In this day and age with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use for creative projects, just adding personal touches to your space, Tax Deduction For Energy Efficient Appliances can be an excellent source. Through this post, we'll take a dive into the world "Tax Deduction For Energy Efficient Appliances," exploring what they are, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Tax Deduction For Energy Efficient Appliances Below

Tax Deduction For Energy Efficient Appliances

Tax Deduction For Energy Efficient Appliances -

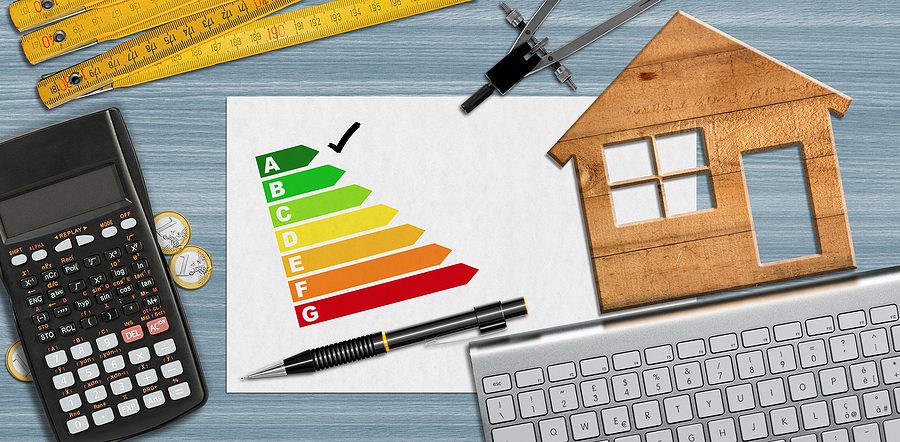

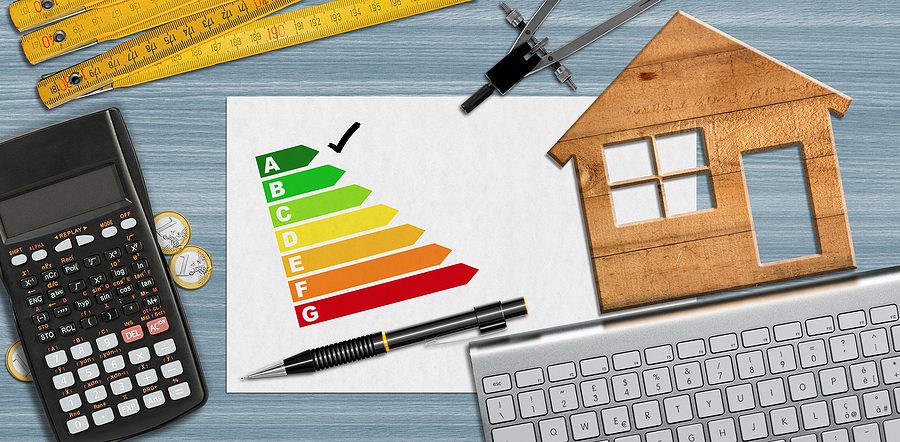

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product and services

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

Printables for free cover a broad collection of printable materials that are accessible online for free cost. They come in many designs, including worksheets coloring pages, templates and much more. One of the advantages of Tax Deduction For Energy Efficient Appliances is in their variety and accessibility.

More of Tax Deduction For Energy Efficient Appliances

Inflation Reduction Act 179D Energy Efficient Tax Deduction Explained

Inflation Reduction Act 179D Energy Efficient Tax Deduction Explained

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many state and local governments and utility companies offer incentives or rebates for energy or water saving home improvements

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: This allows you to modify designs to suit your personal needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages, which makes these printables a powerful instrument for parents and teachers.

-

An easy way to access HTML0: You have instant access a variety of designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction For Energy Efficient Appliances

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to ENERGY STAR certified models Accountants should assist clients in understanding the eligibility criteria and documenting the installation of energy efficient water heating systems

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Now that we've ignited your interest in Tax Deduction For Energy Efficient Appliances Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Tax Deduction For Energy Efficient Appliances for all goals.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad range of topics, ranging from DIY projects to party planning.

Maximizing Tax Deduction For Energy Efficient Appliances

Here are some new ways that you can make use use of Tax Deduction For Energy Efficient Appliances:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Tax Deduction For Energy Efficient Appliances are a treasure trove of innovative and useful resources catering to different needs and pursuits. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the plethora of Tax Deduction For Energy Efficient Appliances now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these materials for free.

-

Can I utilize free templates for commercial use?

- It's determined by the specific rules of usage. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright issues in Tax Deduction For Energy Efficient Appliances?

- Some printables may come with restrictions in use. Be sure to check the terms and conditions provided by the designer.

-

How can I print Tax Deduction For Energy Efficient Appliances?

- Print them at home with your printer or visit an in-store print shop to get better quality prints.

-

What program do I require to open printables for free?

- The majority of printables are as PDF files, which can be opened with free software such as Adobe Reader.

179D Section 179 Energy Efficient Commercial Building Deduction Is

Update Again On Energy Efficient Commercial Buildings Tax Deduction

Check more sample of Tax Deduction For Energy Efficient Appliances below

Estimate 179D Energy Efficient Tax Deduction Incentives Alliantgroup

Fog o A Lenha Mais Eficiente EDUCA

Section 179D Tax Deduction For Energy Efficient Commercial Buildings NV5

Major Changes To 179D Deduction And 45L Tax Credit In 2023 To

Tax Deduction For Energy Efficient Windows FridayNewsWorld

How To Claim The New IRC 179D Energy Efficient Tax Deduction

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

https://www.irs.gov/newsroom/irs-updates...

Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will be treated as a reduction in the purchase price or cost of property for eligible upgrades and projects

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will be treated as a reduction in the purchase price or cost of property for eligible upgrades and projects

Major Changes To 179D Deduction And 45L Tax Credit In 2023 To

Fog o A Lenha Mais Eficiente EDUCA

Tax Deduction For Energy Efficient Windows FridayNewsWorld

How To Claim The New IRC 179D Energy Efficient Tax Deduction

How The Inflation Reduction Act Helps You Save More By Going Green

The Inflation Reduction Act Significantly Changes The 179D Energy

The Inflation Reduction Act Significantly Changes The 179D Energy

179D Energy Efficient Commercial Building Deduction NELSON