Today, when screens dominate our lives and the appeal of physical printed objects hasn't waned. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding personal touches to your home, printables for free are now a useful source. Through this post, we'll dive into the world of "Tax Credit Solar Rebate," exploring their purpose, where to get them, as well as how they can improve various aspects of your life.

Get Latest Tax Credit Solar Rebate Below

Tax Credit Solar Rebate

Tax Credit Solar Rebate -

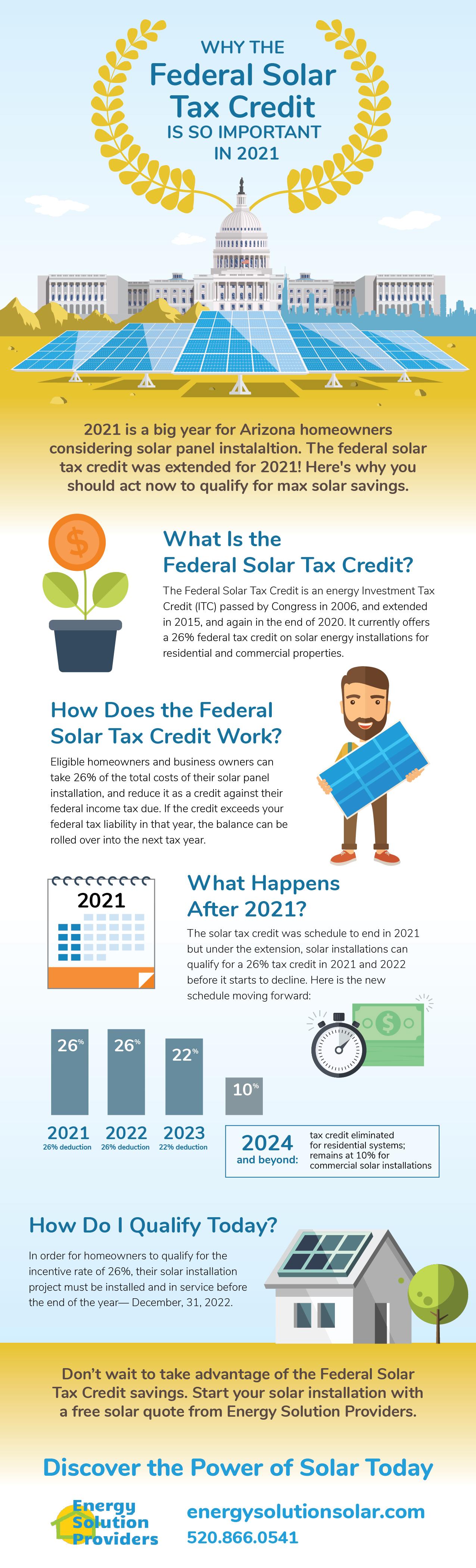

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed a system in 2022 your tax credit has increased from 22 to 30 if you haven t already claimed it

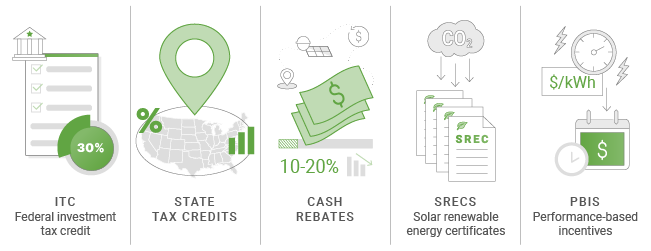

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

Tax Credit Solar Rebate cover a large range of downloadable, printable material that is available online at no cost. They come in many kinds, including worksheets templates, coloring pages, and more. The appealingness of Tax Credit Solar Rebate is in their variety and accessibility.

More of Tax Credit Solar Rebate

U S Solar Shares Rise On Hopes For Tax Credit Extension Solar Solar

U S Solar Shares Rise On Hopes For Tax Credit Extension Solar Solar

But it will not reduce the federal solar tax credit Rebate from My State Government Unlike utility rebates rebates from state governments generally do not reduce your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

Tax Credit Solar Rebate have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize printed materials to meet your requirements be it designing invitations or arranging your schedule or decorating your home.

-

Education Value Printing educational materials for no cost are designed to appeal to students from all ages, making these printables a powerful tool for parents and educators.

-

Simple: instant access the vast array of design and templates is time-saving and saves effort.

Where to Find more Tax Credit Solar Rebate

How Solar Panels Can Earn You A Big Tax Credit CNET

How Solar Panels Can Earn You A Big Tax Credit CNET

In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the credit s value

The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for

We've now piqued your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Tax Credit Solar Rebate suitable for many reasons.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a wide variety of topics, starting from DIY projects to planning a party.

Maximizing Tax Credit Solar Rebate

Here are some unique ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home or in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Credit Solar Rebate are a treasure trove of fun and practical tools designed to meet a range of needs and passions. Their access and versatility makes them an invaluable addition to both professional and personal lives. Explore the vast array of Tax Credit Solar Rebate to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credit Solar Rebate really for free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I use the free printables to make commercial products?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright concerns with Tax Credit Solar Rebate?

- Some printables may contain restrictions regarding their use. Be sure to check the terms and regulations provided by the designer.

-

How can I print Tax Credit Solar Rebate?

- You can print them at home using the printer, or go to an in-store print shop to get higher quality prints.

-

What software must I use to open Tax Credit Solar Rebate?

- The majority are printed in PDF format. These is open with no cost software, such as Adobe Reader.

Federal Solar Tax Credit What It Is How To Claim It For 2023

When Does Solar Tax Credit End SolarProGuide 2022

Check more sample of Tax Credit Solar Rebate below

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Are Solar Panels Worth It Here s What You Should Know

The Federal Solar Tax Credit Energy Solution Providers Arizona

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Are Solar Panels Worth It Here s What You Should Know

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Solar Rebates And Incentives EnergySage

Solar Rebates And Incentives EnergySage

Solar Tax Credit Calculator NikiZsombor