In this age of electronic devices, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education in creative or artistic projects, or simply adding personal touches to your area, Tax Deduction On Salary In India 2023 can be an excellent source. For this piece, we'll dive through the vast world of "Tax Deduction On Salary In India 2023," exploring what they are, how you can find them, and how they can improve various aspects of your daily life.

Get Latest Tax Deduction On Salary In India 2023 Below

Tax Deduction On Salary In India 2023

Tax Deduction On Salary In India 2023 -

Verkko Income tax deduction under Section 80G for charitable donations Tax deduction of up to Rs 10 000 on savings account interest income New Tax Regime The following deductions are available under the new tax regime 2023 Section 24 b allows for a deduction on interest paid on a home loan for a rented out property

Verkko 21 helmik 2023 nbsp 0183 32 Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction Leave Travel

Tax Deduction On Salary In India 2023 offer a wide assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and many more. The attraction of printables that are free is in their versatility and accessibility.

More of Tax Deduction On Salary In India 2023

Standard Deduction On Salary In India 2023 Limits Calims

Standard Deduction On Salary In India 2023 Limits Calims

Verkko In the budget 2023 In case of New Regime The maximum limit of non taxable income for an individual is set at Rs 3 lakh However you can also get a rebate of Rs 25000 under section 87A if you have a total income of up to Rs 7 lacs for FY 2023 24

Verkko Deductions Show Details Net Taxable Income Income Liable to Tax at Normal Rate Short Term Capital Gains Covered u s 111A 15 Long Term Capital Gains Charged to tax 20 20 Long Term Capital Gains Charged to tax 10 10 Winnings from Lottery Crossword Puzzles etc 30 Income Tax Surcharge Education Cess

The Tax Deduction On Salary In India 2023 have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: It is possible to tailor printables to fit your particular needs, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational value: These Tax Deduction On Salary In India 2023 can be used by students of all ages. This makes them a great device for teachers and parents.

-

An easy way to access HTML0: Fast access many designs and templates will save you time and effort.

Where to Find more Tax Deduction On Salary In India 2023

Standard Deduction On Salary For AY 2022 23 New Tax Route

Standard Deduction On Salary For AY 2022 23 New Tax Route

Verkko Standard deduction introduced for salaried individuals pensioners under the new tax regime Highest surcharge rate reduced to 25 from 37 under the new tax regime Rebate under Section 87A increased to taxable income of Rs 7 lakh under the new tax regime from Rs 5 lakh earlier

Verkko 19 maalisk 2023 nbsp 0183 32 However the Budget 2023 has now proposed to allow such standard deduction for taxpayers opting for the proposed new tax regime u s 115BAC of the IT Act in Financial Year 2023 24

Since we've got your interest in Tax Deduction On Salary In India 2023 Let's look into where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of motives.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning tools.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Tax Deduction On Salary In India 2023

Here are some fresh ways that you can make use use of Tax Deduction On Salary In India 2023:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Deduction On Salary In India 2023 are an abundance of practical and innovative resources catering to different needs and interests. Their accessibility and versatility make these printables a useful addition to both professional and personal lives. Explore the wide world that is Tax Deduction On Salary In India 2023 today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print the resources for free.

-

Can I use free printables in commercial projects?

- It depends on the specific usage guidelines. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with Tax Deduction On Salary In India 2023?

- Certain printables may be subject to restrictions regarding usage. Make sure you read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home with printing equipment or visit an area print shop for superior prints.

-

What program do I require to open printables for free?

- The majority of printables are in the format PDF. This can be opened using free software such as Adobe Reader.

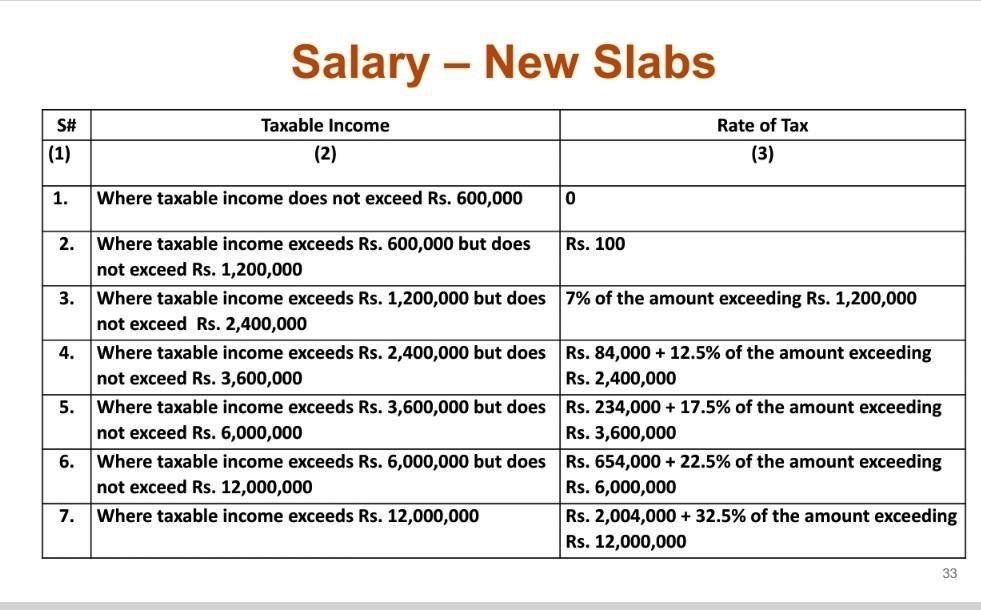

Income Tax Slabs Year 2022 23 Info Ghar Educational News

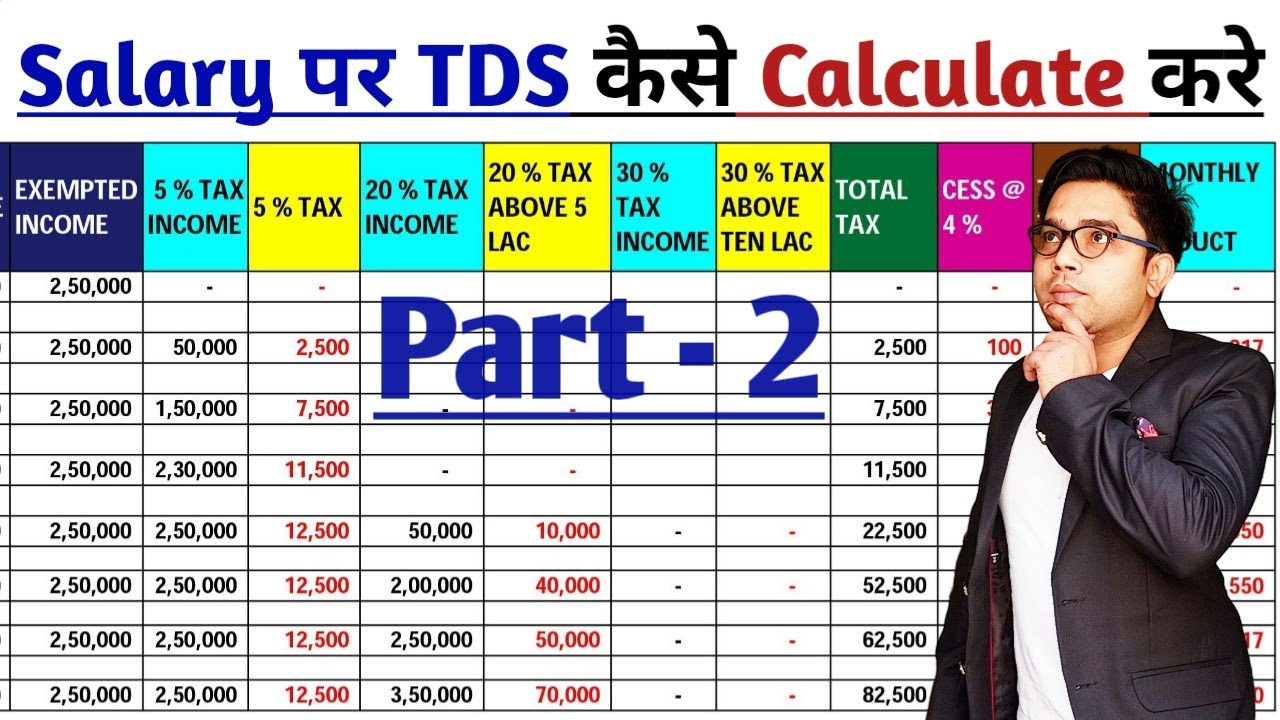

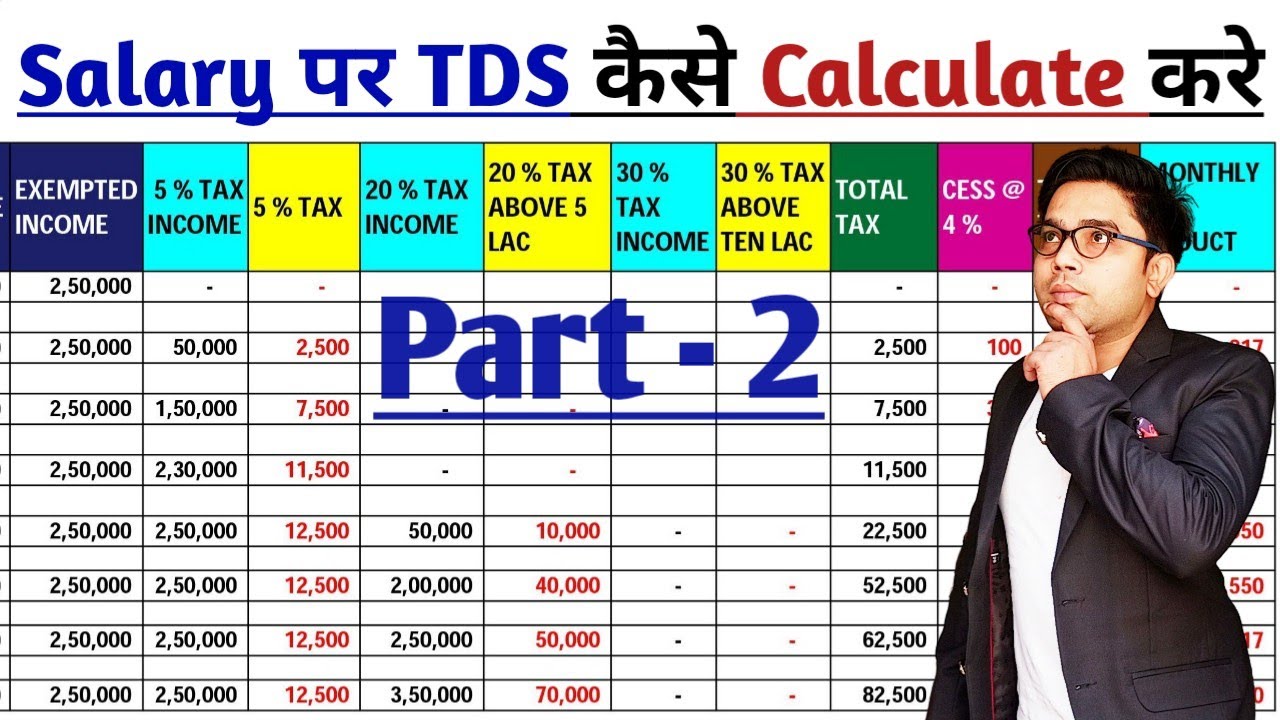

TDS On Salary Calculation Tax Deduction On Salary FinCalC

Check more sample of Tax Deduction On Salary In India 2023 below

Tax Deduction On Salary Budget 2023 24 Income Tax On Income From

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

How Does Tax Deduction Work In India Tax Walls

Standard Deduction 2020 Self Employed Standard Deduction 2021

TDS On Salary Calculation Tax Deduction On Salary FinCalC

2023 Tax Tables Australia IMAGESEE

https://cleartax.in/s/income-tax-allowances-and-deductions

Verkko 21 helmik 2023 nbsp 0183 32 Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction Leave Travel

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Verkko The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less This Rebate is available in both tax regimes

Verkko 21 helmik 2023 nbsp 0183 32 Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction Leave Travel

Verkko The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less This Rebate is available in both tax regimes

Standard Deduction 2020 Self Employed Standard Deduction 2021

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

TDS On Salary Calculation Tax Deduction On Salary FinCalC

2023 Tax Tables Australia IMAGESEE

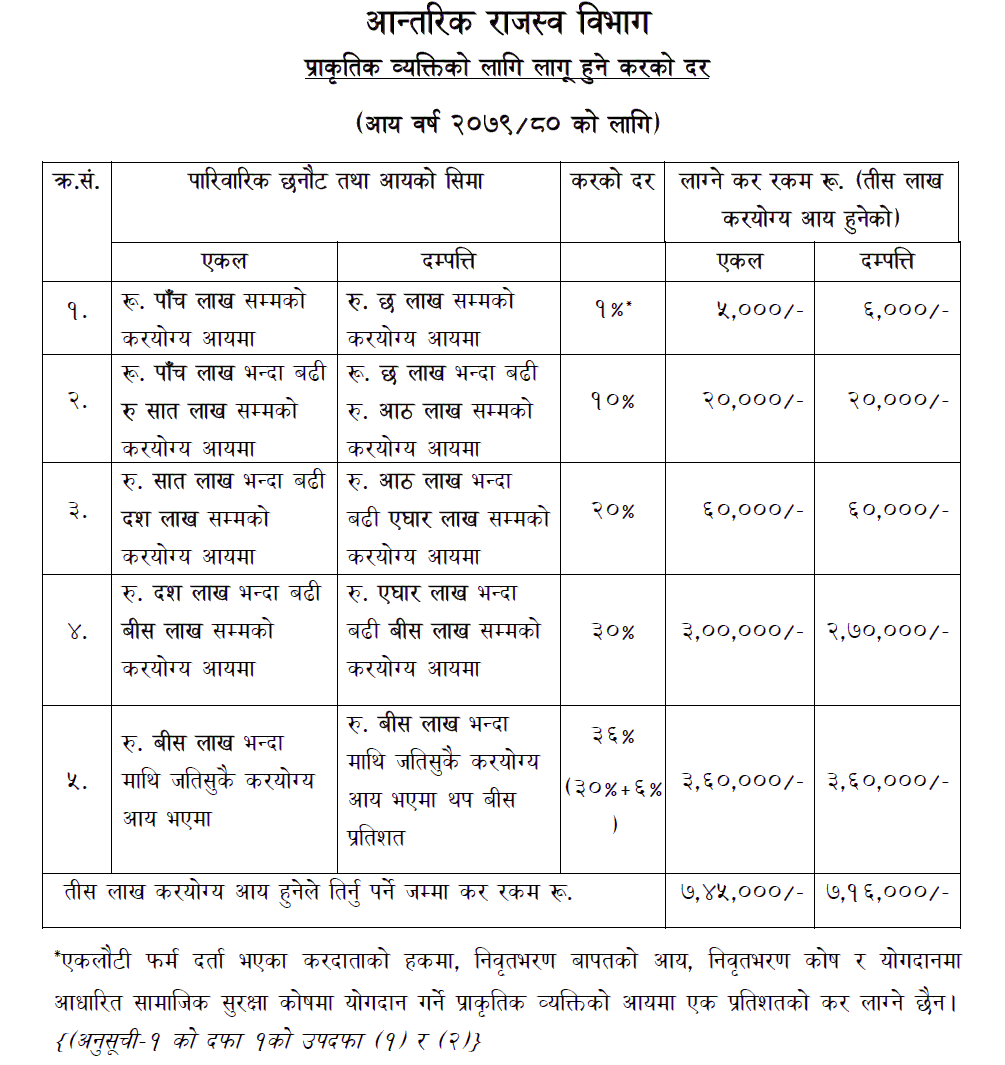

Income Tax Rate In Nepal For Fiscal Year 2079 80 For Natural Person

My Salary Calculator Shop Save 49 Jlcatj gob mx

My Salary Calculator Shop Save 49 Jlcatj gob mx

What Does Gross Annual Income Mean In India Does It Include Any