In this day and age in which screens are the norm, the charm of tangible printed items hasn't gone away. Whatever the reason, whether for education, creative projects, or just adding an individual touch to the area, Tax Exemption For Dependents In Japan are a great resource. Through this post, we'll dive to the depths of "Tax Exemption For Dependents In Japan," exploring the different types of printables, where to locate them, and how they can improve various aspects of your life.

Get Latest Tax Exemption For Dependents In Japan Below

Tax Exemption For Dependents In Japan

Tax Exemption For Dependents In Japan -

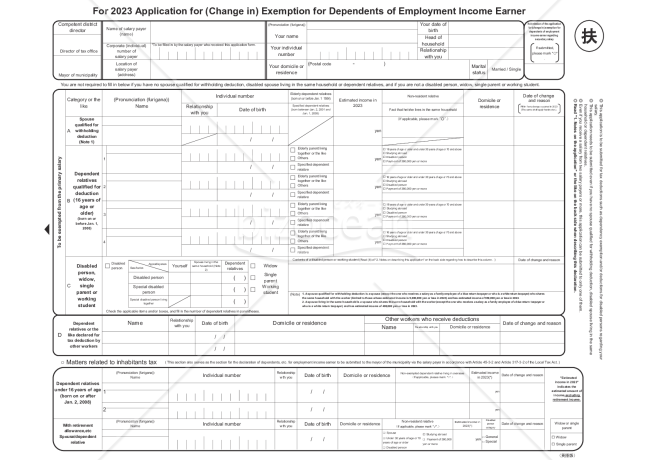

Japan s National Tax Agency NTA issued guidance in Japanese dated 1 October 2022 that provides new and clarified rules which are effective as from 1 January 2023 on the

Can You Claim an Exemption for Dependents Who Live Outside Japan Yes as long as the dependent fits in the criteria explained above and the taxpayer has the required

Tax Exemption For Dependents In Japan encompass a wide assortment of printable, downloadable materials online, at no cost. They come in many forms, like worksheets coloring pages, templates and much more. The appeal of printables for free is in their variety and accessibility.

More of Tax Exemption For Dependents In Japan

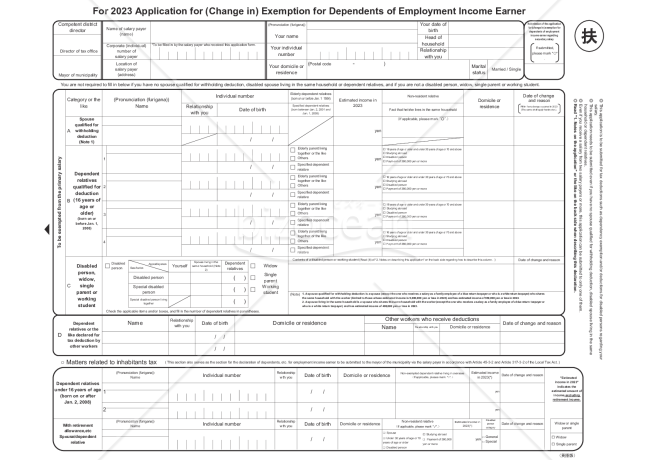

5 For 2023 Application For Change In Exemption For

5 For 2023 Application For Change In Exemption For

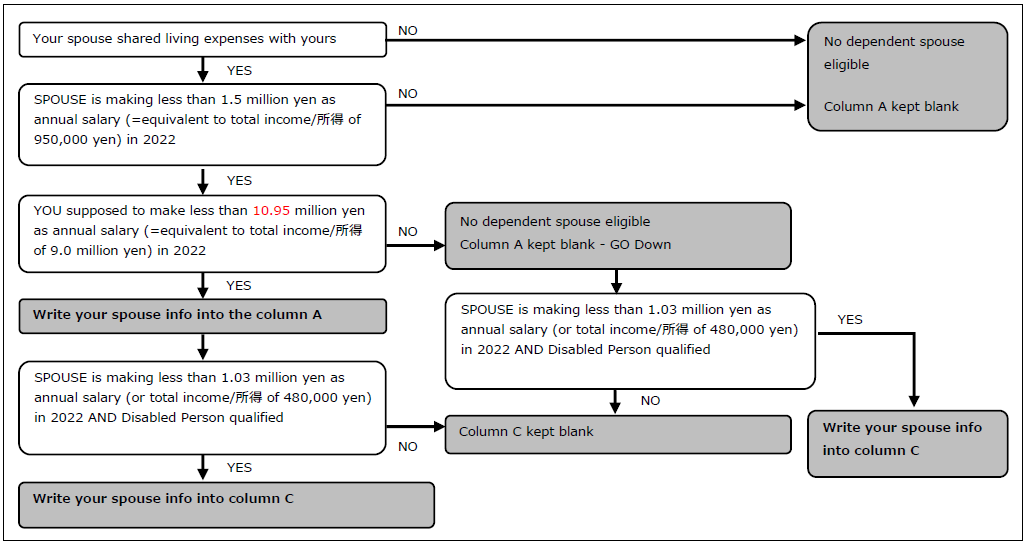

The Japanese government has changed the tax laws exempting non resident dependents from tax The law came into force on 1 January 2023 The Ecovis experts explain the details Background

Foreigners who leave their families abroad and working in Japan Japanese who leave their families abroad for work reasons those who send money to children

Tax Exemption For Dependents In Japan have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor printing templates to your own specific requirements whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational Value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them a vital source for educators and parents.

-

An easy way to access HTML0: instant access numerous designs and templates, which saves time as well as effort.

Where to Find more Tax Exemption For Dependents In Japan

Reiwa 3 Document For Annual Adjustment Stock Photo Download Image Now

Reiwa 3 Document For Annual Adjustment Stock Photo Download Image Now

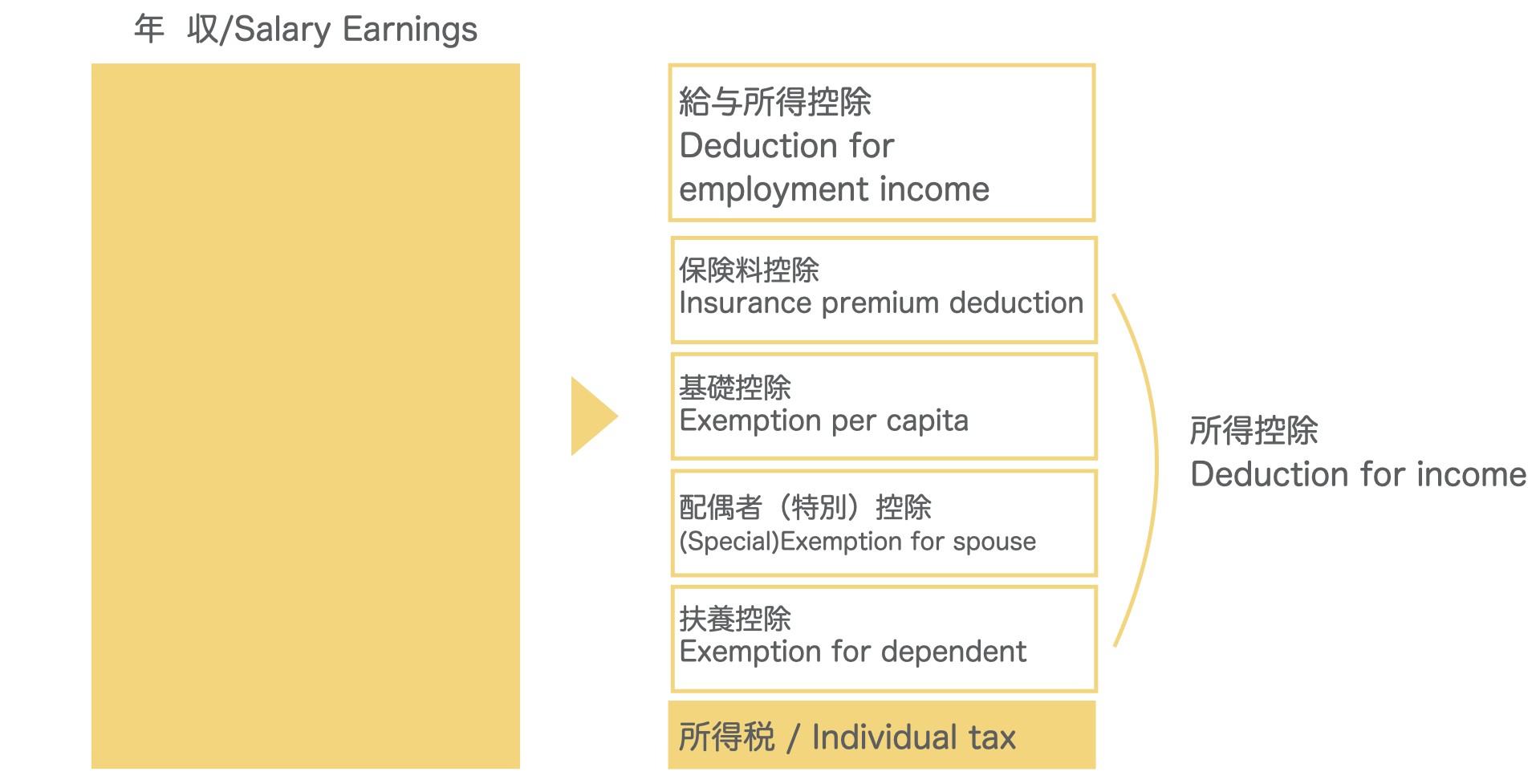

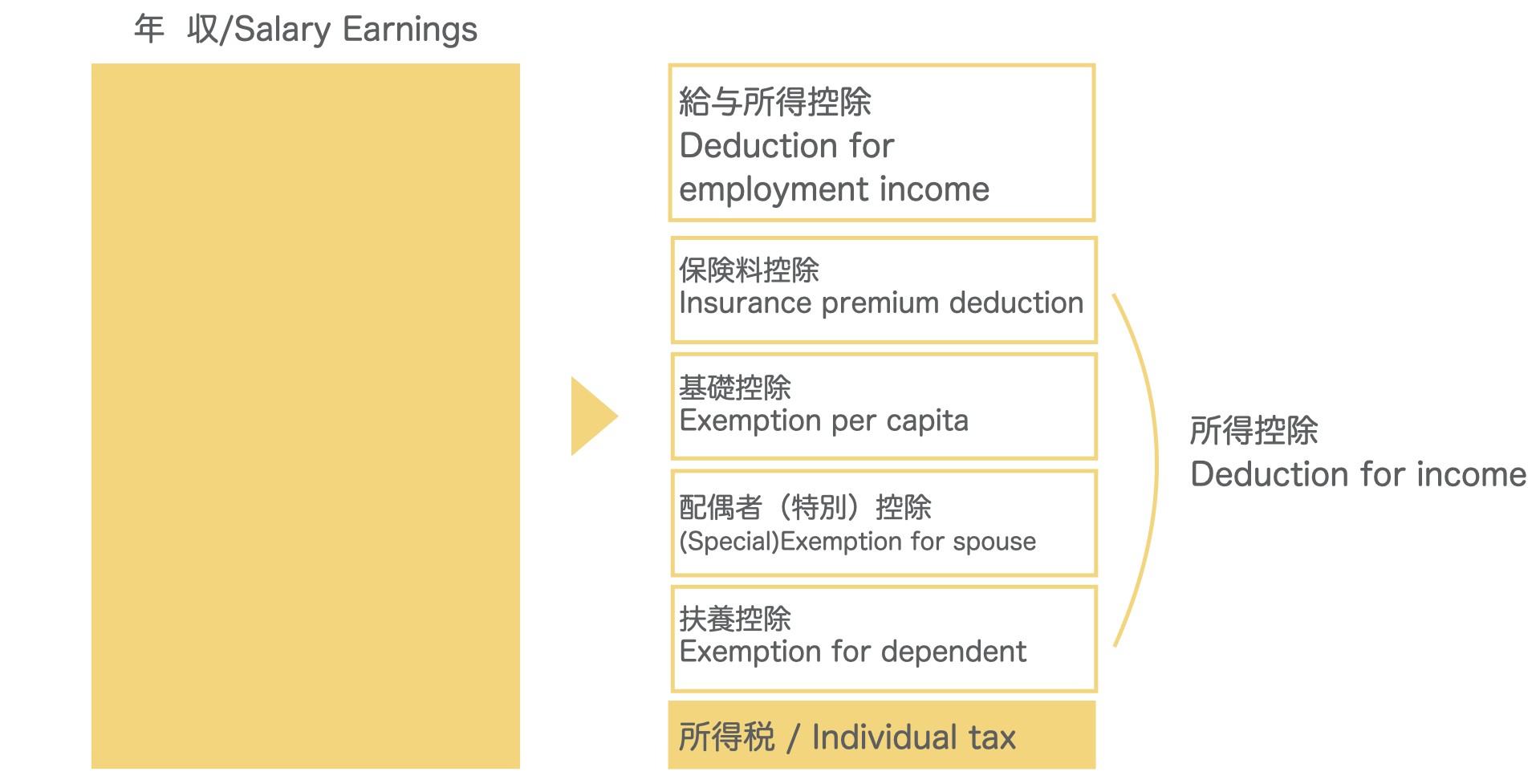

These deductions can significantly lower your taxable income thereby reducing your overall tax burden The amount of deduction that you can claim varies based on the age of the

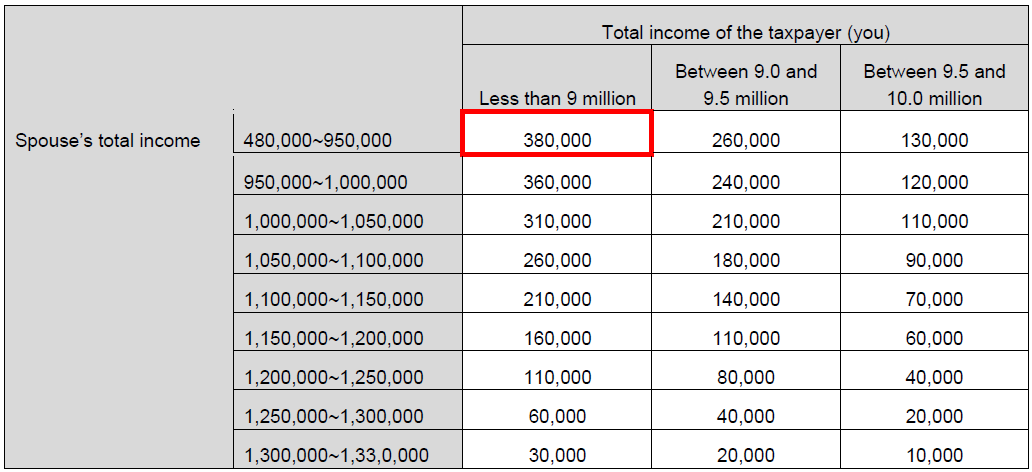

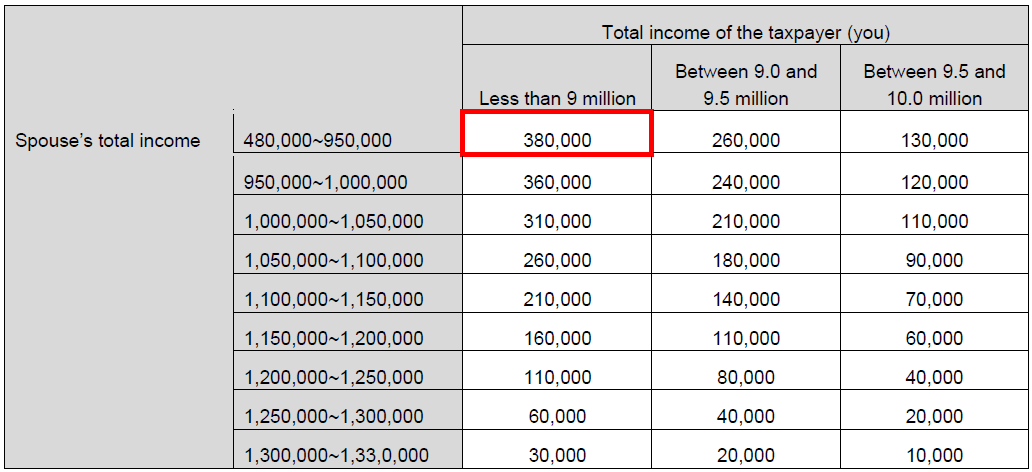

In the case of a non dependent spouse a special spouse exemption a maximum JPY 380 000 and JPY 330 000 for national income tax purposes and local

Now that we've ignited your curiosity about Tax Exemption For Dependents In Japan and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Exemption For Dependents In Japan for various applications.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Tax Exemption For Dependents In Japan

Here are some unique ways create the maximum value of Tax Exemption For Dependents In Japan:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets for teaching at-home as well as in the class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Exemption For Dependents In Japan are an abundance of useful and creative resources that cater to various needs and interest. Their accessibility and versatility make them a wonderful addition to any professional or personal life. Explore the vast collection of Tax Exemption For Dependents In Japan now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Exemption For Dependents In Japan truly free?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free templates for commercial use?

- It's contingent upon the specific usage guidelines. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may contain restrictions in use. Be sure to check the terms and regulations provided by the author.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a print shop in your area for better quality prints.

-

What program is required to open printables that are free?

- The majority are printed with PDF formats, which can be opened with free software such as Adobe Reader.

4 For 2022 Application For change In Exemption For

Wisconsin Withholding Form 2023 Printable Forms Free Online

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)

Check more sample of Tax Exemption For Dependents In Japan below

How Can My Spouse Be Tax Dependent Workcloud

Printable W4 Form

Providing Health Insurance For Dependents Yes Or No

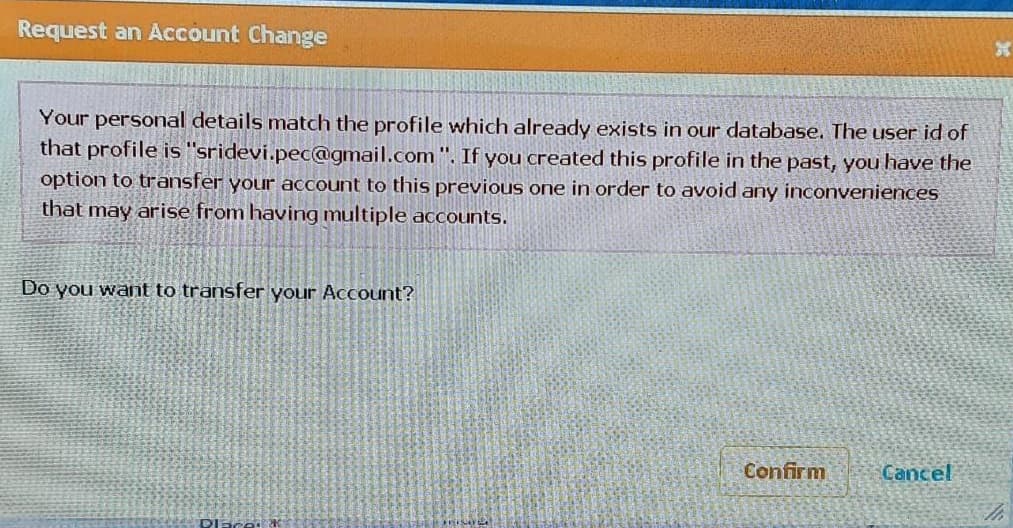

Create Separate Account For Dependents In CGI Portal RedBus2US Community

How To Fill Out Form W 4 In 2022 2023

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

Tax Deductions For Dependents In Japan

https://freedomtax.jp/article/claiming-dependents...

Can You Claim an Exemption for Dependents Who Live Outside Japan Yes as long as the dependent fits in the criteria explained above and the taxpayer has the required

https://en.an-japan.com/2019/10/19/income-tax-deduction-dependent

Exemption for dependents is one of the largest tax deductions from income tax in amount Amount to be exempted depends on a type of dependent and income

Can You Claim an Exemption for Dependents Who Live Outside Japan Yes as long as the dependent fits in the criteria explained above and the taxpayer has the required

Exemption for dependents is one of the largest tax deductions from income tax in amount Amount to be exempted depends on a type of dependent and income

Create Separate Account For Dependents In CGI Portal RedBus2US Community

Printable W4 Form

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

How To Fill Out Form W 4 In 2022 2023

Tax Deductions For Dependents In Japan

Should The Child Tax Credit Be Limited To Those With Lower Incomes As

2 2020 blog