In this age of electronic devices, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. In the case of educational materials and creative work, or simply adding an individual touch to your area, Tax Credits For Married Couples have become an invaluable resource. With this guide, you'll dive in the world of "Tax Credits For Married Couples," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Credits For Married Couples Below

Tax Credits For Married Couples

Tax Credits For Married Couples -

Married couples often have access to a range of tax credits that can significantly reduce their tax liability Key credits include the Child Tax Credit which provides a credit for each qualifying child and the Child and Dependent Care Credit

The Employee Tax Credit formerly known as the PAYE tax credit and expenses if any are allocated to the appropriate spouse civil partner Any tax credits other than the Employee Tax Credit and employment expenses that are unused by one partner can be claimed by the other spouse or civil partner

Tax Credits For Married Couples offer a wide variety of printable, downloadable documents that can be downloaded online at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and much more. The beauty of Tax Credits For Married Couples lies in their versatility as well as accessibility.

More of Tax Credits For Married Couples

Tax Credits For Married Couples All You Need To Know

Tax Credits For Married Couples All You Need To Know

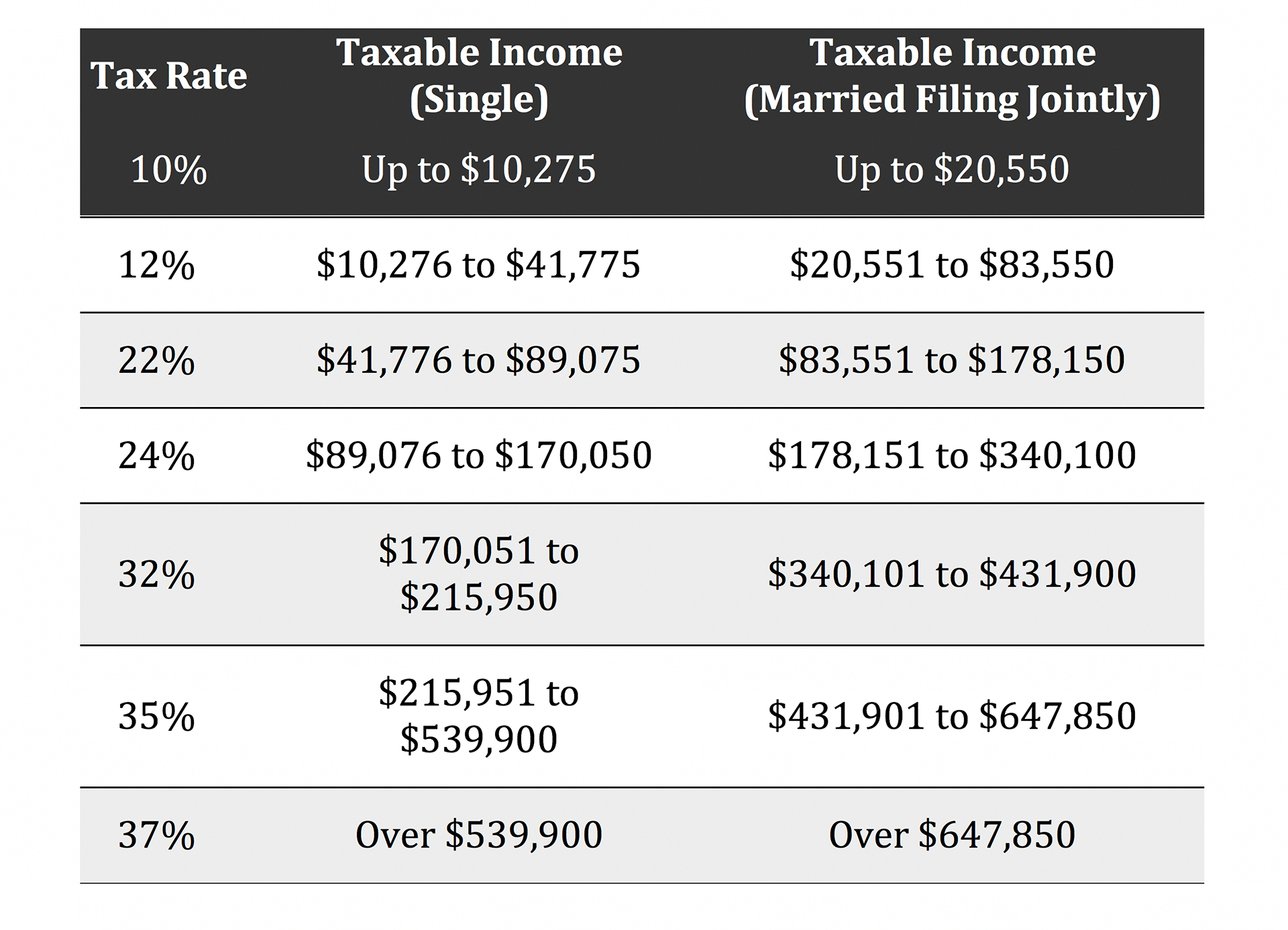

27 700 for married couples filing jointly or qualifying surviving spouse 20 800 for head of household Find the standard deduction if you re Over 65 or blind A dependent on someone else s tax return If you re married filing separately you can t take the standard deduction if your spouse itemizes You must both choose the same

Couples have 2 options when filing their income tax returns married filing jointly or married filing separately When filing jointly which is the most common method spouses combine their income and collectively deduct allowable expenses on one return

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements be it designing invitations and schedules, or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages, making them a vital tool for teachers and parents.

-

Convenience: The instant accessibility to the vast array of design and templates cuts down on time and efforts.

Where to Find more Tax Credits For Married Couples

Married Couples In UK Are Collectively Ignoring 1 3bn worth Of Tax

Married Couples In UK Are Collectively Ignoring 1 3bn worth Of Tax

New standard deduction for 2025 The standard deduction in 2025 will rise to 30 000 for married couples filing jointly a roughly 2 7 increase from the current tax year s 29 200 Meanwhile

Tax credits are offered on both the federal and state levels to incentivize certain actions such as purchasing an electric vehicle or to offset the cost of certain expenses e g raising or

After we've peaked your interest in Tax Credits For Married Couples we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Tax Credits For Married Couples for all objectives.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast selection of subjects, ranging from DIY projects to planning a party.

Maximizing Tax Credits For Married Couples

Here are some unique ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Credits For Married Couples are a treasure trove of useful and creative resources designed to meet a range of needs and passions. Their accessibility and versatility make them an invaluable addition to the professional and personal lives of both. Explore the vast collection of Tax Credits For Married Couples today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download these free resources for no cost.

-

Does it allow me to use free printables for commercial use?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may come with restrictions on their use. Be sure to read the terms and conditions set forth by the designer.

-

How do I print Tax Credits For Married Couples?

- You can print them at home with a printer or visit any local print store for better quality prints.

-

What software do I need to run printables free of charge?

- Many printables are offered in the format of PDF, which can be opened using free programs like Adobe Reader.

Treasury Grants Equal Tax Benefits To Married Gay Couples Al Jazeera

How Getting Married Affects Taxes Filing Status Tax Credits

Check more sample of Tax Credits For Married Couples below

A Quick Guide To Tax Considerations For Married Couples

Tax Tips For Newly Married Couples

Register For Superhero Webinar 80 Inheritance Tax Planning For Married

Hawley Proposes 12K Tax Credit For Married Parents With Kids Under 13

7 Out Of 10 Married Couples Are Availing Their Marriage Tax Credits

Are There Tax Benefits For Married Couples In Canada Koinly

https://www.citizensinformation.ie › en › money-and...

The Employee Tax Credit formerly known as the PAYE tax credit and expenses if any are allocated to the appropriate spouse civil partner Any tax credits other than the Employee Tax Credit and employment expenses that are unused by one partner can be claimed by the other spouse or civil partner

https://www.nerdwallet.com › article › taxes › tax...

You may deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state and local income taxes or sales taxes through a tax break known as

The Employee Tax Credit formerly known as the PAYE tax credit and expenses if any are allocated to the appropriate spouse civil partner Any tax credits other than the Employee Tax Credit and employment expenses that are unused by one partner can be claimed by the other spouse or civil partner

You may deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state and local income taxes or sales taxes through a tax break known as

Hawley Proposes 12K Tax Credit For Married Parents With Kids Under 13

Tax Tips For Newly Married Couples

7 Out Of 10 Married Couples Are Availing Their Marriage Tax Credits

Are There Tax Benefits For Married Couples In Canada Koinly

Tax Rates Heemer Klein Company PLLC

Married Filing Jointly Vs Separately Filing Taxes The Year You Get

Married Filing Jointly Vs Separately Filing Taxes The Year You Get

Tax Tips For Married Couples Floyd Financial Group