In the age of digital, with screens dominating our lives, the charm of tangible printed objects isn't diminished. For educational purposes as well as creative projects or simply adding an element of personalization to your space, Tax Credits 2024 are now a useful source. This article will take a dive into the sphere of "Tax Credits 2024," exploring their purpose, where they can be found, and what they can do to improve different aspects of your life.

Get Latest Tax Credits 2024 Below

Tax Credits 2024

Tax Credits 2024 -

For 2023 taxes filed in 2024 the credit ranges from 600 to 7 430 depending on how many kids you have your marital status and how much you made

Rates of Income Tax With effect from 1 January 2024 the tax free threshold was increased to ZWL 9 000 000 00 for remuneration earned in ZWL Bonus tax free threshold increased to ZWL7 500 000 with effect from November 2023 to 31 December 2023 and is USD400 or ZWL equivalent with effect from 1 January 2024

Tax Credits 2024 include a broad assortment of printable resources available online for download at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and much more. The attraction of printables that are free is their versatility and accessibility.

More of Tax Credits 2024

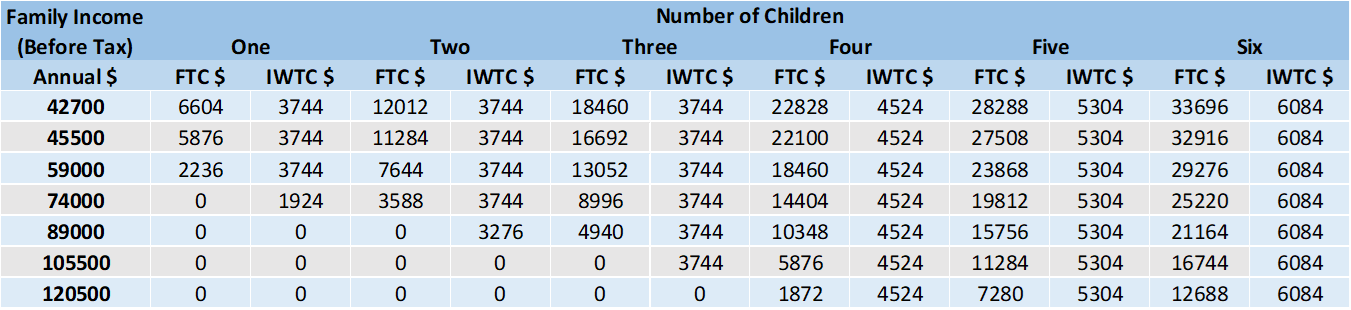

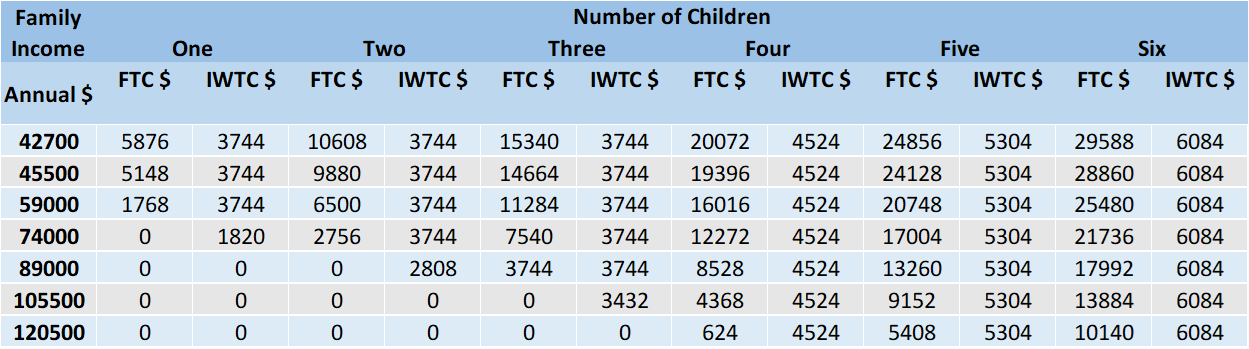

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

New Tax changes for Businesses and Individuals should know as per Finance Act 13 of 2023 Finance Act 13 of 2023 is finally here and it is packed with the following changes Corporate Income Tax rate has been revised up to 24 with effect from w e f 1 January 2024

IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility

Tax Credits 2024 have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor the design to meet your needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational value: These Tax Credits 2024 offer a wide range of educational content for learners of all ages. This makes them an essential source for educators and parents.

-

Affordability: You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Tax Credits 2024

Franking Credit Refund 2023 Atotaxrates info

Franking Credit Refund 2023 Atotaxrates info

The following tables show the tax rates rate bands and tax reliefs for the tax year 2024 and the previous tax years Calculating your Income Tax gives more information on how these work Note The increase in the rate band is capped at the lower of 33 000 or the income of the lower earner

They are 10 12 22 24 32 35 and 37 there is also a zero rate Here s how those break out by filing status Single Taxpayers 2024 official tax brackets Kelly

If we've already piqued your interest in Tax Credits 2024, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Tax Credits 2024 to suit a variety of purposes.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free, flashcards, and learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing Tax Credits 2024

Here are some new ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Credits 2024 are an abundance filled with creative and practical information that can meet the needs of a variety of people and preferences. Their accessibility and flexibility make these printables a useful addition to both personal and professional life. Explore the wide world of Tax Credits 2024 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credits 2024 really available for download?

- Yes you can! You can print and download these materials for free.

-

Can I use the free printables for commercial uses?

- It's contingent upon the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Tax Credits 2024?

- Certain printables may be subject to restrictions on usage. Be sure to read the terms of service and conditions provided by the author.

-

How do I print Tax Credits 2024?

- Print them at home using a printer or visit a local print shop for more high-quality prints.

-

What program is required to open printables for free?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software, such as Adobe Reader.

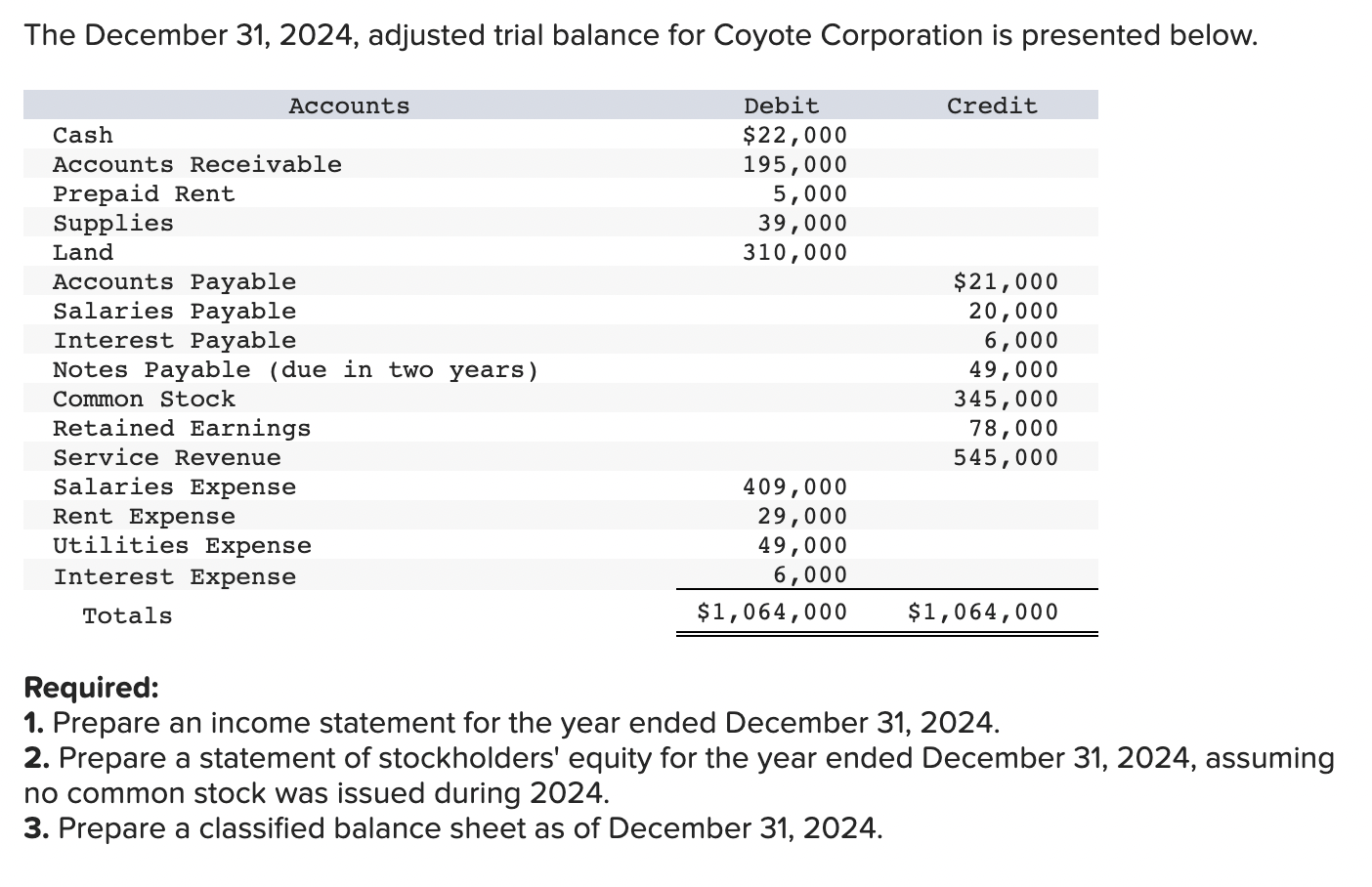

Solved The December 31 2024 Adjusted Trial Balance For Chegg

Energy Tax Credits Predicting The Tax Credit Marketplace Of 2024 And

Check more sample of Tax Credits 2024 below

EV Tax Credits All The 2023 And 2024 Electric Cars And Trucks That Get

The Enhanced Premium Tax Credits Are Substantial

Sonic The Hedgehog 3 ENDING CREDITS 2024 FAN MADE YouTube

Tesla Says Model 3 Model Y Tax Credits Likely To Be Reduced By 2024

Federal Solar Tax Credits For Businesses Department Of Energy

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://www.zimra.co.zw/public-notices?download=...

Rates of Income Tax With effect from 1 January 2024 the tax free threshold was increased to ZWL 9 000 000 00 for remuneration earned in ZWL Bonus tax free threshold increased to ZWL7 500 000 with effect from November 2023 to 31 December 2023 and is USD400 or ZWL equivalent with effect from 1 January 2024

https://www.zimra.co.zw/public-notices?download=...

Due date of the January 2024 PAYE return and payment is the 10th of February 2024 This new return makes the submission of the annual ITF16 not relevant starting from the 2024 tax year However ITF16s for year 2023 and prior years are still required to be submitted Please take note of the following

Rates of Income Tax With effect from 1 January 2024 the tax free threshold was increased to ZWL 9 000 000 00 for remuneration earned in ZWL Bonus tax free threshold increased to ZWL7 500 000 with effect from November 2023 to 31 December 2023 and is USD400 or ZWL equivalent with effect from 1 January 2024

Due date of the January 2024 PAYE return and payment is the 10th of February 2024 This new return makes the submission of the annual ITF16 not relevant starting from the 2024 tax year However ITF16s for year 2023 and prior years are still required to be submitted Please take note of the following

Tesla Says Model 3 Model Y Tax Credits Likely To Be Reduced By 2024

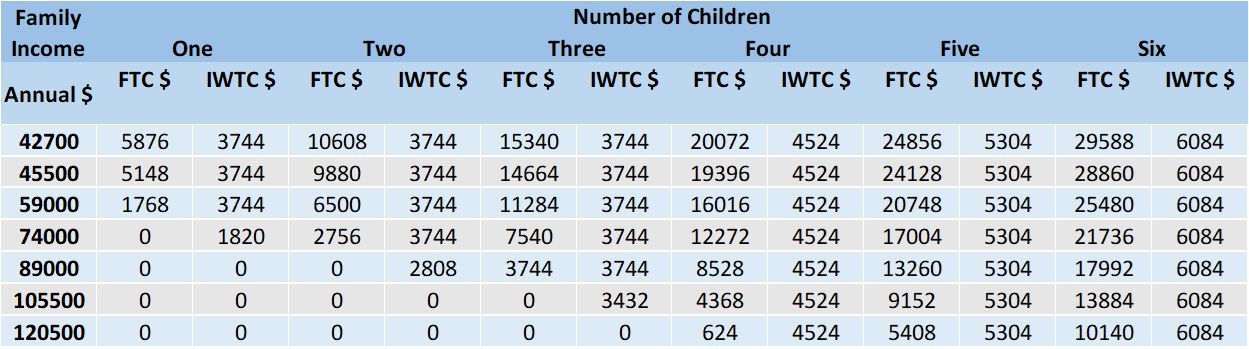

The Enhanced Premium Tax Credits Are Substantial

Federal Solar Tax Credits For Businesses Department Of Energy

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

New Home Construction Tax Credits 2023 2024 Building The Future WICZ

National Budget Speech 2023 SimplePay Blog

National Budget Speech 2023 SimplePay Blog

Begin Your New Year With My Wellness Marquette Today