Today, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses, creative projects, or simply adding the personal touch to your space, Tax Deduction For Rental Properties are a great resource. The following article is a take a dive in the world of "Tax Deduction For Rental Properties," exploring the benefits of them, where they are, and how they can enhance various aspects of your life.

Get Latest Tax Deduction For Rental Properties Below

Tax Deduction For Rental Properties

Tax Deduction For Rental Properties -

Landlord tax deductions include just about every conceivable expense associated with rental properties plus some just on paper expenses However tax laws change fast so investors need to stay on top of real estate

Rental property owners can deduct the costs of owning maintaining and operating the property Most residential rental property is depreciated at a rate of 3 636 per year for 27 5 years what

Tax Deduction For Rental Properties cover a large assortment of printable, downloadable materials that are accessible online for free cost. These resources come in many types, like worksheets, templates, coloring pages and many more. The great thing about Tax Deduction For Rental Properties is their flexibility and accessibility.

More of Tax Deduction For Rental Properties

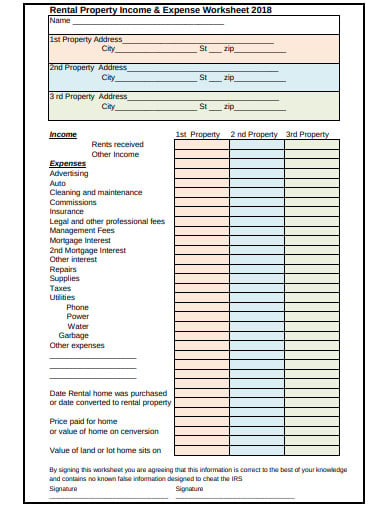

Rental Property Tax Worksheets

Rental Property Tax Worksheets

Tax deductions for rental property Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say should be

You must divide the real estate taxes mortgage interest and fire insurance between the personal use of the property and the rental use of the property You can deduct eleven twelfths of these expenses as rental expenses

Tax Deduction For Rental Properties have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor printables to your specific needs when it comes to designing invitations to organize your schedule or even decorating your house.

-

Educational Benefits: The free educational worksheets cater to learners of all ages. This makes them a valuable source for educators and parents.

-

Simple: Instant access to a myriad of designs as well as templates can save you time and energy.

Where to Find more Tax Deduction For Rental Properties

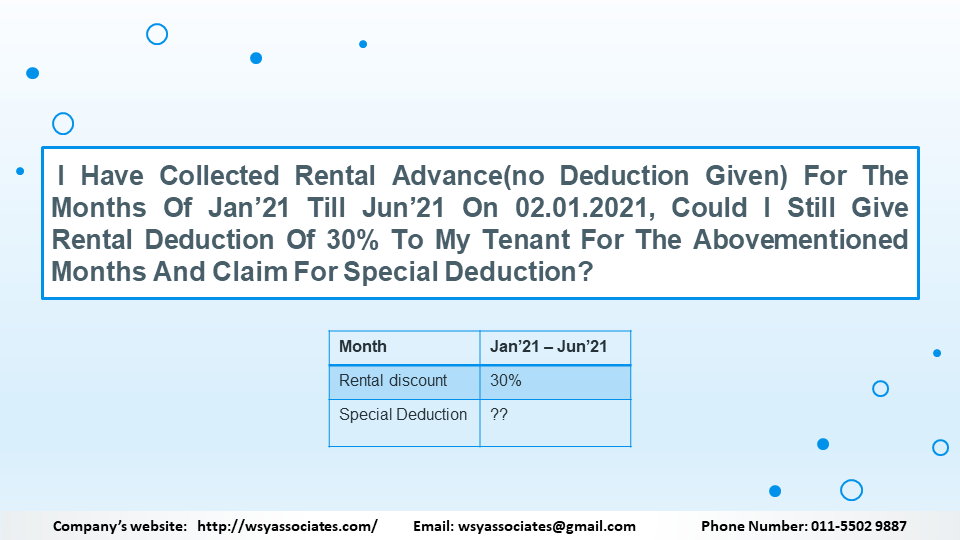

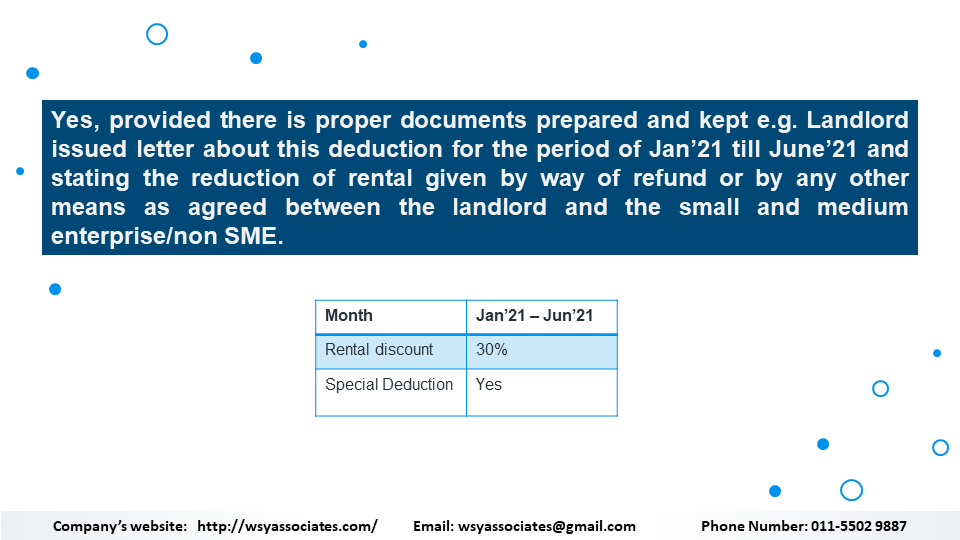

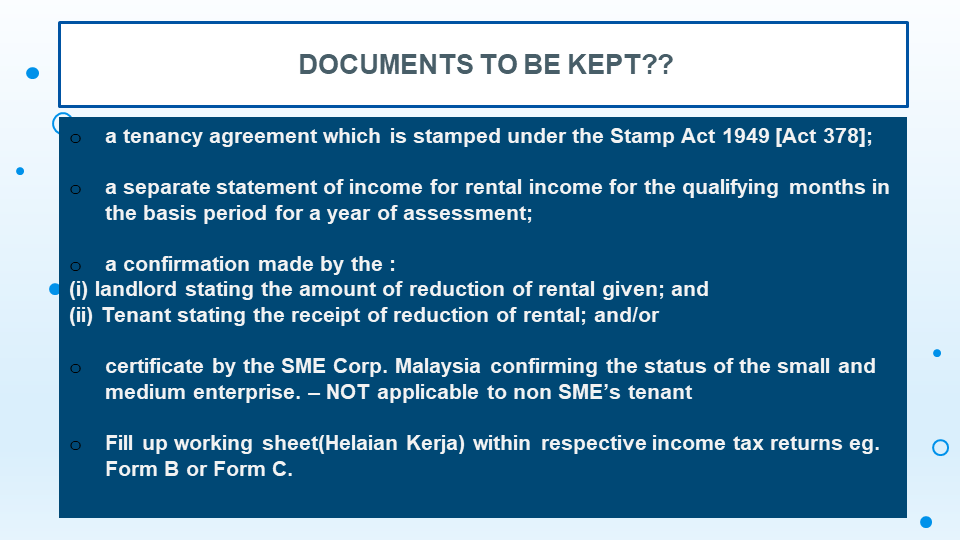

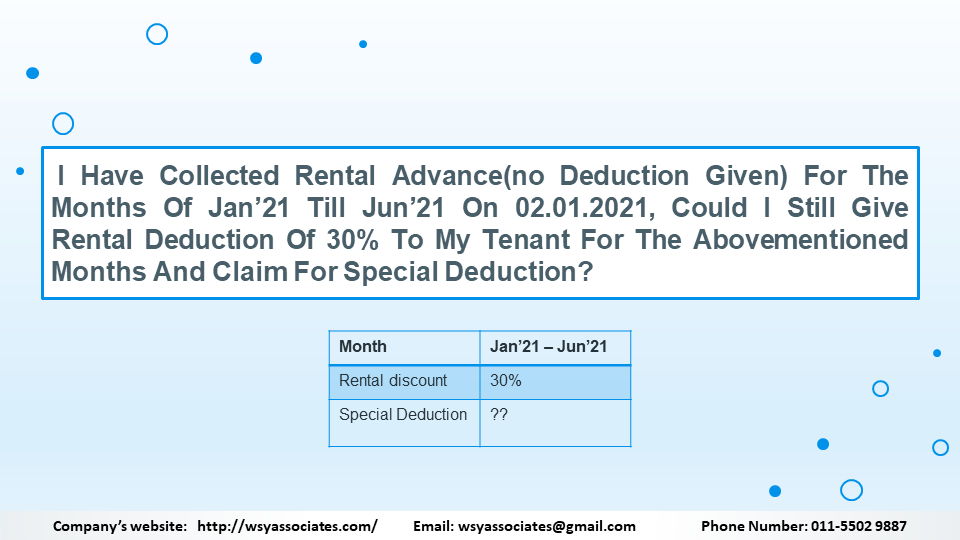

Special Tax Deduction Rental Reduction Apr 26 2022 Johor Bahru JB

Special Tax Deduction Rental Reduction Apr 26 2022 Johor Bahru JB

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of

One significant advantage of owning a rental property is the plethora of tax deductions available These deductions allow you to reduce your taxable income resulting in

Since we've got your curiosity about Tax Deduction For Rental Properties We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of applications.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs covered cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Tax Deduction For Rental Properties

Here are some new ways for you to get the best use of Tax Deduction For Rental Properties:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Deduction For Rental Properties are a treasure trove of useful and creative resources that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make they a beneficial addition to both professional and personal lives. Explore the many options of Tax Deduction For Rental Properties now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these tools for free.

-

Do I have the right to use free printables for commercial use?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations on usage. Make sure you read these terms and conditions as set out by the creator.

-

How can I print Tax Deduction For Rental Properties?

- You can print them at home with either a printer or go to the local print shop for more high-quality prints.

-

What program do I require to open printables that are free?

- The majority of printed documents are in the format PDF. This is open with no cost software, such as Adobe Reader.

20 Tax Deduction For Rental Real Estate

Tax Deductions For Rental Property Derland Bahr CPA Inc

Check more sample of Tax Deduction For Rental Properties below

Special Deduction Rental Reduction To SME And Non SME WSY Associates

Mortgage Interest Rate A New Tax Regime Allows The Deduction Of

Special Deduction Rental Reduction To SME And Non SME WSY Associates

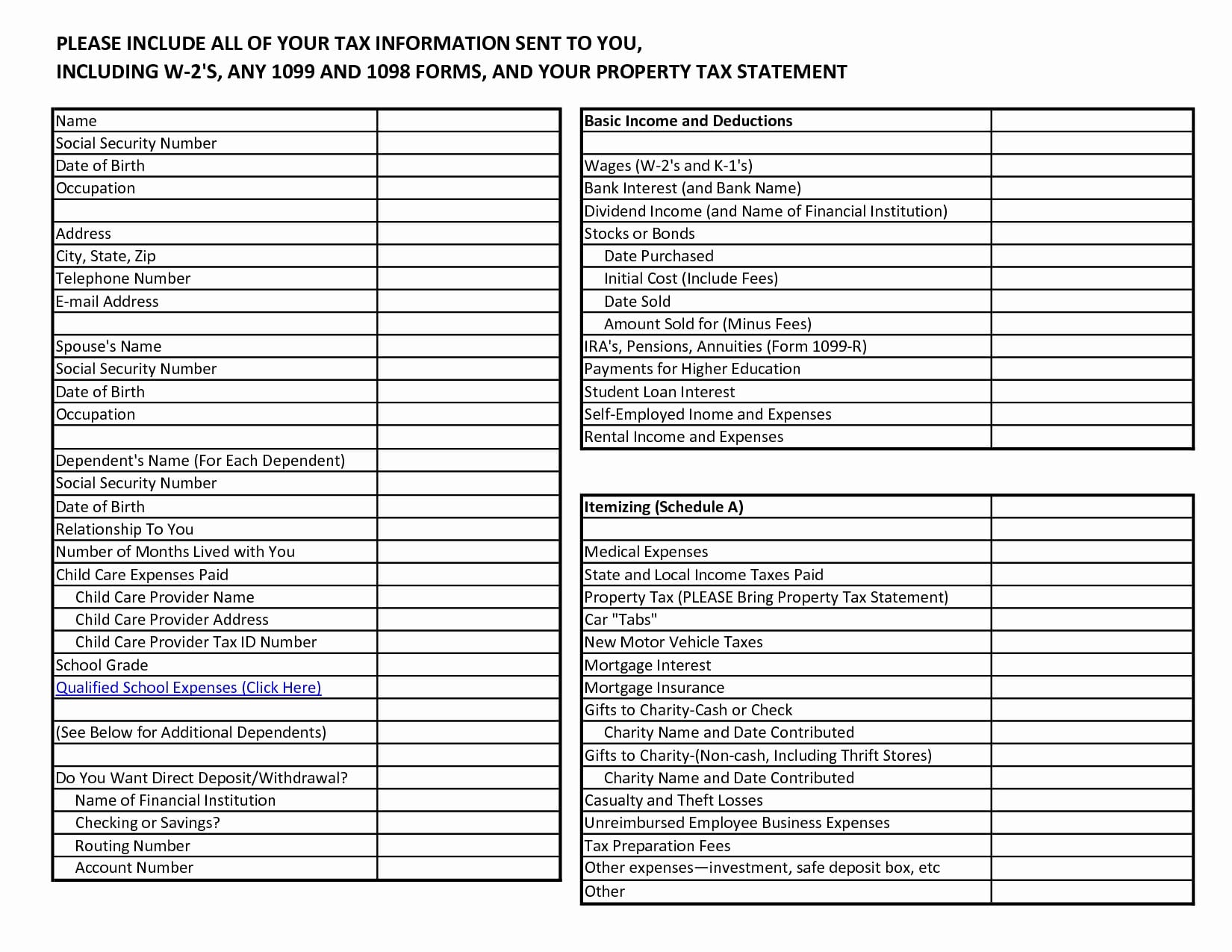

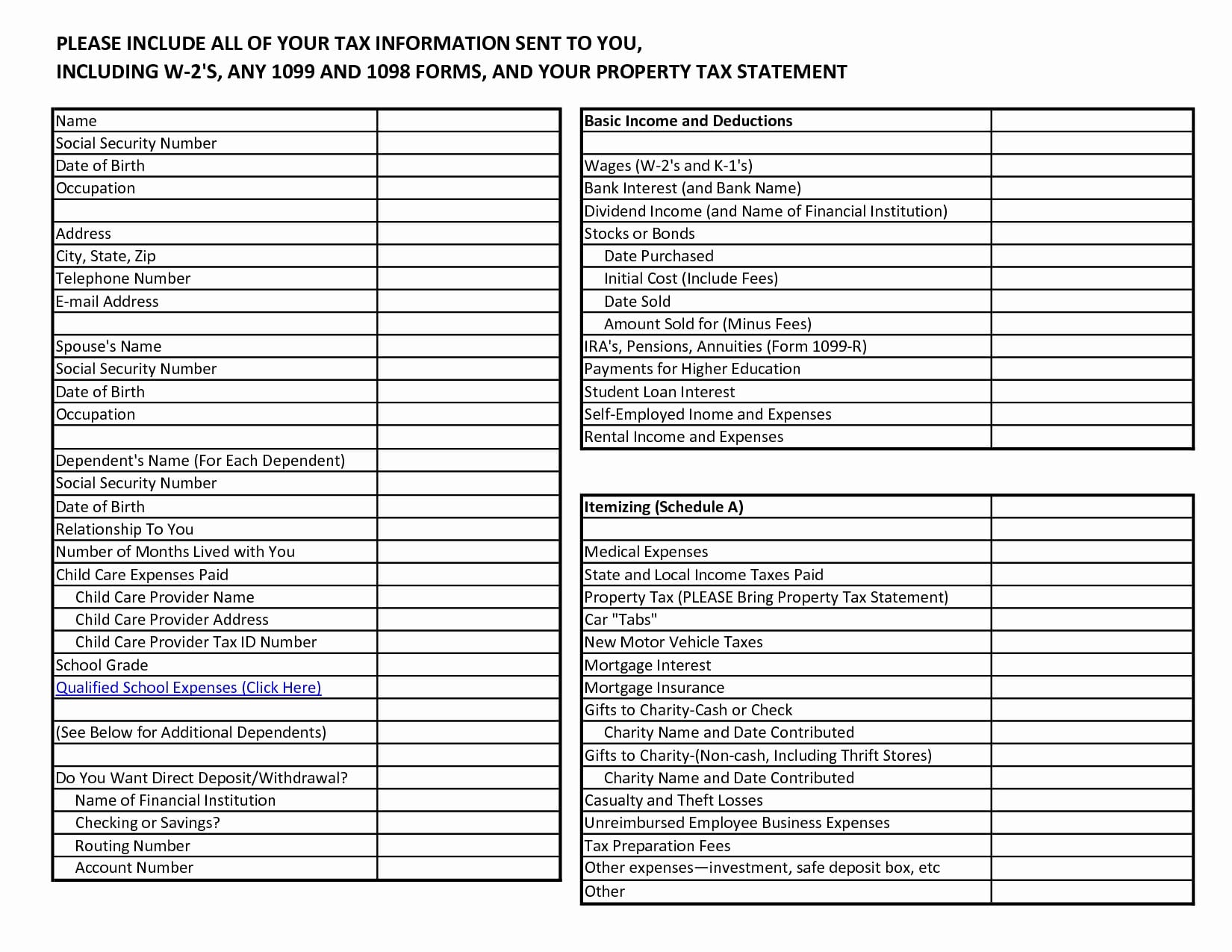

Rental Property Tax Deductions Worksheet New Tax Prep Db excel

Home Office Tax Deduction For Landlords American Landlord

Tax On Rental Properties What Is Tax Deductible Page Design Web

https://www.investopedia.com › article…

Rental property owners can deduct the costs of owning maintaining and operating the property Most residential rental property is depreciated at a rate of 3 636 per year for 27 5 years what

https://www.irs.gov › businesses › small-businesses...

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest

Rental property owners can deduct the costs of owning maintaining and operating the property Most residential rental property is depreciated at a rate of 3 636 per year for 27 5 years what

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest

Rental Property Tax Deductions Worksheet New Tax Prep Db excel

Mortgage Interest Rate A New Tax Regime Allows The Deduction Of

Home Office Tax Deduction For Landlords American Landlord

Tax On Rental Properties What Is Tax Deductible Page Design Web

Rental Property Tax Worksheet

Rental House Properties Tax Deduction To Claim

Rental House Properties Tax Deduction To Claim

Printable Itemized Deductions Worksheet