In this digital age, where screens dominate our lives but the value of tangible printed materials isn't diminishing. For educational purposes project ideas, artistic or simply to add personal touches to your home, printables for free are a great source. This article will take a dive deeper into "Tax Deduction Upto 5 Lakhs," exploring their purpose, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Tax Deduction Upto 5 Lakhs Below

Tax Deduction Upto 5 Lakhs

Tax Deduction Upto 5 Lakhs -

Standard deduction introduced for salaried individuals pensioners under the new tax regime Highest surcharge rate reduced to 25 from 37 under the new tax regime

Following are the steps to use the tax calculator 1 Choose the financial year for which you want your taxes to be calculated 2 Select your age accordingly Tax liability in India differs based on the age groups 3

Tax Deduction Upto 5 Lakhs include a broad variety of printable, downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages and much more. The great thing about Tax Deduction Upto 5 Lakhs is in their variety and accessibility.

More of Tax Deduction Upto 5 Lakhs

Reality Of No Income Tax Upto 5 Lakhs Here Is The Truth About Budget

Reality Of No Income Tax Upto 5 Lakhs Here Is The Truth About Budget

Income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years Surcharge and cess will be applicable as discussed above Income

Increase of basic exemption limit from Rs 2 50 lakhs to Rs 3 5 lakhs Currently the Income Tax Act 1961 hereinafter referred to as the IT Act provides for a basic

The Tax Deduction Upto 5 Lakhs have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: It is possible to tailor the templates to meet your individual needs such as designing invitations planning your schedule or decorating your home.

-

Educational Use: Education-related printables at no charge can be used by students of all ages, making them an essential source for educators and parents.

-

Convenience: You have instant access numerous designs and templates helps save time and effort.

Where to Find more Tax Deduction Upto 5 Lakhs

How Much Income Tax Upto 5 Lakhs what Is Rebate Income Tax sec 87A

How Much Income Tax Upto 5 Lakhs what Is Rebate Income Tax sec 87A

The revised tax slabs presented in Budget 2023 for the new income tax regime included tax free income up to Rs 3 lakh with subsequent slabs ranging from 5 to 30

Presently the rebate of tax is available for those whose income does not exceed 5 lakh This rebate is available under Section 87A Let us discuss how it works

If we've already piqued your curiosity about Tax Deduction Upto 5 Lakhs Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deduction Upto 5 Lakhs to suit a variety of goals.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide range of topics, ranging from DIY projects to planning a party.

Maximizing Tax Deduction Upto 5 Lakhs

Here are some inventive ways ensure you get the very most use of Tax Deduction Upto 5 Lakhs:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Deduction Upto 5 Lakhs are an abundance of fun and practical tools for a variety of needs and desires. Their availability and versatility make them a fantastic addition to both personal and professional life. Explore the vast world of Tax Deduction Upto 5 Lakhs now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction Upto 5 Lakhs really completely free?

- Yes, they are! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial purposes?

- It is contingent on the specific rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Tax Deduction Upto 5 Lakhs?

- Certain printables might have limitations on usage. You should read the terms and conditions provided by the creator.

-

How do I print Tax Deduction Upto 5 Lakhs?

- Print them at home using any printer or head to an in-store print shop to get the highest quality prints.

-

What software do I need to run printables free of charge?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost programs like Adobe Reader.

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Budget 2017 18 No Income Tax Upto Rs 3 Lakh And 5 Percent Upto Rs 5

Check more sample of Tax Deduction Upto 5 Lakhs below

How To Save Income Tax On Salary 5 TIPS To Save Income Tax Upto 12

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

No Income Tax Upto Rs 9 5 Lakhs Subscribe To Https taxyadnya in

Take Home Salary Calculator India 2021 22 Excel Download

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Salary Slip Or Payslip Format Validity C Importance And Components

https://cleartax.in/paytax/taxcalculator

Following are the steps to use the tax calculator 1 Choose the financial year for which you want your taxes to be calculated 2 Select your age accordingly Tax liability in India differs based on the age groups 3

https://taxguru.in/income-tax/income-tax-exemption-rs-5-lakhs.html

As per present Section 87A an individual is entitled to tax rebate upto Rs 2 500 if his total income does not exceed Rs 3 50 lakhs This rebate is available only for the individual

Following are the steps to use the tax calculator 1 Choose the financial year for which you want your taxes to be calculated 2 Select your age accordingly Tax liability in India differs based on the age groups 3

As per present Section 87A an individual is entitled to tax rebate upto Rs 2 500 if his total income does not exceed Rs 3 50 lakhs This rebate is available only for the individual

Take Home Salary Calculator India 2021 22 Excel Download

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Salary Slip Or Payslip Format Validity C Importance And Components

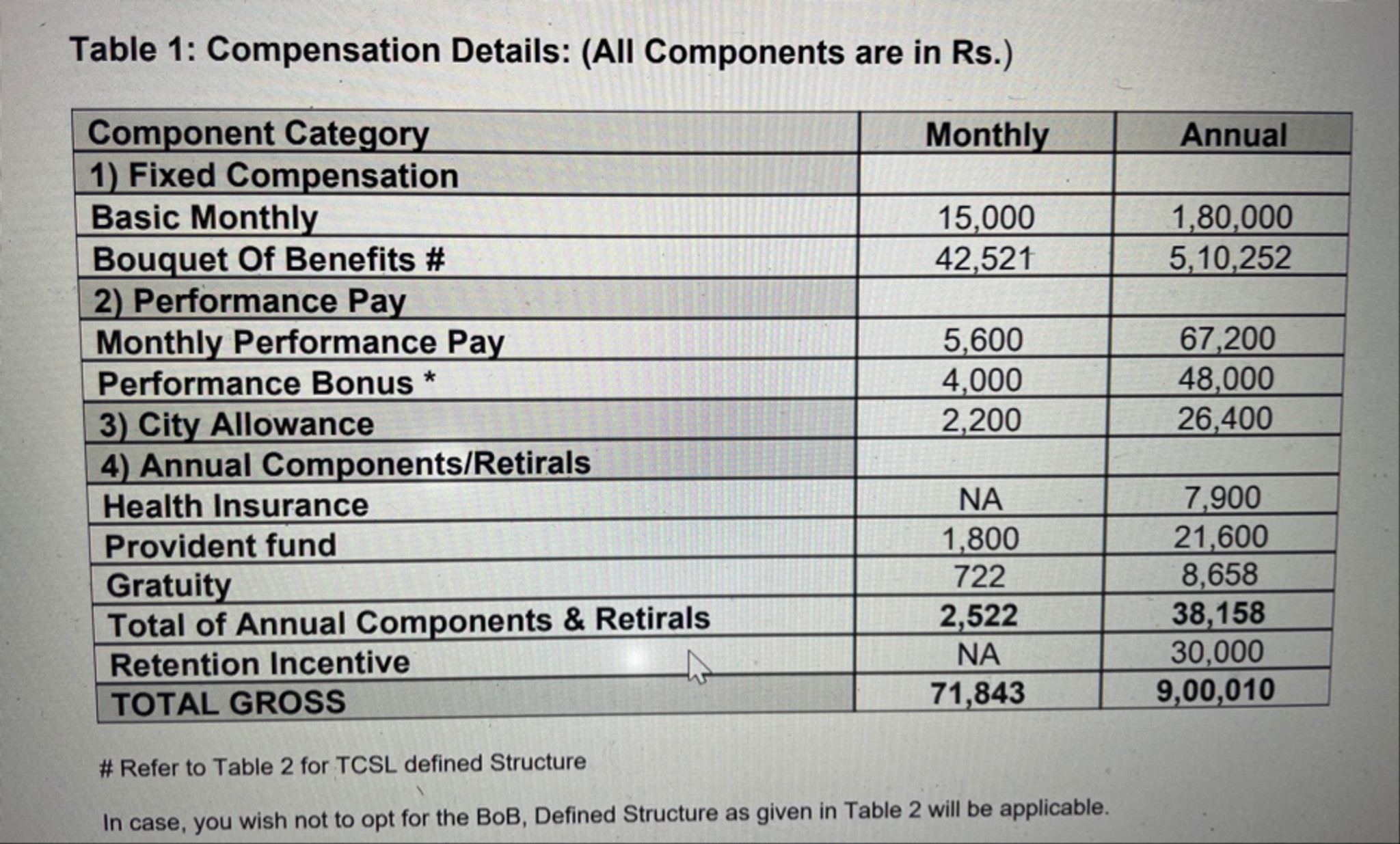

Hello TCSers What Will Be In Hand Salary Of 9 LPA Fishbowl

Budget Prediction 2020 Income Tax Return Tax Deductions Budgeting

Budget Prediction 2020 Income Tax Return Tax Deductions Budgeting

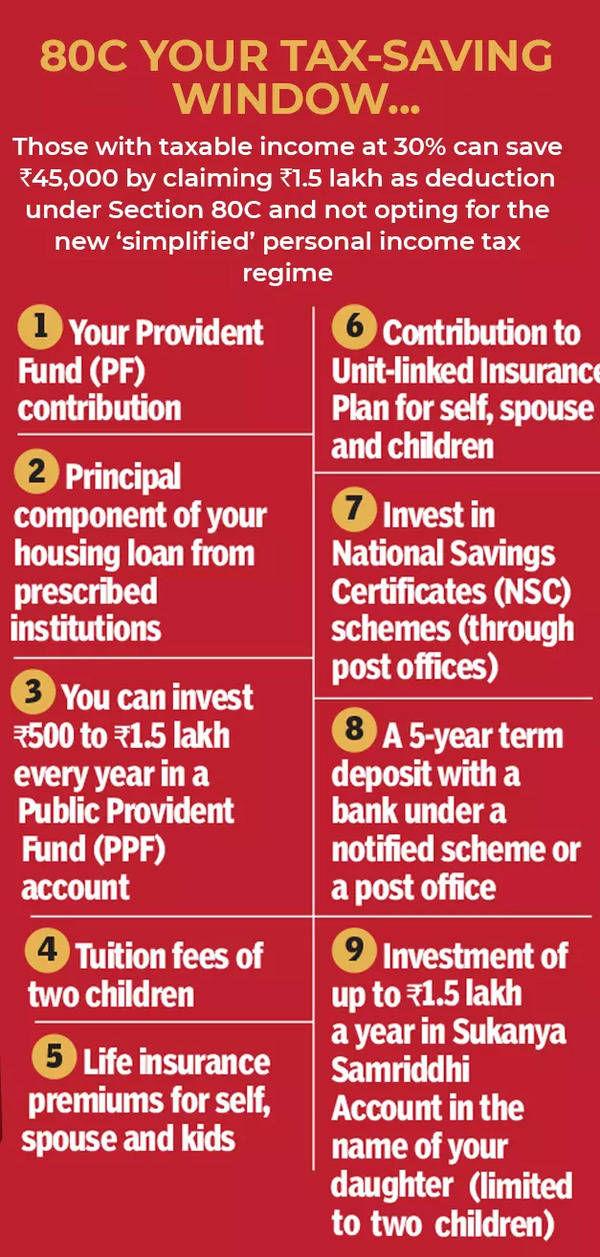

Union Budget 2022 Your Tax saving Window Section 80C And Beyond