Today, with screens dominating our lives yet the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses such as creative projects or just adding an extra personal touch to your space, Tax Deduction For Energy Efficiency are now a vital resource. Here, we'll dive deeper into "Tax Deduction For Energy Efficiency," exploring their purpose, where they are available, and how they can be used to enhance different aspects of your life.

Get Latest Tax Deduction For Energy Efficiency Below

Tax Deduction For Energy Efficiency

Tax Deduction For Energy Efficiency -

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

Tax Deduction For Energy Efficiency cover a large selection of printable and downloadable materials that are accessible online for free cost. The resources are offered in a variety types, like worksheets, templates, coloring pages and much more. The benefit of Tax Deduction For Energy Efficiency is in their versatility and accessibility.

More of Tax Deduction For Energy Efficiency

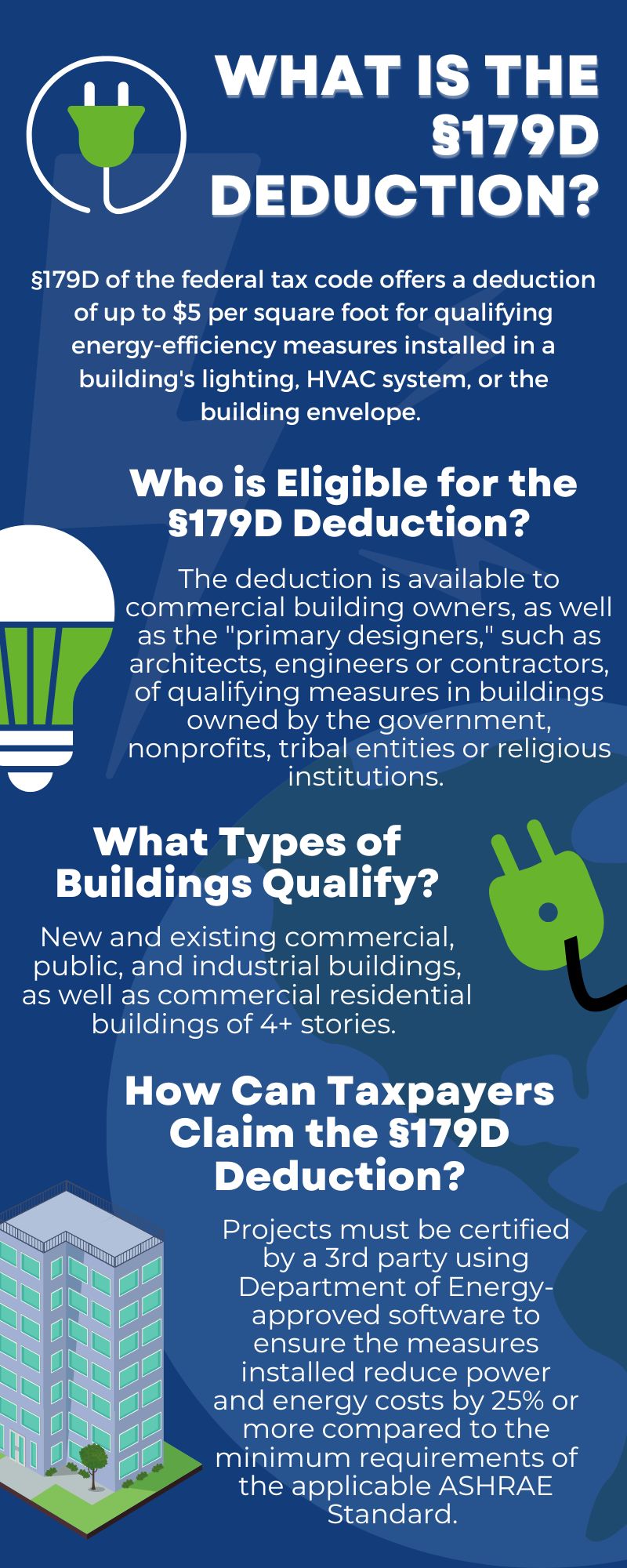

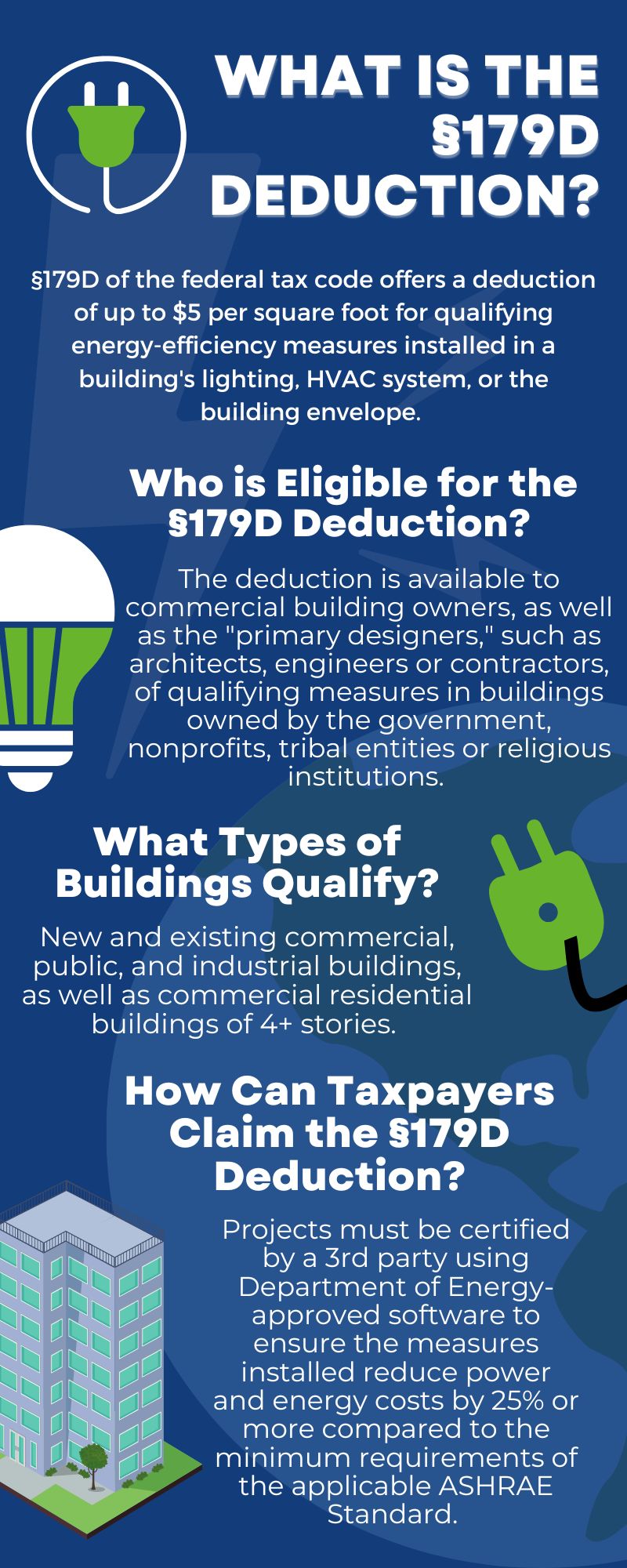

179D Deduction Energy Efficiency Tax Incentives

179D Deduction Energy Efficiency Tax Incentives

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources

On 30 April 2023 the Australian Government announced it will provide businesses with an annual turnover of less than 50 million with an additional 20 deduction on spending that supports electrification and more efficient use of energy This measure is now law

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: We can customize the templates to meet your individual needs be it designing invitations or arranging your schedule or decorating your home.

-

Education Value Educational printables that can be downloaded for free cater to learners of all ages, which makes these printables a powerful tool for teachers and parents.

-

Easy to use: The instant accessibility to many designs and templates is time-saving and saves effort.

Where to Find more Tax Deduction For Energy Efficiency

Energy Efficiency Tax Deduction For Architects Engineers Contractors

Energy Efficiency Tax Deduction For Architects Engineers Contractors

In the past you could get an energy efficient home improvement tax credit worth 10 of the cost of certain energy efficient windows doors and skylights and 100 of the cost of certain air

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022

Since we've got your curiosity about Tax Deduction For Energy Efficiency Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deduction For Energy Efficiency to suit a variety of uses.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast variety of topics, starting from DIY projects to planning a party.

Maximizing Tax Deduction For Energy Efficiency

Here are some creative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction For Energy Efficiency are an abundance filled with creative and practical information that can meet the needs of a variety of people and interests. Their availability and versatility make them an invaluable addition to the professional and personal lives of both. Explore the vast array of Tax Deduction For Energy Efficiency right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these resources at no cost.

-

Do I have the right to use free printables to make commercial products?

- It depends on the specific rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted in their usage. Be sure to check these terms and conditions as set out by the author.

-

How do I print Tax Deduction For Energy Efficiency?

- You can print them at home with an printer, or go to a print shop in your area for better quality prints.

-

What program do I require to open printables free of charge?

- Most PDF-based printables are available with PDF formats, which is open with no cost software such as Adobe Reader.

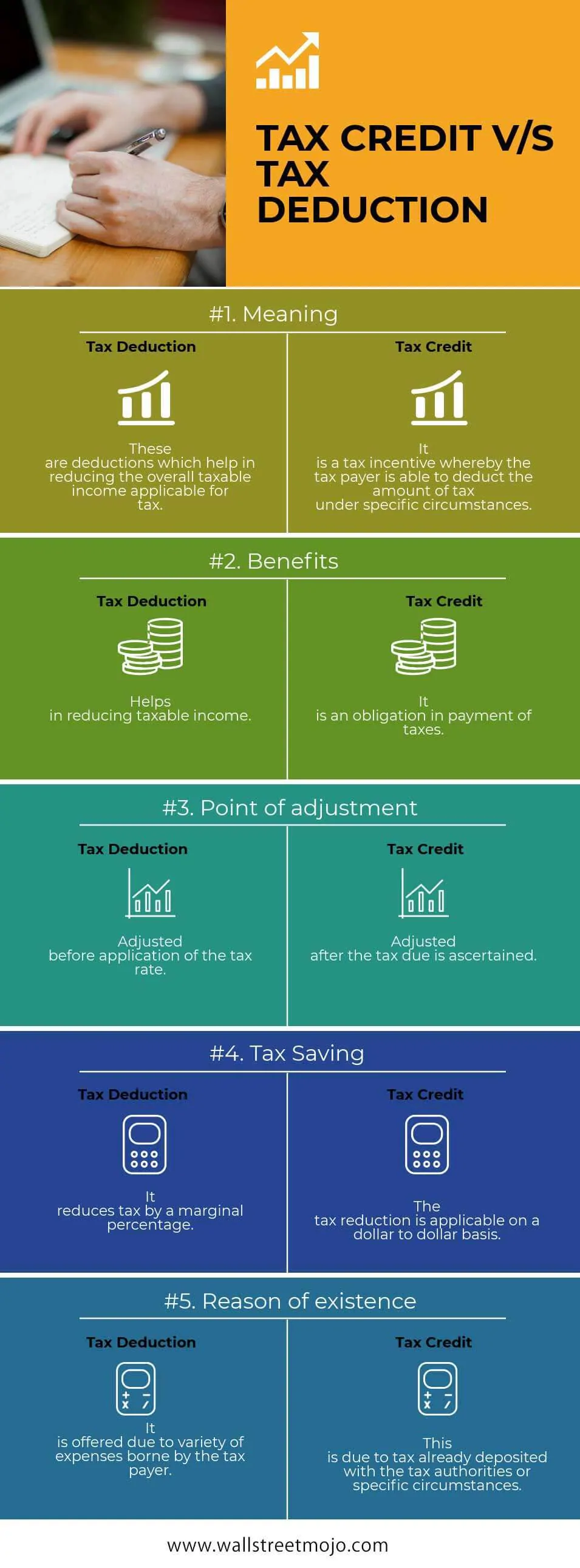

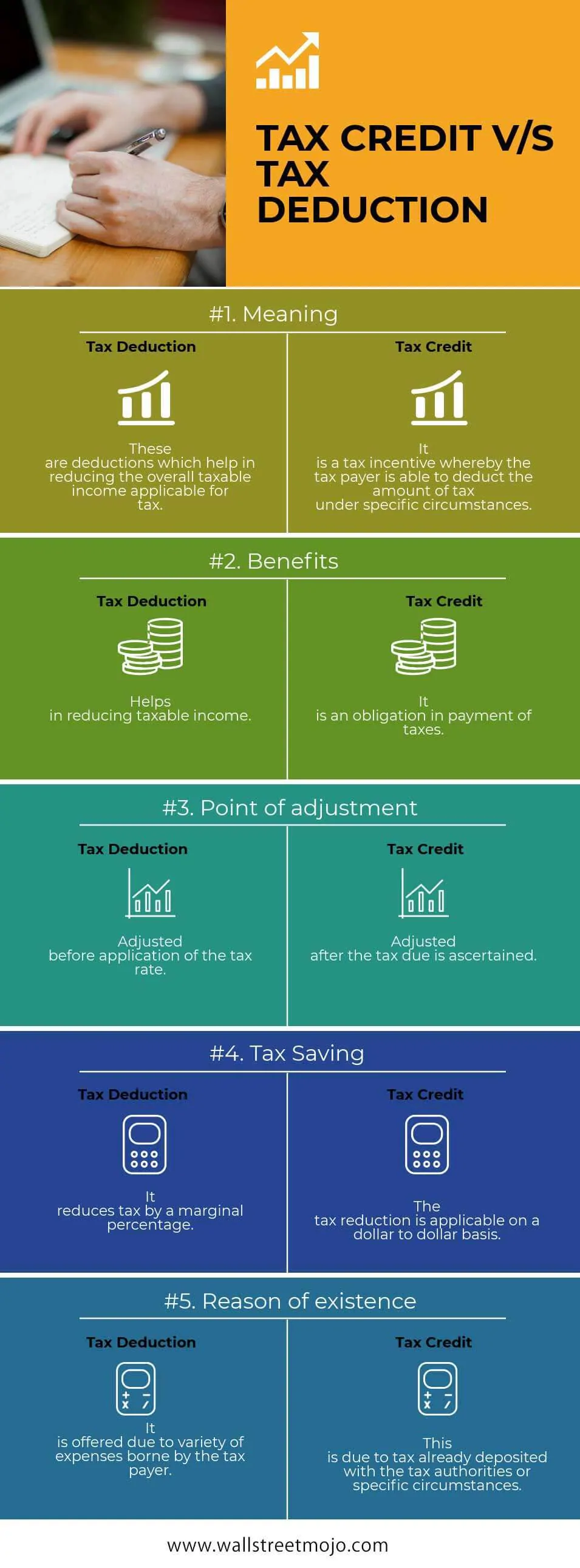

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

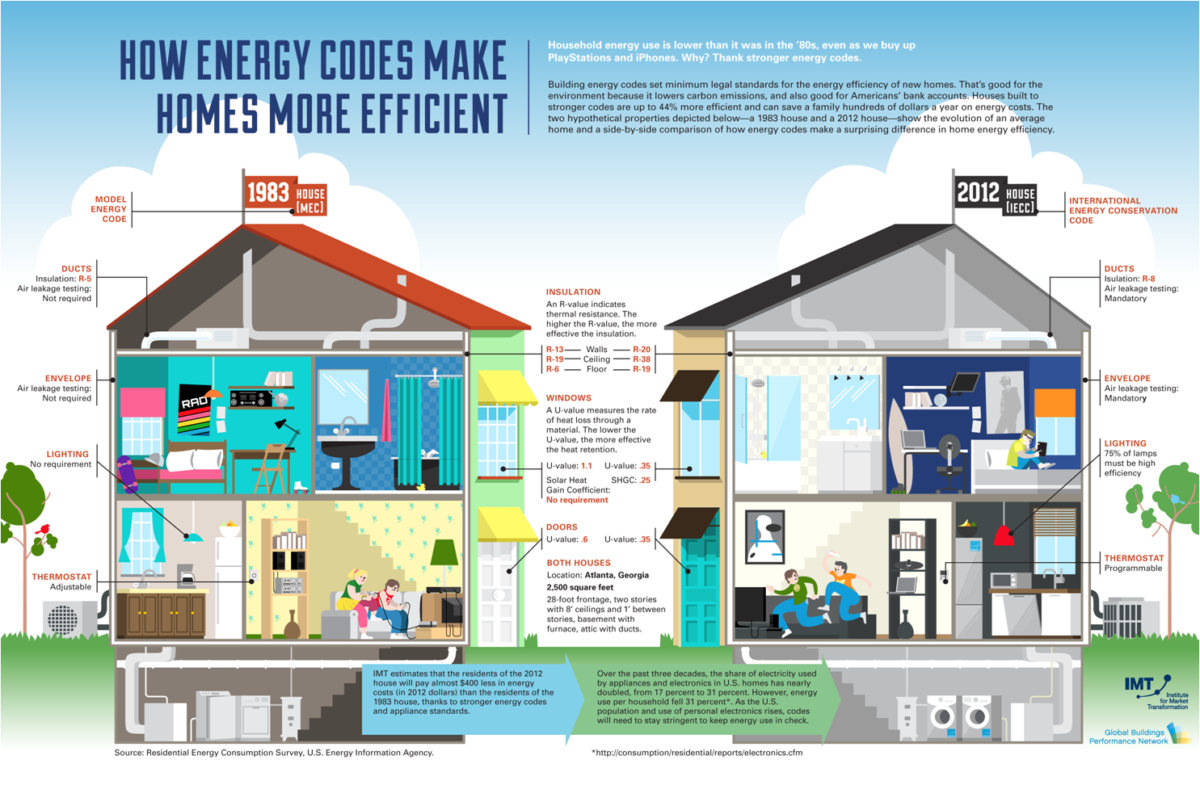

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

Check more sample of Tax Deduction For Energy Efficiency below

Bonus Tax Deduction For Investments To Improve Energy Efficiency

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

Section 179D Energy Efficient Tax Deduction Wipfli

Energy Efficient Buildings RD D

179D Section 179 Energy Efficient Commercial Building Deduction Is

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

https://www.irs.gov/newsroom/irs-updates...

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

https://www.irs.gov/credits-deductions/home-energy-tax-credits

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses

Energy Efficient Buildings RD D

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

179D Section 179 Energy Efficient Commercial Building Deduction Is

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Tax Credits Save You More Than Deductions Here Are The Best Ones

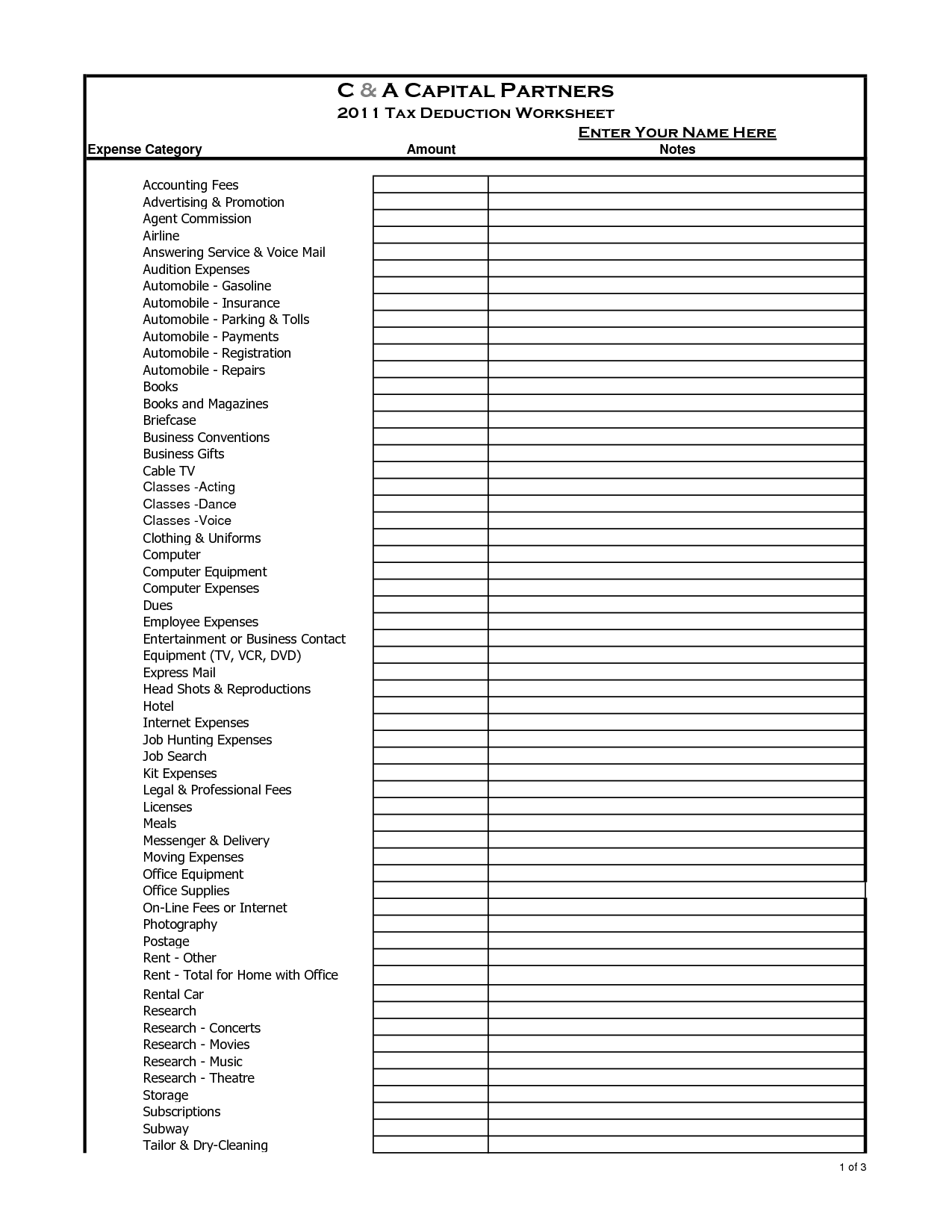

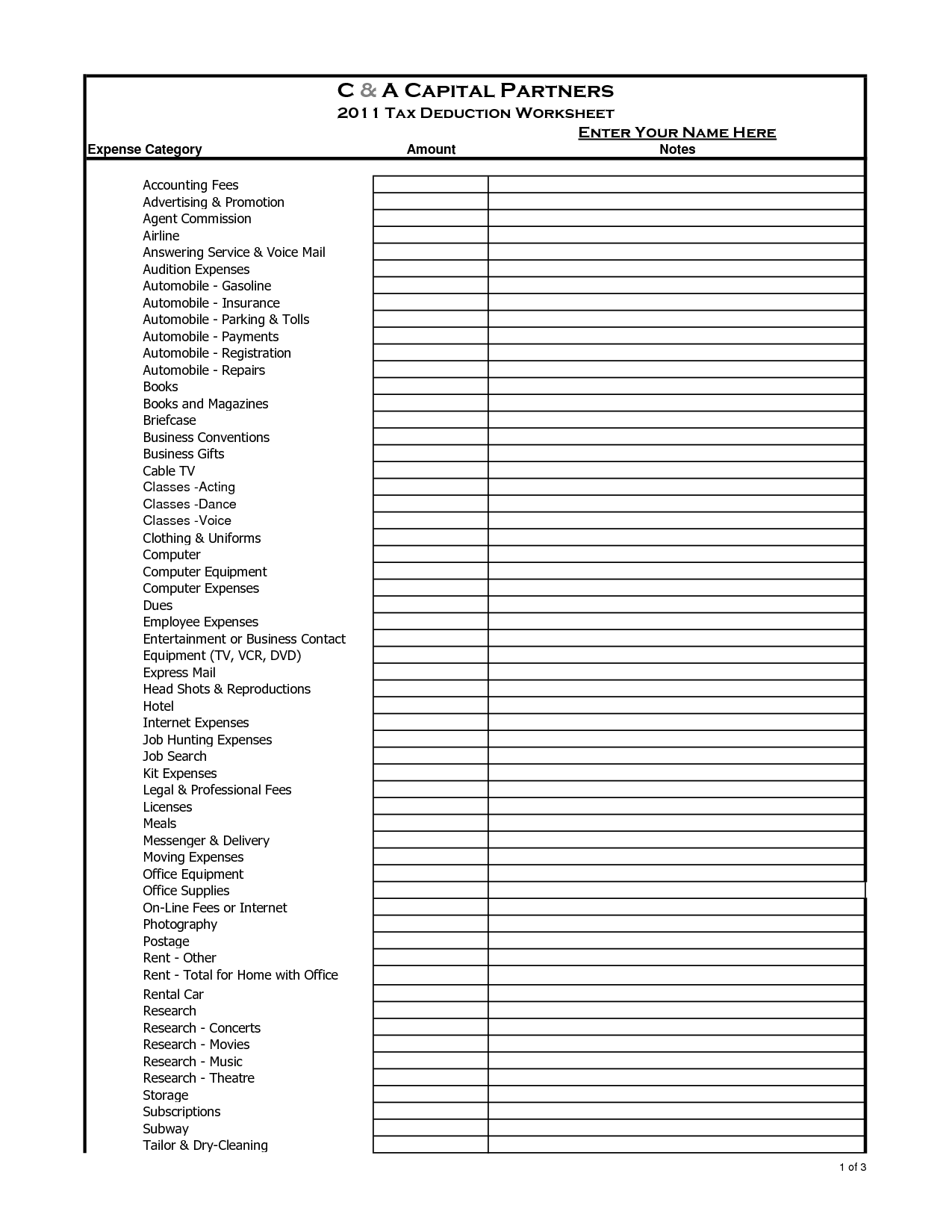

8 Tax Preparation Organizer Worksheet Worksheeto

8 Tax Preparation Organizer Worksheet Worksheeto

Section 179D Tax Deductions Energy Efficient Buildings BRS Business