In the age of digital, with screens dominating our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education project ideas, artistic or simply adding an individual touch to the space, Tax Credits Oregon have become an invaluable source. With this guide, you'll take a dive in the world of "Tax Credits Oregon," exploring the benefits of them, where they are, and how they can add value to various aspects of your lives.

Get Latest Tax Credits Oregon Below

Tax Credits Oregon

Tax Credits Oregon -

Hundreds of thousands of Oregonians are eligible for the Earned Income Tax Credit but don t know it and could be missing out on a tax credit of up to 7 430 DO I QUALIFY FOR THIS TAX CREDIT If your income was less than 63 698 in 2023 you may be able to get this refund You can find general eligiblity information here

In 2024 eligible Oregon taxpayers will receive a kicker tax credit Your kicker is either included in your refund or it will reduce the amount of tax you owe The Oregon kicker tax credit is how the state returns money to taxpayers when there is a revenue surplus You need to have filed a 2022 tax return to get the kicker credit on

Tax Credits Oregon encompass a wide array of printable materials online, at no cost. These resources come in various kinds, including worksheets templates, coloring pages and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tax Credits Oregon

Here s How To Make The Most Of Oregon s Home Energy Tax Credits

Here s How To Make The Most Of Oregon s Home Energy Tax Credits

Oregonians will receive part of a record breaking 5 6 billion kicker state tax credit when they file their 2023 tax return the state s Department of Revenue announced Monday The kicker

You may qualify to claim certain tax credits such as Oregon s earned income credit EIC or the federal child tax credit CTC The amount of the credit may be affected by the age of your child or other dependent

The Tax Credits Oregon have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: This allows you to modify printables to fit your particular needs whether it's making invitations planning your schedule or even decorating your home.

-

Educational Value Printables for education that are free offer a wide range of educational content for learners from all ages, making the perfect aid for parents as well as educators.

-

Convenience: You have instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Credits Oregon

Reforms Could Help Oregon Families Missing Out On Millions In Tax

Reforms Could Help Oregon Families Missing Out On Millions In Tax

An annual refundable tax credit of 1 000 per eligible child aged 0 5 to help Oregon families struggling with the rising costs of raising kids All Oregon families who meet the income requirements and file taxes are eligible The credit begins phasing out at 25 000 in adjusted gross income and ends entirely at 30 000 for eligible filers

Families may be eligible for a maximum refundable credit of 7 430 on their federal tax return and a maximum Oregon EIC of 891 on their state tax return All three credits are fully refundable meaning the portion of the credit that is larger than what a taxpayer owes can be refunded

After we've peaked your interest in Tax Credits Oregon and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of needs.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing Tax Credits Oregon

Here are some innovative ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Credits Oregon are an abundance of practical and imaginative resources which cater to a wide range of needs and interests. Their accessibility and versatility make them a wonderful addition to your professional and personal life. Explore the vast array of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes you can! You can print and download these items for free.

-

Does it allow me to use free printables in commercial projects?

- It's contingent upon the specific usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted on usage. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer or go to an area print shop for the highest quality prints.

-

What software is required to open Tax Credits Oregon?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost software, such as Adobe Reader.

Oregon Tax Credits For Business Moves All Service Moving

Shepherd s Flat Tax Credits Oregon Wine Industry Business Roundup

Check more sample of Tax Credits Oregon below

Reforms Could Help Oregon Families Missing Out On Millions In Tax

Oregon Claws Back 13 Million From Tesla Over Tax Credits Report Says

Oregon Homeowner Tax Credits Saving And Rebates

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

Oregon Recoups 13 Million For Inflated Solar Tax Credits Oregonlive

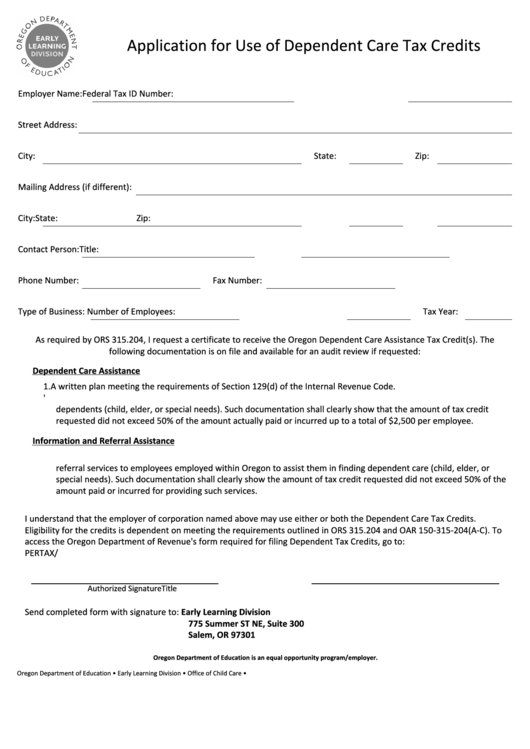

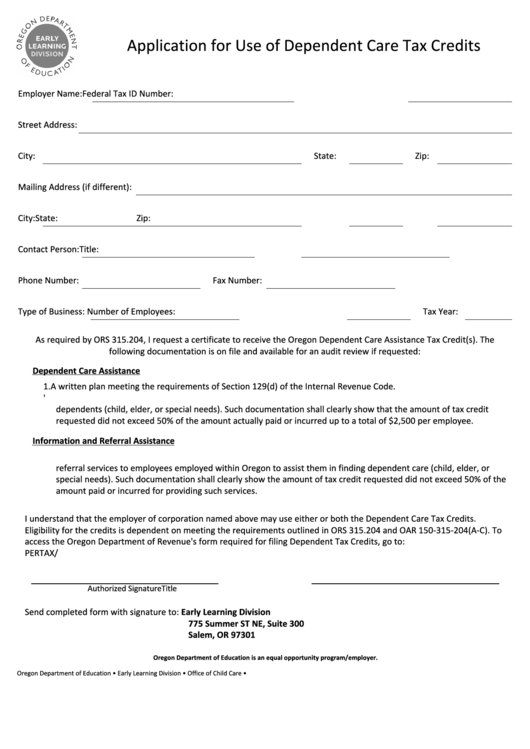

Oregon Department Of Education Application For Use Of Dependent Care

https://www.oregon.gov/dor/programs/individuals/Pages/Kicker.aspx

In 2024 eligible Oregon taxpayers will receive a kicker tax credit Your kicker is either included in your refund or it will reduce the amount of tax you owe The Oregon kicker tax credit is how the state returns money to taxpayers when there is a revenue surplus You need to have filed a 2022 tax return to get the kicker credit on

https://www.oregon.gov/dor/programs/individuals/Pages/other-credits.aspx

Oregon has three kinds of credits standard carryforward and refundable Standard credits can be claimed up to the amount of your tax liability for the year but any extra amount can t be refunded Carryforward credits can t be refunded either but any amount that is more than your tax liability for the year can be carried forward to another

In 2024 eligible Oregon taxpayers will receive a kicker tax credit Your kicker is either included in your refund or it will reduce the amount of tax you owe The Oregon kicker tax credit is how the state returns money to taxpayers when there is a revenue surplus You need to have filed a 2022 tax return to get the kicker credit on

Oregon has three kinds of credits standard carryforward and refundable Standard credits can be claimed up to the amount of your tax liability for the year but any extra amount can t be refunded Carryforward credits can t be refunded either but any amount that is more than your tax liability for the year can be carried forward to another

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

Oregon Claws Back 13 Million From Tesla Over Tax Credits Report Says

Oregon Recoups 13 Million For Inflated Solar Tax Credits Oregonlive

Oregon Department Of Education Application For Use Of Dependent Care

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

Oregon Homeowner Tax Credits Saving And Rebates

Oregon Homeowner Tax Credits Saving And Rebates

Tax Credits Are Now Closed