In a world where screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding an extra personal touch to your home, printables for free are now a vital resource. Through this post, we'll take a dive to the depths of "Tax Deduction Senior Citizens," exploring the benefits of them, where they are available, and how they can improve various aspects of your lives.

Get Latest Tax Deduction Senior Citizens Below

Tax Deduction Senior Citizens

Tax Deduction Senior Citizens -

Profit and prosper with the best of expert advice on investing taxes retirement personal finance and more straight to your e mail

AARP Foundation Tax Aide offers free tax preparation and has more than 5 000 locations in neighborhood libraries malls banks community centers and senior centers annually during the filing season

Tax Deduction Senior Citizens provide a diverse collection of printable material that is available online at no cost. These resources come in various types, such as worksheets coloring pages, templates and more. The beauty of Tax Deduction Senior Citizens lies in their versatility as well as accessibility.

More of Tax Deduction Senior Citizens

Finance Tips For Senior Citizens What Deductible Tax Expenses For

Finance Tips For Senior Citizens What Deductible Tax Expenses For

Older adults and people who are retired can take advantage of additional tax breaks and savings when it comes time to file their taxes For starters there is a larger standard deduction for people over the age of 65

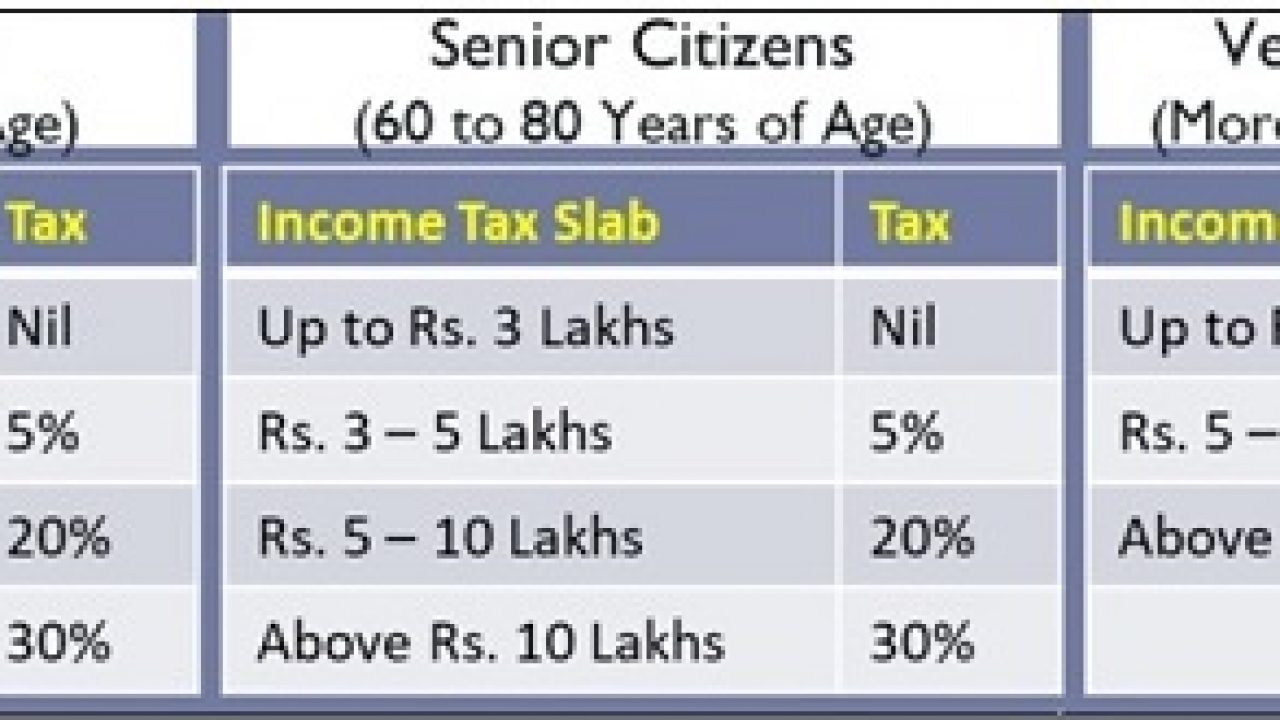

As per Income tax Act 1961 senior citizen is an individual whose age is 60 years or more but less than 80 years While a super senior citizen is an individual whose age is 80 years or more This article briefly explains all the income tax provisions applicable to the resident senior citizen and super senior citizen

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization This allows you to modify the design to meet your needs be it designing invitations and schedules, or decorating your home.

-

Educational Worth: Printables for education that are free can be used by students of all ages, which makes these printables a powerful source for educators and parents.

-

An easy way to access HTML0: The instant accessibility to the vast array of design and templates reduces time and effort.

Where to Find more Tax Deduction Senior Citizens

80 TTA Deduction For Ay 2022 23 II 80ttb Deduction For Senior Citizens

80 TTA Deduction For Ay 2022 23 II 80ttb Deduction For Senior Citizens

Home Lifestyle Guide How to Calculate Tax for Senior Citizens Made Easy Leave a Comment Business Initiatives Lifestyle By Francis Welcome to our comprehensive guide on how to calculate tax for senior citizens in the United States

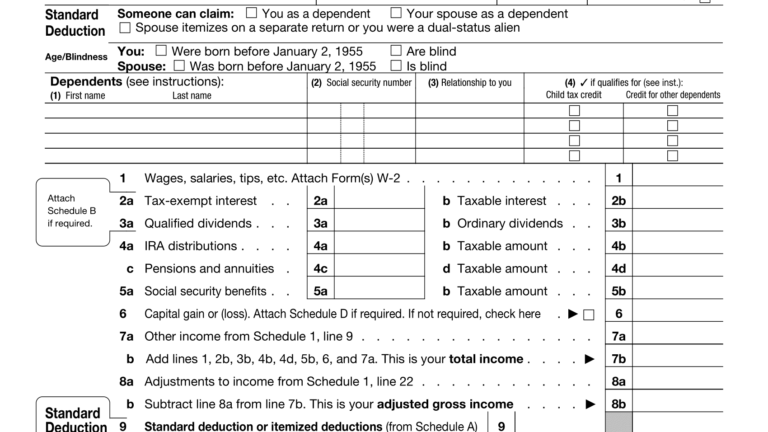

When You Turn 65 Higher Standard Deductions Those aged 65 and over get their taxable incomes lowered with a larger standard deduction

Since we've got your curiosity about Tax Deduction Senior Citizens Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Tax Deduction Senior Citizens to suit a variety of objectives.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Tax Deduction Senior Citizens

Here are some ideas of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Deduction Senior Citizens are a treasure trove of creative and practical resources for a variety of needs and needs and. Their access and versatility makes them a great addition to both professional and personal lives. Explore the vast world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can print and download these files for free.

-

Can I make use of free printing templates for commercial purposes?

- It's dependent on the particular usage guidelines. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright issues in Tax Deduction Senior Citizens?

- Some printables may have restrictions in use. Always read the terms and regulations provided by the author.

-

How do I print Tax Deduction Senior Citizens?

- You can print them at home using a printer or visit a print shop in your area for premium prints.

-

What software is required to open printables for free?

- The majority of printed documents are in the PDF format, and is open with no cost software, such as Adobe Reader.

Standard Deduction For Senior Citizens 2020 Standard Deduction 2021

Can Claim Section 80TTB Deduction While Filing ITR Senior Citizens

Check more sample of Tax Deduction Senior Citizens below

SECTION 194P Deduction Of Tax In Case Of Certain Senior Citizens

Tax Tips For Senior Citizens Robergtaxsolutions

Standard Deduction For Ay 2020 21 For Senior Citizens Standard

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

Actualizar 54 Imagen Senior Citizen Tax Deduction Ecover mx

How Senior Citizens Can Claim Up To Rs 50 000 Deduction Under Section

www.irs.gov/publications/p554

AARP Foundation Tax Aide offers free tax preparation and has more than 5 000 locations in neighborhood libraries malls banks community centers and senior centers annually during the filing season

www.usatoday.com/story/money/taxes/2024/01/...

However whether you should itemize or not depends on whether the total of your itemized deductions tops your standard deduction or whether you must itemize deductions because you can t use the

AARP Foundation Tax Aide offers free tax preparation and has more than 5 000 locations in neighborhood libraries malls banks community centers and senior centers annually during the filing season

However whether you should itemize or not depends on whether the total of your itemized deductions tops your standard deduction or whether you must itemize deductions because you can t use the

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

Tax Tips For Senior Citizens Robergtaxsolutions

Actualizar 54 Imagen Senior Citizen Tax Deduction Ecover mx

How Senior Citizens Can Claim Up To Rs 50 000 Deduction Under Section

Preventive Check Up 80d Wkcn

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Astrid Merrill

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Astrid Merrill

Section 80TTB Deduction For Senior Citizens Eligibility Exemptions