In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. In the case of educational materials and creative work, or just adding an element of personalization to your space, Tax Deduction Working From Home 2023 are now a useful resource. With this guide, you'll dive into the world "Tax Deduction Working From Home 2023," exploring the different types of printables, where they are, and what they can do to improve different aspects of your lives.

Get Latest Tax Deduction Working From Home 2023 Below

Tax Deduction Working From Home 2023

Tax Deduction Working From Home 2023 -

Home Office Tax Deduction 2023 2024 Rules Who Qualifies The home office deduction is a tax break for self employed people who use part of their home for business activities Here s how

You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office Who cannot claim

Tax Deduction Working From Home 2023 cover a large variety of printable, downloadable resources available online for download at no cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. One of the advantages of Tax Deduction Working From Home 2023 lies in their versatility as well as accessibility.

More of Tax Deduction Working From Home 2023

Home Office Tax Deduction For Small Businesses MileIQ

Home Office Tax Deduction For Small Businesses MileIQ

2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home

Eligible employees who worked from home in 2023 will be required to use the detailed method to claim home office expenses The temporary flat rate method does not apply to the 2023 tax year How work from home expense calculations have

Tax Deduction Working From Home 2023 have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Personalization It is possible to tailor printing templates to your own specific requirements in designing invitations making your schedule, or decorating your home.

-

Educational Benefits: Downloads of educational content for free are designed to appeal to students of all ages, making them a useful tool for parents and educators.

-

Easy to use: instant access various designs and templates, which saves time as well as effort.

Where to Find more Tax Deduction Working From Home 2023

Working From Home Tax Deduction KLC Recruitment Blog

Working From Home Tax Deduction KLC Recruitment Blog

The Australian Taxation Office ATO has refreshed the way that taxpayers claim deductions for costs incurred when working from home The changes better reflect contemporary working from home arrangements

If you re a regular employee working from home you can t deduct any of your related expenses on your tax return In the past you could claim an itemized deduction for

If we've already piqued your curiosity about Tax Deduction Working From Home 2023 and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of reasons.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Tax Deduction Working From Home 2023

Here are some fresh ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Deduction Working From Home 2023 are an abundance filled with creative and practical information designed to meet a range of needs and passions. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the plethora of Tax Deduction Working From Home 2023 today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction Working From Home 2023 really cost-free?

- Yes they are! You can print and download these materials for free.

-

Can I use free printables for commercial purposes?

- It's contingent upon the specific terms of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions in use. Check the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using a printer or visit any local print store for high-quality prints.

-

What program do I need to run printables free of charge?

- The majority of printed documents are in the format of PDF, which can be opened with free software such as Adobe Reader.

Home Office Deduction Can You Deduct Home Office Expenses Ramsay And

Working From Home Deduction

Check more sample of Tax Deduction Working From Home 2023 below

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Working From Home Can Be A Tax Deduction Charltons

What Tax Deductions Can I Claim Working From Home Fitzroy Financial

Do You Work From Home As An Employee If So You May Qualify For Some

Everything About The Work From Home Tax Deduction

Changes To Working From Home Deductions Magnus

https://www.gov.uk/tax-relief-for-employees/working-at-home

You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office Who cannot claim

https://community.ato.gov.au/s/article/a07RF00000JLQDAYA5

You may be able to claim a tax deduction for your working from home expenses To be eligible you need to incur extra running costs related to working from home be doing work related tasks from home not just minor tasks like checking emails have records to prove your expenses Fixed Rate Method You can claim a fixed rate of 67 cents for

You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office Who cannot claim

You may be able to claim a tax deduction for your working from home expenses To be eligible you need to incur extra running costs related to working from home be doing work related tasks from home not just minor tasks like checking emails have records to prove your expenses Fixed Rate Method You can claim a fixed rate of 67 cents for

Do You Work From Home As An Employee If So You May Qualify For Some

Working From Home Can Be A Tax Deduction Charltons

Everything About The Work From Home Tax Deduction

Changes To Working From Home Deductions Magnus

How To Claim Home Office Deductions 9 Steps with Pictures Home

New Tax Deduction For Canadians Working From Home Prasad Knowledge Base

New Tax Deduction For Canadians Working From Home Prasad Knowledge Base

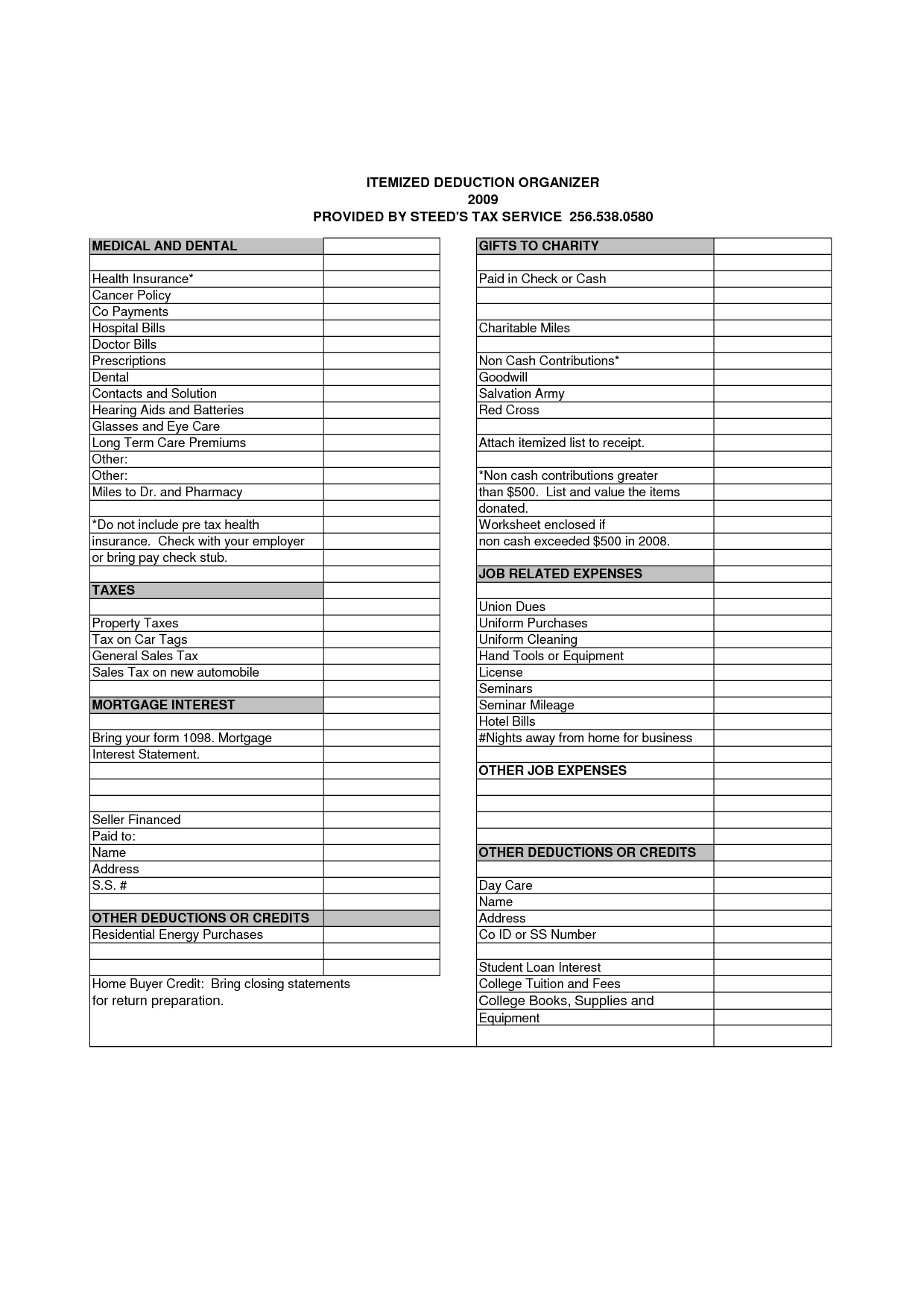

Printable Itemized Deductions Worksheet