In this age of technology, where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or just adding some personal flair to your area, Tax Deduction For Driving To Work are a great source. In this article, we'll dive deeper into "Tax Deduction For Driving To Work," exploring what they are, where to find them and how they can improve various aspects of your lives.

Get Latest Tax Deduction For Driving To Work Below

Tax Deduction For Driving To Work

Tax Deduction For Driving To Work -

As a self employed person or contractor you can deduct miles driven based on a per mile rate or you can deduct the full expenses as they relate to your business and vehicle See the key differences in the table

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs

Printables for free include a vast collection of printable resources available online for download at no cost. They come in many styles, from worksheets to templates, coloring pages, and many more. The benefit of Tax Deduction For Driving To Work is in their versatility and accessibility.

More of Tax Deduction For Driving To Work

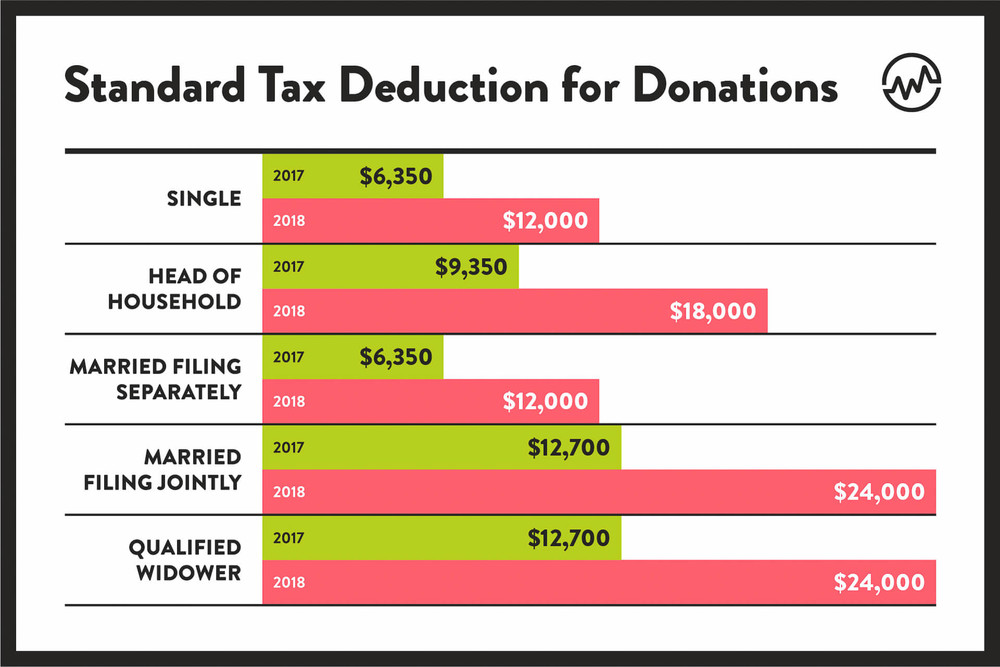

How Much Do You Need To Donate For Tax Deduction

How Much Do You Need To Donate For Tax Deduction

You claim the tax deduction in your income tax return as a work related car expense If you receive an allowance from your employer for car expenses you must include

Driving your vehicle a lot of work can mean a lot of extra miles and added costs Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization This allows you to modify printables to your specific needs for invitations, whether that's creating them planning your schedule or even decorating your home.

-

Educational Value: Printing educational materials for no cost can be used by students of all ages, making the perfect device for teachers and parents.

-

The convenience of immediate access many designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction For Driving To Work

Tax Deduction For Driving To Your Rental Property Tax Modern Income

Tax Deduction For Driving To Your Rental Property Tax Modern Income

3 Office supplies and equipment Remote self employed workers and independent contractors can deduct up to 1 050 000 for office supplies like printer ink paper and stationary as well as

If you have a full time job but use your vehicle for work duties driving to meetings picking up supplies etc your reimbursements from your employer are likely to be tax free for those driving costs

Now that we've piqued your interest in Tax Deduction For Driving To Work, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Tax Deduction For Driving To Work for various purposes.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a wide range of topics, from DIY projects to planning a party.

Maximizing Tax Deduction For Driving To Work

Here are some fresh ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Deduction For Driving To Work are an abundance of creative and practical resources which cater to a wide range of needs and interests. Their access and versatility makes them an essential part of both professional and personal lives. Explore the many options of Tax Deduction For Driving To Work today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial purposes?

- It depends on the specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright problems with Tax Deduction For Driving To Work?

- Some printables may come with restrictions on usage. Make sure you read the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit an in-store print shop to get better quality prints.

-

What program will I need to access printables free of charge?

- The majority of printables are as PDF files, which is open with no cost software, such as Adobe Reader.

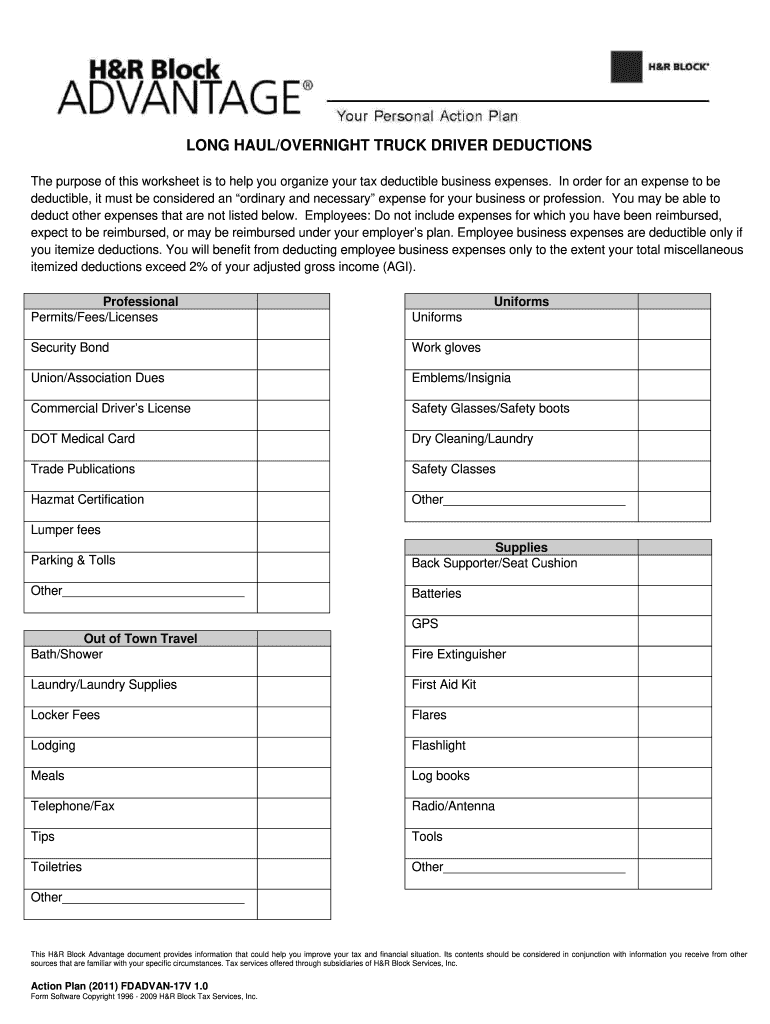

Pin On Business Template

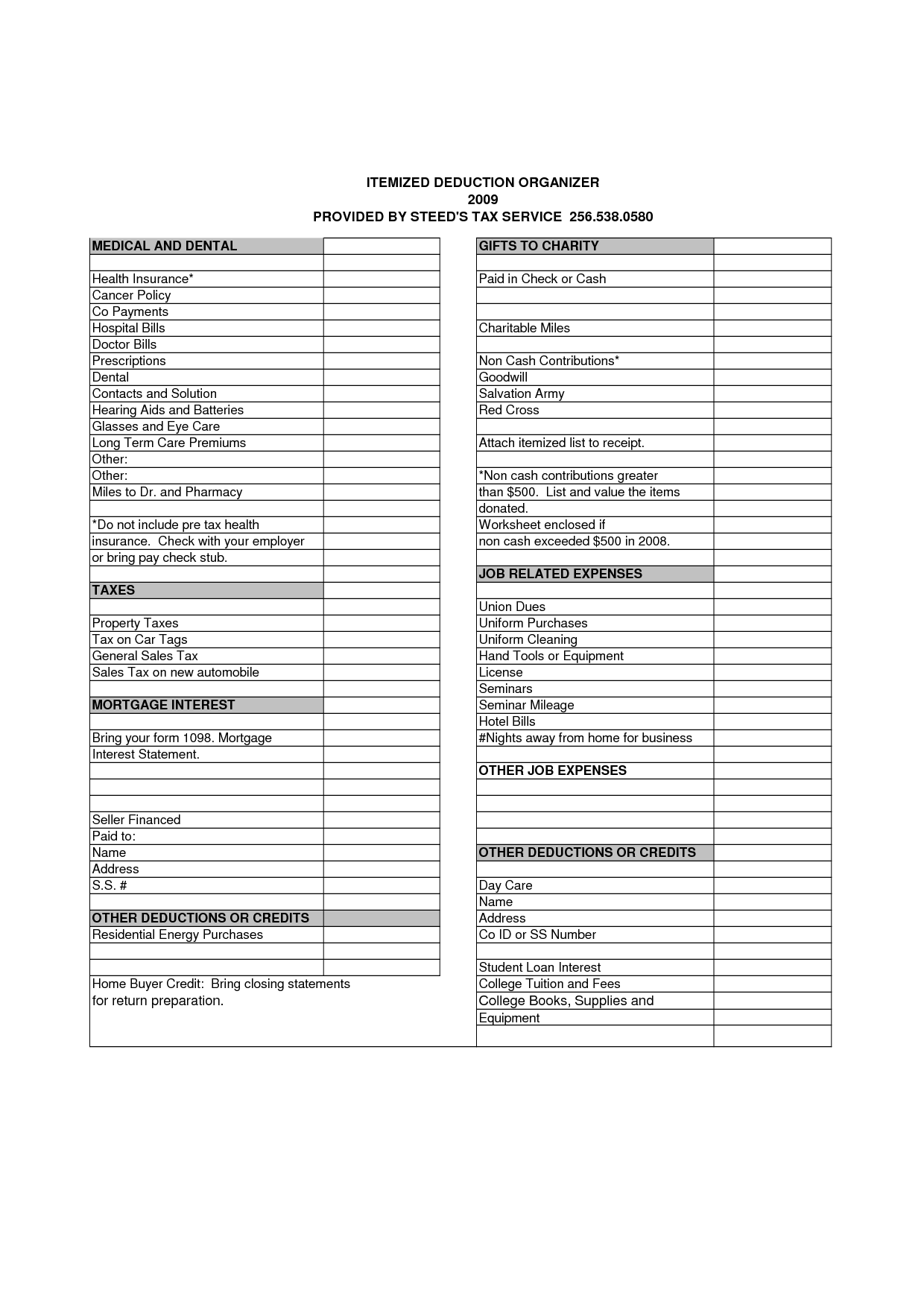

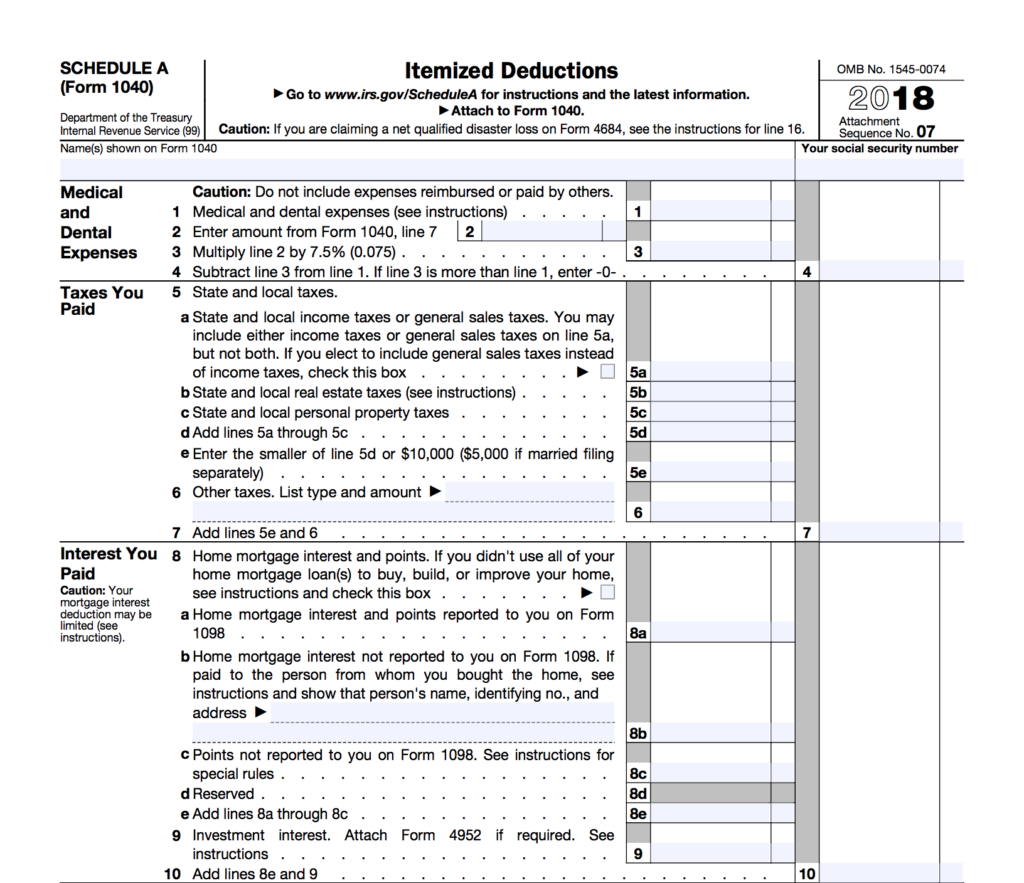

Printable Itemized Deductions Worksheet

Check more sample of Tax Deduction For Driving To Work below

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Truck Driver Tax Deductions Worksheet Form Fill Out And Sign

How Does Tax Deduction Work In India Tax Walls

Printable Itemized Deductions Worksheet

Small Business Bookkeeping Startup Business Plan Successful Business

https://money.usnews.com/money/pers…

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs

https://www.thebalancemoney.com/how …

Learn the IRS rules for deducting your mileage on your tax return including how to choose a mileage method what records you need and how to claim the deduction at tax time

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs

Learn the IRS rules for deducting your mileage on your tax return including how to choose a mileage method what records you need and how to claim the deduction at tax time

How Does Tax Deduction Work In India Tax Walls

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Printable Itemized Deductions Worksheet

Small Business Bookkeeping Startup Business Plan Successful Business

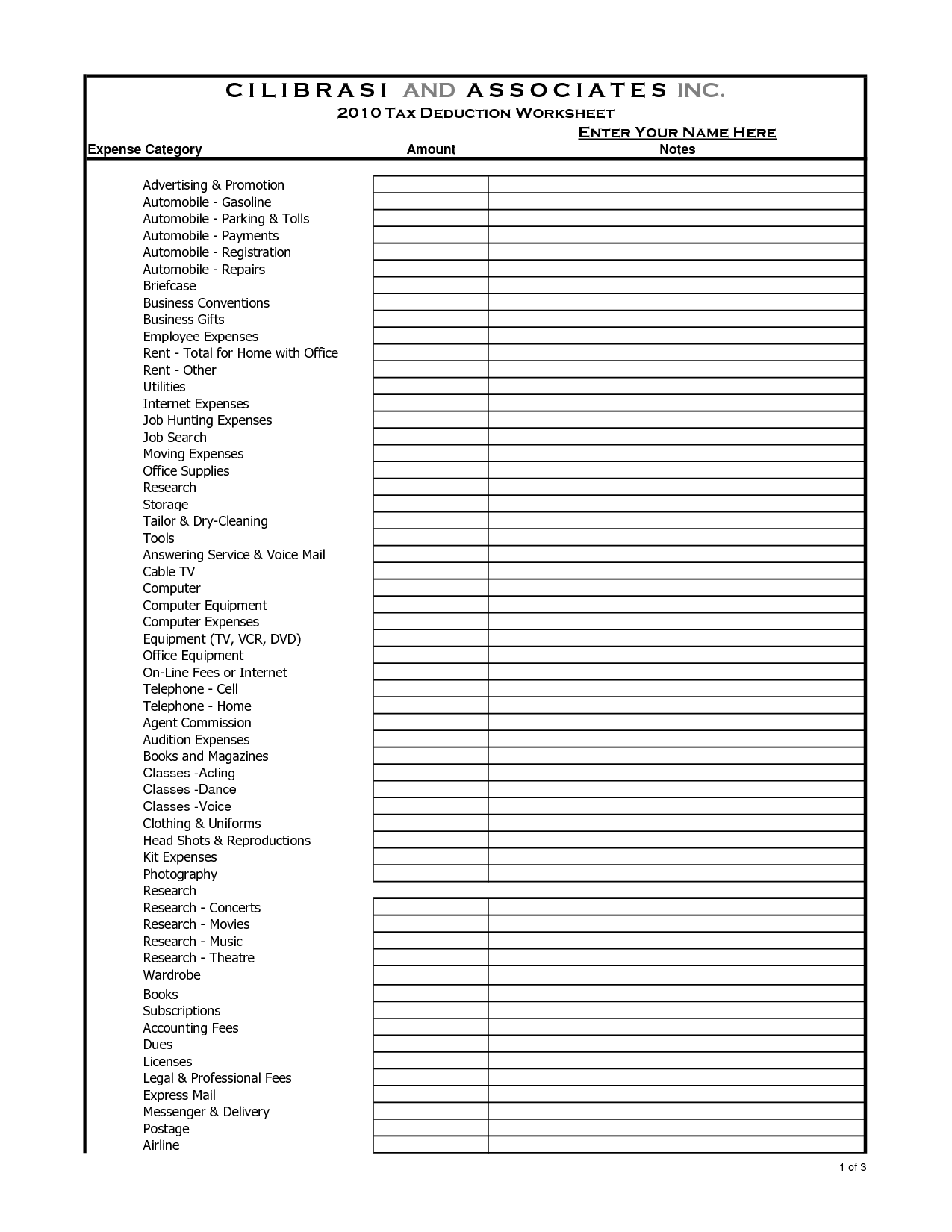

Tax Deduction Worksheet

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021