In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes, creative projects, or just adding some personal flair to your space, Tax Deduction On Education Loan In India can be an excellent resource. We'll dive through the vast world of "Tax Deduction On Education Loan In India," exploring the benefits of them, where to find them, and the ways that they can benefit different aspects of your lives.

Get Latest Tax Deduction On Education Loan In India Below

Tax Deduction On Education Loan In India

Tax Deduction On Education Loan In India -

Learn how to maximize tax savings on your education loan with Section 80E This comprehensive guide explains eligibility deduction limits and step by step instructions to claim your benefit

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Printables for free cover a broad collection of printable material that is available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and more. The beauty of Tax Deduction On Education Loan In India is in their versatility and accessibility.

More of Tax Deduction On Education Loan In India

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

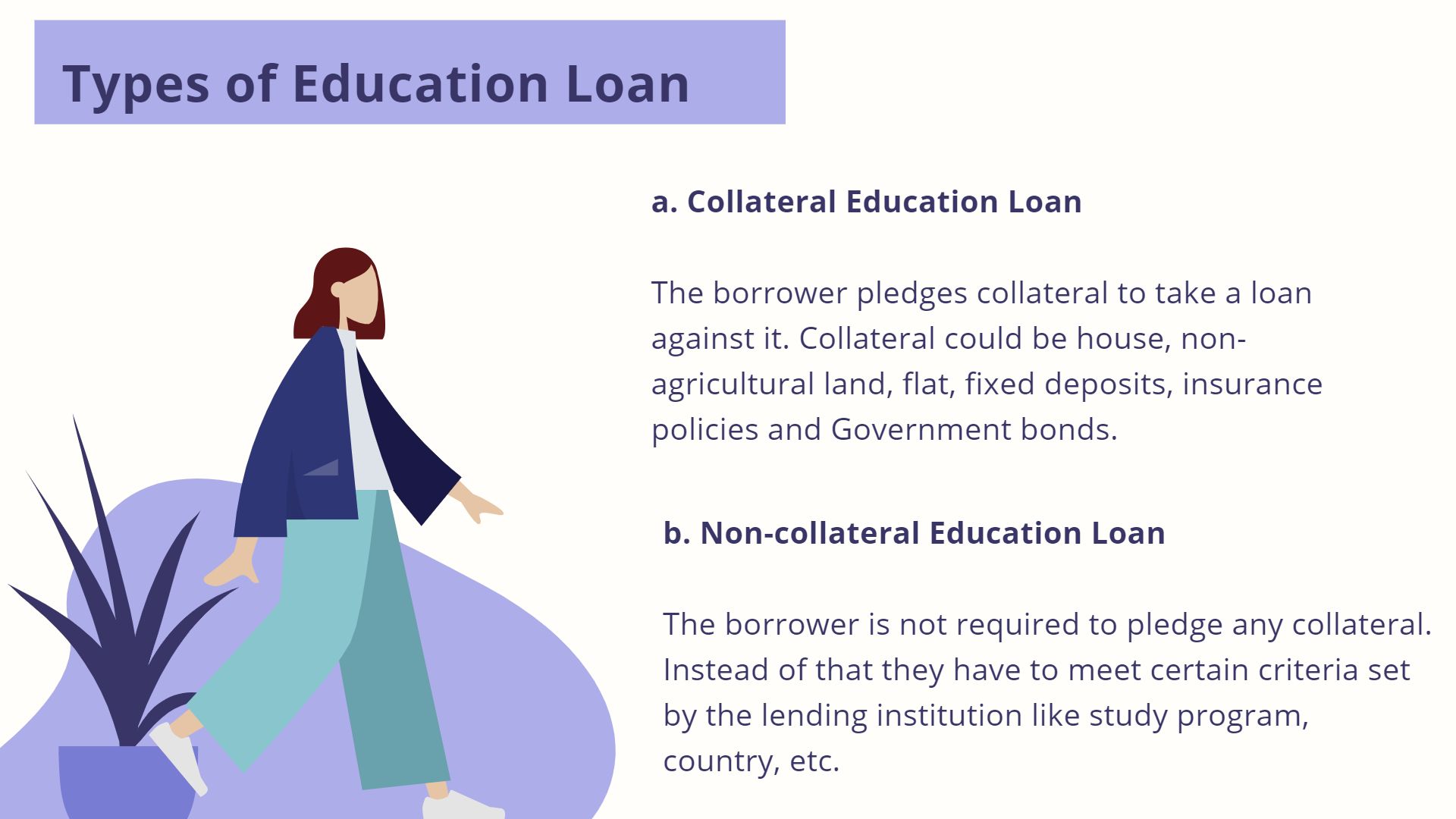

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden

Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan There are other benefits to an education loan and they can be taken for professional

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: You can tailor the design to meet your needs such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Impact: Education-related printables at no charge cater to learners of all ages, which makes them a great resource for educators and parents.

-

Simple: immediate access an array of designs and templates is time-saving and saves effort.

Where to Find more Tax Deduction On Education Loan In India

Tax Deduction On Education Loan Taken For Higher Studies

Tax Deduction On Education Loan Taken For Higher Studies

Section 80E of the Income Tax Act provides deduction towards interest paid on loan taken for higher education

The tax benefit on education loans is given under Section 80E of the Income Tax Act It allows taxpayers to claim deductions on the interest paid towards education loans for themselves their spouse their children or a

In the event that we've stirred your interest in Tax Deduction On Education Loan In India Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Tax Deduction On Education Loan In India for different reasons.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad range of interests, starting from DIY projects to party planning.

Maximizing Tax Deduction On Education Loan In India

Here are some unique ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction On Education Loan In India are an abundance of useful and creative resources that can meet the needs of a variety of people and desires. Their availability and versatility make these printables a useful addition to both professional and personal lives. Explore the vast collection that is Tax Deduction On Education Loan In India today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes, they are! You can print and download these materials for free.

-

Can I make use of free printing templates for commercial purposes?

- It depends on the specific usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted regarding usage. You should read the terms and regulations provided by the author.

-

How do I print Tax Deduction On Education Loan In India?

- Print them at home with a printer or visit a local print shop to purchase top quality prints.

-

What software do I need to open printables at no cost?

- Most printables come as PDF files, which is open with no cost software such as Adobe Reader.

Reasons To Get Personal Loan In India By Pratikshajadhav698 Issuu

Education Loan Process Education Holistic Education Loan

Check more sample of Tax Deduction On Education Loan In India below

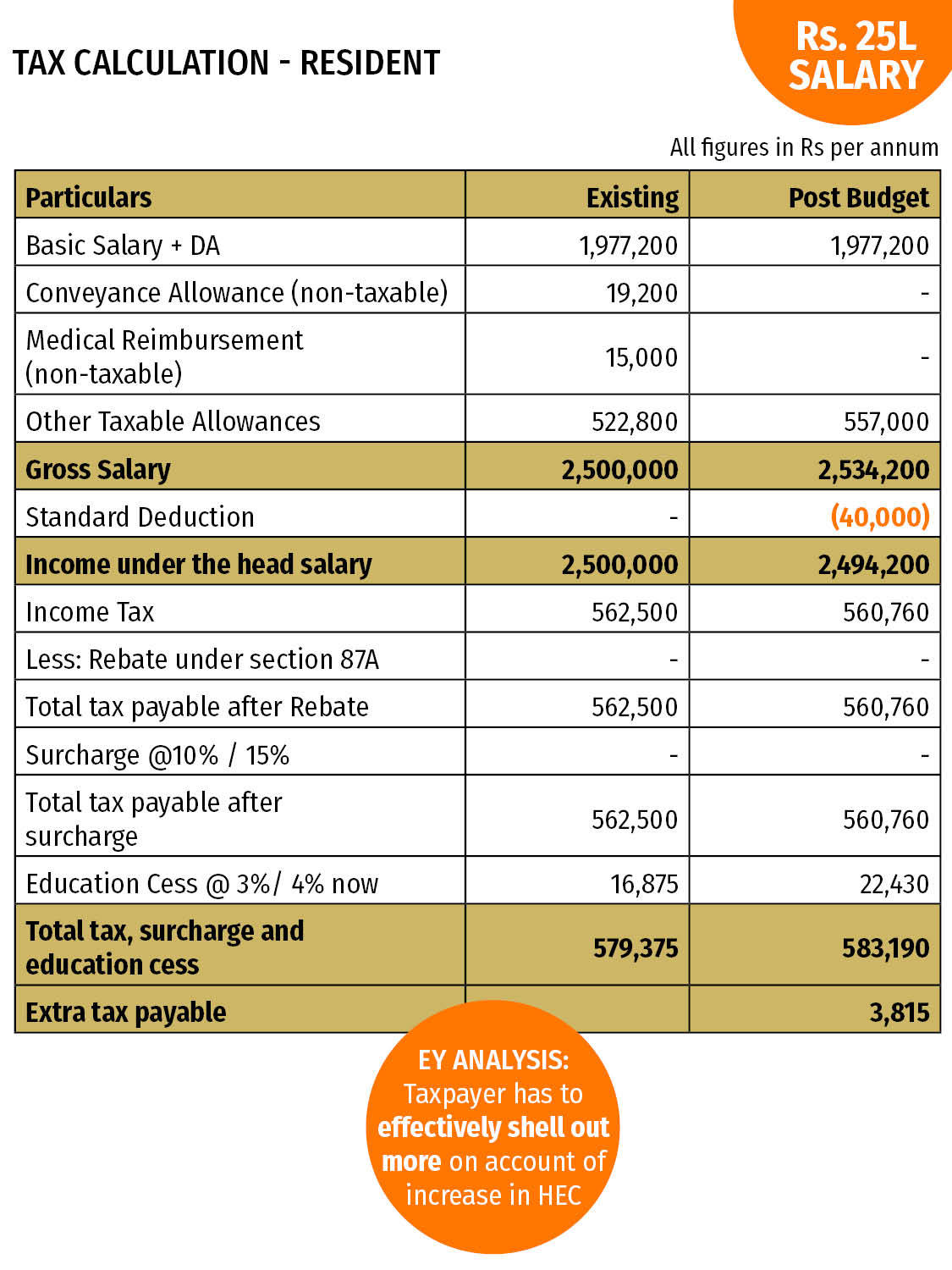

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

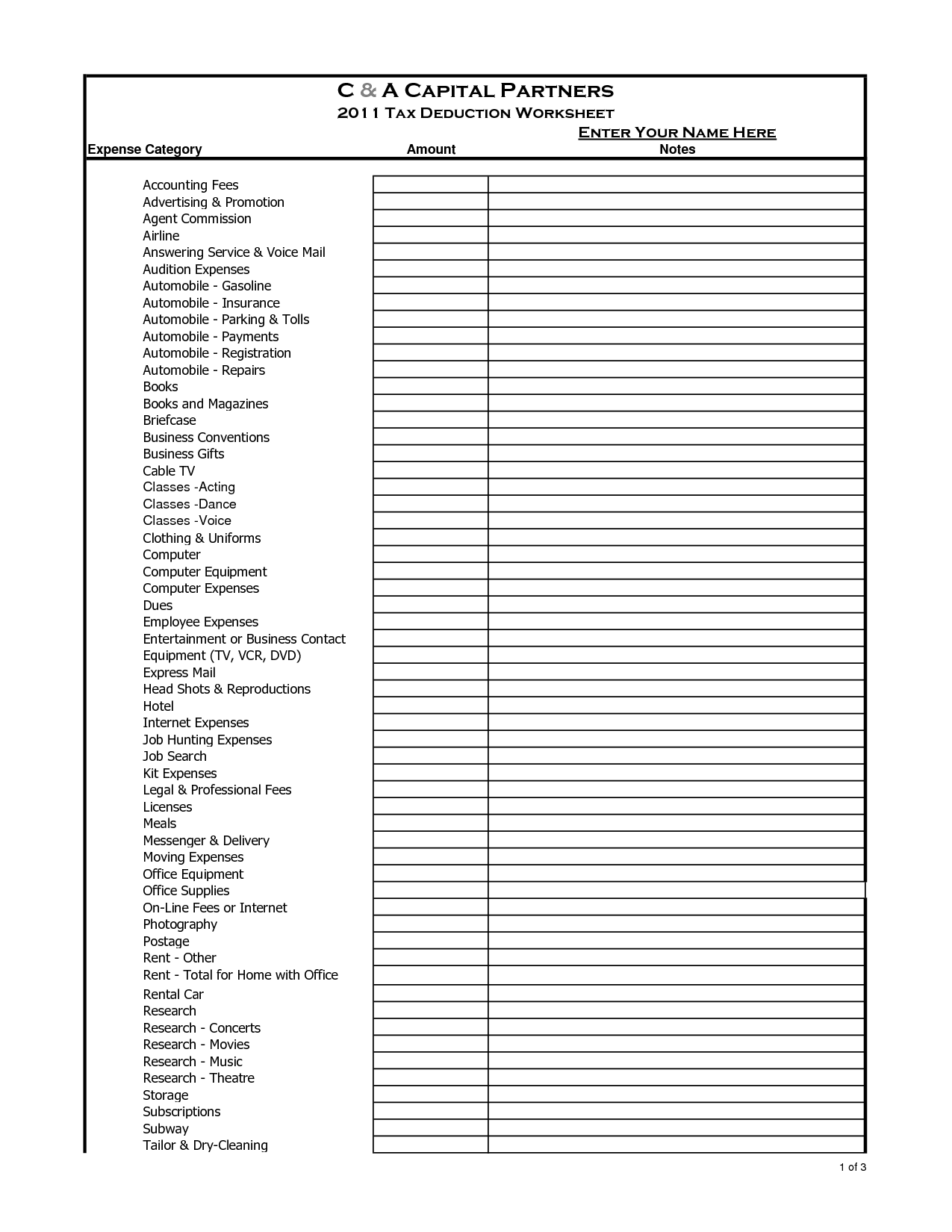

10 2014 Itemized Deductions Worksheet Worksheeto

Standard Deduction For Salaried Employees Impact Of Standard

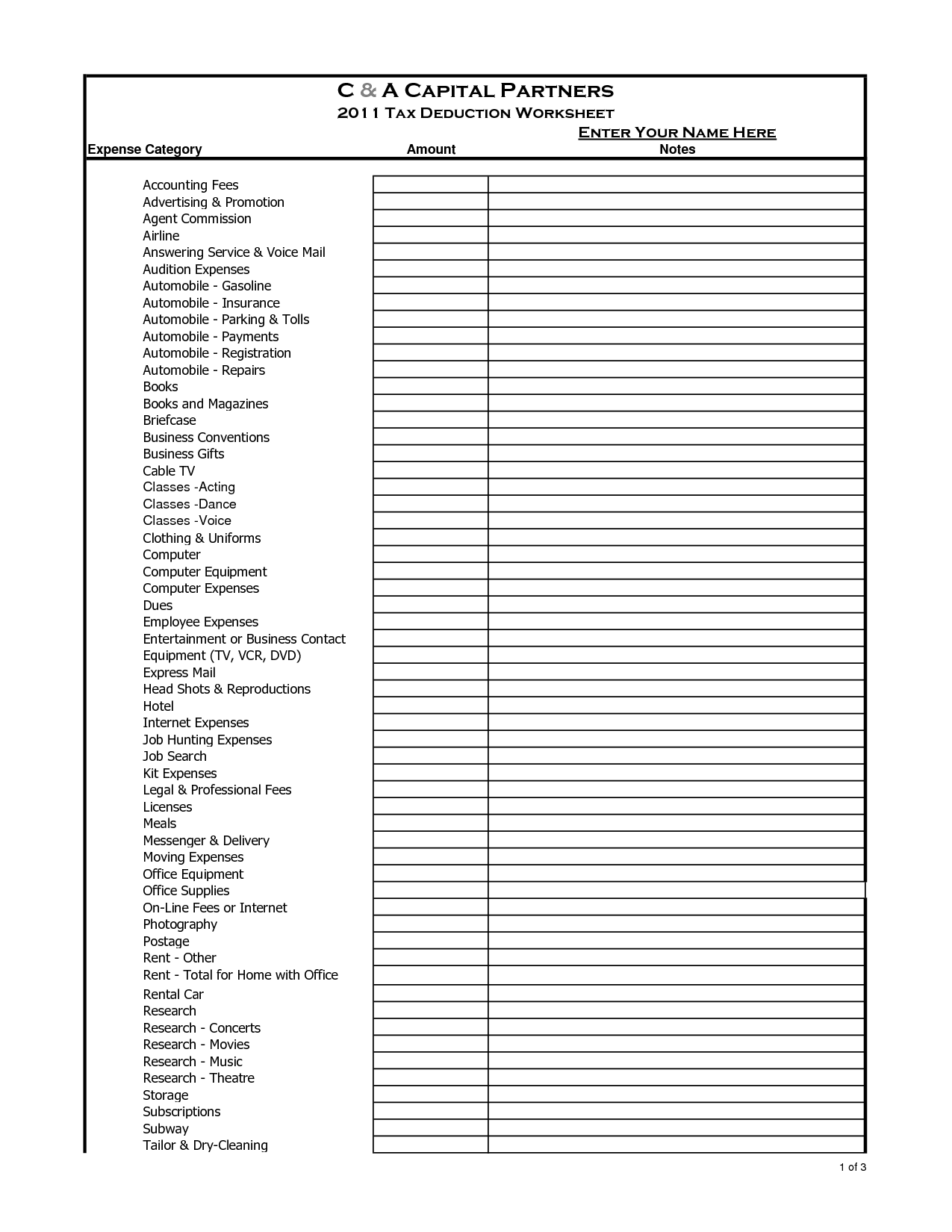

What Financing Does Not Require Any Collateral Leia Aqui How Can I

How To Apply For Education Loan In India

Tax Deductions You Can Deduct What Napkin Finance

https://cleartax.in

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://tax2win.in › guide

Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

What Financing Does Not Require Any Collateral Leia Aqui How Can I

10 2014 Itemized Deductions Worksheet Worksheeto

How To Apply For Education Loan In India

Tax Deductions You Can Deduct What Napkin Finance

How Does Tax Deduction Work In India Tax Walls

Know About Section 43B In Income Tax Act 1961

Know About Section 43B In Income Tax Act 1961

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1