In this day and age when screens dominate our lives and the appeal of physical printed material hasn't diminished. Be it for educational use as well as creative projects or just adding personal touches to your area, Tax Deductions For Home Working are now a vital resource. For this piece, we'll take a dive deep into the realm of "Tax Deductions For Home Working," exploring the different types of printables, where to find them and how they can improve various aspects of your daily life.

Get Latest Tax Deductions For Home Working Below

Tax Deductions For Home Working

Tax Deductions For Home Working -

Updated on December 18 2023 Written by Mark Henricks Edited by Jeff White CEPF The 2017 tax reform law ended the ability for most taxpayers to deduct expenses for working from home just in time for millions more people to begin working from in response to the Covid pandemic

This page is being updated If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction

The Tax Deductions For Home Working are a huge range of printable, free material that is available online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and much more. The benefit of Tax Deductions For Home Working is in their variety and accessibility.

More of Tax Deductions For Home Working

Do You Know You Can Claim Tax Deductions For Your Home Loan

Do You Know You Can Claim Tax Deductions For Your Home Loan

How much you can claim You can either claim tax relief on 6 a week from 6 April 2020 you will not need to keep evidence of your extra costs the exact amount of extra costs you ve incurred

Click to expand Key Takeaways Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the 2018 tax reform employees could claim these expenses as an itemized deduction

Tax Deductions For Home Working have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization We can customize printables to fit your particular needs for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational Benefits: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them an essential tool for teachers and parents.

-

It's easy: Instant access to various designs and templates is time-saving and saves effort.

Where to Find more Tax Deductions For Home Working

Tax Deductions For Home Buyers Tax Deductions Deduction Home Buying

Tax Deductions For Home Buyers Tax Deductions Deduction Home Buying

Step 2 Find out the square footage of your home For our example let s say your home has a total area of 1 600 square feet Step 3 Now divide the area of your office by the area of your house

Although you can t take federal tax deductions for work from home expenses if you are an employee some states have enacted their own laws requiring employers to reimburse employees for necessary business expenses or allowing them to deduct unreimbursed employee expenses on their state tax returns

Now that we've ignited your interest in printables for free Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of motives.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free including flashcards, learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Tax Deductions For Home Working

Here are some ideas for you to get the best of Tax Deductions For Home Working:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Deductions For Home Working are an abundance with useful and creative ideas designed to meet a range of needs and preferences. Their availability and versatility make them a great addition to both personal and professional life. Explore the vast array of Tax Deductions For Home Working to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes, they are! You can print and download these resources at no cost.

-

Are there any free templates for commercial use?

- It's all dependent on the usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright issues with Tax Deductions For Home Working?

- Some printables may contain restrictions in their usage. Make sure you read the terms and conditions offered by the designer.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase high-quality prints.

-

What program will I need to access printables for free?

- Most PDF-based printables are available in PDF format. They is open with no cost software like Adobe Reader.

Tax Deductions For Home Business Owners Inside Napoleon Hill List Of

List Of 10 Best Tax Write Offs For Small Business 2023 Reviews

Check more sample of Tax Deductions For Home Working below

Tax Deductions For Home Daycare Businesses

Hecht Group Can You Write Off Christmas Decorations For Your Business

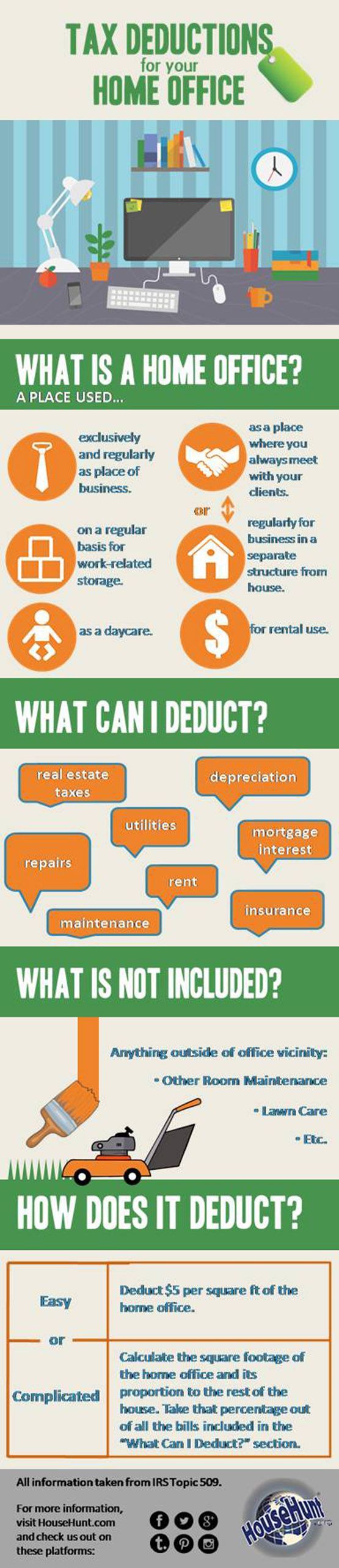

Tax Deductions For Your Home Office Visual ly

Small Business Tax Deductions Deductible Expenses

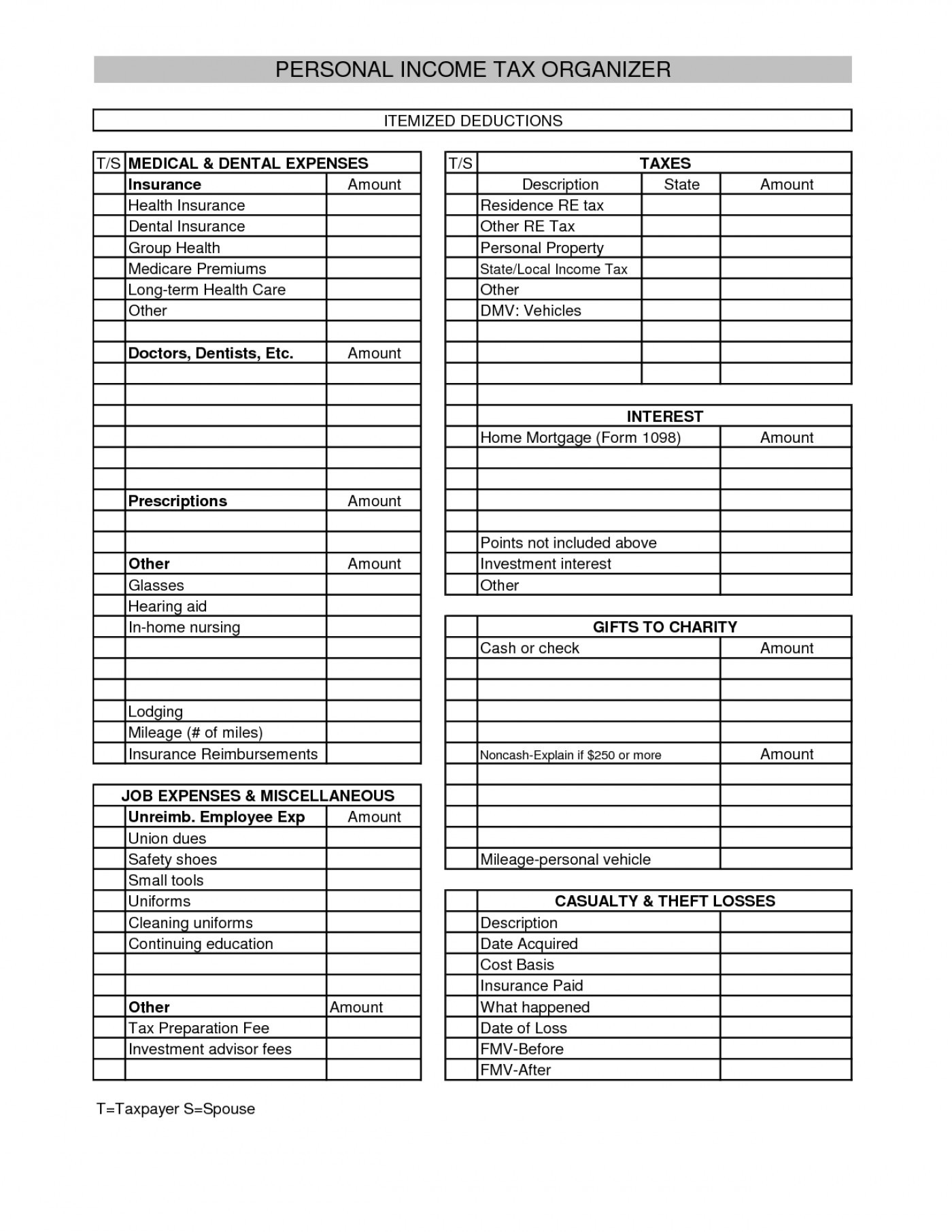

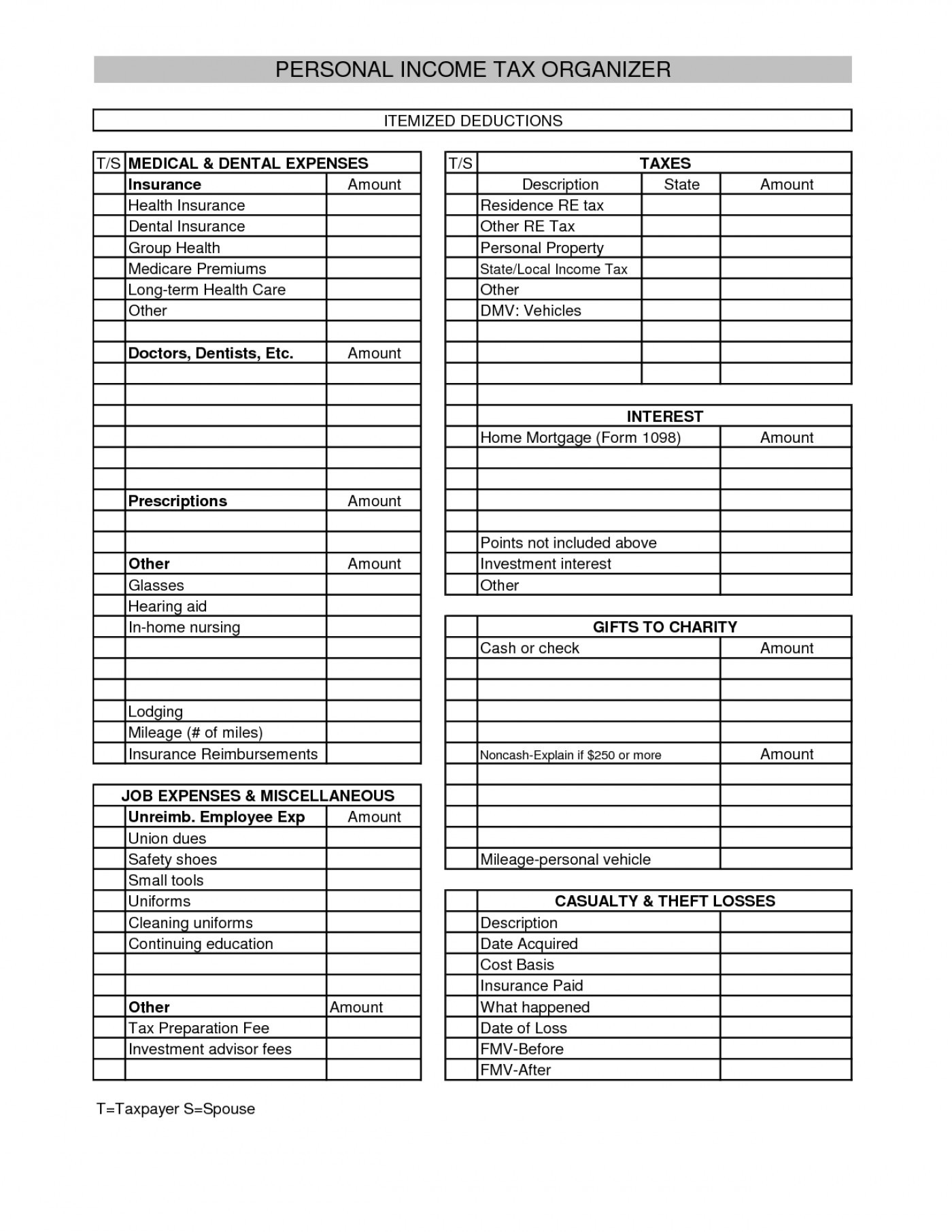

Printable Itemized Deductions Worksheet

7 Tax Deductions When Selling Your Home 2021 Guide LaptrinhX News

https://www.vero.fi/.../home-office-deduction

This page is being updated If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction

https://yle.fi/a/3-11337523

An employee working from home for less than half of the year can claim 450 euros In this case the sum is below 750 euros so there is no provision for an additional deduction However if full time remote working days exceed six months taxpayers are entitled to a 900 euro home office tax break 2 Save receipts

This page is being updated If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction

An employee working from home for less than half of the year can claim 450 euros In this case the sum is below 750 euros so there is no provision for an additional deduction However if full time remote working days exceed six months taxpayers are entitled to a 900 euro home office tax break 2 Save receipts

Small Business Tax Deductions Deductible Expenses

Hecht Group Can You Write Off Christmas Decorations For Your Business

Printable Itemized Deductions Worksheet

7 Tax Deductions When Selling Your Home 2021 Guide LaptrinhX News

Business Use Of Home Simplified Method 2022 Business Use Of Home

California Real Estate Exam Cheat Sheet Cheat Sheet Vrogue

California Real Estate Exam Cheat Sheet Cheat Sheet Vrogue

3 Simple Tax Deductions For A Home Renovation Huddleston Tax CPAs