Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. For educational purposes as well as creative projects or simply adding a personal touch to your space, Tax Deductions For Home Based Business are now a useful source. Through this post, we'll dive through the vast world of "Tax Deductions For Home Based Business," exploring the benefits of them, where they can be found, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Deductions For Home Based Business Below

Tax Deductions For Home Based Business

Tax Deductions For Home Based Business -

The home office deduction is a tax break for self employed people who use part of their home for business activities Here s how it works

Home businesses have some unique expenses including costs for the space where you are doing business at home You can save on taxes by deducting many of these expenses so it s important to know what they are and how much you can deduct

Tax Deductions For Home Based Business include a broad variety of printable, downloadable resources available online for download at no cost. These resources come in many types, such as worksheets templates, coloring pages and much more. The beauty of Tax Deductions For Home Based Business is in their variety and accessibility.

More of Tax Deductions For Home Based Business

5 Tax Deductions For Home Sellers YouTube

5 Tax Deductions For Home Sellers YouTube

If you operate some or all of your business from home you may be able to claim tax deductions for the business portion of expenses These may include occupancy expenses such as mortgage interest or rent council

Home based businesses can use deductions to reduce taxable income and ultimately what they may owe in taxes Home based businesses can take many of the same deductions that other small businesses have including those for employee wages and benefits advertising utilities and interest

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: You can tailor printables to fit your particular needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Impact: Printables for education that are free cater to learners of all ages, making them a valuable instrument for parents and teachers.

-

Accessibility: Access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Tax Deductions For Home Based Business

Tax Deductions For Home Based Businesses TechMirror

Tax Deductions For Home Based Businesses TechMirror

Simplified method for business use of home deduction The IRS provides a simplified method to figure your expenses for business use of your home For more information see Using the Simplified Method under Figuring the Deduction later Photographs of

Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction The simplified option has a rate of 5 a square foot for business use of the home The maximum size for this option is 300 square feet The maximum deduction under this method is 1 500

In the event that we've stirred your curiosity about Tax Deductions For Home Based Business we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deductions For Home Based Business for various motives.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide variety of topics, from DIY projects to party planning.

Maximizing Tax Deductions For Home Based Business

Here are some ways of making the most use of Tax Deductions For Home Based Business:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Deductions For Home Based Business are an abundance of practical and innovative resources which cater to a wide range of needs and desires. Their availability and versatility make them an essential part of both professional and personal lives. Explore the wide world of Tax Deductions For Home Based Business and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes you can! You can download and print these documents for free.

-

Can I download free printables to make commercial products?

- It's all dependent on the conditions of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright issues with Tax Deductions For Home Based Business?

- Some printables could have limitations on usage. Always read the terms and conditions set forth by the author.

-

How do I print Tax Deductions For Home Based Business?

- You can print them at home with either a printer at home or in an area print shop for better quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are in the PDF format, and can be opened with free software such as Adobe Reader.

A Guide To Tax Deductions For Home Based Business

List Of 10 Best Tax Write Offs For Small Business 2023 Reviews

Check more sample of Tax Deductions For Home Based Business below

A Guide To Tax Deductions For Home Based Business

Pin Di Worksheet

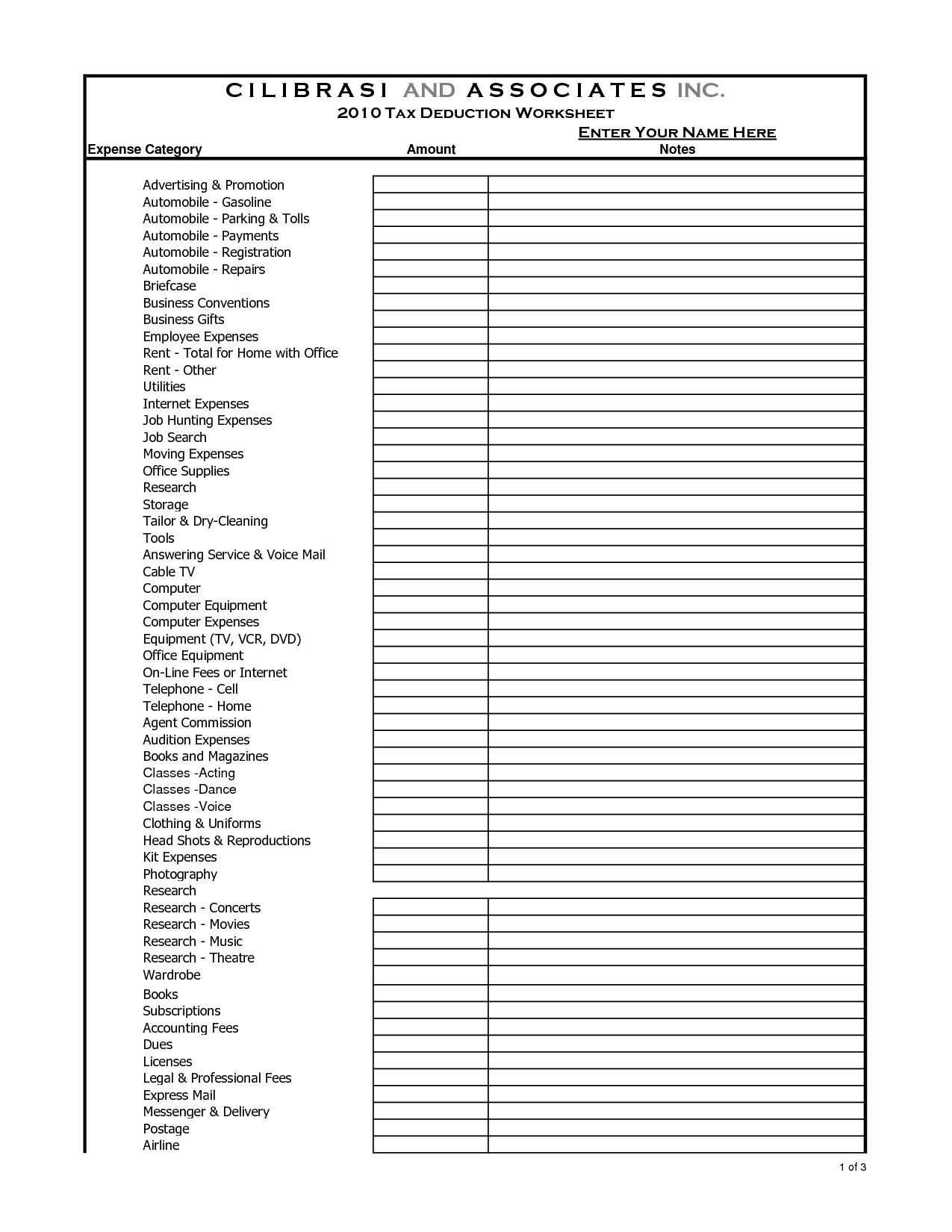

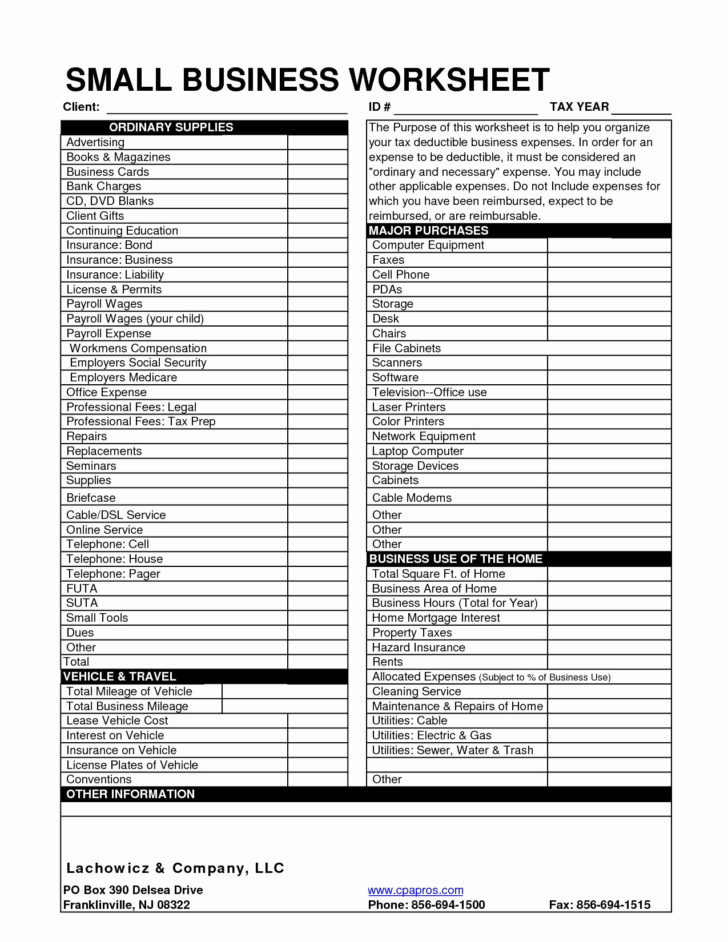

10 Home Based Business Tax Worksheet Worksheeto

Truck Driver Tax Deductions Best Truck In The World Db excel

Small Business Tax Deductions Deductible Expenses

Itemized Deductions Worksheet 2017 Printable Worksheets And

https://www.thebalancemoney.com/a-guide-to-tax...

Home businesses have some unique expenses including costs for the space where you are doing business at home You can save on taxes by deducting many of these expenses so it s important to know what they are and how much you can deduct

https://www.allbusiness.com/home-based-business...

If you have switched to working from home you may be entitled to certain tax deductions Whether you telecommute work as a freelancer or own a business that you run from your home you have a cost to running your business and the IRS recognizes many of

Home businesses have some unique expenses including costs for the space where you are doing business at home You can save on taxes by deducting many of these expenses so it s important to know what they are and how much you can deduct

If you have switched to working from home you may be entitled to certain tax deductions Whether you telecommute work as a freelancer or own a business that you run from your home you have a cost to running your business and the IRS recognizes many of

Truck Driver Tax Deductions Best Truck In The World Db excel

Pin Di Worksheet

Small Business Tax Deductions Deductible Expenses

Itemized Deductions Worksheet 2017 Printable Worksheets And

Common Tax Deductions For Home Based Business The Rucker Report YouTube

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

Brilliant Tax Write Off Template Stores Inventory Excel Format