In this day and age where screens dominate our lives The appeal of tangible printed materials hasn't faded away. If it's to aid in education such as creative projects or simply adding an element of personalization to your space, Tax Deduction For Work Clothes Self Employed have become an invaluable resource. We'll dive into the sphere of "Tax Deduction For Work Clothes Self Employed," exploring what they are, how to locate them, and how they can add value to various aspects of your lives.

Get Latest Tax Deduction For Work Clothes Self Employed Below

Tax Deduction For Work Clothes Self Employed

Tax Deduction For Work Clothes Self Employed -

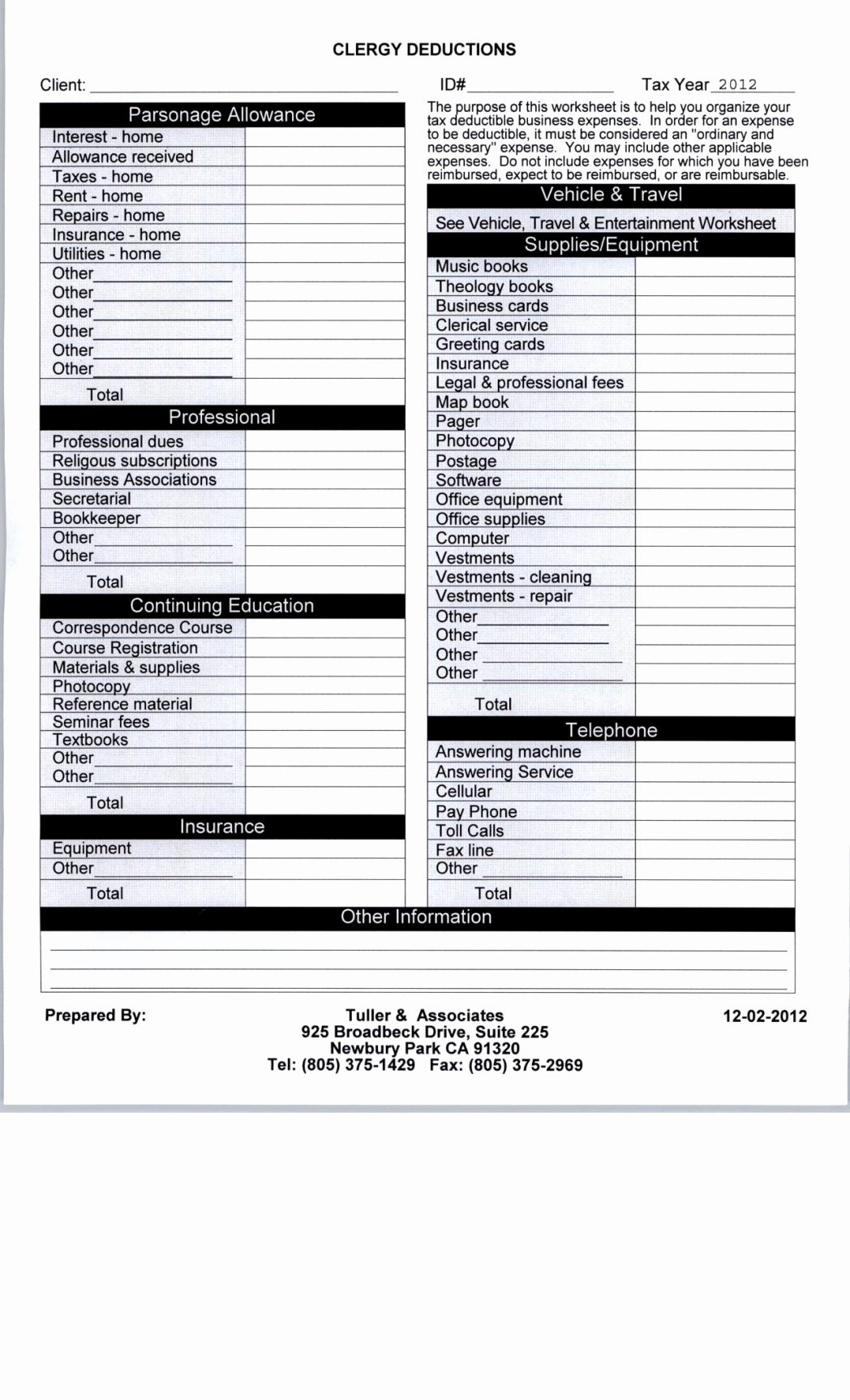

You also might wonder Are work clothes tax deductible for self employed people The short answer Typically you can t write off work clothing or personal expenses for appearance Clothing is only deductible if it s protective wear like a hard hat or work gloves promotional wear like a shirt with your logo printed on it or a costume

Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes If you re a regular W 2 employee you ll either have to swallow the cost of any uniforms or have your employer reimburse you for it

Printables for free cover a broad range of downloadable, printable items that are available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and many more. The great thing about Tax Deduction For Work Clothes Self Employed is their versatility and accessibility.

More of Tax Deduction For Work Clothes Self Employed

How To Claim A Tax Deduction For Work Clothes Sapling

How To Claim A Tax Deduction For Work Clothes Sapling

Key Takeaways Certain job related expenses such as theatrical costumes hard hats and other safety gear may be deductible Items that can be worn outside of work including overalls white dress shirts and bibs are

Under Section 179 you can expense the full cost of a tool the year you place it in service The deduction is limited to the amount of your self employment income You can deduct the cost of the tools as an unreimbursed employee expense on Schedule A if both of these apply You work for an employer rather than being self employed

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Use: Downloads of educational content for free provide for students of all ages, which makes these printables a powerful tool for teachers and parents.

-

It's easy: Fast access numerous designs and templates, which saves time as well as effort.

Where to Find more Tax Deduction For Work Clothes Self Employed

Tax Deduction For Work Clothing Uniform

Tax Deduction For Work Clothing Uniform

Here are 16 current tax deductions for self employed individuals Key Takeaways Reviewing what you can deduct each year is important to make your business as profitable as possible if

Are you self employed and wondering whether clothes are on the allowable expenses list Read through our quick guide here to make sure you re not overpaying tax

We hope we've stimulated your curiosity about Tax Deduction For Work Clothes Self Employed Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Tax Deduction For Work Clothes Self Employed for different needs.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast selection of subjects, that includes DIY projects to party planning.

Maximizing Tax Deduction For Work Clothes Self Employed

Here are some ways create the maximum value of Tax Deduction For Work Clothes Self Employed:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Deduction For Work Clothes Self Employed are a treasure trove with useful and creative ideas that cater to various needs and needs and. Their accessibility and flexibility make them a valuable addition to both professional and personal life. Explore the endless world of Tax Deduction For Work Clothes Self Employed today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction For Work Clothes Self Employed truly gratis?

- Yes you can! You can download and print the resources for free.

-

Can I download free templates for commercial use?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright problems with Tax Deduction For Work Clothes Self Employed?

- Some printables may come with restrictions regarding usage. Check the terms and conditions offered by the creator.

-

How can I print Tax Deduction For Work Clothes Self Employed?

- You can print them at home with the printer, or go to an area print shop for better quality prints.

-

What program do I require to open Tax Deduction For Work Clothes Self Employed?

- Most printables come in the format PDF. This can be opened with free software like Adobe Reader.

Printable Tax Deduction Form For Donations Printable Forms Free Online

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

Check more sample of Tax Deduction For Work Clothes Self Employed below

Deduction For Work Related Vehicle Expenses Disallowed Tradies Advantage

Actual Or Standard Mileage Deduction For Your Work Vehicle YouTube

Small Business Bookkeeping Startup Business Plan Successful Business

24 Vehicle Lease Mileage Tracker Sample Excel Templates

How To Donate Clothes To Goodwill For The Tax Deduction Secret Hacks

Tax Deduction Worksheet

https://www.keepertax.com/posts/write-off-clothes-for-work

Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes If you re a regular W 2 employee you ll either have to swallow the cost of any uniforms or have your employer reimburse you for it

https://www.vero.fi/en/individuals/deductions/what-can-I-deduct

You can be given the tax credit for employment income i e work income if you receive wages subject to tax profit shares of a small business or other comparable earnings The credit reduces your state income tax directly

Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes If you re a regular W 2 employee you ll either have to swallow the cost of any uniforms or have your employer reimburse you for it

You can be given the tax credit for employment income i e work income if you receive wages subject to tax profit shares of a small business or other comparable earnings The credit reduces your state income tax directly

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Actual Or Standard Mileage Deduction For Your Work Vehicle YouTube

How To Donate Clothes To Goodwill For The Tax Deduction Secret Hacks

Tax Deduction Worksheet

How To Donate Clothes To Goodwill For The Tax Deduction Secret Hacks

A Singaporean s Guide How To Claim Income Tax Deduction For Work

A Singaporean s Guide How To Claim Income Tax Deduction For Work

How To Claim A Tax Deduction For Work Uniforms YouTube