In this day and age where screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education such as creative projects or simply to add an extra personal touch to your home, printables for free are now a useful source. We'll dive to the depths of "Tax Deduction Percentage," exploring the benefits of them, where to find them and how they can add value to various aspects of your lives.

What Are Tax Deduction Percentage?

Tax Deduction Percentage encompass a wide variety of printable, downloadable documents that can be downloaded online at no cost. These resources come in many types, like worksheets, templates, coloring pages and more. The value of Tax Deduction Percentage is their flexibility and accessibility.

Tax Deduction Percentage

Tax Deduction Percentage

Tax Deduction Percentage -

[desc-5]

[desc-1]

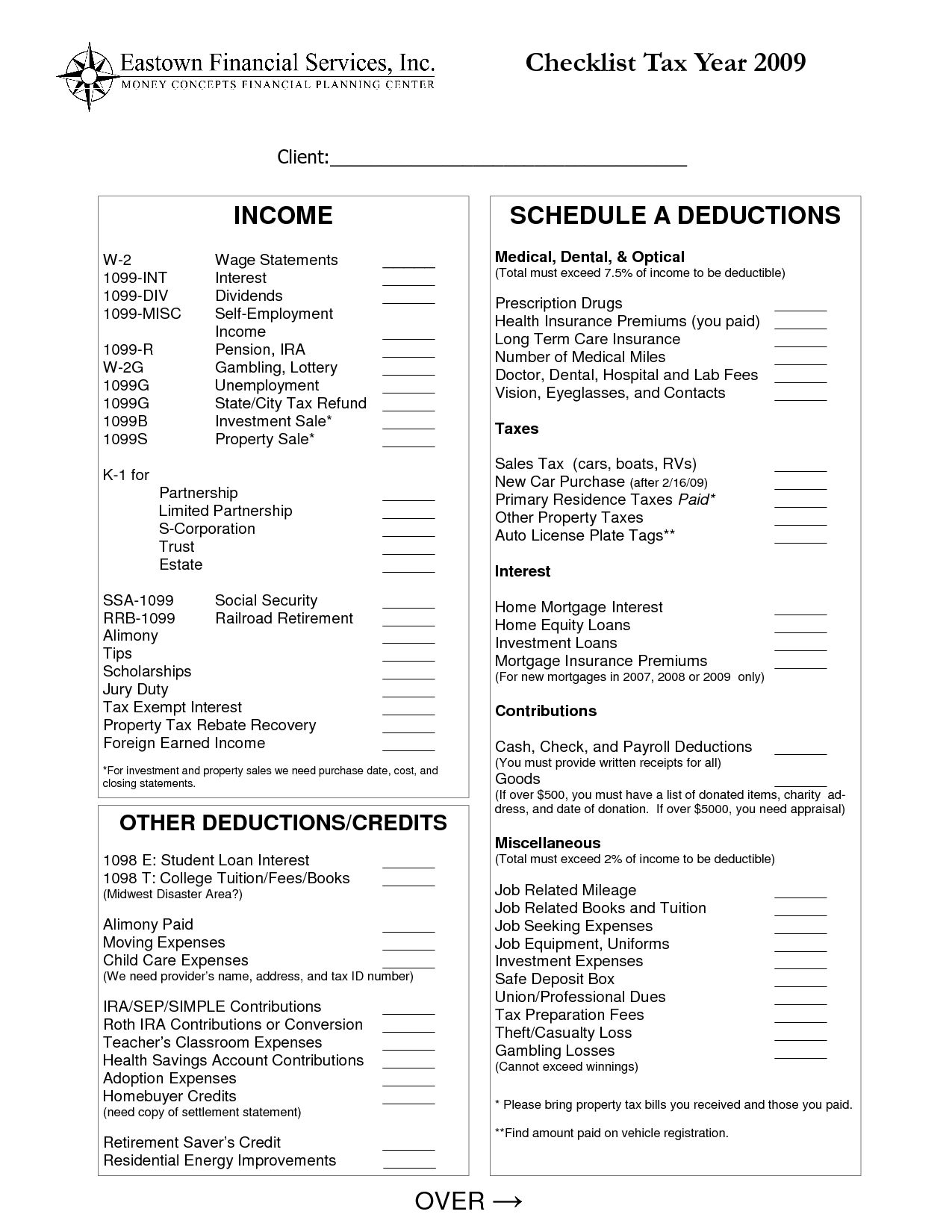

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

[desc-4]

[desc-6]

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

[desc-9]

[desc-7]

10 Business Tax Deductions Worksheet Worksheeto

Zru nos Do Toho Ob ianstvo Tax Return Calculator Ontario 2019

2022 Federal Tax Brackets And Standard Deduction Printable Form

Income Tax Deductions Available For The Financial Year 2017 18

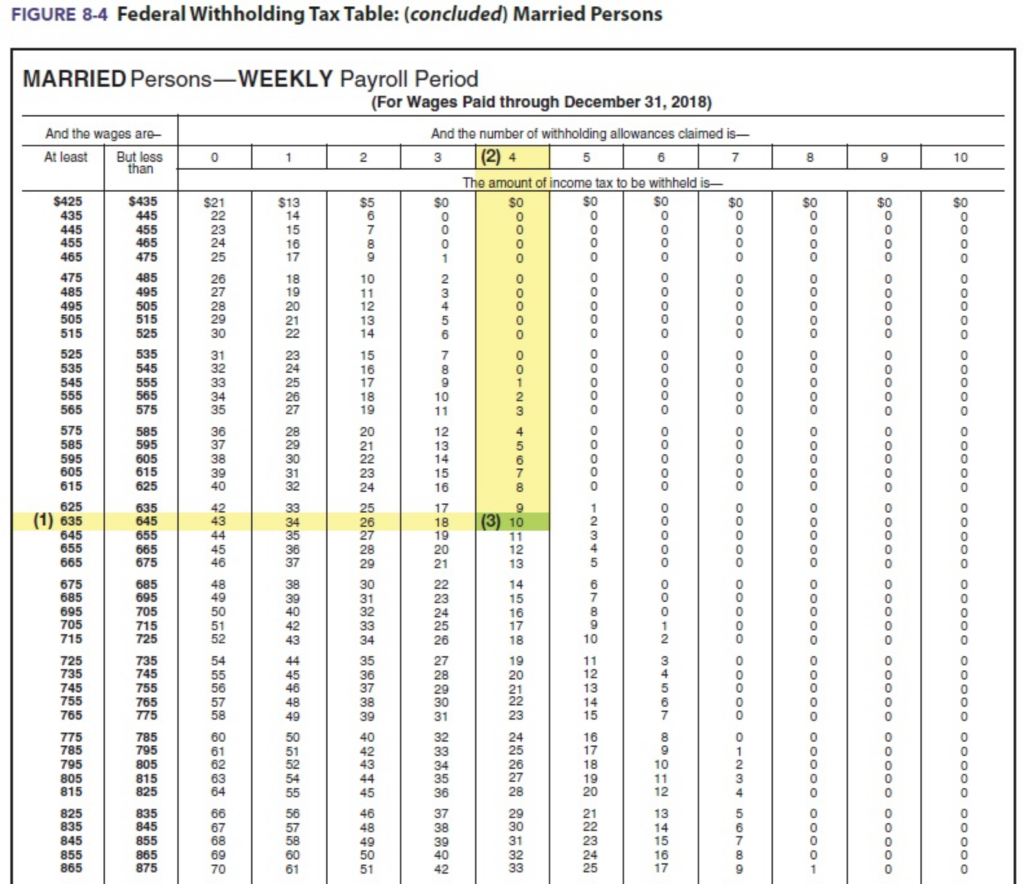

Withholding Tax Table

Federal State Payroll Tax Rates For Employers

Federal State Payroll Tax Rates For Employers

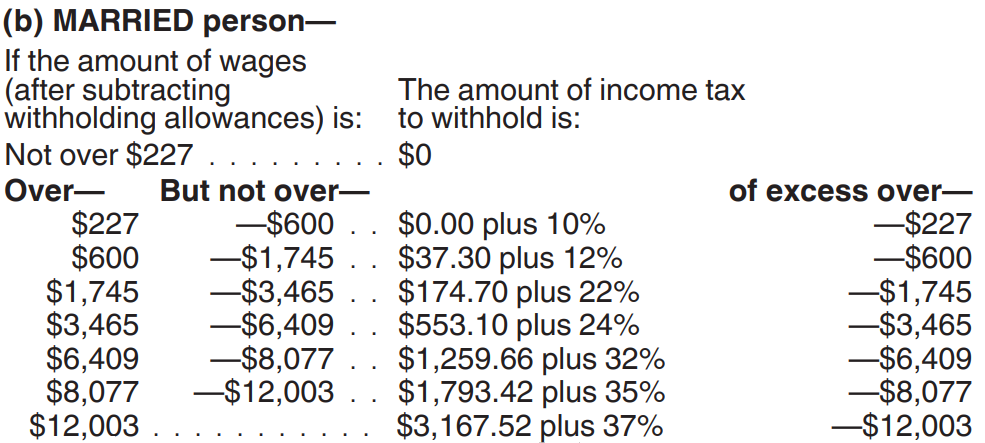

In Each Of The Following Independent Situations Determine The