In this day and age where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons for creative projects, simply adding an individual touch to the area, Tax Credits For New Air Conditioners are now an essential resource. We'll dive deep into the realm of "Tax Credits For New Air Conditioners," exploring what they are, how you can find them, and how they can enrich various aspects of your life.

Get Latest Tax Credits For New Air Conditioners Below

Tax Credits For New Air Conditioners

Tax Credits For New Air Conditioners -

Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for ENERGY STAR certified heat pumps Natural gas propane or oil furnace 150 for ENERGY STAR certified gas furnaces except those certified for U S South only

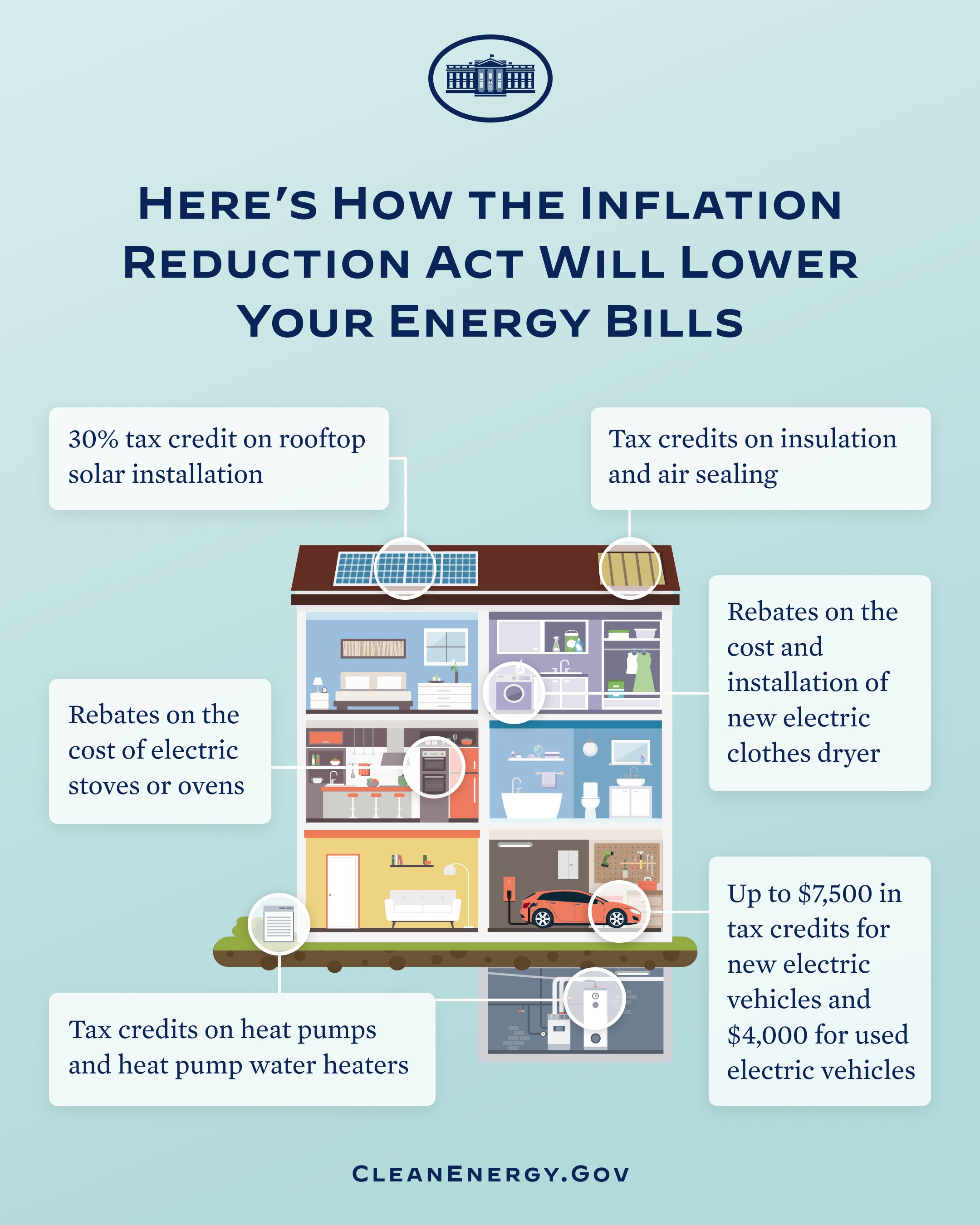

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Tax Credits For New Air Conditioners encompass a wide assortment of printable materials available online at no cost. They come in many formats, such as worksheets, templates, coloring pages and many more. The value of Tax Credits For New Air Conditioners lies in their versatility as well as accessibility.

More of Tax Credits For New Air Conditioners

Why Freon Leaks Are Bad For Your Health And The Environment

Why Freon Leaks Are Bad For Your Health And The Environment

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to

For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of the total project with a max benefit of 600 New construction homes and

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization They can make print-ready templates to your specific requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Education Value Free educational printables cater to learners of all ages. This makes them a useful source for educators and parents.

-

Easy to use: The instant accessibility to an array of designs and templates reduces time and effort.

Where to Find more Tax Credits For New Air Conditioners

Get New AC Now To Beat Big Price Increases Southlake Style

Get New AC Now To Beat Big Price Increases Southlake Style

Determining if your central ACs heat pump or furnace qualifies for a tax credit in 2023 involves understanding specific criteria set by the federal government primarily focusing on reducing energy consumption and compliance with set standards

Air conditioners natural gas or propane or oil water heaters natural gas or propane or oil furnaces or hot water boilers that meet or exceed the specific efficiency tiers established by the Consortium for Energy Efficiency Eligible products here https cee1 node 729

We hope we've stimulated your interest in printables for free Let's take a look at where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Tax Credits For New Air Conditioners suitable for many reasons.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to party planning.

Maximizing Tax Credits For New Air Conditioners

Here are some ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Tax Credits For New Air Conditioners are an abundance of innovative and useful resources catering to different needs and passions. Their accessibility and flexibility make them a valuable addition to your professional and personal life. Explore the vast collection of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can download and print these resources at no cost.

-

Are there any free printables for commercial use?

- It is contingent on the specific terms of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Tax Credits For New Air Conditioners?

- Some printables may come with restrictions on their use. Be sure to check the terms and conditions set forth by the creator.

-

How do I print Tax Credits For New Air Conditioners?

- You can print them at home using printing equipment or visit the local print shops for the highest quality prints.

-

What software do I need to run printables that are free?

- The majority are printed as PDF files, which can be opened using free programs like Adobe Reader.

Inflation Reduction Act

Tax Credits For New Roofs Residential And Commercial Buildings

Check more sample of Tax Credits For New Air Conditioners below

Whiskey Tango Foxtrot On Twitter WhiteHouse Gas And Electricity Were

Unpacking The Clean Vehicle Credits Under IRA 22 Roger Rossmeisl CPA

How Can Your AC Benefit From New Features That Are Available

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Get Free Air Conditioners For Low Income Families

New MLS Owners In St Louis Want 40 Million In State Tax Credits For

https://www. irs.gov /credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https:// airconditionerlab.com /what-hvac-systems...

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Unpacking The Clean Vehicle Credits Under IRA 22 Roger Rossmeisl CPA

Get Free Air Conditioners For Low Income Families

New MLS Owners In St Louis Want 40 Million In State Tax Credits For

Stephanie Billers New Adventures

Tax Credits For New Clean Vehicles Purchased In 2023 Or After

Tax Credits For New Clean Vehicles Purchased In 2023 Or After

HVAC Tax Credits 2018 2019 Magic Touch Mechanical