Today, with screens dominating our lives but the value of tangible printed materials isn't diminishing. For educational purposes in creative or artistic projects, or simply adding the personal touch to your home, printables for free have become an invaluable resource. With this guide, you'll take a dive into the world "Tax Deduction For Car Purchase For Business," exploring what they are, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Tax Deduction For Car Purchase For Business Below

Tax Deduction For Car Purchase For Business

Tax Deduction For Car Purchase For Business -

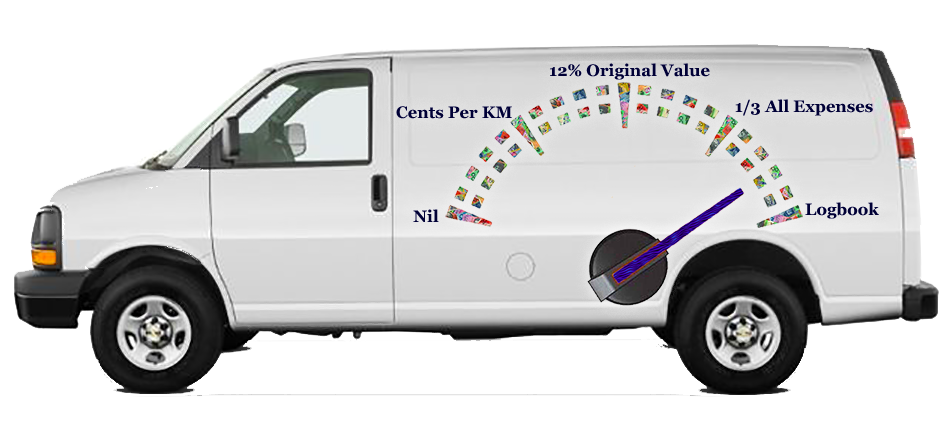

For most vehicles you can calculate expenses using the IRS s standard mileage rate 65 5 cents per mile for 2023 67 cents

Navigate to the Settings page and Vehicle Settings section Add the costs

Tax Deduction For Car Purchase For Business offer a wide selection of printable and downloadable items that are available online at no cost. They are available in a variety of styles, from worksheets to coloring pages, templates and more. The attraction of printables that are free is in their versatility and accessibility.

More of Tax Deduction For Car Purchase For Business

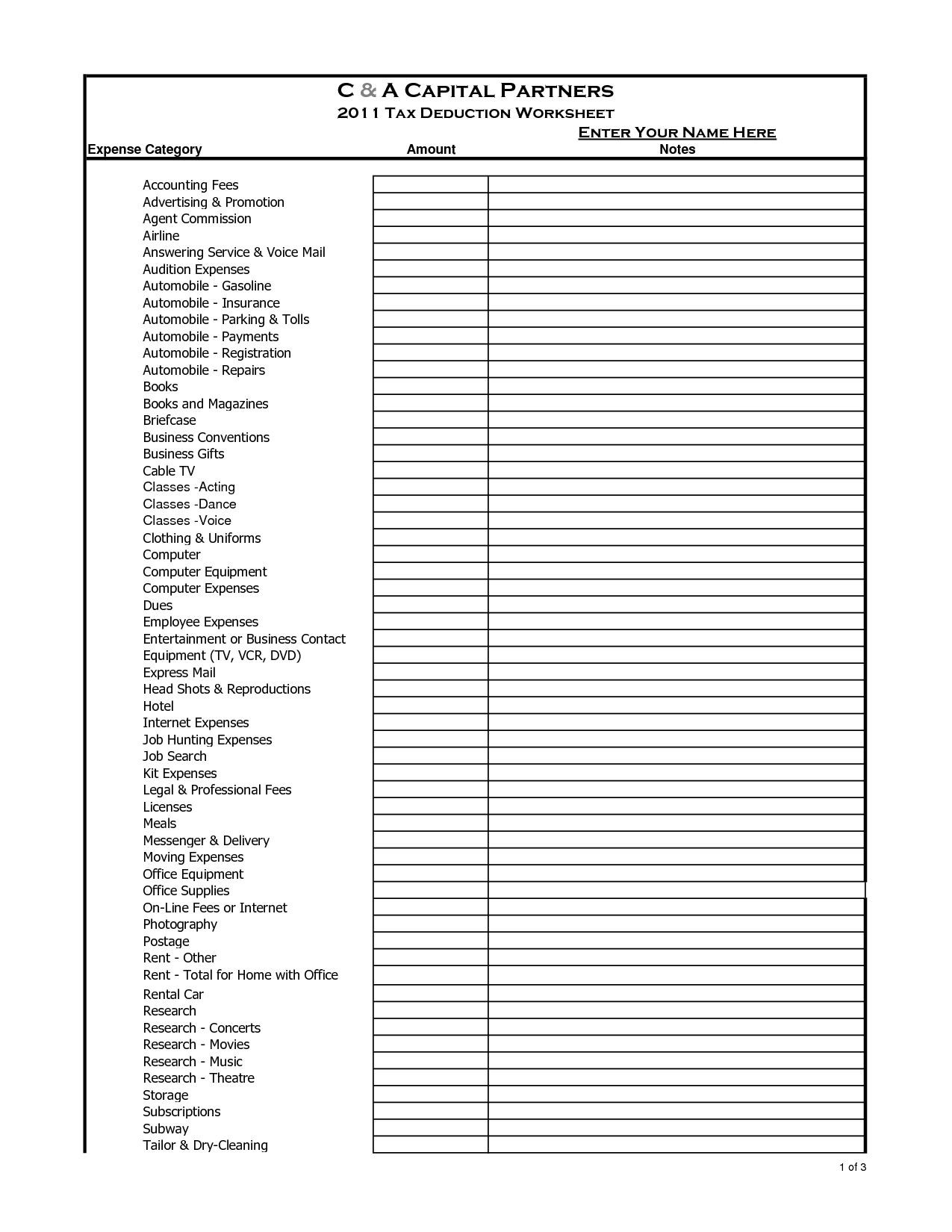

13 Car Expenses Worksheet Worksheeto

13 Car Expenses Worksheet Worksheeto

Can you deduct taxes for the business use of your car The self

This rate changes regularly and in 2022 the standard mileage rate for businesses was set at 58 5 cents per mile Miles driven to and from work from your home otherwise known as commuting miles

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization Your HTML0 customization options allow you to customize printing templates to your own specific requirements when it comes to designing invitations and schedules, or decorating your home.

-

Educational Impact: Free educational printables can be used by students from all ages, making them a great device for teachers and parents.

-

Simple: Fast access various designs and templates, which saves time as well as effort.

Where to Find more Tax Deduction For Car Purchase For Business

How Much Tax Deduction For A Donated Car

How Much Tax Deduction For A Donated Car

Can I Deduct the Purchase of a Vehicle For My Business SuperMoney Explore Log in Sign up Through IRS Section 179 business owners can file tax deductions for expenses related to purchasing and

Buying or Leasing a Car for Business What Are the Tax Benefits

After we've peaked your interest in Tax Deduction For Car Purchase For Business we'll explore the places you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Tax Deduction For Car Purchase For Business suitable for many applications.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Tax Deduction For Car Purchase For Business

Here are some inventive ways of making the most use of Tax Deduction For Car Purchase For Business:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction For Car Purchase For Business are a treasure trove of innovative and useful resources that meet a variety of needs and interests. Their accessibility and flexibility make them a fantastic addition to both personal and professional life. Explore the vast array of Tax Deduction For Car Purchase For Business to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can download and print these files for free.

-

Can I download free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations in their usage. Be sure to check the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer or go to any local print store for high-quality prints.

-

What software do I require to open printables free of charge?

- Most PDF-based printables are available as PDF files, which is open with no cost programs like Adobe Reader.

Business Use Of Vehicle Tax Deductions

Tax Deduction For Buying A Car For Business Everything You Should Know

Check more sample of Tax Deduction For Car Purchase For Business below

Tax Deduction For Car Expenses KMT Partners

Car Donation And IRS Deductions Explained Kars4Kids Hub

BEST Vehicle Tax Deduction 2023 it s Not Section 179 Deduction YouTube

Nh Car Tax Calculator Rosana Clapp

Doctors Are You Maximising Your Tax Deduction For Car Expenses

Can You Claim Car Expenses As A Tax Deduction

https://tmi.ukko.fi/hc/en-us/articles/...

Navigate to the Settings page and Vehicle Settings section Add the costs

https://www.blockadvisors.com/resource-center/...

A Section 179 tax deduction vehicle can be purchased new or used but

Navigate to the Settings page and Vehicle Settings section Add the costs

A Section 179 tax deduction vehicle can be purchased new or used but

Nh Car Tax Calculator Rosana Clapp

Car Donation And IRS Deductions Explained Kars4Kids Hub

Doctors Are You Maximising Your Tax Deduction For Car Expenses

Can You Claim Car Expenses As A Tax Deduction

Can You Claim Tax Deductions For Your Car The Finance Guy

NO AUTO INTEREST DEDUCTION For You My Car Lady

NO AUTO INTEREST DEDUCTION For You My Car Lady

Receive A Tax Deduction For Donating A Car