In the digital age, where screens rule our lives but the value of tangible printed objects hasn't waned. Whatever the reason, whether for education project ideas, artistic or just adding the personal touch to your area, Tax Deduction For Mileage To Medical Appointments have proven to be a valuable resource. With this guide, you'll take a dive through the vast world of "Tax Deduction For Mileage To Medical Appointments," exploring what they are, how to locate them, and how they can enhance various aspects of your daily life.

Get Latest Tax Deduction For Mileage To Medical Appointments Below

Tax Deduction For Mileage To Medical Appointments

Tax Deduction For Mileage To Medical Appointments -

The standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 cents mile Find out when you can deduct vehicle mileage

If you don t want to use your actual expenses for 2023 you can use the standard medical mileage rate of 22 cents a mile You can also include parking fees and tolls You can add these fees and tolls to your medical expenses whether you use actual expenses or the standard mileage rate

Tax Deduction For Mileage To Medical Appointments encompass a wide collection of printable materials available online at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and more. The beauty of Tax Deduction For Mileage To Medical Appointments lies in their versatility and accessibility.

More of Tax Deduction For Mileage To Medical Appointments

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

As of on Jan 1 2024 the standard IRS mileage rates for cars also vans pickups or panel trucks are as follows 67 cents per mile driven for business use 21 cents per mile driven for medical purposes 14 cents per mile driven in service of charitable organizations

The IRS lets you deduct medical expenses only if the amount is more than 10 of your adjusted gross income AGI If you or your spouse were born before January 2 1951 you can deduct medical and dental expenses that are more than 7 5 of your AGI

Tax Deduction For Mileage To Medical Appointments have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: It is possible to tailor printing templates to your own specific requirements when it comes to designing invitations and schedules, or even decorating your home.

-

Educational Use: The free educational worksheets provide for students of all ages. This makes them an essential device for teachers and parents.

-

Affordability: Quick access to various designs and templates reduces time and effort.

Where to Find more Tax Deduction For Mileage To Medical Appointments

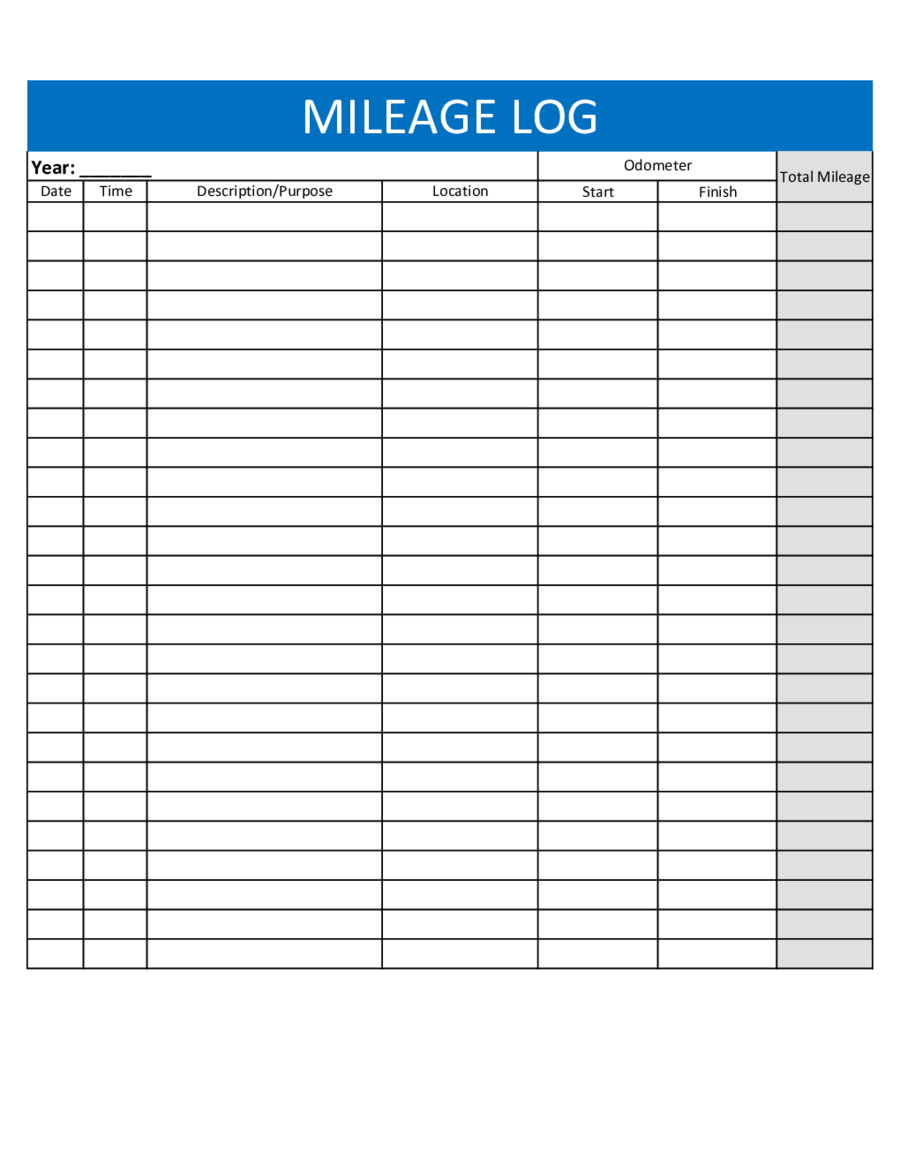

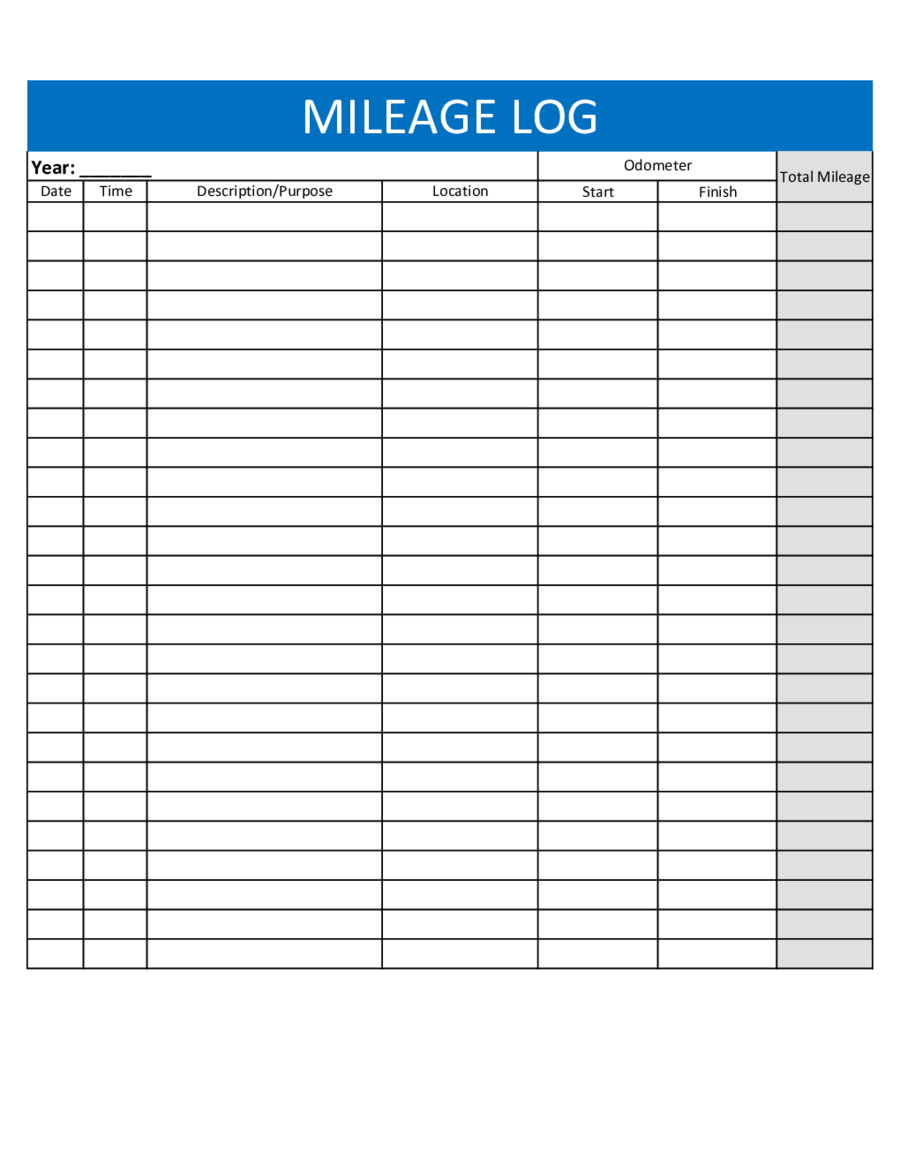

Free Mileage Log Template IRS Compliant Excel PDF

Free Mileage Log Template IRS Compliant Excel PDF

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return You were resident in Canada throughout 2023 You were 18 years of age or older at the end of 2023 You must also meet the criteria related to income

Standard Mileage Deduction Rates Purpose 2022 tax return due in 2023 2023 tax return due in 2024 Business mileage 58 5 cents per mile 65 5 cents per mile Medical and moving mileage 18 cents per mile 22 cents per mile Charitable mileage 14 cents per mile 14 cents per mile

We've now piqued your curiosity about Tax Deduction For Mileage To Medical Appointments Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Tax Deduction For Mileage To Medical Appointments for a variety objectives.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs covered cover a wide spectrum of interests, including DIY projects to party planning.

Maximizing Tax Deduction For Mileage To Medical Appointments

Here are some ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction For Mileage To Medical Appointments are an abundance with useful and creative ideas which cater to a wide range of needs and pursuits. Their availability and versatility make they a beneficial addition to both professional and personal lives. Explore the vast world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can download and print these materials for free.

-

Can I make use of free printables for commercial uses?

- It's all dependent on the conditions of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions in their usage. Always read these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home with your printer or visit an area print shop for higher quality prints.

-

What program is required to open printables for free?

- Many printables are offered in PDF format. These can be opened with free software, such as Adobe Reader.

Printable Itemized Deductions Worksheet

Mileage Log Template Sample For PDF And Doc Mileage Food Diary

Check more sample of Tax Deduction For Mileage To Medical Appointments below

Peerless Google Sheets Mileage Template Best Powerpoint Templates 2018 Free

Mileage Sheets Free Excel Templates

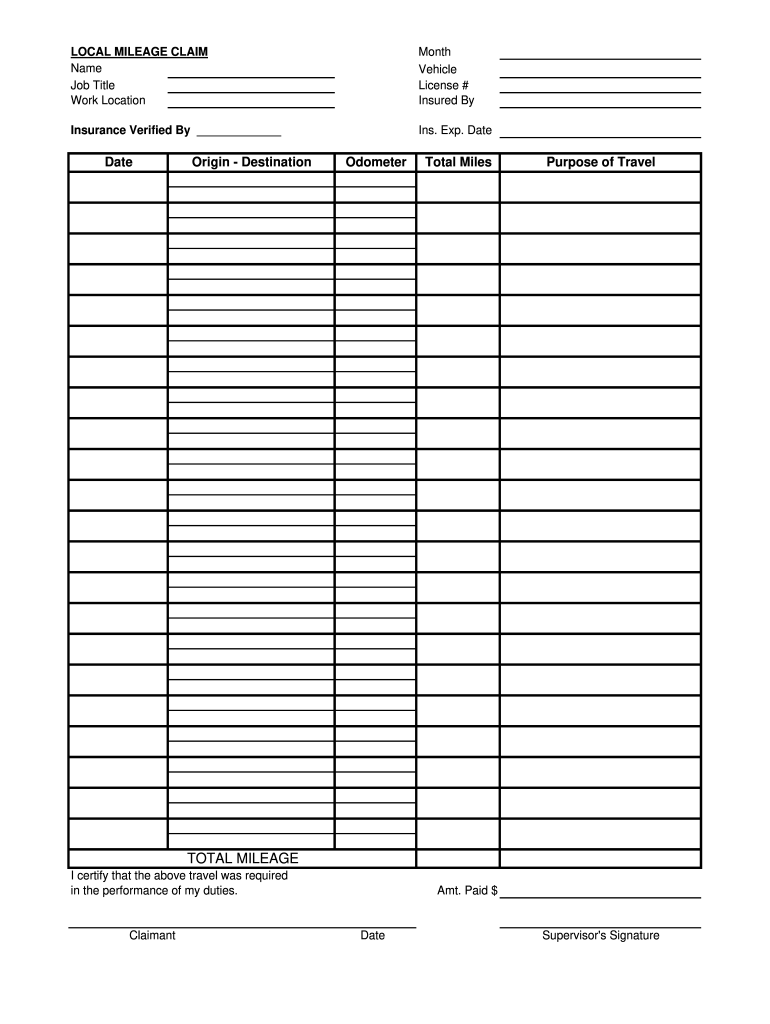

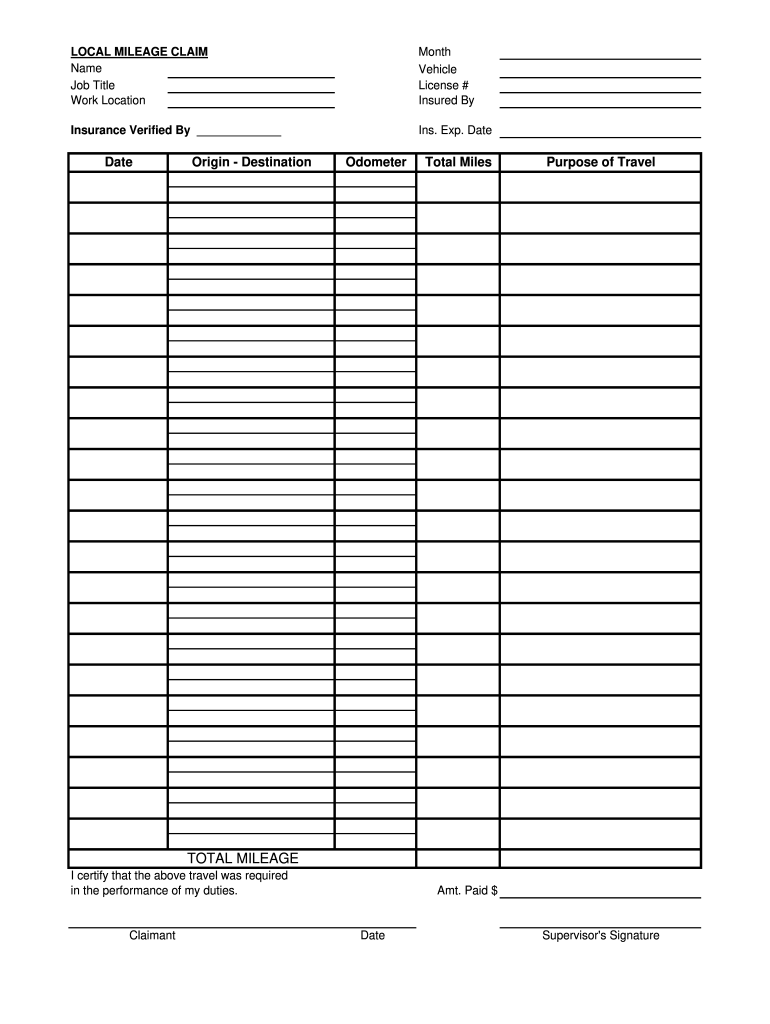

Mileage Sheet IRS IRS Mileage Rate 2021

![]()

Mileage Form PDF IRS Mileage Rate 2021

Tax Deduction For Mileage To Second Job Sapling

Printable Itemized Deductions Worksheet

https://www. irs.gov /publications/p502

If you don t want to use your actual expenses for 2023 you can use the standard medical mileage rate of 22 cents a mile You can also include parking fees and tolls You can add these fees and tolls to your medical expenses whether you use actual expenses or the standard mileage rate

https:// ttlc.intuit.com /turbotax-support/en-us/help-article/...

SOLVED by TurboTax 2054 Updated December 13 2023 Yes you can deduct costs associated with using your car or public transportation for medical visits and even to pick up prescriptions For car expenses you can use either the standard mileage rate TurboTax figures it for you or actual expenses such as gas

If you don t want to use your actual expenses for 2023 you can use the standard medical mileage rate of 22 cents a mile You can also include parking fees and tolls You can add these fees and tolls to your medical expenses whether you use actual expenses or the standard mileage rate

SOLVED by TurboTax 2054 Updated December 13 2023 Yes you can deduct costs associated with using your car or public transportation for medical visits and even to pick up prescriptions For car expenses you can use either the standard mileage rate TurboTax figures it for you or actual expenses such as gas

Mileage Form PDF IRS Mileage Rate 2021

Mileage Sheets Free Excel Templates

Tax Deduction For Mileage To Second Job Sapling

Printable Itemized Deductions Worksheet

Do I Have To Pay Quarterly Taxes On My Side Job FJ Koelle

Solved In This Project You Will Finish An Application That Provides

Solved In This Project You Will Finish An Application That Provides

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction