In this age of electronic devices, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. Be it for educational use such as creative projects or simply adding a personal touch to your space, Tax Deduction For Utility Bills are now a vital resource. For this piece, we'll take a dive through the vast world of "Tax Deduction For Utility Bills," exploring their purpose, where they are available, and how they can improve various aspects of your life.

Get Latest Tax Deduction For Utility Bills Below

Tax Deduction For Utility Bills

Tax Deduction For Utility Bills -

The home office deduction calculated on Form 8829 is available to both homeowners and renters There are certain expenses taxpayers can deduct These may include mortgage interest insurance utilities repairs maintenance depreciation and rent

If you have a brick and mortar business you can always deduct expenses such as utility bills If you have a home office you can also deduct a portion of your maintenance costs

Tax Deduction For Utility Bills provide a diverse assortment of printable resources available online for download at no cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. The appeal of printables for free is their versatility and accessibility.

More of Tax Deduction For Utility Bills

Potentially Bigger Tax Breaks In 2023

Potentially Bigger Tax Breaks In 2023

You can deduct mortgage interest taxes maintenance and repairs insurance utilities and other expenses You can use Form 8829 to figure out the expenses you can deduct MORE See our picks

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 How to claim If you can claim these expenses you must

Tax Deduction For Utility Bills have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Personalization This allows you to modify print-ready templates to your specific requirements such as designing invitations making your schedule, or even decorating your house.

-

Educational Value Downloads of educational content for free cater to learners of all ages. This makes them an invaluable instrument for parents and teachers.

-

Convenience: Instant access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Tax Deduction For Utility Bills

What You Should Consider So That Your Energy Provider Does Not

What You Should Consider So That Your Energy Provider Does Not

The Chancellor of the Exchequer presented her Autumn Budget to Parliament on Wednesday 30 October 2024 Impact on households distributional analysis to accompany Autumn Budget 2024 This document

The home office tax deduction is an often overlooked tax break for the self employed that covers expenses for the business use of your home including mortgage interest rent insurance

Now that we've piqued your curiosity about Tax Deduction For Utility Bills, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Tax Deduction For Utility Bills designed for a variety objectives.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad range of topics, all the way from DIY projects to planning a party.

Maximizing Tax Deduction For Utility Bills

Here are some fresh ways create the maximum value of Tax Deduction For Utility Bills:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home or in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Deduction For Utility Bills are an abundance of fun and practical tools which cater to a wide range of needs and interest. Their accessibility and flexibility make they a beneficial addition to any professional or personal life. Explore the endless world of Tax Deduction For Utility Bills right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printables for commercial uses?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to read the terms and conditions offered by the author.

-

How can I print Tax Deduction For Utility Bills?

- Print them at home with either a printer at home or in a print shop in your area for more high-quality prints.

-

What software must I use to open printables free of charge?

- Many printables are offered in the format PDF. This can be opened with free software, such as Adobe Reader.

Delinquent Letter Form Fill Out And Sign Printable PDF Template SignNow

The IRS Just Boosted Standard Deduction By 7 What It Means For You

Check more sample of Tax Deduction For Utility Bills below

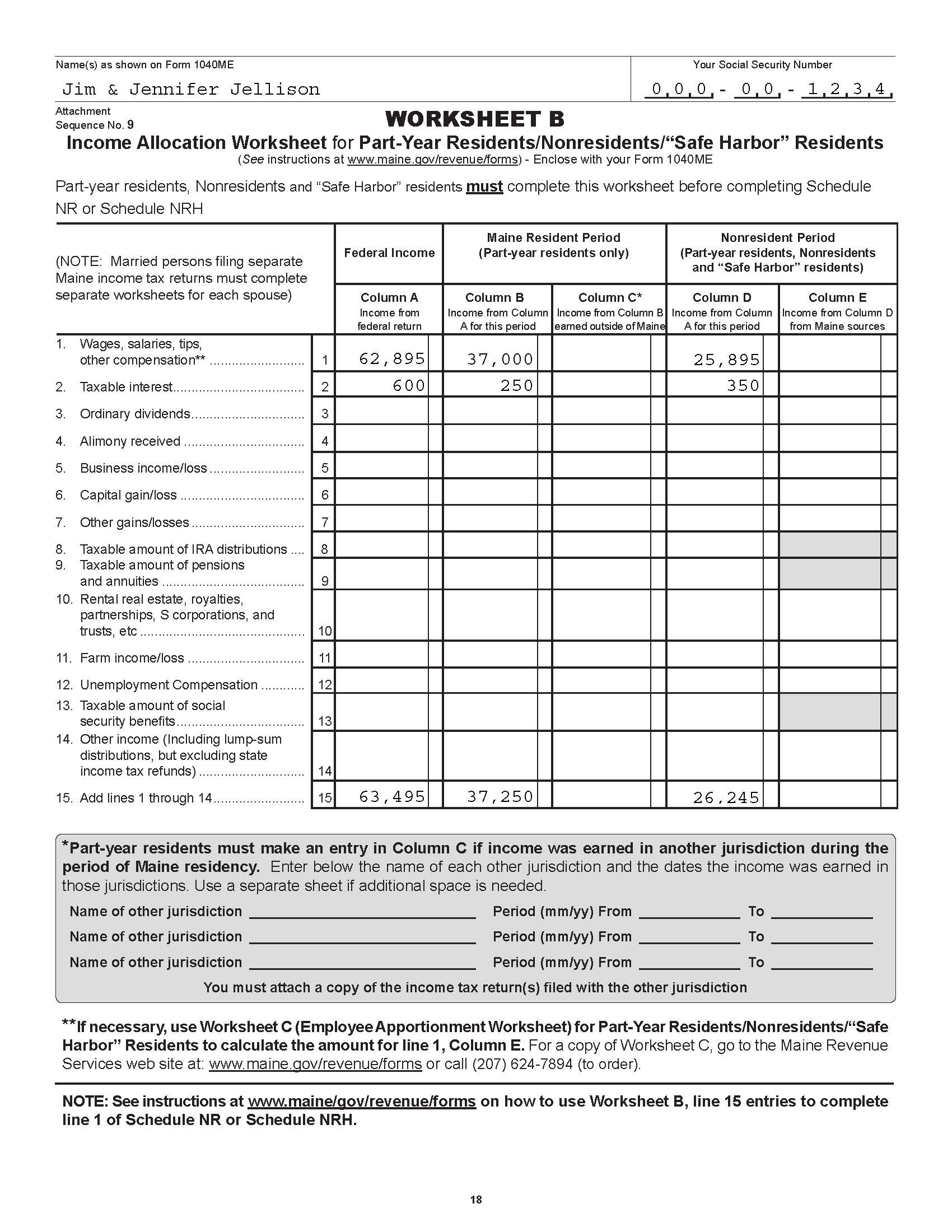

Standard Deduction On Salary For AY 2022 23 New Tax Route

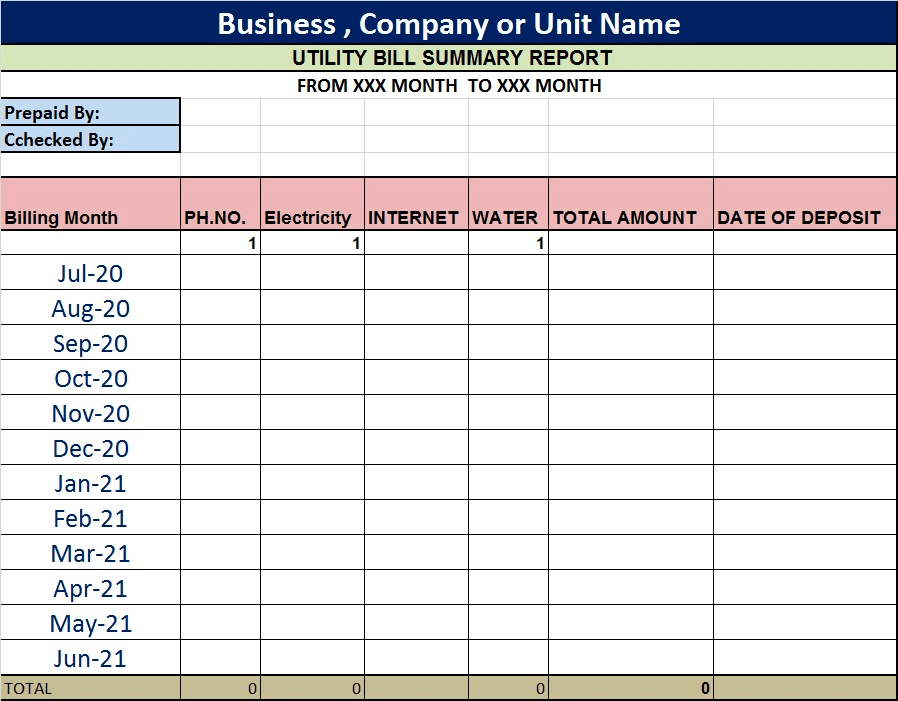

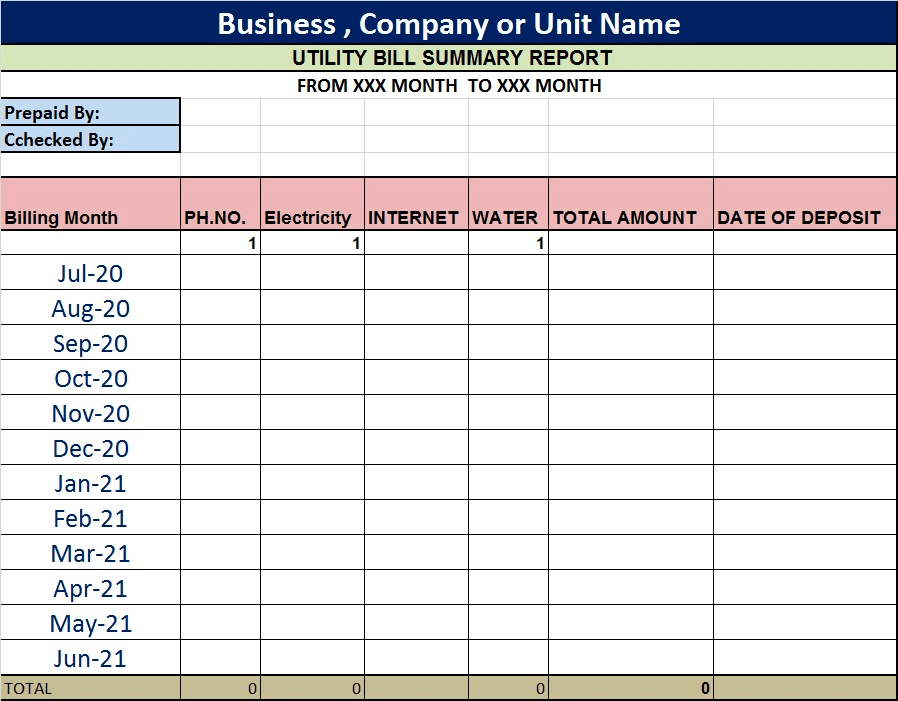

Free Excel Templates For Summary Reporting BPI The Destination For

Managing Utility Bills Guide For Tenants And Landlords

Home Office Tax Deduction For Landlords American Landlord

Free Utility Bill Icon Of Glyph Style Available In SVG PNG EPS AI

![]()

A Singaporean s Guide How To Claim Income Tax Deduction For Work

https://smallbusiness.chron.com/tax-deductions...

If you have a brick and mortar business you can always deduct expenses such as utility bills If you have a home office you can also deduct a portion of your maintenance costs

https://www.gov.uk/simpler-income-tax-simplified...

Use a simpler calculation to work out income tax for your vehicle home and business premises expenses

If you have a brick and mortar business you can always deduct expenses such as utility bills If you have a home office you can also deduct a portion of your maintenance costs

Use a simpler calculation to work out income tax for your vehicle home and business premises expenses

Home Office Tax Deduction For Landlords American Landlord

Free Excel Templates For Summary Reporting BPI The Destination For

Free Utility Bill Icon Of Glyph Style Available In SVG PNG EPS AI

A Singaporean s Guide How To Claim Income Tax Deduction For Work

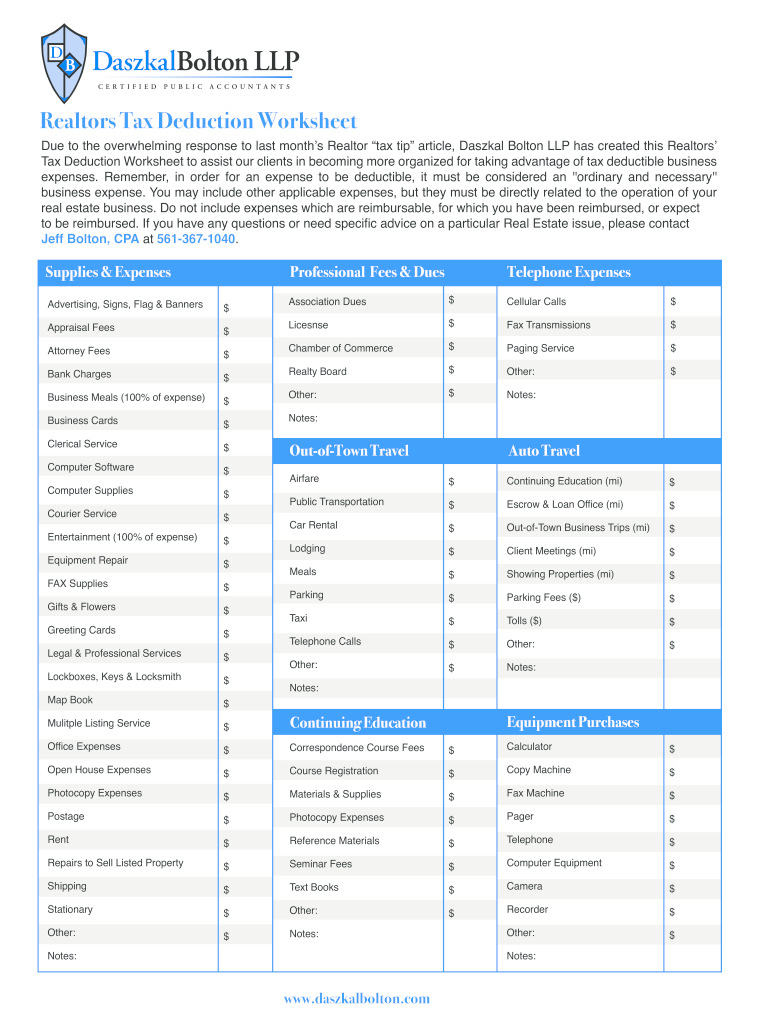

Real Estate Agent Tax Deductions Worksheet 2022 Form Fill Out And

Solved Zoe Is Single And 42 Years Old She Has One Dependent Chegg

Solved Zoe Is Single And 42 Years Old She Has One Dependent Chegg

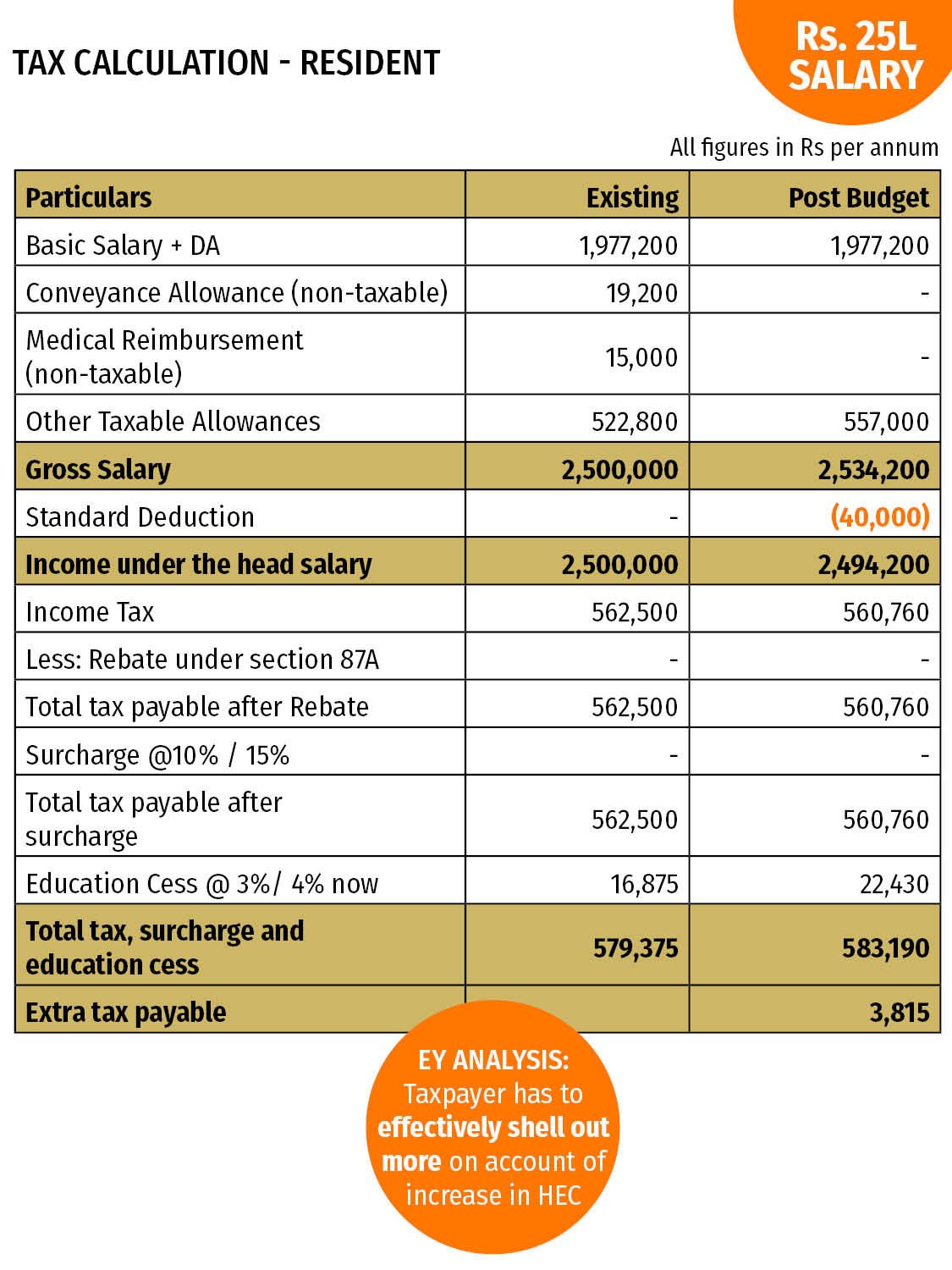

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000