Today, where screens dominate our lives The appeal of tangible printed items hasn't gone away. If it's to aid in education project ideas, artistic or just adding the personal touch to your space, Tax Deduction On Retirement Annuity have become a valuable resource. In this article, we'll take a dive in the world of "Tax Deduction On Retirement Annuity," exploring what they are, where to find them, and how they can improve various aspects of your daily life.

Get Latest Tax Deduction On Retirement Annuity Below

Tax Deduction On Retirement Annuity

Tax Deduction On Retirement Annuity -

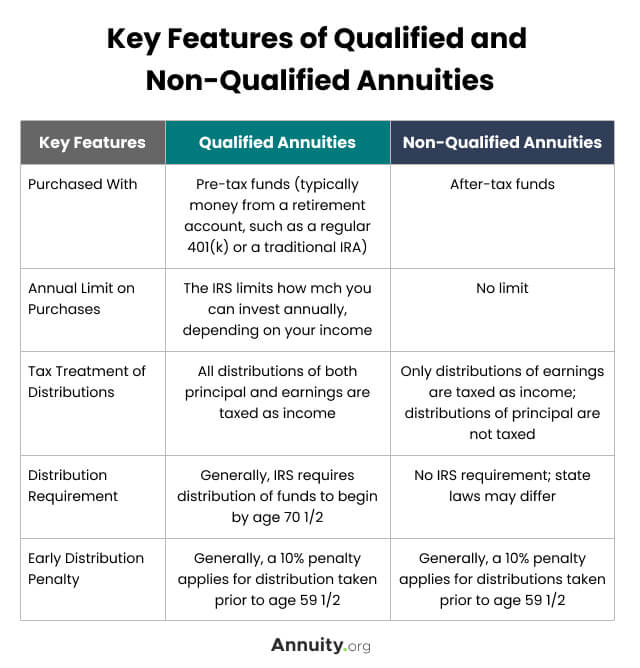

If you make a withdrawal you will be subject to taxes and a 10 early withdrawal penalty One of the advantages of buying an annuity is that the earnings are allowed to grow on a tax deferred basis until withdrawal Earnings include interest dividends and capital gains The earnings are reinvested each year without any tax impact

Espa ol If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may be taxable unless the payment is a qualified distribution from a designated Roth account

Printables for free cover a broad array of printable materials online, at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and many more. The great thing about Tax Deduction On Retirement Annuity is in their variety and accessibility.

More of Tax Deduction On Retirement Annuity

Qualified Vs Non Qualified Annuities Taxation And Distribution

Qualified Vs Non Qualified Annuities Taxation And Distribution

Taxes for Retirees Taxes for retirees are primary from distributions taken from your retirement plan The following are fully taxable All contributions your company made into your retirement plan Pre tax contributions like to a 401 k plan you made They re taxable since you didn t pay taxes on your contributions when you made them

Annuities are designed to build wealth and income for your retirement through tax deferral Interest earned in a deferred annuity the most popular type is not taxed until withdrawn

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring printables to your specific needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: Education-related printables at no charge cater to learners of all ages, making them an invaluable aid for parents as well as educators.

-

The convenience of immediate access various designs and templates reduces time and effort.

Where to Find more Tax Deduction On Retirement Annuity

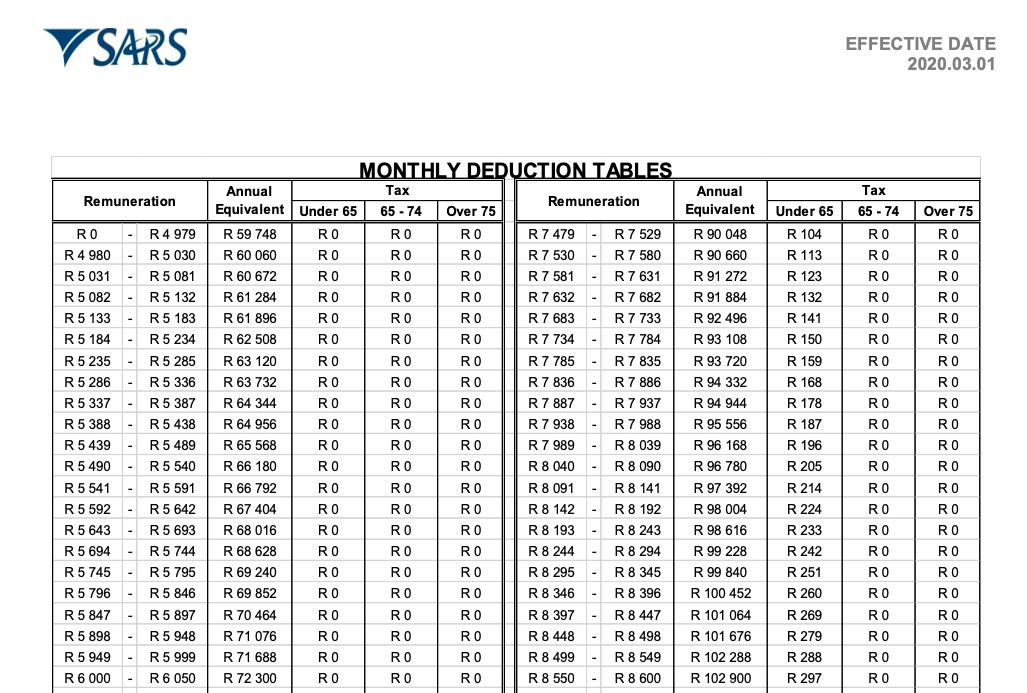

What Is Tax Rebate On A Retirement Annuity

What Is Tax Rebate On A Retirement Annuity

An individual retirement annuity is an annuity held within a tax advantaged account similar to an IRA With an individual retirement annuity however you make premium payments to the insurance company rather than contributing deferred salary to an IRA Later when you retire rather than taking funds from your IRA to get money to pay

Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an employer pension annuity profit sharing stock bonus or other deferred compensation plan The rules also apply to payments or distributions from an individual retirement

If we've already piqued your interest in printables for free Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Tax Deduction On Retirement Annuity suitable for many applications.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast range of interests, from DIY projects to planning a party.

Maximizing Tax Deduction On Retirement Annuity

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Tax Deduction On Retirement Annuity are a treasure trove of practical and innovative resources designed to meet a range of needs and interest. Their accessibility and flexibility make them a wonderful addition to the professional and personal lives of both. Explore the vast array of Tax Deduction On Retirement Annuity and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial use?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may come with restrictions regarding their use. Check these terms and conditions as set out by the designer.

-

How do I print printables for free?

- Print them at home using an printer, or go to any local print store for premium prints.

-

What software do I need to open printables free of charge?

- The majority of PDF documents are provided in PDF format. They can be opened using free programs like Adobe Reader.

Minimizing Your Tax Burden With A Retirement Annuity Olemera Blog

How Federal Employee Retirement Benefits Are Taxed By The IRS Part I

Check more sample of Tax Deduction On Retirement Annuity below

Biweekly Payroll Tax Table 2021 Federal Withholding Tables 2021

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

How Federal Employee Retirement Benefits Are Taxed By The IRS Part I

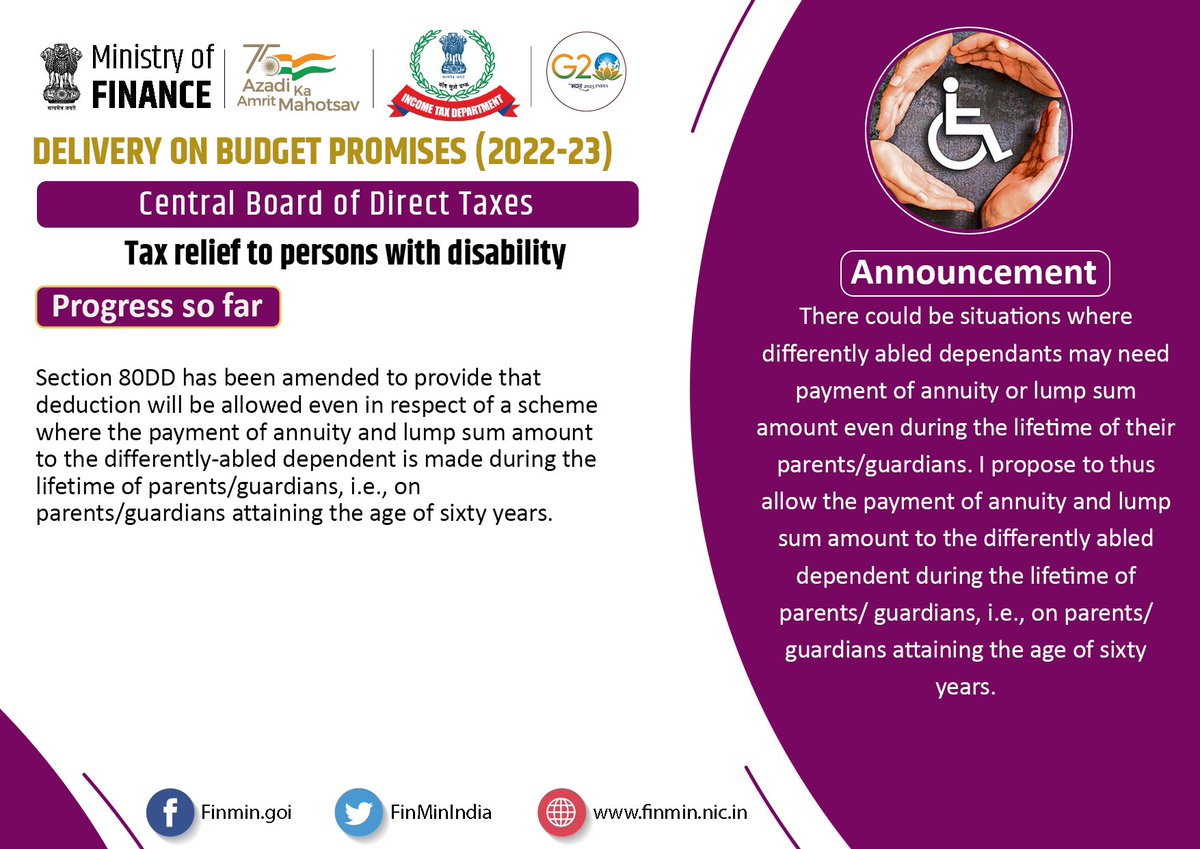

Tax Deduction TDS To Be Deducted On Annuity Payable To Overseas

MyGovIndia On Twitter RT FinMinIndia Income Tax Department Cares

Retirement Annuity Tax Benefit 1st Step In Saving Tax Today

https://www.irs.gov/taxtopics/tc410

Espa ol If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may be taxable unless the payment is a qualified distribution from a designated Roth account

https://www.annuity.org/annuities/taxation

When you take distributions or withdraw from the annuity later in retirement you will be taxed on the growth at your then current tax rate explained annuity and retirement expert Paul Tyler Because of the complexity it s best to consult with a tax professional when purchasing an annuity and before withdrawing any funds

Espa ol If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may be taxable unless the payment is a qualified distribution from a designated Roth account

When you take distributions or withdraw from the annuity later in retirement you will be taxed on the growth at your then current tax rate explained annuity and retirement expert Paul Tyler Because of the complexity it s best to consult with a tax professional when purchasing an annuity and before withdrawing any funds

Tax Deduction TDS To Be Deducted On Annuity Payable To Overseas

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

MyGovIndia On Twitter RT FinMinIndia Income Tax Department Cares

Retirement Annuity Tax Benefit 1st Step In Saving Tax Today

Charitable Gift Annuity Tax Deduction Wai Tiller

Retirement Annuity Vs Pension Fund

Retirement Annuity Vs Pension Fund

Annuity Emporium Blog Expert Insights On Retirement Annuity Strategies