In this day and age where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education, creative projects, or simply adding an element of personalization to your home, printables for free have proven to be a valuable source. We'll take a dive into the world "Tax Deduction Car Loan Interest," exploring the different types of printables, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Tax Deduction Car Loan Interest Below

Tax Deduction Car Loan Interest

Tax Deduction Car Loan Interest -

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax

When can you deduct car loan interest from your taxes Only those who are self employed or own a business and use a vehicle for business purposes may claim a tax deduction for car loan

Printables for free include a vast selection of printable and downloadable material that is available online at no cost. These printables come in different formats, such as worksheets, templates, coloring pages, and many more. One of the advantages of Tax Deduction Car Loan Interest is in their versatility and accessibility.

More of Tax Deduction Car Loan Interest

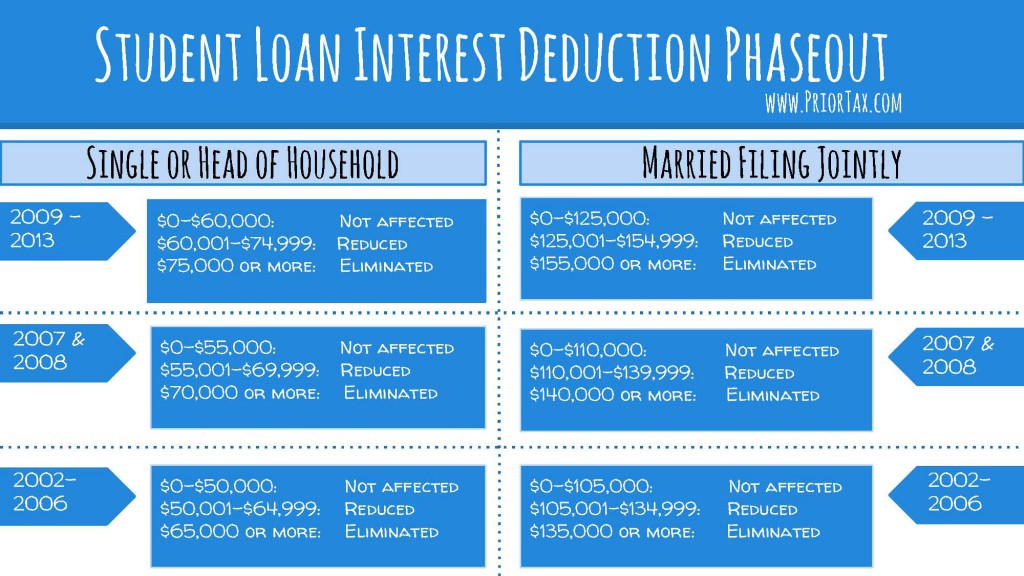

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Interest Deduction 2013 PriorTax Blog

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take

Tax Deduction for Interest paid on Car Loan The Interest paid on some types of Loans is allowed to be claimed as an Expense under the Income Tax Act However all types of

Tax Deduction Car Loan Interest have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization They can make the templates to meet your individual needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: Educational printables that can be downloaded for free can be used by students of all ages, which makes them a vital tool for parents and educators.

-

The convenience of Fast access various designs and templates will save you time and effort.

Where to Find more Tax Deduction Car Loan Interest

Car Donation Tax Deduction In 4 Simple Steps Donate Your Car Today

Car Donation Tax Deduction In 4 Simple Steps Donate Your Car Today

Interest on car loans If you are an employee you can t deduct any interest paid on a car loan This interest is treated as personal interest and isn t deductible If you are self

Work out how to claim motor vehicle expenses depending on your business structure and the type of vehicle Cents per kilometre method Check how sole traders and some

We've now piqued your interest in Tax Deduction Car Loan Interest, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deduction Car Loan Interest for various applications.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide variety of topics, all the way from DIY projects to party planning.

Maximizing Tax Deduction Car Loan Interest

Here are some creative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home for the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Deduction Car Loan Interest are an abundance filled with creative and practical information which cater to a wide range of needs and desires. Their availability and versatility make these printables a useful addition to both personal and professional life. Explore the plethora of Tax Deduction Car Loan Interest right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can print and download these resources at no cost.

-

Can I use the free printables to make commercial products?

- It's dependent on the particular rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Tax Deduction Car Loan Interest?

- Certain printables could be restricted in their usage. Make sure you read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a local print shop to purchase superior prints.

-

What program will I need to access Tax Deduction Car Loan Interest?

- Most PDF-based printables are available in PDF format. These is open with no cost programs like Adobe Reader.

Student Loan Interest Deduction Worksheet

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Check more sample of Tax Deduction Car Loan Interest below

Donate A Car To Charity But Avoid Crooks One Of The Biggest Scams

Learn How The Student Loan Interest Deduction Works

13 Car Expenses Worksheet Worksheeto

Understanding The Student Loan Interest Tax Deduction

Claim Your Car As A Tax Deduction YouTube

All About Section 80EEA For Deduction On Home Loan Interest

https://www.bankrate.com/loans/auto-l…

When can you deduct car loan interest from your taxes Only those who are self employed or own a business and use a vehicle for business purposes may claim a tax deduction for car loan

https://www.hrblock.com/tax-center/filing/...

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car

When can you deduct car loan interest from your taxes Only those who are self employed or own a business and use a vehicle for business purposes may claim a tax deduction for car loan

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car

Understanding The Student Loan Interest Tax Deduction

Learn How The Student Loan Interest Deduction Works

Claim Your Car As A Tax Deduction YouTube

All About Section 80EEA For Deduction On Home Loan Interest

Student Loan Interest Deduction Los Angeles ORT College

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

Car Tax Deduction