In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible, printed materials hasn't diminished. For educational purposes as well as creative projects or simply to add an element of personalization to your home, printables for free have become a valuable source. In this article, we'll dive to the depths of "Tax Deduction Uniforms," exploring their purpose, where they are, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Deduction Uniforms Below

Tax Deduction Uniforms

Tax Deduction Uniforms -

The IRS looks for a direct correlation between the expense and the job requirement ensuring that the deduction is justified Learn how to claim uniform expenses on your taxes

Determine which work clothes are necessary for your job but not suitable to wear outside of work However just buying clothes specifically for work and never wearing them at any other time isn t good enough The IRS has accepted deductions for theatrical costumes hard hats and other safety gear Among the See more

Tax Deduction Uniforms include a broad assortment of printable, downloadable items that are available online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. One of the advantages of Tax Deduction Uniforms is their versatility and accessibility.

More of Tax Deduction Uniforms

Tax Deductions For Work Attire Finance Zacks

Tax Deductions For Work Attire Finance Zacks

Yes uniforms and necessary job specific attire can be deducted for tax purposes as long as they are required for your employment and aren t suitable for everyday use Examples include uniforms with company logos or attire designed

Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs

Tax Deduction Uniforms have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization This allows you to modify the templates to meet your individual needs for invitations, whether that's creating them planning your schedule or even decorating your home.

-

Educational Value The free educational worksheets offer a wide range of educational content for learners from all ages, making them an invaluable tool for parents and educators.

-

The convenience of Fast access an array of designs and templates reduces time and effort.

Where to Find more Tax Deduction Uniforms

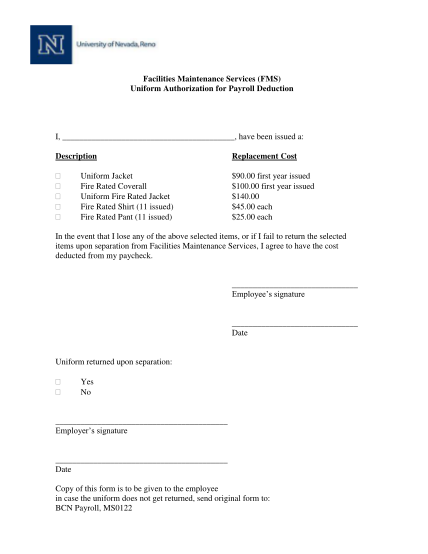

20 Payroll Deduction Authorization Form For Uniforms Free To Edit

20 Payroll Deduction Authorization Form For Uniforms Free To Edit

Uniforms occupation specific clothing laundering and dry cleaning of this clothing Things to know To claim a deduction for a work related expense you must have

A business could potentially qualify for a tax deduction related to business attire in various scenarios including Furnishing clothing to their employees Providing a clothing

In the event that we've stirred your curiosity about Tax Deduction Uniforms, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of reasons.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning tools.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide variety of topics, including DIY projects to party planning.

Maximizing Tax Deduction Uniforms

Here are some unique ways in order to maximize the use of Tax Deduction Uniforms:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Deduction Uniforms are an abundance of practical and imaginative resources catering to different needs and preferences. Their accessibility and flexibility make they a beneficial addition to both personal and professional life. Explore the vast collection of Tax Deduction Uniforms now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can download and print these files for free.

-

Does it allow me to use free templates for commercial use?

- It's contingent upon the specific rules of usage. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions on usage. Make sure you read the terms and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home with a printer or visit a local print shop to purchase premium prints.

-

What software do I need in order to open printables for free?

- Many printables are offered as PDF files, which is open with no cost software such as Adobe Reader.

Work Clothing Tax Deduction Things You Should Know

Can You Deduct Dry Cleaning Expenses On Your Taxes Uniforms Clothing

Check more sample of Tax Deduction Uniforms below

15 Payroll Deduction Authorization Form For Uniforms Free To Edit

How Can You Get A Tax Deduction On Staff Uniforms

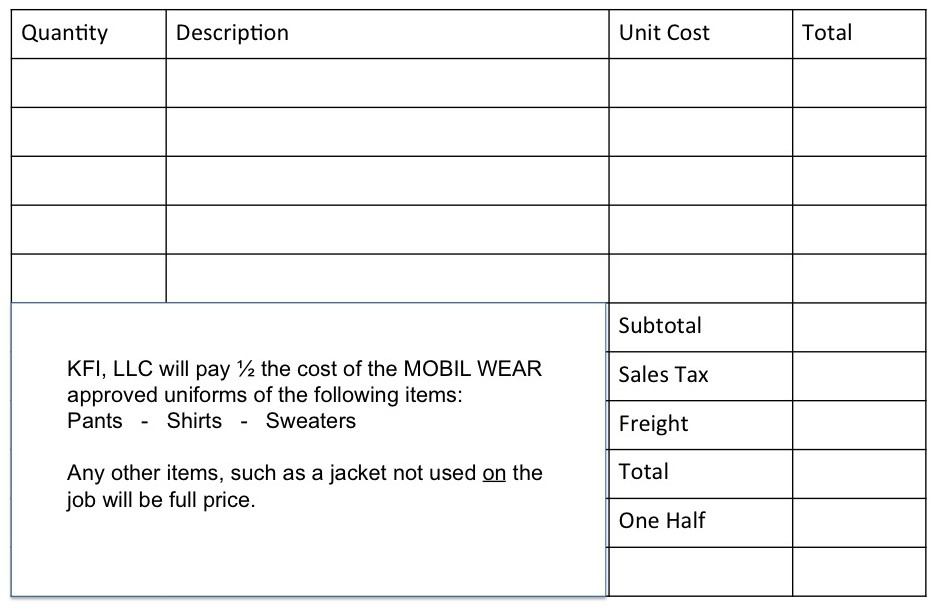

Uniform Cost Deduction Form Kelly Express Mart

Tax Deductions For Nurses Finance Zacks

How To Claim A Tax Deduction For Work Uniform Expenses Keats Accounting

Deduction Uniforms CSMonitor

https://turbotax.intuit.com/tax-tips/jobs-and...

Determine which work clothes are necessary for your job but not suitable to wear outside of work However just buying clothes specifically for work and never wearing them at any other time isn t good enough The IRS has accepted deductions for theatrical costumes hard hats and other safety gear Among the See more

https://www.hrblock.com/tax-center/filing...

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a

Determine which work clothes are necessary for your job but not suitable to wear outside of work However just buying clothes specifically for work and never wearing them at any other time isn t good enough The IRS has accepted deductions for theatrical costumes hard hats and other safety gear Among the See more

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a

Tax Deductions For Nurses Finance Zacks

How Can You Get A Tax Deduction On Staff Uniforms

How To Claim A Tax Deduction For Work Uniform Expenses Keats Accounting

Deduction Uniforms CSMonitor

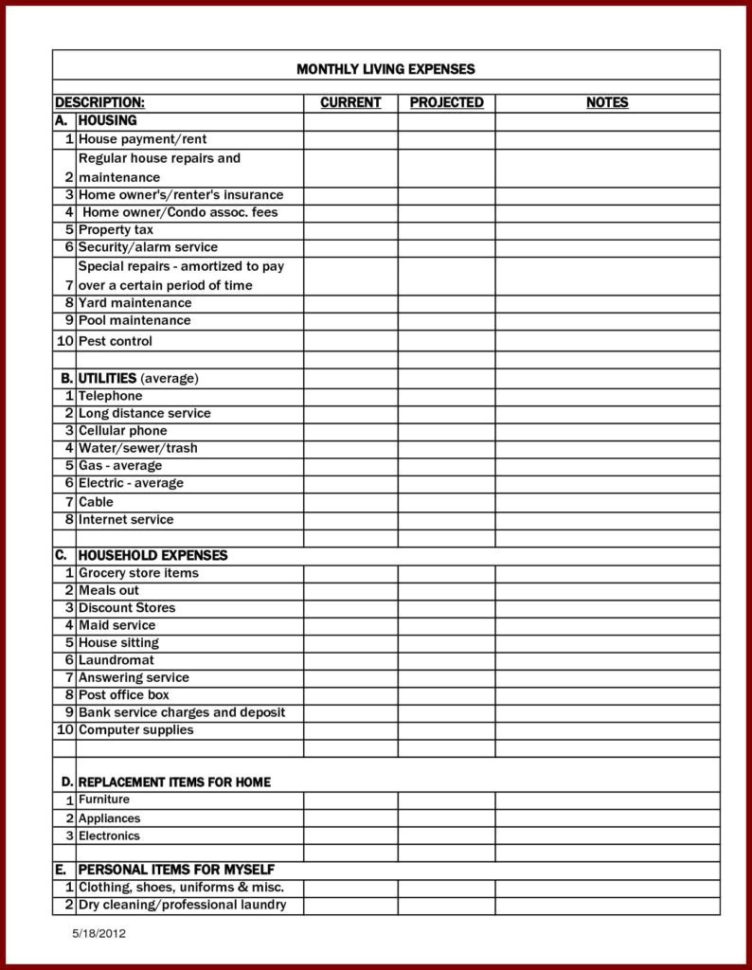

Self Employed Tax Deductions Worksheet Db excel

Badi Ceren On LinkedIn uniforms taxclaim deduction laundry claim

Badi Ceren On LinkedIn uniforms taxclaim deduction laundry claim

Ron Burgundy Can t Deduct His Wardrobe Costs But The UPS Guy Can