In this age of technology, where screens dominate our lives yet the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes or creative projects, or just adding the personal touch to your space, Tax Deduction Star Tax Rebate are a great resource. Through this post, we'll take a dive in the world of "Tax Deduction Star Tax Rebate," exploring what they are, how they can be found, and what they can do to improve different aspects of your lives.

Get Latest Tax Deduction Star Tax Rebate Below

Tax Deduction Star Tax Rebate

Tax Deduction Star Tax Rebate -

Web Ce convertisseur permet de calculer un prix toutes taxes comprises TTC 224 partir d un prix hors taxes HT et vice versa selon le taux de TVA applicable

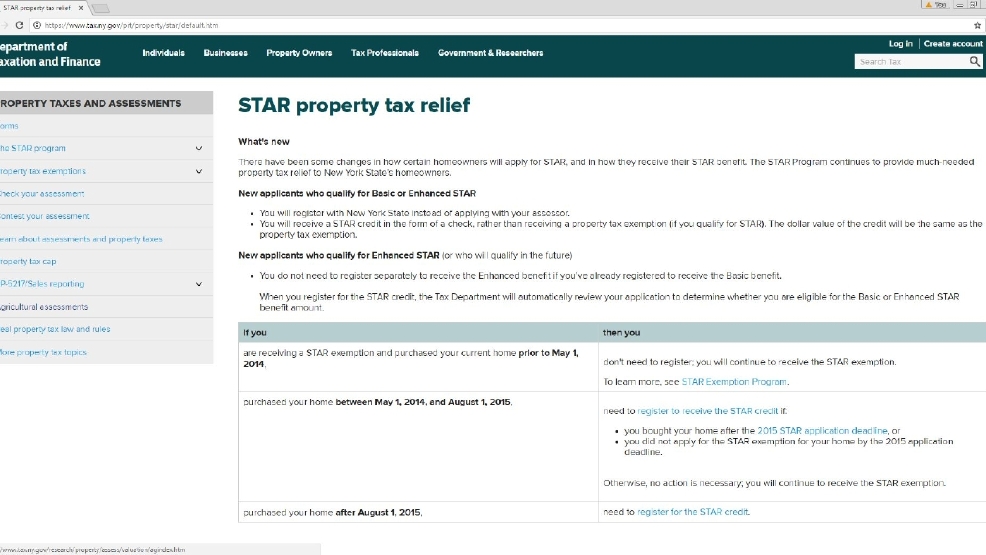

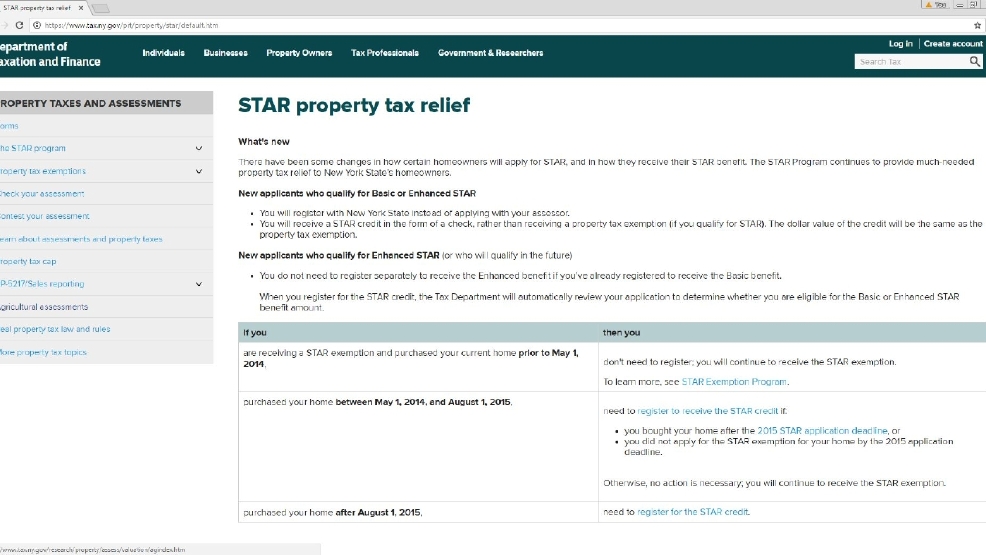

Web 5 sept 2023 nbsp 0183 32 You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000

Tax Deduction Star Tax Rebate provide a diverse selection of printable and downloadable content that can be downloaded from the internet at no cost. These printables come in different types, such as worksheets templates, coloring pages and much more. The great thing about Tax Deduction Star Tax Rebate lies in their versatility and accessibility.

More of Tax Deduction Star Tax Rebate

Does This Have Anything To Do With STAR Tax Rebate Sorry If This Is A

Does This Have Anything To Do With STAR Tax Rebate Sorry If This Is A

Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits

Web The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: It is possible to tailor printing templates to your own specific requirements whether it's making invitations making your schedule, or even decorating your house.

-

Educational value: Free educational printables offer a wide range of educational content for learners of all ages. This makes these printables a powerful source for educators and parents.

-

It's easy: instant access various designs and templates is time-saving and saves effort.

Where to Find more Tax Deduction Star Tax Rebate

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Web To be eligible for Basic STAR your income must be 250 000 or less You currently receive Basic STAR and would like to apply for Enhanced STAR You may be eligible for

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

We hope we've stimulated your interest in Tax Deduction Star Tax Rebate we'll explore the places you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Tax Deduction Star Tax Rebate for all purposes.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a wide range of interests, that includes DIY projects to party planning.

Maximizing Tax Deduction Star Tax Rebate

Here are some unique ways create the maximum value of Tax Deduction Star Tax Rebate:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets for teaching at-home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction Star Tax Rebate are a treasure trove of practical and imaginative resources catering to different needs and needs and. Their accessibility and versatility make them a valuable addition to each day life. Explore the vast collection of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction Star Tax Rebate truly gratis?

- Yes, they are! You can download and print these files for free.

-

Are there any free printables for commercial use?

- It's all dependent on the usage guidelines. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright issues in Tax Deduction Star Tax Rebate?

- Some printables may contain restrictions regarding their use. Always read the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home using an printer, or go to the local print shop for better quality prints.

-

What software must I use to open printables that are free?

- A majority of printed materials are in the PDF format, and is open with no cost programs like Adobe Reader.

Foster Appliance Promotions

DEDUCTION UNDER SECTION 80C TO 80U PDF

Check more sample of Tax Deduction Star Tax Rebate below

Nys Star Tax Rebate Checks 2022 StarRebate

2007 Tax Rebate Tax Deduction Rebates

Major Exemptions Deductions Availed By Taxpayers In India

How To Calculate Tax Rebate On Home Loan Grizzbye

80C TO 80U DEDUCTIONS LIST PDF

Travelling Expenses Tax Deductible Malaysia Paul Springer

https://www.tax.ny.gov/star

Web 5 sept 2023 nbsp 0183 32 You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 5 sept 2023 nbsp 0183 32 You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

How To Calculate Tax Rebate On Home Loan Grizzbye

2007 Tax Rebate Tax Deduction Rebates

80C TO 80U DEDUCTIONS LIST PDF

Travelling Expenses Tax Deductible Malaysia Paul Springer

Pin On Tax Credits Vs Tax Deductions

Standard Deduction For 2021 22 Standard Deduction 2021

Standard Deduction For 2021 22 Standard Deduction 2021

Solved Janice Morgan Age 24 Is Single And Has No Chegg