In the digital age, where screens rule our lives however, the attraction of tangible printed materials hasn't faded away. If it's to aid in education or creative projects, or simply to add an extra personal touch to your area, Tax Deduction For Ev are now a useful resource. Here, we'll take a dive deeper into "Tax Deduction For Ev," exploring the different types of printables, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Tax Deduction For Ev Below

.jpg)

Tax Deduction For Ev

Tax Deduction For Ev -

Section 80EEB has been introduced allowing a deduction for interest paid on loan taken for the purchase of electric vehicles A deduction for interest payments up to Rs

The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable tax credits lower your tax liability by the corresponding credit amount This means the credit can make a sizable dent in your tax bill but See more

Printables for free cover a broad array of printable items that are available online at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and more. The beauty of Tax Deduction For Ev lies in their versatility as well as accessibility.

More of Tax Deduction For Ev

7 500 EV Tax Credit Use It Or Lose It YouTube

7 500 EV Tax Credit Use It Or Lose It YouTube

VAT deduction and exemption for zero emission passenger and combination cars used for business purposes eg BEVs and FCEVs VAT deduction applies according to gross

The Inflation Reduction Act established changes to the EV tax credit a federal incentive to encourage consumers to purchase electric vehicles Those who meet the income requirements and buy a

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization You can tailor the templates to meet your individual needs in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Educational printables that can be downloaded for free provide for students from all ages, making them a valuable source for educators and parents.

-

It's easy: Fast access a variety of designs and templates helps save time and effort.

Where to Find more Tax Deduction For Ev

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Explore the unique aspects of electric vehicle EV mileage for tax deductions and business use in this comprehensive guide Learn how to calculate the IRS mileage rate for EVs understand

The tax credit for EVs provides up to 7 500 toward a purchase of a qualifying Tesla Rivian or other plug in car

After we've peaked your interest in Tax Deduction For Ev Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Tax Deduction For Ev to suit a variety of needs.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide range of interests, including DIY projects to party planning.

Maximizing Tax Deduction For Ev

Here are some ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Tax Deduction For Ev are an abundance of creative and practical resources that cater to various needs and desires. Their availability and versatility make them a fantastic addition to both personal and professional life. Explore the vast array of Tax Deduction For Ev today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes, they are! You can download and print these files for free.

-

Are there any free printables in commercial projects?

- It's based on the conditions of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may have restrictions on use. You should read these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in the local print shops for superior prints.

-

What software must I use to open printables free of charge?

- Many printables are offered in the PDF format, and can be opened using free software like Adobe Reader.

Simple Guide To Deduction U S 80EEB For Purchasing Of EV SAG Infotech

A Complete Guide To The New EV Tax Credit

Check more sample of Tax Deduction For Ev below

The Inflation Reduction Act Discourages Electric Vehicle Buyers From

EV Tax Credit 2022 Updates Shared Economy Tax

How Much Do You Need To Donate For Tax Deduction

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

EV Tax Credits Explained How EV Tax Credits Work Krystal A CPA

Tax Deduction For Food Donation Guide Published The LL M Program In

.jpg?w=186)

https://www.nerdwallet.com/article/taxes/ev-tax...

The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable tax credits lower your tax liability by the corresponding credit amount This means the credit can make a sizable dent in your tax bill but See more

https://www.acea.auto/files/Electric_vehicles-Tax...

Tax deduction of 170 per month from taxable value income tax for BEVs from 1 January 2021 until 31 December 2025 Charging of electric vehicles at workplace is exempted from

The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable tax credits lower your tax liability by the corresponding credit amount This means the credit can make a sizable dent in your tax bill but See more

Tax deduction of 170 per month from taxable value income tax for BEVs from 1 January 2021 until 31 December 2025 Charging of electric vehicles at workplace is exempted from

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

EV Tax Credit 2022 Updates Shared Economy Tax

EV Tax Credits Explained How EV Tax Credits Work Krystal A CPA

Tax Deduction For Food Donation Guide Published The LL M Program In

EV Drive SIAM For 5 Pc GST Income Tax Deduction For Individual Buyers

The New EV Tax Credit In 2023 Everything You Need To Know Updated

The New EV Tax Credit In 2023 Everything You Need To Know Updated

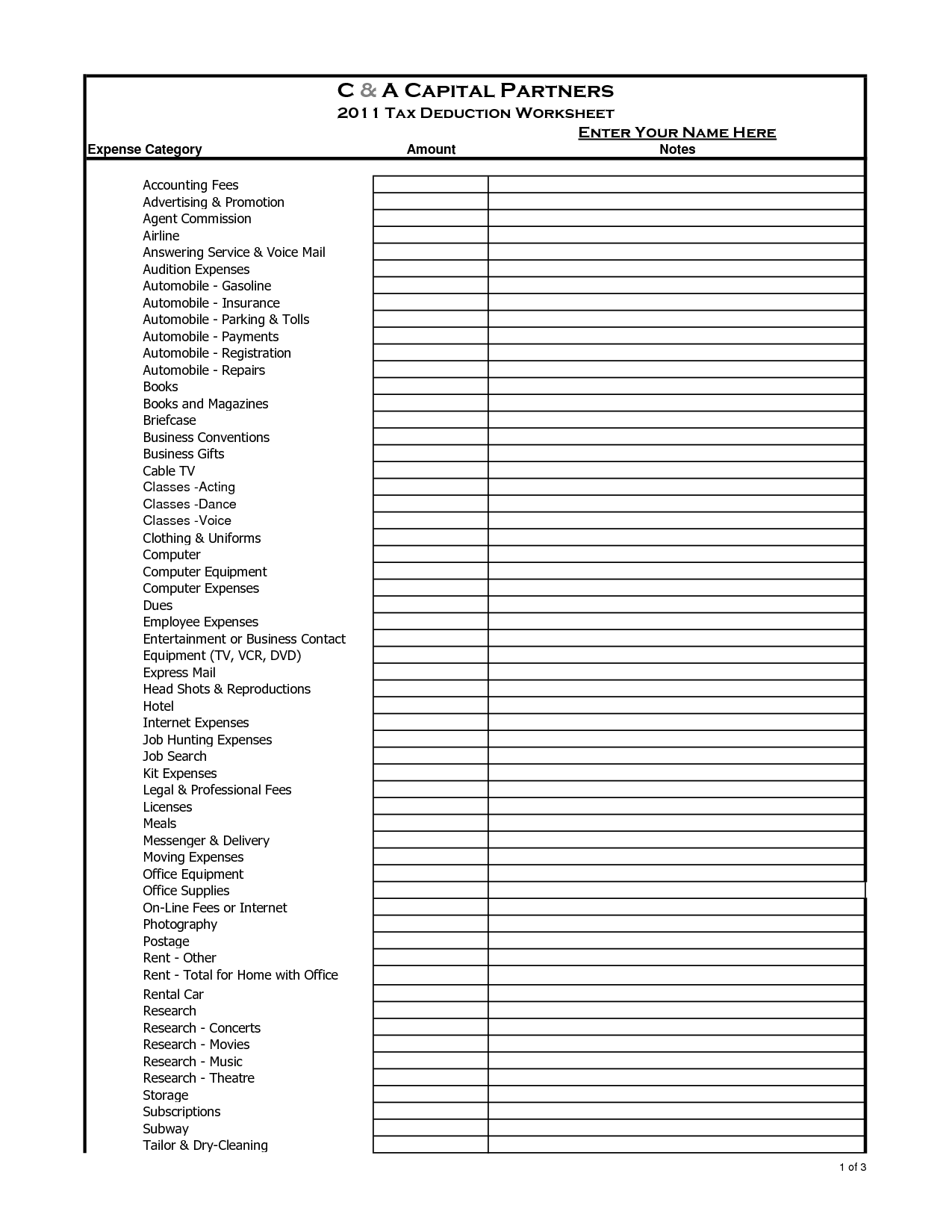

8 Tax Preparation Organizer Worksheet Worksheeto