In this age of technology, where screens have become the dominant feature of our lives but the value of tangible printed products hasn't decreased. Be it for educational use as well as creative projects or just adding an individual touch to the home, printables for free have become a valuable source. With this guide, you'll dive in the world of "Tax Deduction On Life Insurance Premium," exploring their purpose, where to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Tax Deduction On Life Insurance Premium Below

Tax Deduction On Life Insurance Premium

Tax Deduction On Life Insurance Premium -

Key takeaways The IRS considers life insurance a personal expense and ineligible for tax deductions Employers paying employees life insurance premiums can deduct those payments with some restrictions Policies bought as part of child or spousal support agreements before 2019 are tax deductible

The short answer is most often going to be no life insurance premiums are not tax deductible if you re buying a policy for yourself or another family member That s because the IRS views life insurance as a personal expense

Tax Deduction On Life Insurance Premium include a broad selection of printable and downloadable items that are available online at no cost. They come in many designs, including worksheets coloring pages, templates and more. The benefit of Tax Deduction On Life Insurance Premium lies in their versatility and accessibility.

More of Tax Deduction On Life Insurance Premium

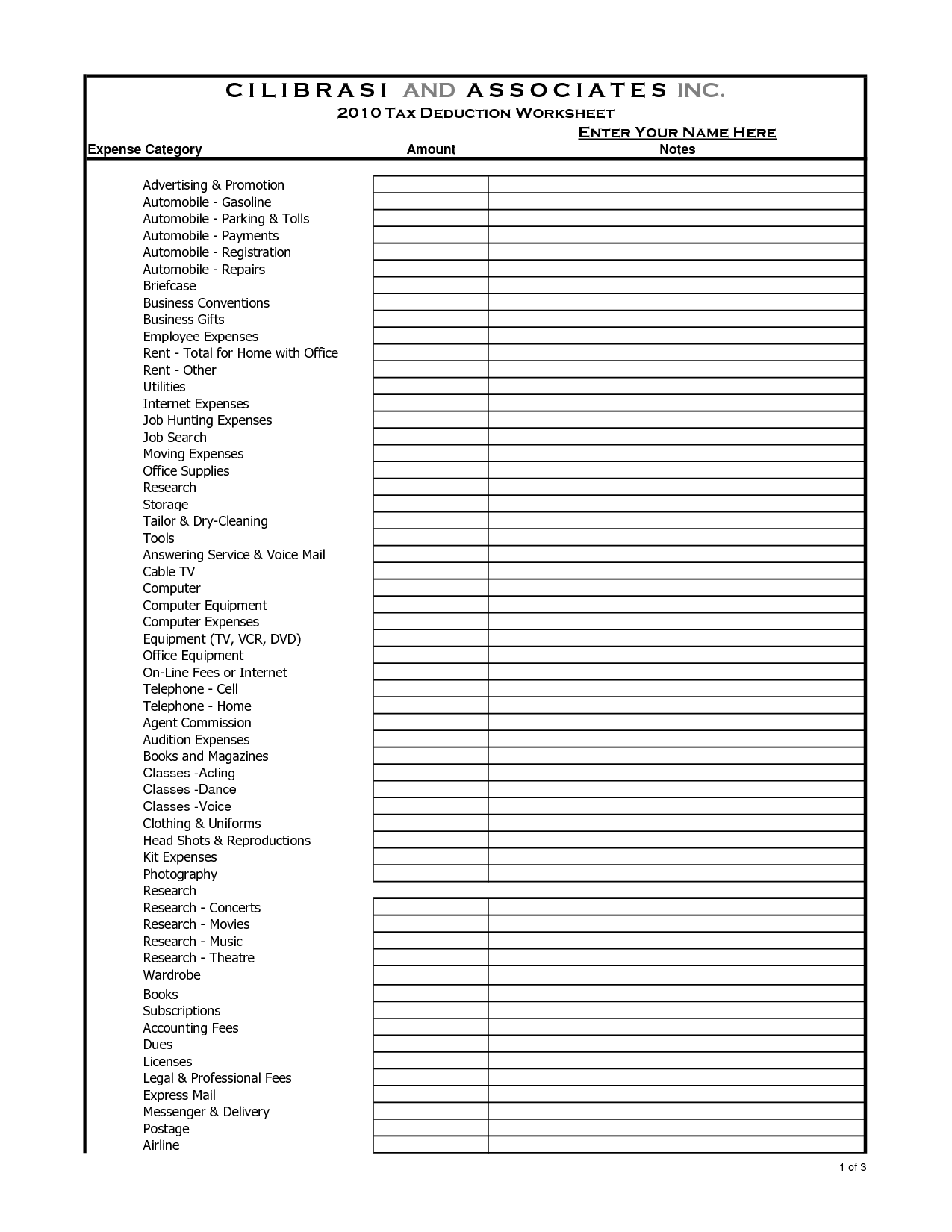

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

Generally life insurance premiums are not tax deductible However there are some exceptions to this rule For instance some businesses may deduct premiums they pay on behalf of employees Life insurance premiums may be tax deductible in some cases including Group term life insurance

You generally can t deduct your life insurance premiums on your tax returns In most cases the IRS considers your premiums a personal expense like food or clothing Life insurance is also not required by your state or federal government so you can t expect a tax break after buying a policy

The Tax Deduction On Life Insurance Premium have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor print-ready templates to your specific requirements whether it's making invitations or arranging your schedule or even decorating your home.

-

Educational Impact: Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them a vital device for teachers and parents.

-

Accessibility: immediate access an array of designs and templates helps save time and effort.

Where to Find more Tax Deduction On Life Insurance Premium

Tax On Life Insurance Premium

Tax On Life Insurance Premium

Life insurance premiums are not tax deductible for most people If you re a business owner and premiums for your employees are a business expense they may be deductible Life insurance

Yes you can deduct life insurance premiums if they are for employee benefits and the business is not the beneficiary following the rules on the tax treatment of life insurance premiums paid by the employer

We've now piqued your interest in printables for free Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Tax Deduction On Life Insurance Premium for various reasons.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free as well as flashcards and other learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs covered cover a wide variety of topics, including DIY projects to planning a party.

Maximizing Tax Deduction On Life Insurance Premium

Here are some unique ways create the maximum value use of Tax Deduction On Life Insurance Premium:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Deduction On Life Insurance Premium are a treasure trove of fun and practical tools that meet a variety of needs and pursuits. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the endless world of Tax Deduction On Life Insurance Premium today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can print and download these documents for free.

-

Does it allow me to use free printables to make commercial products?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Tax Deduction On Life Insurance Premium?

- Some printables may contain restrictions in their usage. Always read the terms and condition of use as provided by the author.

-

How can I print Tax Deduction On Life Insurance Premium?

- You can print them at home using your printer or visit a local print shop for more high-quality prints.

-

What software do I require to view Tax Deduction On Life Insurance Premium?

- Most printables come in PDF format, which can be opened using free software like Adobe Reader.

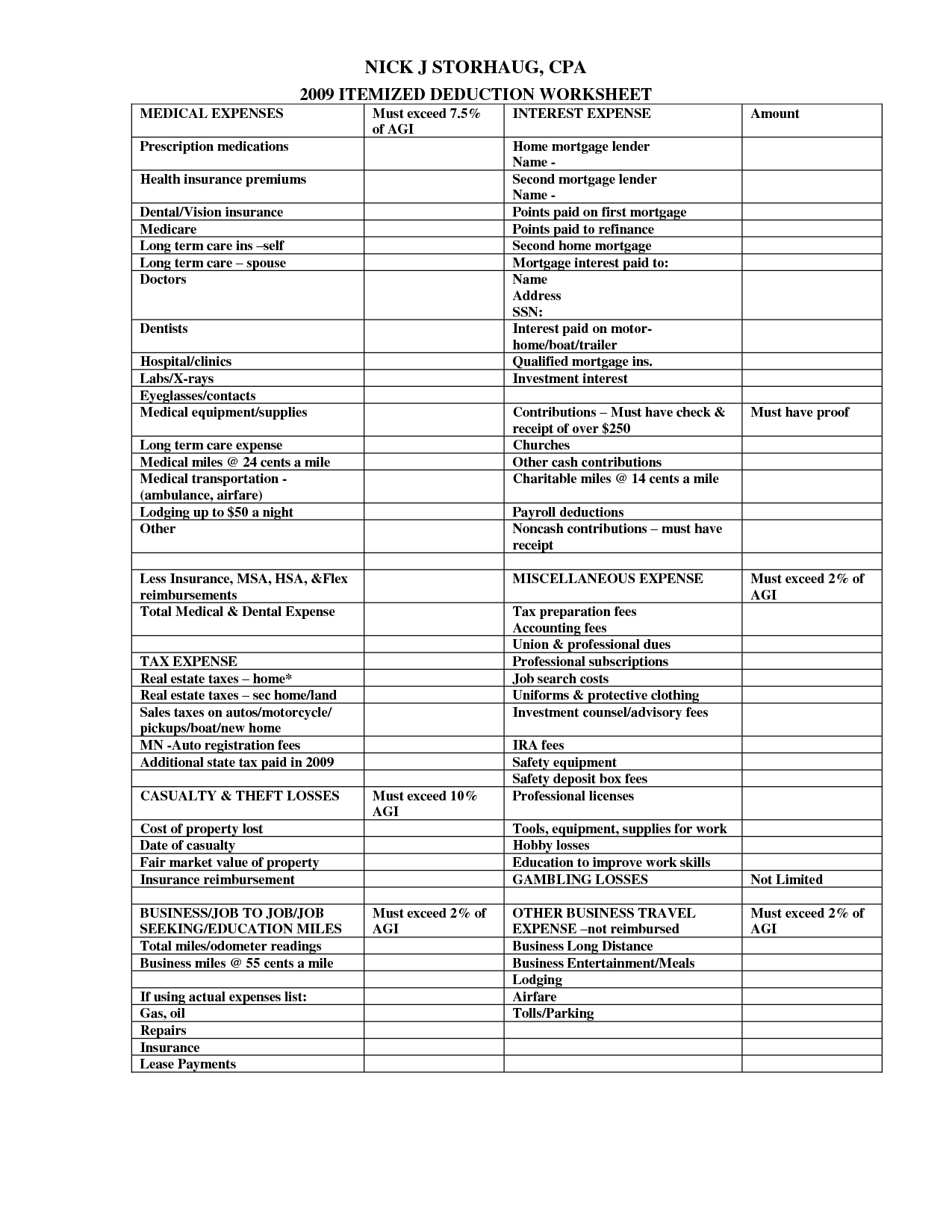

16 Tax Organizer Worksheet Worksheeto

Preventive Check Up 80d Wkcn

Check more sample of Tax Deduction On Life Insurance Premium below

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Tax Deductions You Can Deduct What Napkin Finance

Section 80C Life Insurance Premium Eligible Amount Deduction 2022

Anything To Everything Income Tax Guide For Individuals Including

When Can You Claim A Tax Deduction For Health Insurance

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

https://smartasset.com/life-insurance/are-life...

The short answer is most often going to be no life insurance premiums are not tax deductible if you re buying a policy for yourself or another family member That s because the IRS views life insurance as a personal expense

https://www.finder.com/life-insurance/are-life...

In most cases life insurance premiums aren t tax deductible even for individuals or businesses who can deduct other kinds of insurance But you might be able to write your premiums off as a business expense if the coverage is an employee benefit

The short answer is most often going to be no life insurance premiums are not tax deductible if you re buying a policy for yourself or another family member That s because the IRS views life insurance as a personal expense

In most cases life insurance premiums aren t tax deductible even for individuals or businesses who can deduct other kinds of insurance But you might be able to write your premiums off as a business expense if the coverage is an employee benefit

Anything To Everything Income Tax Guide For Individuals Including

Tax Deductions You Can Deduct What Napkin Finance

When Can You Claim A Tax Deduction For Health Insurance

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

80d Medical Insurance Premium Receipt Pdf Fill Online Printable

Are Life Insurance Premiums Tax Deductible Insurance

Are Life Insurance Premiums Tax Deductible Insurance

Section 80D Deduction For Medical Insurance Health Checkups 2019