In a world with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply adding personal touches to your home, printables for free are now a useful resource. Here, we'll take a dive deep into the realm of "Tax Deduction Insurance Premiums," exploring the different types of printables, where to find them and how they can improve various aspects of your lives.

Get Latest Tax Deduction Insurance Premiums Below

Tax Deduction Insurance Premiums

Tax Deduction Insurance Premiums -

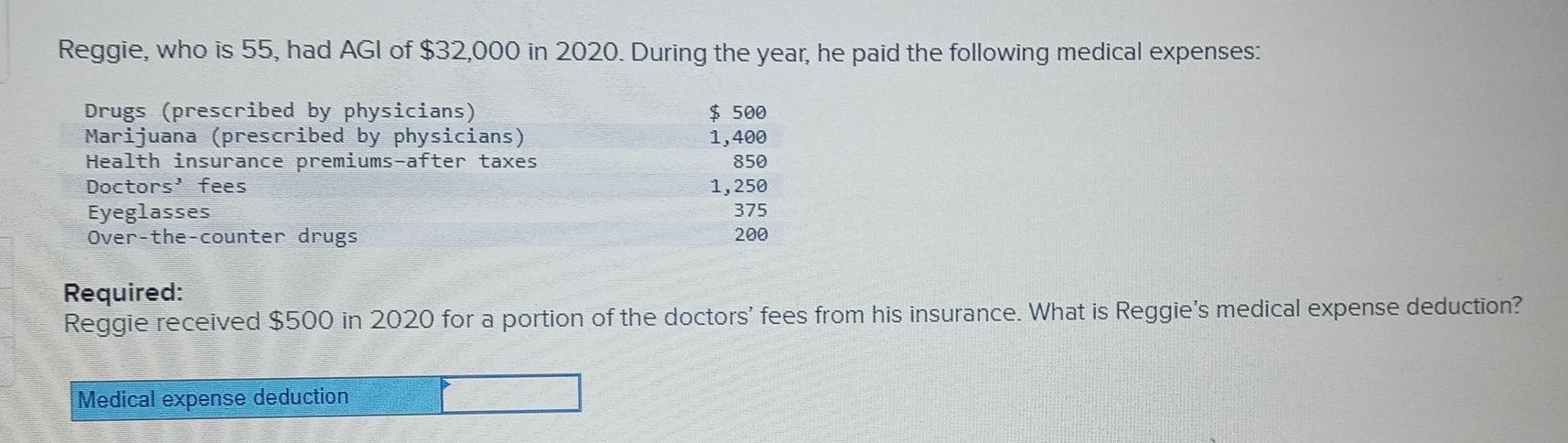

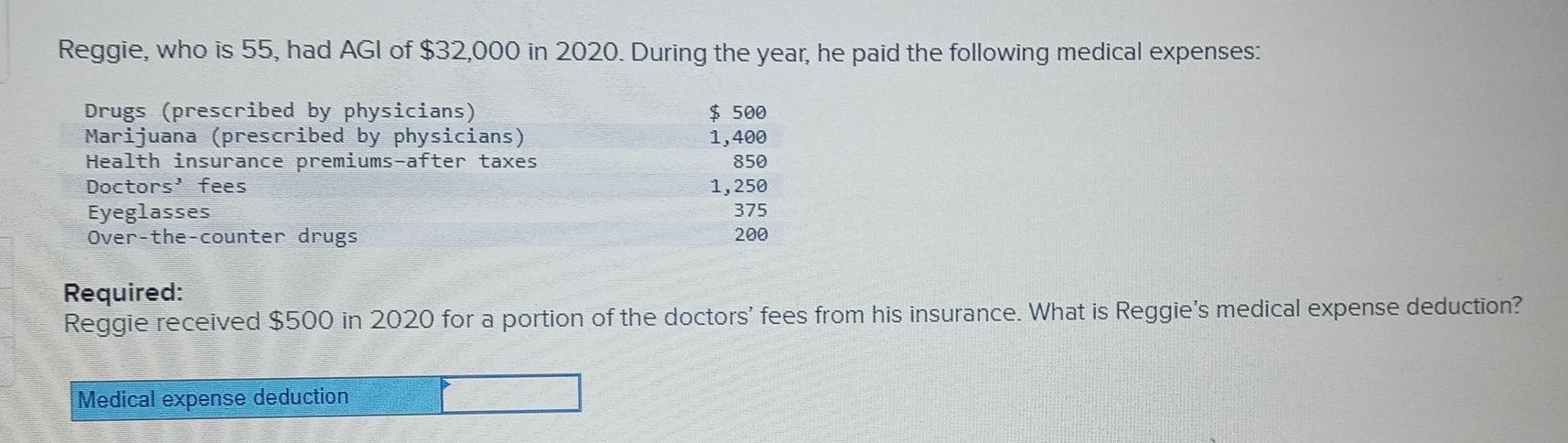

Health insurance premiums can be tax deductible but this depends on various circumstances The IRS has specific guidelines determining whether you can

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet

Printables for free include a vast assortment of printable material that is available online at no cost. These resources come in many types, like worksheets, templates, coloring pages and much more. The beauty of Tax Deduction Insurance Premiums is their flexibility and accessibility.

More of Tax Deduction Insurance Premiums

Bob Lopez Way2Alpha

Bob Lopez Way2Alpha

The Bottom Line While it would be a nice perk if all our insurance premiums were tax deductible it s simply not the case But in some instances you can deduct a

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

Tax Deduction Insurance Premiums have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize the design to meet your needs, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Use: The free educational worksheets cater to learners of all ages, which makes the perfect device for teachers and parents.

-

It's easy: Fast access an array of designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction Insurance Premiums

Medicare Deduction From Social Security 2022 SocialSecurityGuide

Medicare Deduction From Social Security 2022 SocialSecurityGuide

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and

Health insurance premiums are deductible on federal taxes in some cases as these monthly payments are classified as medical expenses Generally if you pay for medical insurance on your own you

Now that we've piqued your interest in printables for free Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Tax Deduction Insurance Premiums for various needs.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a wide variety of topics, from DIY projects to party planning.

Maximizing Tax Deduction Insurance Premiums

Here are some new ways for you to get the best use of Tax Deduction Insurance Premiums:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free for teaching at-home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Deduction Insurance Premiums are an abundance with useful and creative ideas that meet a variety of needs and passions. Their accessibility and flexibility make these printables a useful addition to your professional and personal life. Explore the many options that is Tax Deduction Insurance Premiums today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can download and print these tools for free.

-

Do I have the right to use free printables for commercial purposes?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with Tax Deduction Insurance Premiums?

- Some printables could have limitations on usage. Be sure to check the terms and conditions set forth by the designer.

-

How can I print Tax Deduction Insurance Premiums?

- Print them at home using printing equipment or visit the local print shops for better quality prints.

-

What software do I require to view printables at no cost?

- The majority of printables are in PDF format, which is open with no cost software such as Adobe Reader.

File The CPA Continuing Education Society Of

Whole Life Insurance Tax Deduction References Qarbit

Check more sample of Tax Deduction Insurance Premiums below

Views Life Insurance Premiums Tax Deductible Smsf Ato Update Broken Curve

Qualified Business Income Deduction And The Self Employed The CPA Journal

Tax Deductions You Can Deduct What Napkin Finance

Can You Deduct Homeowners Insurance On Your Taxes Square State

Can I Claim A Tax Deduction By Paying Premiums For My In laws

Can I Deduct Health Insurance Premiums

https://www.investopedia.com/are-health-in…

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet

https://blog.turbotax.intuit.com/health-care/when...

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health

Can You Deduct Homeowners Insurance On Your Taxes Square State

Qualified Business Income Deduction And The Self Employed The CPA Journal

Can I Claim A Tax Deduction By Paying Premiums For My In laws

Can I Deduct Health Insurance Premiums

Health Insurance Costs Premiums Deductibles Co Pays Co Insurance

Solved Reggie Who Is 55 Had AGI Of 32 000 In 2020 During Chegg

Solved Reggie Who Is 55 Had AGI Of 32 000 In 2020 During Chegg

Amplified 10 Tax Strategies For S Corporations What How Where