In a world when screens dominate our lives but the value of tangible, printed materials hasn't diminished. Whether it's for educational purposes, creative projects, or simply to add personal touches to your home, printables for free have proven to be a valuable resource. The following article is a take a dive deep into the realm of "Tax Deduction On Nps," exploring the benefits of them, where to find them, and how they can add value to various aspects of your daily life.

Get Latest Tax Deduction On Nps Below

Tax Deduction On Nps

Tax Deduction On Nps -

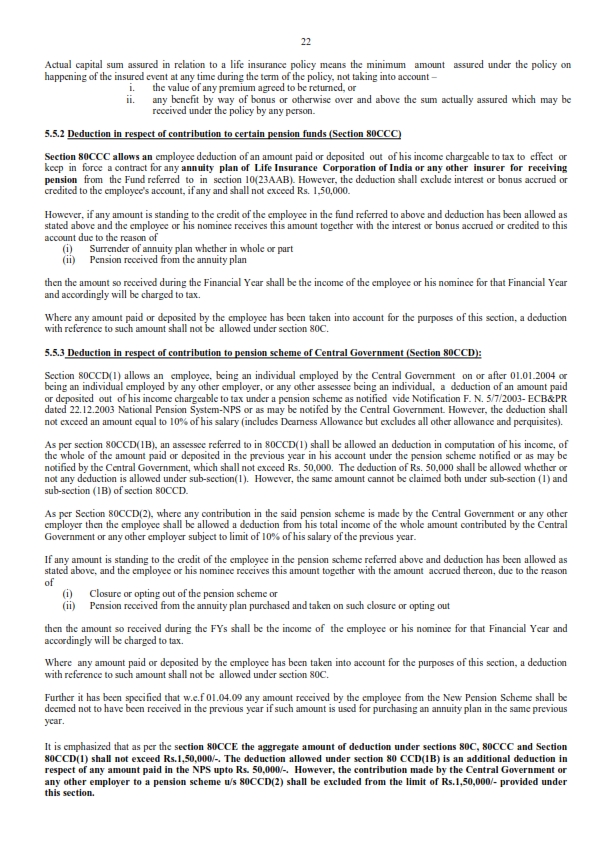

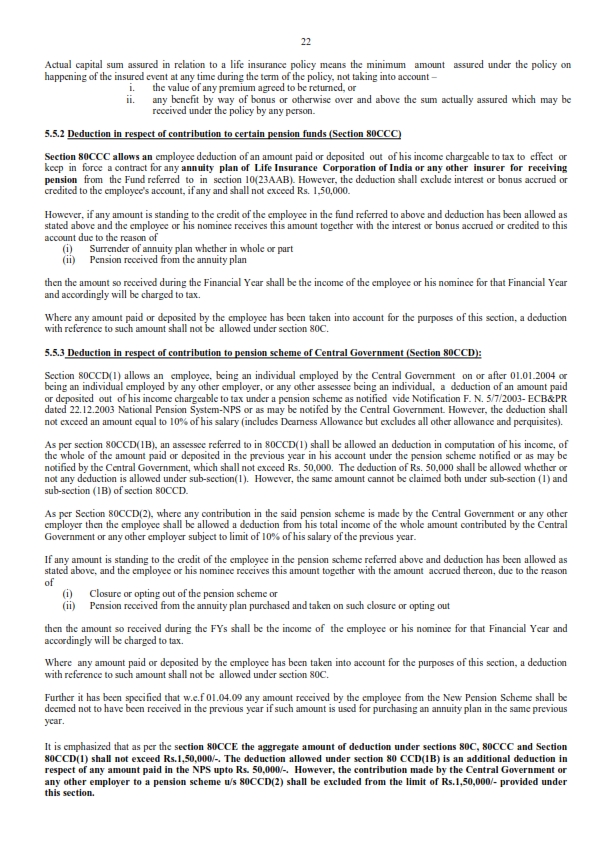

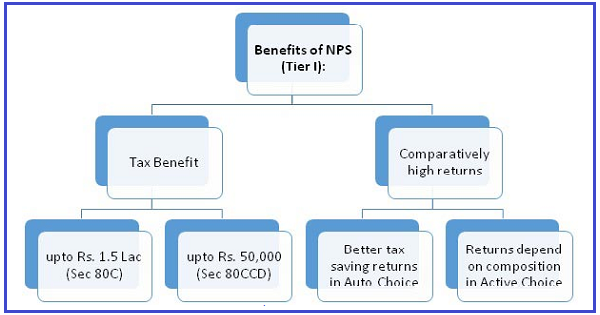

Tax Benefits Under NPS As Per August 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

Tax Deduction On Nps offer a wide range of printable, free documents that can be downloaded online at no cost. They come in many styles, from worksheets to templates, coloring pages, and many more. The beauty of Tax Deduction On Nps is their versatility and accessibility.

More of Tax Deduction On Nps

Creating NPS Deduction Pay Head For Employees Payroll

Creating NPS Deduction Pay Head For Employees Payroll

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits

Learn about tax benefits under the National Pension System NPS and deductions available under Section 80CCD 1B Discover how to maximize your savings with additional tax relief on NPS contributions

Tax Deduction On Nps have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization They can make designs to suit your personal needs for invitations, whether that's creating them and schedules, or even decorating your house.

-

Educational Value: Education-related printables at no charge are designed to appeal to students from all ages, making these printables a powerful tool for teachers and parents.

-

Easy to use: The instant accessibility to a plethora of designs and templates can save you time and energy.

Where to Find more Tax Deduction On Nps

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

Section 80CCD 2 of the Income Tax Act allows employed individuals to claim income tax deductions for employer contributions It is conditional on the following Employees in

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible

Now that we've piqued your interest in printables for free Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Tax Deduction On Nps for various uses.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad spectrum of interests, from DIY projects to party planning.

Maximizing Tax Deduction On Nps

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Tax Deduction On Nps are an abundance of fun and practical tools which cater to a wide range of needs and interest. Their access and versatility makes these printables a useful addition to any professional or personal life. Explore the plethora that is Tax Deduction On Nps today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printables for commercial uses?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright rights issues with Tax Deduction On Nps?

- Some printables may contain restrictions regarding their use. You should read the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer or go to an in-store print shop to get high-quality prints.

-

What program do I need to open printables at no cost?

- The majority of printed documents are as PDF files, which is open with no cost software like Adobe Reader.

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

NPS Subscribers Can Claim This Income Tax Benefit Even After Opting New

Check more sample of Tax Deduction On Nps below

TAX Benefits On NPS YouTube

NPS Investment Proof How To Claim Income Tax Deduction Mint

Creating Employees NPS Deduction Pay Head

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

SIBAPRASAD CHAKRABORTY NPS Tax Deduction Instruction MINISTRY OF

Nps Contribution By Employee Werohmedia

https://cleartax.in › nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

https://www.etmoney.com › learn › nps …

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

NPS Investment Proof How To Claim Income Tax Deduction Mint

SIBAPRASAD CHAKRABORTY NPS Tax Deduction Instruction MINISTRY OF

Nps Contribution By Employee Werohmedia

ALL ABOUT NPS NATIONAL PENSION SCHEME ADDITIONAL DEDUCTION Rs 50000

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021