In this digital age, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses and creative work, or simply to add an individual touch to your area, Tax Deduction For Buying A Car For Business Australia have proven to be a valuable source. This article will take a dive in the world of "Tax Deduction For Buying A Car For Business Australia," exploring what they are, how they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Deduction For Buying A Car For Business Australia Below

Tax Deduction For Buying A Car For Business Australia

Tax Deduction For Buying A Car For Business Australia -

Small businesses with an aggregated turnover of less than 10 million can receive an instant asset write off if they purchase a business vehicle before 30 June 2025 subject to the car limit Be aware of the car limit which sets a maximum claimable amount for tax deductions on passenger vehicles

As a business owner you can claim a tax deduction for expenses for motor vehicles used in running your business Last updated 16 July 2024 Print or Download On this page Types of vehicles Expenses you can claim Separate private from business use Car limit Watch

Tax Deduction For Buying A Car For Business Australia offer a wide assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and more. The benefit of Tax Deduction For Buying A Car For Business Australia is in their variety and accessibility.

More of Tax Deduction For Buying A Car For Business Australia

Business Use Of Vehicle Tax Deductions

Business Use Of Vehicle Tax Deductions

Claiming GST credits vehicle used solely for business You re generally entitled to claim a GST credit for the GST included in the vehicle price provided you have a tax invoice and you use a motor vehicle solely in carrying on your business you re registered for GST

From 1 July 2023 the instant write off is currently legislated to be available only for assets costing up to 1 000 In addition it will only be available to small businesses ie those with a turnover of less than 10 million This means that businesses must take advantage of the tax break in the next few months

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: They can make printables to fit your particular needs when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: The free educational worksheets provide for students of all ages, which makes them a vital tool for parents and teachers.

-

Easy to use: The instant accessibility to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction For Buying A Car For Business Australia

Using A Car For Business What Can I Deduct Lantern By SoFi

Using A Car For Business What Can I Deduct Lantern By SoFi

If you re a business owner in Australia you may be able to claim a tax deduction for your car expenses including the cost of buying leasing or operating a car for business purposes To claim the deduction you ll need to keep records of your expenses and be able to show how the car is used for business

There s a limit on how much you can claim for a business car called the Luxury Car Tax LCT threshold For the 2023 2024 financial year the limits are 84 916 for fuel efficient cars 71 849 for other cars These amounts include the car s cost GST and customs duties

In the event that we've stirred your interest in Tax Deduction For Buying A Car For Business Australia, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Tax Deduction For Buying A Car For Business Australia for various objectives.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Tax Deduction For Buying A Car For Business Australia

Here are some innovative ways ensure you get the very most of Tax Deduction For Buying A Car For Business Australia:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction For Buying A Car For Business Australia are an abundance filled with creative and practical information that satisfy a wide range of requirements and interests. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the vast world that is Tax Deduction For Buying A Car For Business Australia today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these items for free.

-

Does it allow me to use free printouts for commercial usage?

- It's dependent on the particular rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with Tax Deduction For Buying A Car For Business Australia?

- Some printables may come with restrictions regarding usage. Check the conditions and terms of use provided by the creator.

-

How can I print Tax Deduction For Buying A Car For Business Australia?

- You can print them at home using an printer, or go to an in-store print shop to get better quality prints.

-

What program is required to open printables free of charge?

- The majority of printables are as PDF files, which can be opened with free software such as Adobe Reader.

Rent A Car For Business Burhan Rent A Car

3 Factors To Consider When Buying A Car For Business Take Your Success

Check more sample of Tax Deduction For Buying A Car For Business Australia below

Tax Deduction For Buying A Car For Business Everything You Should Know

A Comprehensive Guide To Buying A Car For Your Business Craig Scott

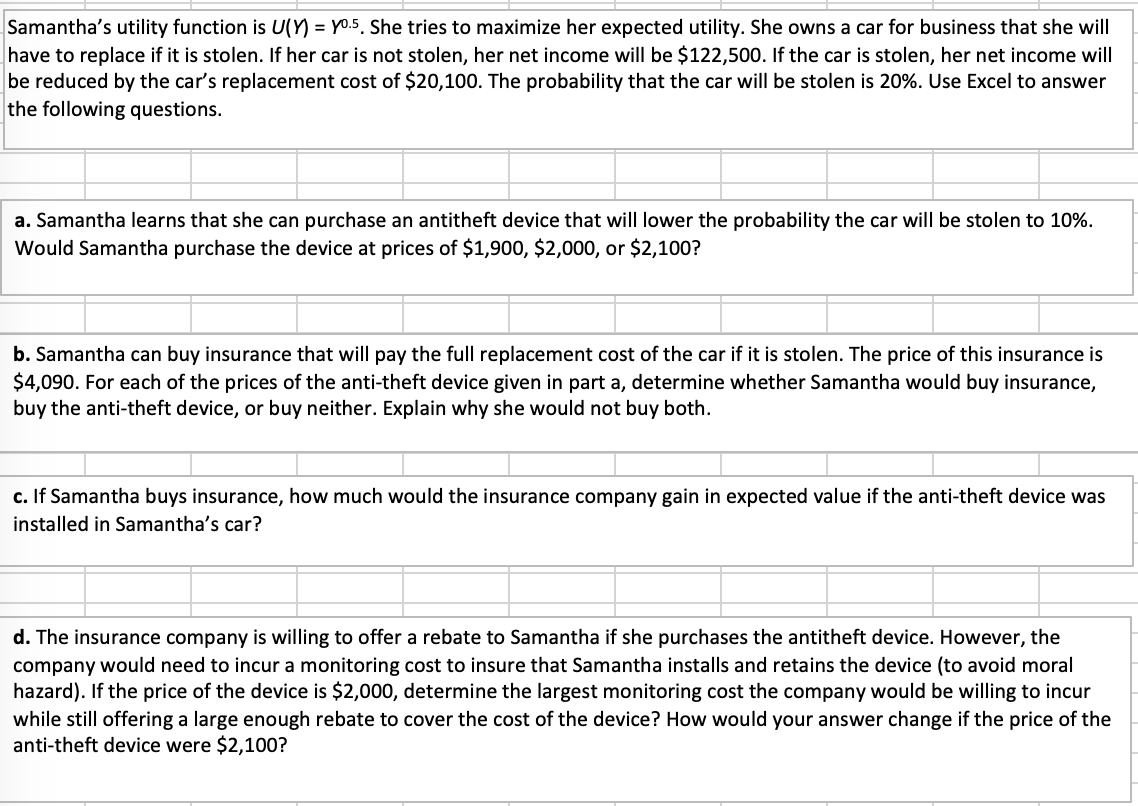

Solved Samantha s Utility Function Is U Y Y0 5 She Tries Chegg

How To Write A Car Off For Business

Tax Tips You Should Know For Buying A Car For Your Business Before You

Make Renting A Car That Much Easier For You When You Take A Vacation Or

https://www.ato.gov.au › businesses-and...

As a business owner you can claim a tax deduction for expenses for motor vehicles used in running your business Last updated 16 July 2024 Print or Download On this page Types of vehicles Expenses you can claim Separate private from business use Car limit Watch

https://boxas.com.au › small-business-handbook › tax...

When claiming tax deductions for a business vehicle you need to consider both your business structure and who owns the car This will impact your calculation method eligible expenses and fringe benefits tax obligations

As a business owner you can claim a tax deduction for expenses for motor vehicles used in running your business Last updated 16 July 2024 Print or Download On this page Types of vehicles Expenses you can claim Separate private from business use Car limit Watch

When claiming tax deductions for a business vehicle you need to consider both your business structure and who owns the car This will impact your calculation method eligible expenses and fringe benefits tax obligations

How To Write A Car Off For Business

A Comprehensive Guide To Buying A Car For Your Business Craig Scott

Tax Tips You Should Know For Buying A Car For Your Business Before You

Make Renting A Car That Much Easier For You When You Take A Vacation Or

3 Expert Tips To Buy Or Lease A Car For Business Paragon

What You Need To Know When Renting A Car For Business

What You Need To Know When Renting A Car For Business

Using A Car For Business New Rules Under TCJA LVBW