In a world with screens dominating our lives The appeal of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply to add an individual touch to the space, Tax Deduction For Car Purchase are now an essential resource. Through this post, we'll dive to the depths of "Tax Deduction For Car Purchase," exploring what they are, how they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest Tax Deduction For Car Purchase Below

Tax Deduction For Car Purchase

Tax Deduction For Car Purchase -

Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business Keep in mind commuting from your home to and from your business in the vehicle is not considered business use

Some electric vehicles can also be eligible for a tax deduction but a standard vehicle purchase is not tax deductible wrote Steber in an email to Cars Deducting Operating Costs

Tax Deduction For Car Purchase cover a large range of downloadable, printable items that are available online at no cost. They come in many styles, from worksheets to templates, coloring pages and many more. The appeal of printables for free is in their variety and accessibility.

More of Tax Deduction For Car Purchase

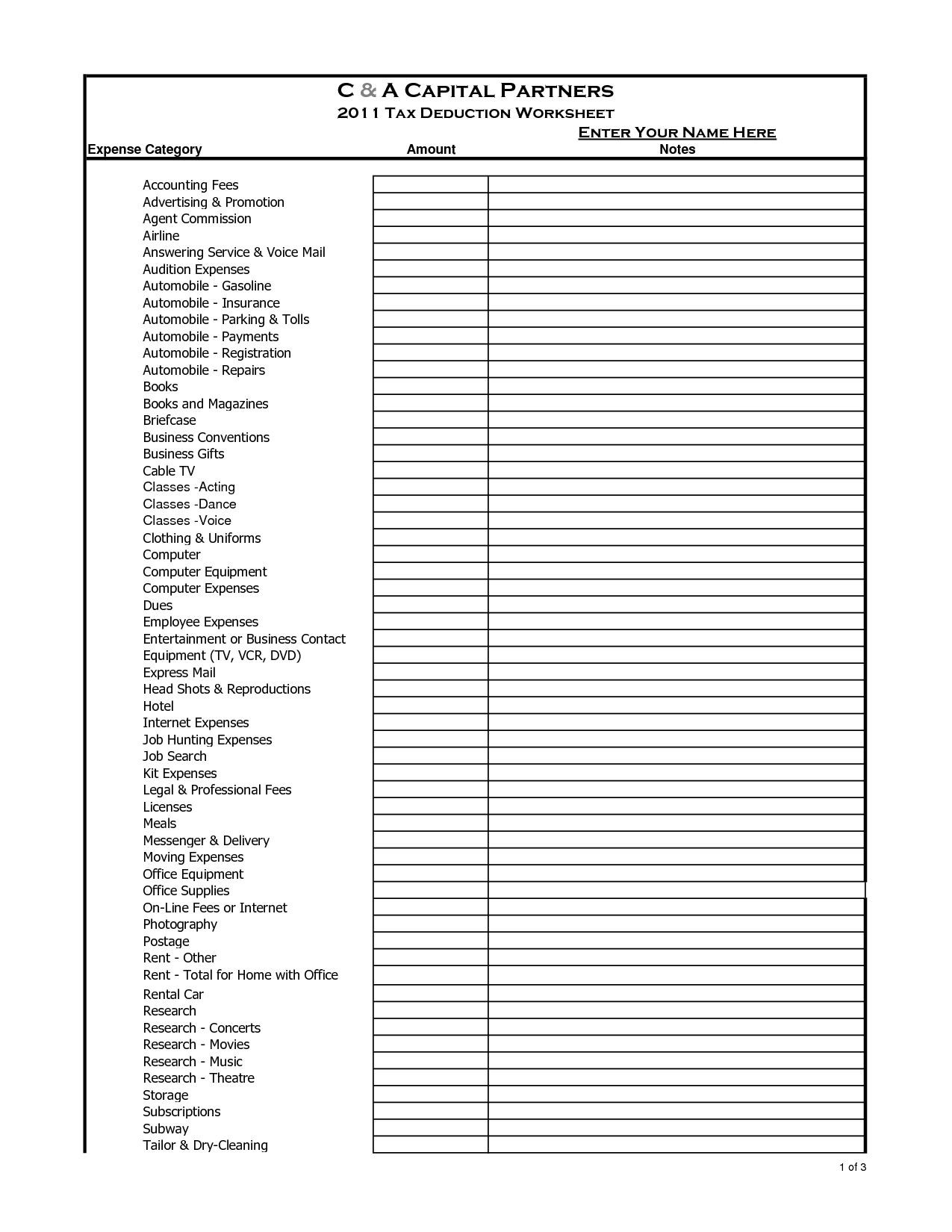

13 Car Expenses Worksheet Worksheeto

13 Car Expenses Worksheet Worksheeto

Business owners and self employed individuals Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for both business and personal purposes the expenses must be split The deduction is based on the portion of mileage

This includes many full size SUVs commercial vans and pickup trucks For 2023 a vehicle qualifying in the heavy category has a Section 179 tax deduction limit of 28 900 However these autos are eligible for 100 bonus depreciation through the end of 2022 Starting in 2023 the allowable bonus depreciation percentage will decrease to 80

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: There is the possibility of tailoring designs to suit your personal needs, whether it's designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Printing educational materials for no cost can be used by students from all ages, making them an invaluable tool for teachers and parents.

-

Easy to use: immediate access an array of designs and templates will save you time and effort.

Where to Find more Tax Deduction For Car Purchase

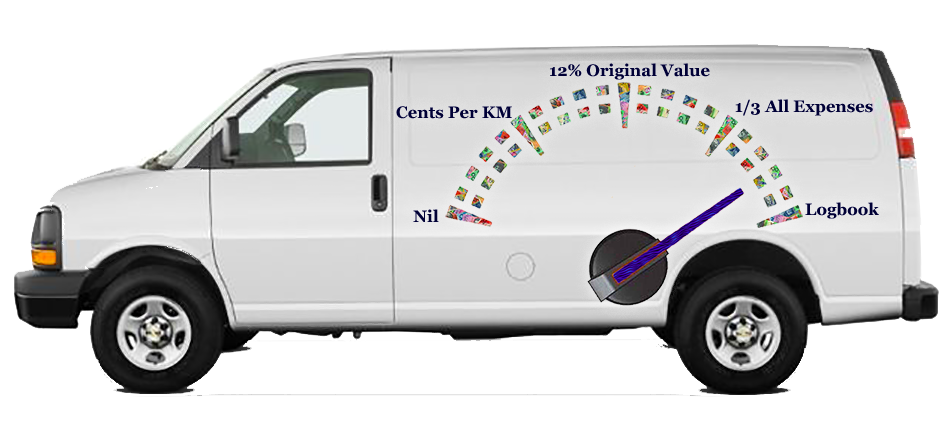

Business Use Of Vehicle Tax Deductions

Business Use Of Vehicle Tax Deductions

Deduct your self employed car expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or Schedule F Form 1040 Profit or Loss From Farming if you re a farmer If you re an Armed Forces reservist a qualified performing artist or a fee basis state or local government official complete Form 2106 Employee

2022 23 use 78 cents per kilometre 2020 21 and 2021 22 use 72 cents per kilometre for rates in earlier years see Prior year tax return forms and schedules You can claim a maximum of 5 000 work related kilometres per car You need to keep records that show how you work out your work related kilometres

We hope we've stimulated your curiosity about Tax Deduction For Car Purchase Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of uses.

- Explore categories such as home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad array of topics, ranging including DIY projects to party planning.

Maximizing Tax Deduction For Car Purchase

Here are some creative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Tax Deduction For Car Purchase are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and interest. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes, they are! You can download and print these files for free.

-

Are there any free printing templates for commercial purposes?

- It's based on the usage guidelines. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright issues in Tax Deduction For Car Purchase?

- Certain printables could be restricted regarding their use. You should read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer or go to an area print shop for high-quality prints.

-

What program is required to open printables that are free?

- The majority of printed documents are in PDF format, which can be opened with free programs like Adobe Reader.

Tax Deduction For Buying A Car For Business Everything You Should Know

Tax Deduction For Car Expenses KMT Partners

Check more sample of Tax Deduction For Car Purchase below

Is There Any Tax Deduction Benefits Of Claiming A Private Car In A

The Qualified Nonpersonal Use Vehicle Houston Tax Attorneys

Can You Claim Tax Deductions For Your Car The Finance Guy

BEST Vehicle Tax Deduction 2023 it s Not Section 179 Deduction YouTube

Doctors Are You Maximising Your Tax Deduction For Car Expenses

Can You Claim Car Expenses As A Tax Deduction

https://www.cars.com/articles/is-buying-a-car-tax-deductible-463517

Some electric vehicles can also be eligible for a tax deduction but a standard vehicle purchase is not tax deductible wrote Steber in an email to Cars Deducting Operating Costs

https://www.thebalancemoney.com/vehicle-tax...

Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The deduction limit in 2024 is 1 220 000

Some electric vehicles can also be eligible for a tax deduction but a standard vehicle purchase is not tax deductible wrote Steber in an email to Cars Deducting Operating Costs

Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The deduction limit in 2024 is 1 220 000

BEST Vehicle Tax Deduction 2023 it s Not Section 179 Deduction YouTube

The Qualified Nonpersonal Use Vehicle Houston Tax Attorneys

Doctors Are You Maximising Your Tax Deduction For Car Expenses

Can You Claim Car Expenses As A Tax Deduction

NO AUTO INTEREST DEDUCTION For You My Car Lady

Receive A Tax Deduction For Donating A Car

Receive A Tax Deduction For Donating A Car

Tax Deduction For Car Donations Car Talk Donation Program