In this age of technology, where screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons as well as creative projects or simply to add an element of personalization to your area, Tax Deduction Laws In India are now a vital source. Here, we'll take a dive deeper into "Tax Deduction Laws In India," exploring what they are, how to locate them, and what they can do to improve different aspects of your lives.

Get Latest Tax Deduction Laws In India Below

Tax Deduction Laws In India

Tax Deduction Laws In India -

Under the new tax regime salaried employees and pensioners can claim a standard deduction of Rs 50 000 Under the new tax regime the highest surcharge has been reduced to 25 from 37 for people earning more than Rs 5 crore This move brings down their tax rate from 42 74 to 39 The new IT regime will be the default tax regime

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 01 Mar 2024 07 09 PM The Income Tax Department recognizing the significance of fostering savings and investments has incorporated a comprehensive set of deductions under Chapter VI A of the Income Tax Act

Tax Deduction Laws In India cover a large assortment of printable, downloadable materials online, at no cost. These resources come in various types, such as worksheets templates, coloring pages and more. The attraction of printables that are free is in their variety and accessibility.

More of Tax Deduction Laws In India

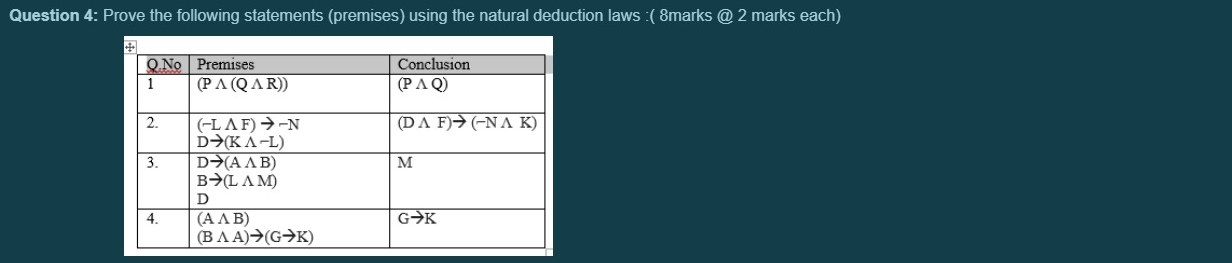

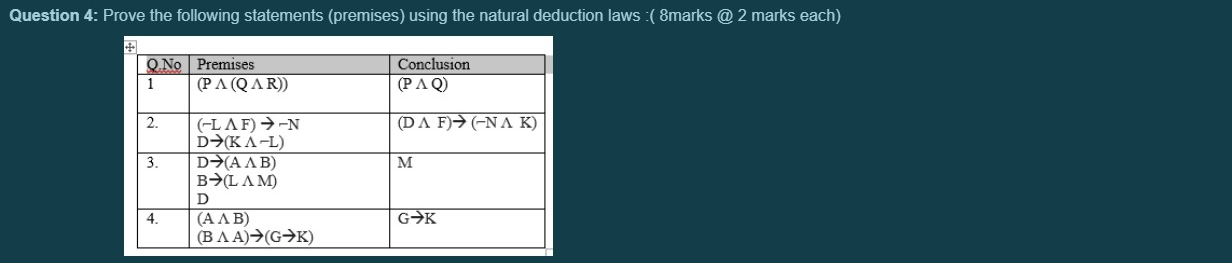

Solved Question 4 Prove The Following Statements premises Chegg

Solved Question 4 Prove The Following Statements premises Chegg

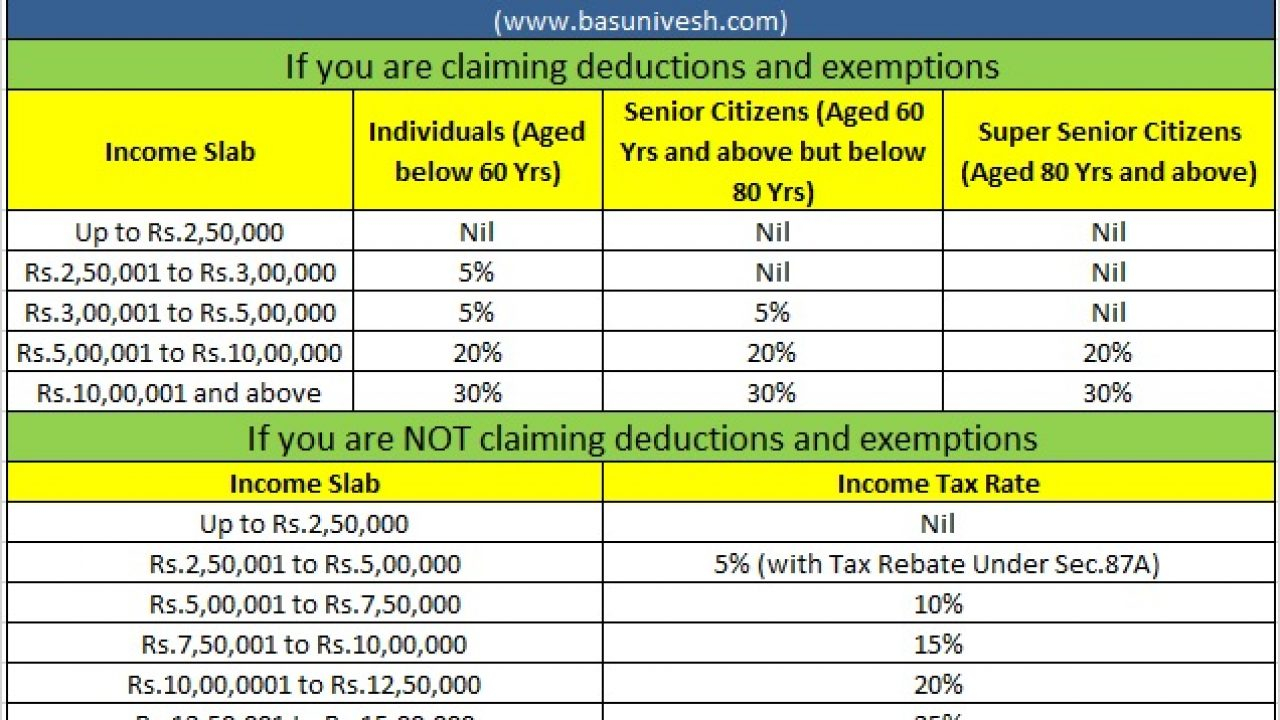

Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime

Certificate for deduction at lower rates or no deduction of tax from income other than dividends Rule 28 Tax Laws Rules Acts Rules Finance Bills Circulars Notifications CBDT Department of Revenue Ministry of Finance Government of India India Code INDIA STQC Visitor counter

The Tax Deduction Laws In India have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: We can customize printables to your specific needs whether you're designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making them an essential device for teachers and parents.

-

Convenience: Access to an array of designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction Laws In India

2022 Tax Brackets Irs Calculator

2022 Tax Brackets Irs Calculator

On donation of a certain amount to certain approved funds charitable institutions etc an individual can claim a deduction of 50 to 100 of the amount donated subject to restrictions provided by the law Deduction for funds and charitable institutions in excess of INR 2 000 is to be allowed only if the donation is made

Introduction A brief overview of the Income Tax Act 1961 Elements of Indian Income Tax Law The Income Tax Act of 1961 Income Tax Regulations 1962 Finance Act Circulars and notifications Types of income tax Direct taxes Indirect taxes Need for the Income Tax Act Liability to pay Applicability of the Income Tax Act 1961

If we've already piqued your interest in Tax Deduction Laws In India Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Tax Deduction Laws In India for a variety reasons.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide range of interests, including DIY projects to party planning.

Maximizing Tax Deduction Laws In India

Here are some innovative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Tax Deduction Laws In India are a treasure trove of fun and practical tools for a variety of needs and needs and. Their accessibility and flexibility make them an essential part of both personal and professional life. Explore the vast array of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free printables to make commercial products?

- It's all dependent on the conditions of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright violations with Tax Deduction Laws In India?

- Some printables may come with restrictions concerning their use. Check the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home with an printer, or go to a local print shop to purchase more high-quality prints.

-

What program do I require to view printables for free?

- A majority of printed materials are in PDF format. These can be opened using free software such as Adobe Reader.

2018 Standard Deduction Chart

Konstantinos Koufos Human Resources Director

Check more sample of Tax Deduction Laws In India below

Yolisa Yolisa Payroll Administrator Don t Waste LinkedIn

Rules For Natural Deduction Attic Philosophy YouTube

Figure 1 From Natural Deduction For Hybrid Logic Semantic Scholar

2023 Tax Tables Australia IMAGESEE

Standard Deduction 2020 Self Employed Standard Deduction 2021

How Does Tax Deduction Work In India Tax Walls

https://tax2win.in/guide/deductions

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 01 Mar 2024 07 09 PM The Income Tax Department recognizing the significance of fostering savings and investments has incorporated a comprehensive set of deductions under Chapter VI A of the Income Tax Act

https://tax2win.in/guide/income-tax

Income tax is a type of direct tax which is payable by an income earning individual Learn about income tax slabs deductions refund rules heads of income income tax return filing process in India with our detailed guide

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 01 Mar 2024 07 09 PM The Income Tax Department recognizing the significance of fostering savings and investments has incorporated a comprehensive set of deductions under Chapter VI A of the Income Tax Act

Income tax is a type of direct tax which is payable by an income earning individual Learn about income tax slabs deductions refund rules heads of income income tax return filing process in India with our detailed guide

2023 Tax Tables Australia IMAGESEE

Rules For Natural Deduction Attic Philosophy YouTube

Standard Deduction 2020 Self Employed Standard Deduction 2021

How Does Tax Deduction Work In India Tax Walls

Logic Using Limited Natural Deduction Rules To Prove De Morgan s Law

Solved Show Each Of The Following Using Only The 12 Basic Chegg

Solved Show Each Of The Following Using Only The 12 Basic Chegg

Income Tax 80c Deduction Fy 2021 22 TAX