent on the usage guidelines. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables might have limitations concerning their use. Always read the terms and regulations provided by the author.

-

How can I print Tax Credit On Rental Property?

- Print them at home using either a printer at home or in a local print shop to purchase the highest quality prints.

-

What program do I need to open printables that are free?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost programs like Adobe Reader.

How To Calculate Depreciation Expense Rental Property Haiper

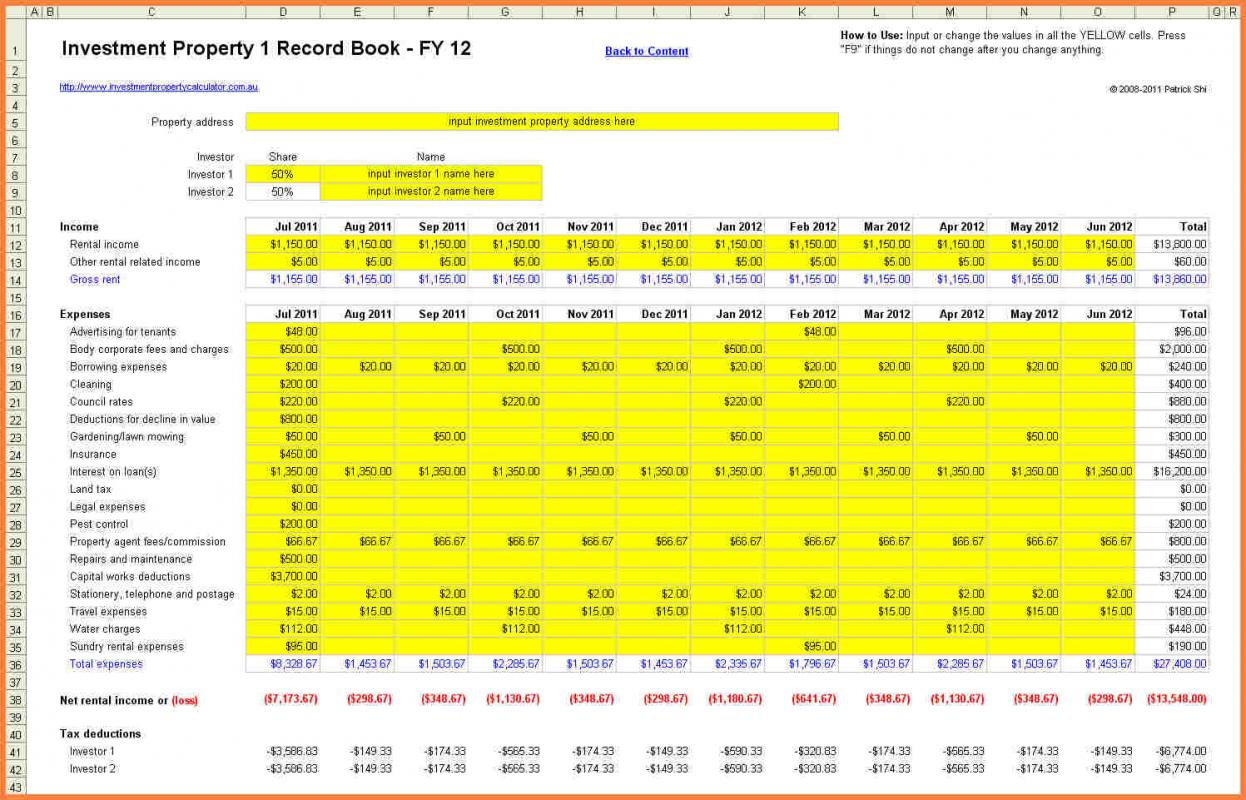

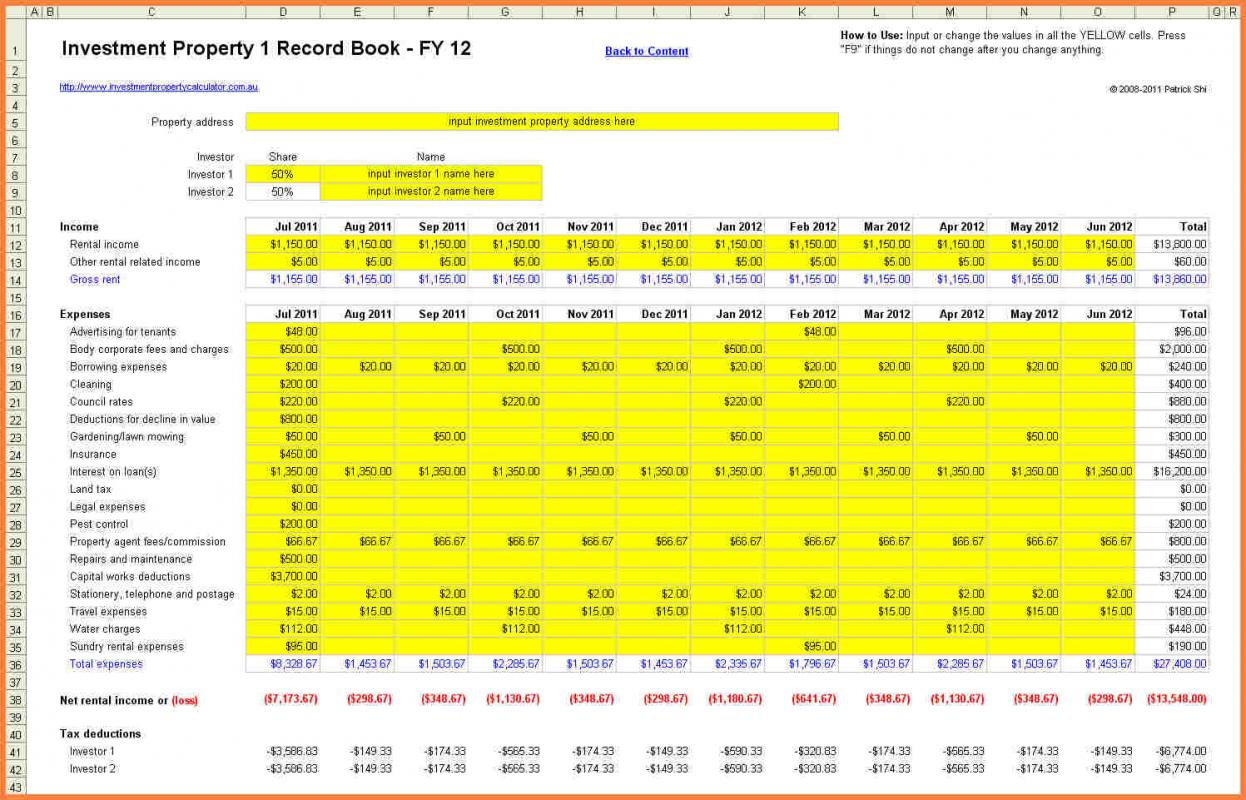

How To Track Your Rental Property Expenses In 2022 2022

Check more sample of Tax Credit On Rental Property below

Can You Take Solar Credit On Rental Property Solair World

Figuring Out Depreciation On Rental Property EamonMunira

20 Capital Gains Worksheet

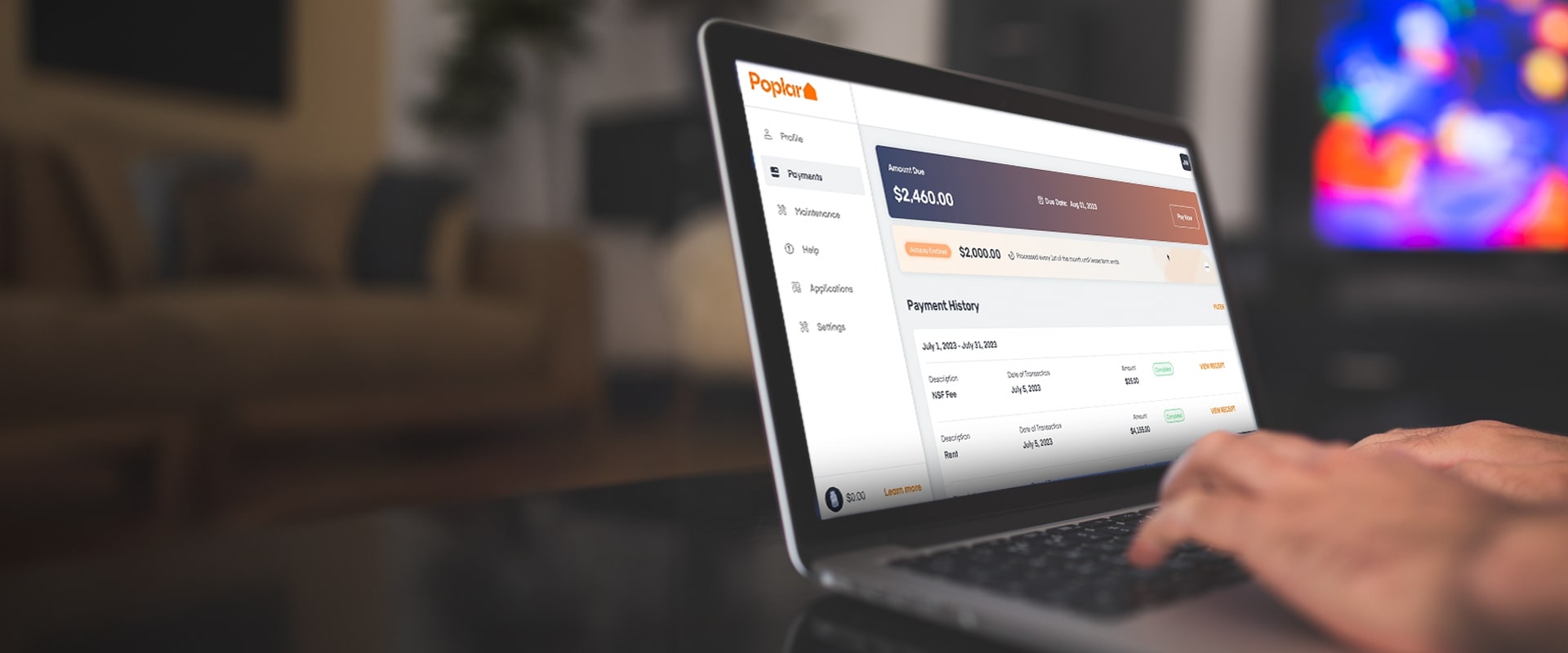

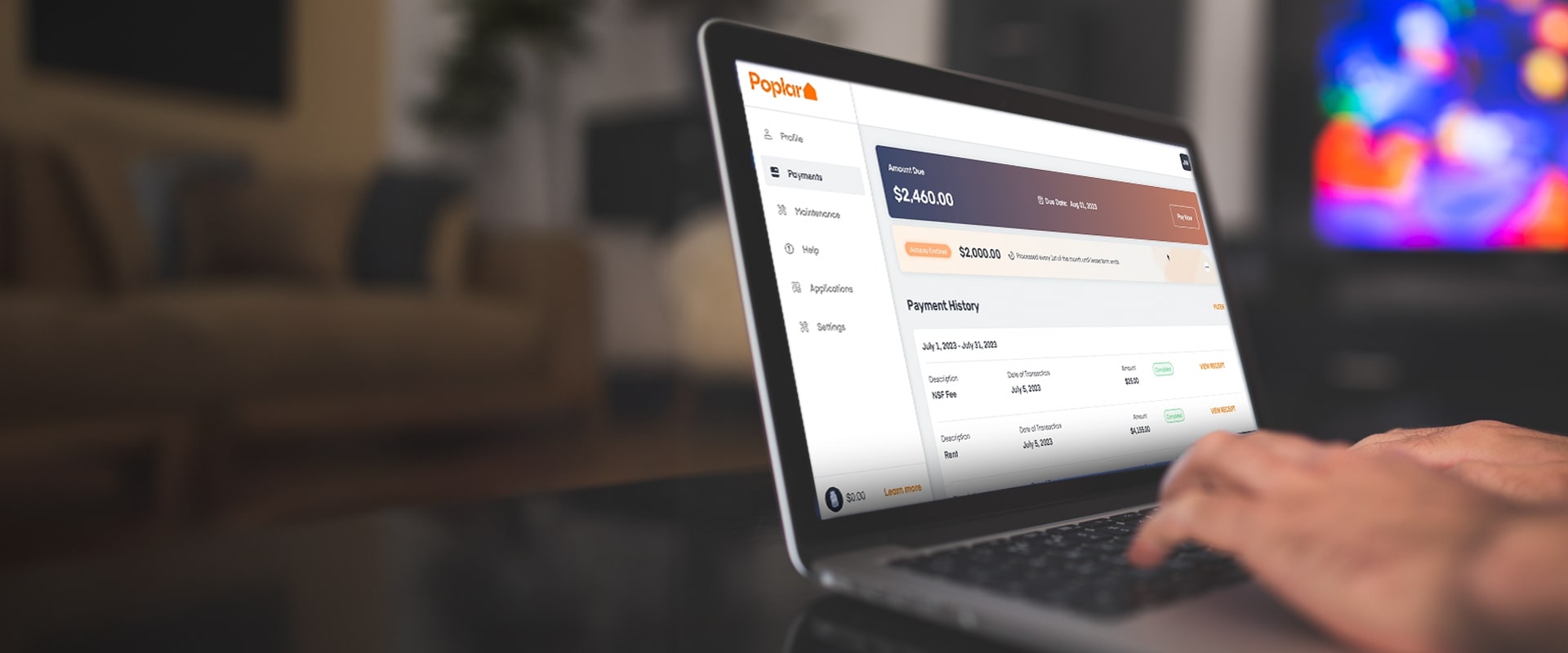

Advantages Of Company Towns Archives Poplar Homes

Property Management Spreadsheet Template Free In Property Management

Disadvantages Of Company Towns Archives Poplar Homes

https://www.investopedia.com/tax-credit-property-156010

The government uses the tax credit to subsidize property owners who acquire construct or rehabilitate affordable rental housing Apartment buildings single family homes townhouses and

https://www.investopedia.com/articles/pf/06/rentalowner.asp

Key Takeaways Rental property owners can deduct the costs of owning maintaining and operating the property Most residential rental property is depreciated at a rate of 3 636 per year for 27 5

The government uses the tax credit to subsidize property owners who acquire construct or rehabilitate affordable rental housing Apartment buildings single family homes townhouses and

Key Takeaways Rental property owners can deduct the costs of owning maintaining and operating the property Most residential rental property is depreciated at a rate of 3 636 per year for 27 5

Advantages Of Company Towns Archives Poplar Homes

Figuring Out Depreciation On Rental Property EamonMunira

Property Management Spreadsheet Template Free In Property Management

Disadvantages Of Company Towns Archives Poplar Homes

San Diego Capital Gains Tax On Rental Property In 2022 2023

How To Avoid Paying Tax On Rental Income Drugphase

How To Avoid Paying Tax On Rental Income Drugphase

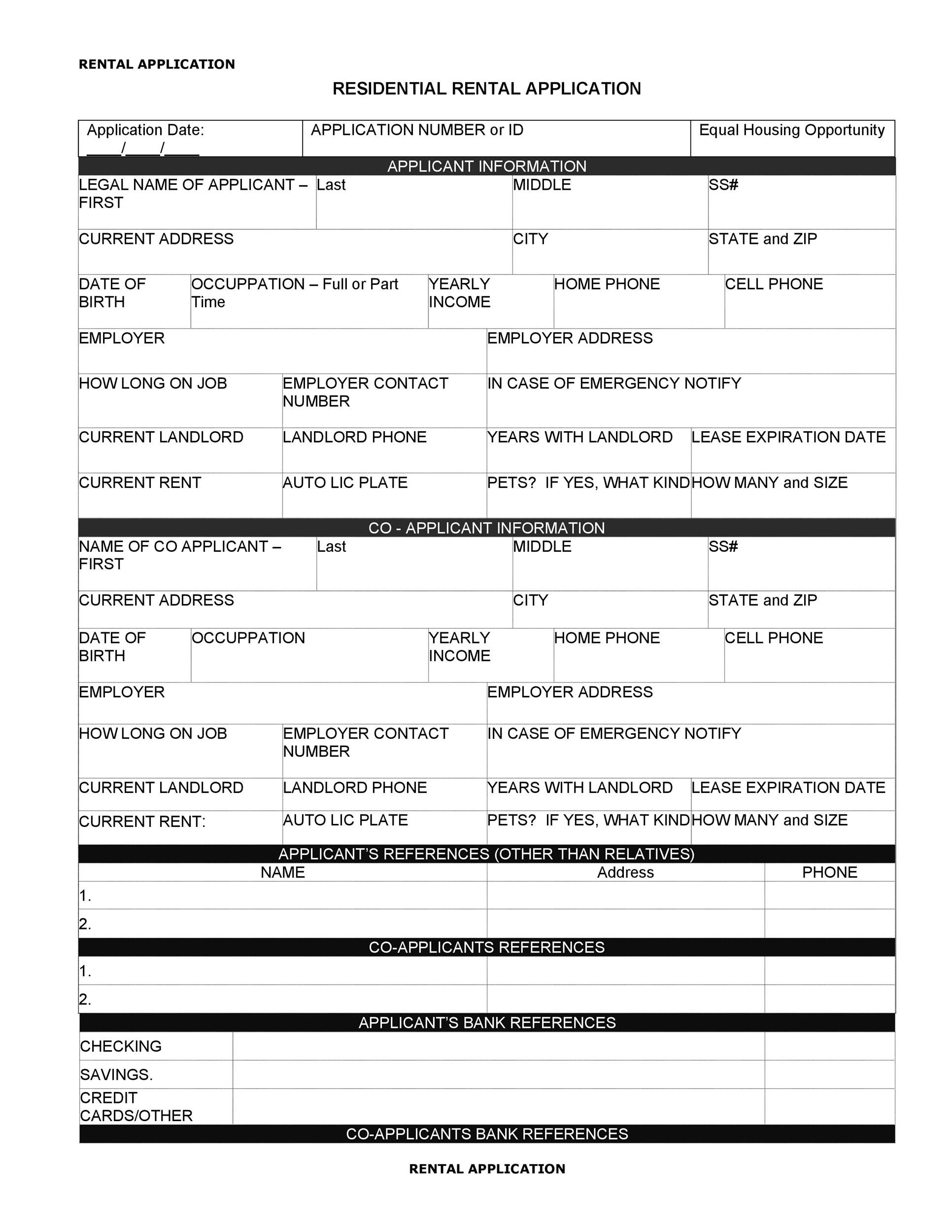

Free Rental Application Download