In the age of digital, where screens rule our lives The appeal of tangible printed material hasn't diminished. If it's to aid in education such as creative projects or simply adding personal touches to your space, Tax Deduction Electricity Bills are now an essential source. For this piece, we'll take a dive in the world of "Tax Deduction Electricity Bills," exploring the different types of printables, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest Tax Deduction Electricity Bills Below

Tax Deduction Electricity Bills

Tax Deduction Electricity Bills -

Tax bracket 1 2 79372 cents kWh incl VAT 24 and security of supply charge Tax bracket 2 0 07812 cents kWh incl VAT 24 and security of supply charge Change your electricity tax bracket All our customers automatically fall into tax bracket 1 unless they have specifically declared otherwise

The maximum credit is 6 000 2 000 x 60 2 400 Do note however that the tax credit for electricity and other deductions for household expenses have a common credit threshold of 100 The threshold is primarily deducted from the tax credit for other household expenses than electricity

Tax Deduction Electricity Bills encompass a wide array of printable content that can be downloaded from the internet at no cost. They are available in numerous designs, including worksheets coloring pages, templates and more. The value of Tax Deduction Electricity Bills is in their versatility and accessibility.

More of Tax Deduction Electricity Bills

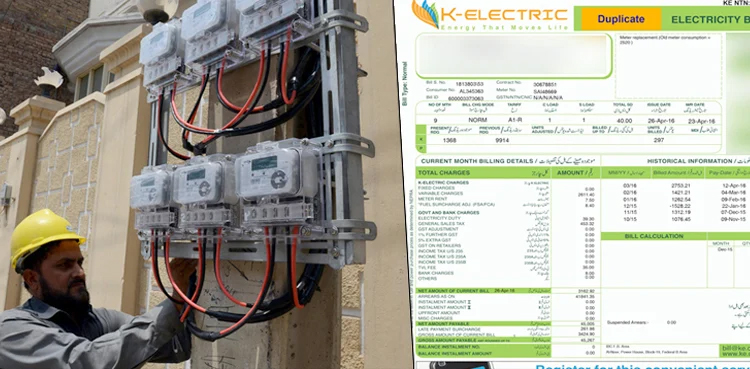

K Electric Has No Benefits From GST On Electricity Bills Spox Four

K Electric Has No Benefits From GST On Electricity Bills Spox Four

The tax relief corresponds to 60 percent of the bill portions exceeding 2 000 euros up to a maximum of 2 400 euros per permanent home Taxpayers can get a full deduction if their electricity bills for January April total at least 6 000 euros An individual can only get an electricity reduction for one place of residence However several

The annual allowance for meal coupons works out to be Rs 26 400 and is tax exempt in the hands of the employee With respect to the other components the employee has to submit proof of incurring the corresponding expense to the employer Upon submission of the proof the employer calculates the tax exemption on the allowance

Tax Deduction Electricity Bills have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: It is possible to tailor designs to suit your personal needs in designing invitations planning your schedule or even decorating your home.

-

Educational value: Printables for education that are free cater to learners of all ages, making the perfect tool for teachers and parents.

-

It's easy: instant access the vast array of design and templates is time-saving and saves effort.

Where to Find more Tax Deduction Electricity Bills

Capital Gain Deduction Of House Sale Rejects Water Electricity Bills

Capital Gain Deduction Of House Sale Rejects Water Electricity Bills

Feb 01 2022 Uncategorized If you live on this planet you already know that taxes are a pain Any tax deduction you can find makes them a little less painful so you re trying to figure out how to get a home office electricity deduction to keep a

A flat 7 5 withholding tax applies to the entire monthly bill if the amount exceeds Rs 25 000 Key Takeaways Being an active tax filer offers an exemption from advance tax deduction on your domestic electricity bill Non filers face a higher tax burden on their electricity bills and may have limited tax adjustment options

We hope we've stimulated your curiosity about Tax Deduction Electricity Bills Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Tax Deduction Electricity Bills designed for a variety reasons.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a broad selection of subjects, including DIY projects to party planning.

Maximizing Tax Deduction Electricity Bills

Here are some creative ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Deduction Electricity Bills are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and passions. Their accessibility and versatility make them an essential part of both personal and professional life. Explore the vast world of Tax Deduction Electricity Bills and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can download and print these files for free.

-

Can I use free printables for commercial use?

- It's based on the usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in Tax Deduction Electricity Bills?

- Certain printables could be restricted on their use. You should read the terms and conditions offered by the designer.

-

How do I print Tax Deduction Electricity Bills?

- Print them at home using the printer, or go to any local print store for top quality prints.

-

What software do I need in order to open Tax Deduction Electricity Bills?

- Most PDF-based printables are available in the format of PDF, which can be opened using free programs like Adobe Reader.

Can I Get A Receipt For Paying Electricity Bills As A Tax Deduction

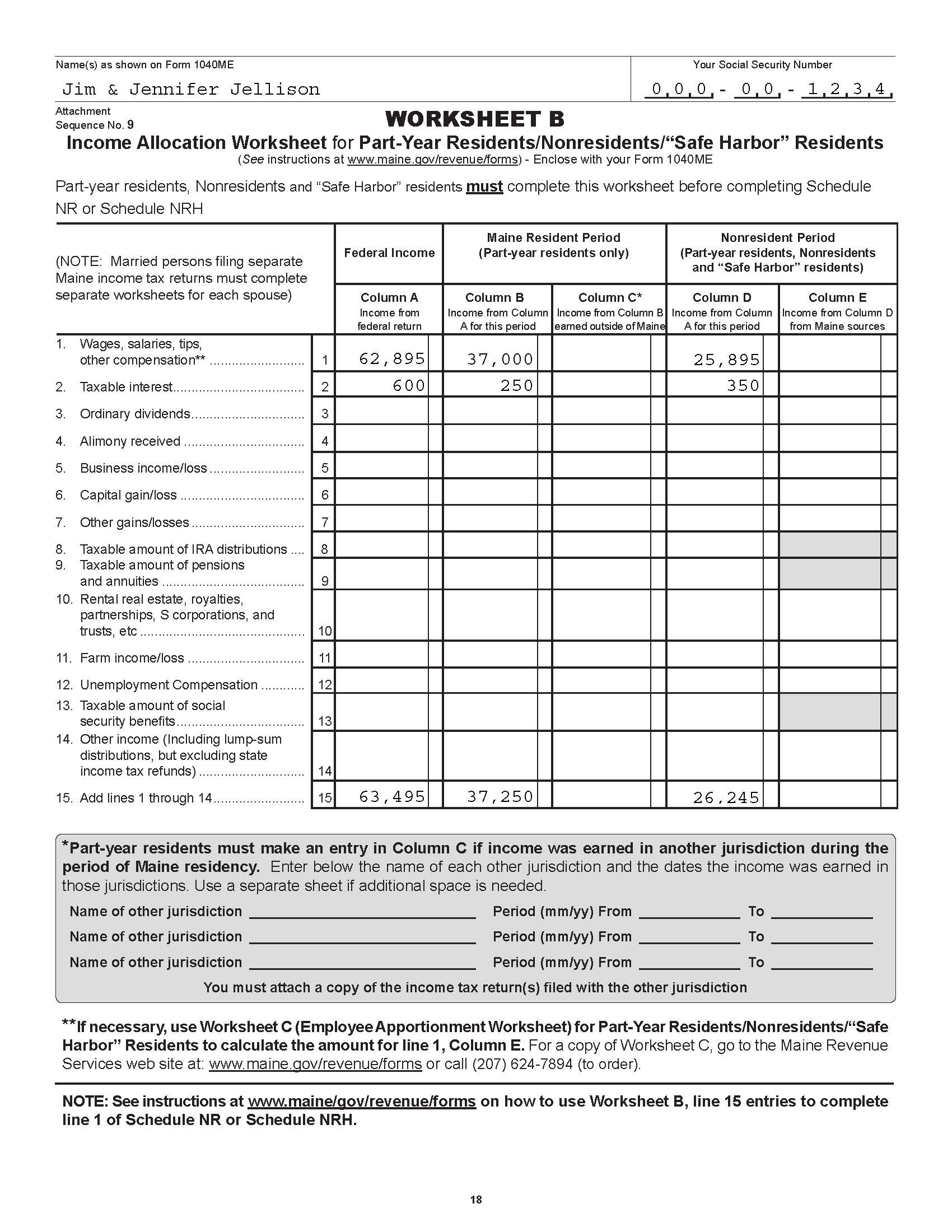

Ssvf Income Eligibility Calculation Worksheet

Check more sample of Tax Deduction Electricity Bills below

Energy Crisis The Government Outlined Its Support For Paying

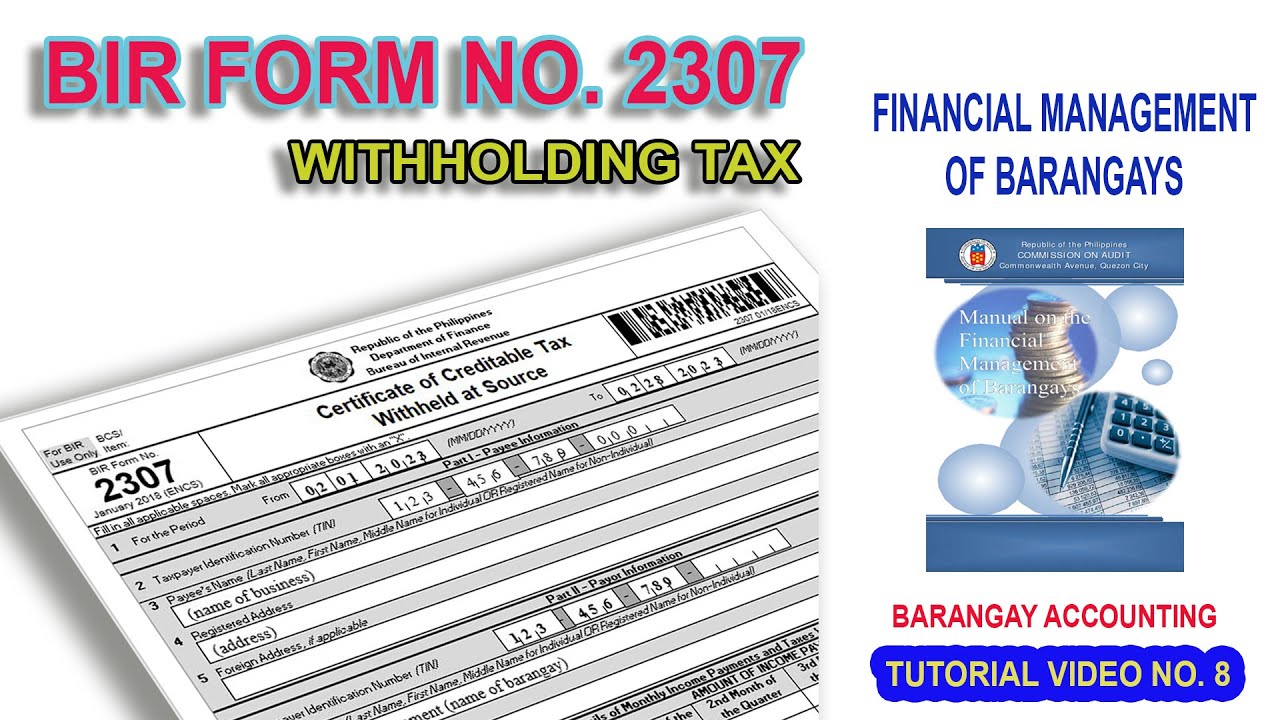

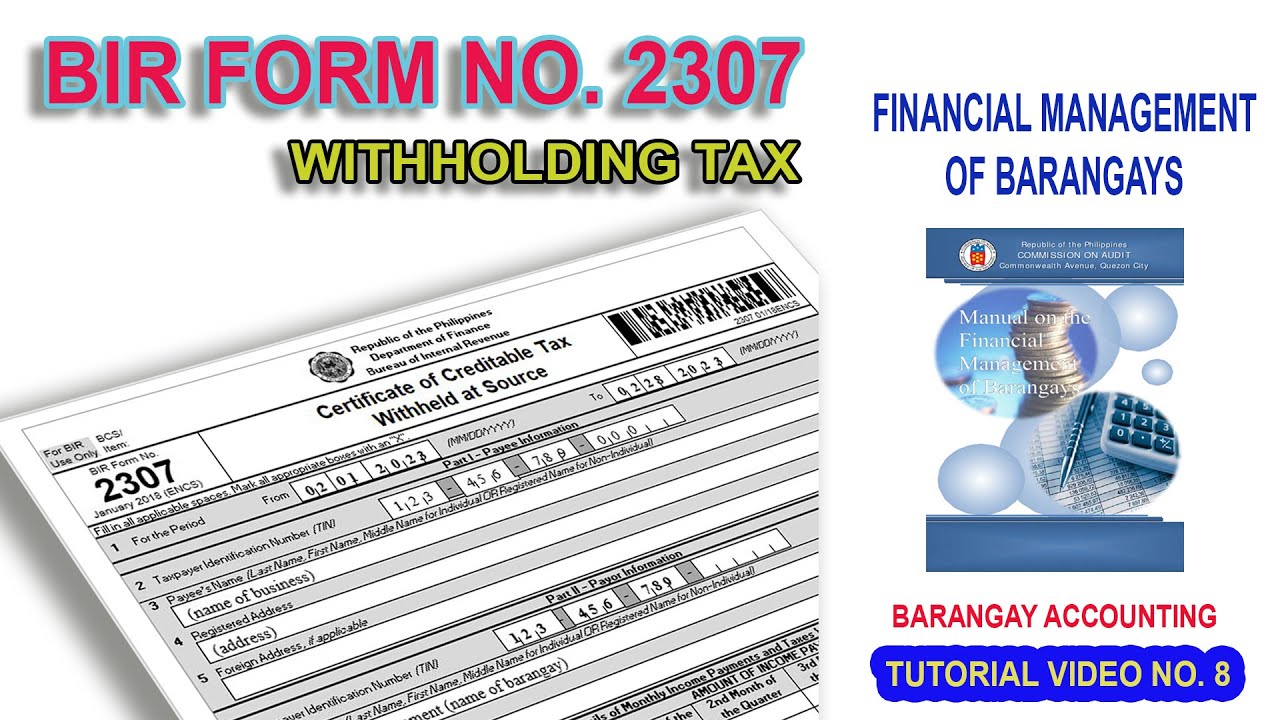

HOW TO FILL UP BIR FORM NO 2307 YouTube

Flick To Electricity For 20 Tax Deduction Small Business Told

How To Apply For Tax Deduction Certificate In India Electricity Bill

Social Security Tax On Electricity Bills PUCSL Issues Clarification

3 70 Daily Jasarat News

https://www.vero.fi/en/individuals/tax-cards-and...

The maximum credit is 6 000 2 000 x 60 2 400 Do note however that the tax credit for electricity and other deductions for household expenses have a common credit threshold of 100 The threshold is primarily deducted from the tax credit for other household expenses than electricity

https://www.vero.fi/en/individuals/tax-cards-and...

This calculator helps you estimate your tax credit for electricity You can claim a tax credit for electricity that you have used in your permanent home between 1 January and 30 April 2023 The credit is 60 of the electricity expenses exceeding 2 000

The maximum credit is 6 000 2 000 x 60 2 400 Do note however that the tax credit for electricity and other deductions for household expenses have a common credit threshold of 100 The threshold is primarily deducted from the tax credit for other household expenses than electricity

This calculator helps you estimate your tax credit for electricity You can claim a tax credit for electricity that you have used in your permanent home between 1 January and 30 April 2023 The credit is 60 of the electricity expenses exceeding 2 000

How To Apply For Tax Deduction Certificate In India Electricity Bill

HOW TO FILL UP BIR FORM NO 2307 YouTube

Social Security Tax On Electricity Bills PUCSL Issues Clarification

3 70 Daily Jasarat News

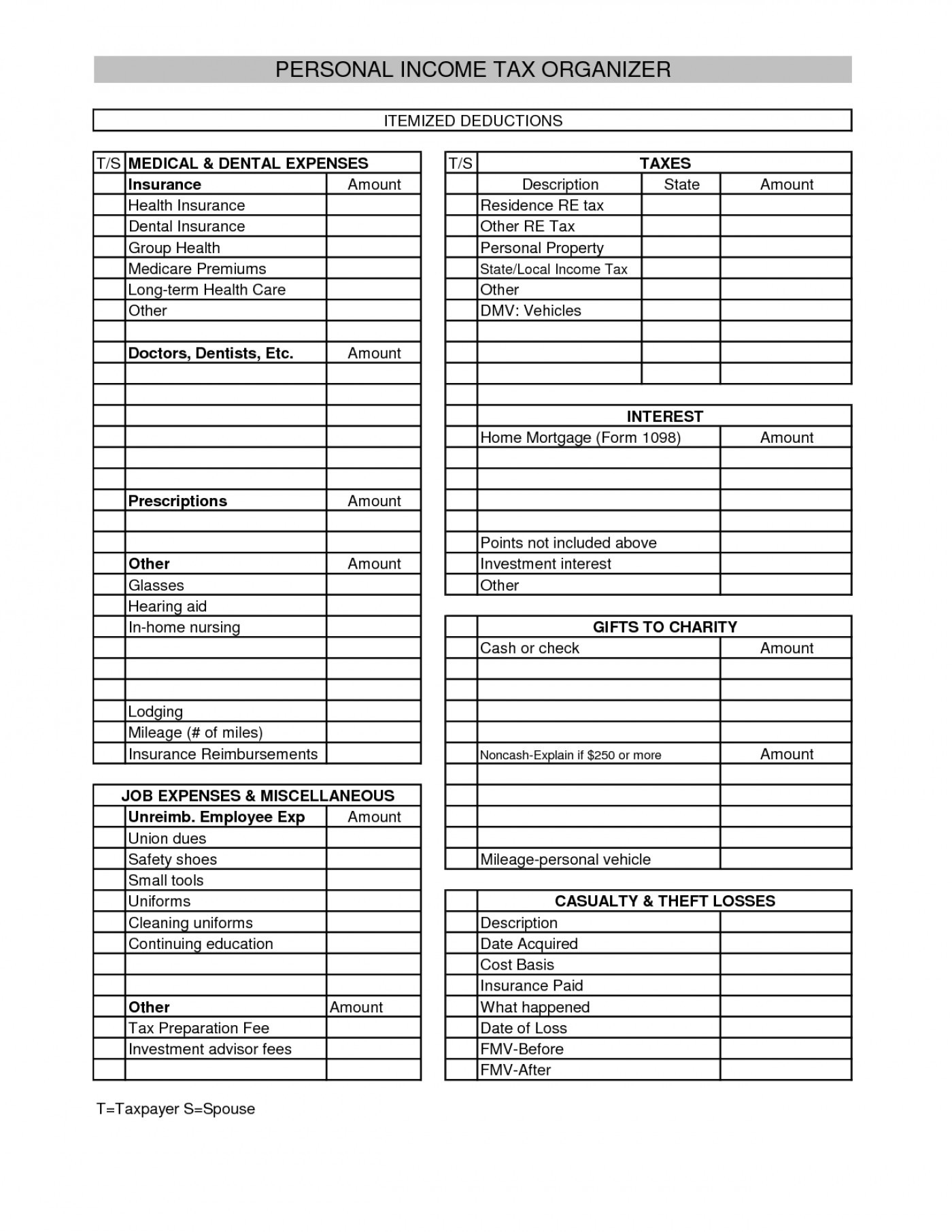

Printable Itemized Deductions Worksheet

GMarinovich 9806 jpg Greg Marinovich Photography

GMarinovich 9806 jpg Greg Marinovich Photography