Today, where screens dominate our lives and the appeal of physical printed products hasn't decreased. Be it for educational use in creative or artistic projects, or just adding an individual touch to your space, Tax Exemption For Donation are now an essential source. This article will dive through the vast world of "Tax Exemption For Donation," exploring their purpose, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Tax Exemption For Donation Below

Tax Exemption For Donation

Tax Exemption For Donation -

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section 80G apart from Section 80C and save maximum taxes

The Income Tax Act of 2004 allows you to donate to charitable institutions However the Act caps the amount you are allowed to deduct from your profit and loss statement

Tax Exemption For Donation offer a wide assortment of printable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, templates, coloring pages, and many more. The value of Tax Exemption For Donation is their flexibility and accessibility.

More of Tax Exemption For Donation

Tax Exempt Form Request Letter Inspirational Agreement With Regard To

Tax Exempt Form Request Letter Inspirational Agreement With Regard To

Is my donation eligible for 80G tax exemption Created by Vinay Singh Modified on Thu 18 Aug 2022 at 2 04 PM by Vinay Singh Only donations made to fundraisers that are set up by legally registered non profits NGOs or charities may be considered eligible for donors to claim as a tax deduction

For individuals the deduction under Section 80G can be claimed on the amount donated to eligible institutions or funds up to a maximum of 50 or 100 of the donated amount depending on the institution or fund to which the donation has been made

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: The Customization feature lets you tailor printables to your specific needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Worth: These Tax Exemption For Donation can be used by students of all ages, making them a useful tool for parents and teachers.

-

Affordability: Access to many designs and templates reduces time and effort.

Where to Find more Tax Exemption For Donation

Fingers Raised At Tax Exemption For Temple Donation VHP Says Got

Fingers Raised At Tax Exemption For Temple Donation VHP Says Got

Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866 562 5227 This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization

On 08th October 2021 the Government of Tanzania published a set of new Tax Regulations that provides and carters for efficient tax administration but also streamline the tax exemption process and procedures The Regulations issued are

In the event that we've stirred your curiosity about Tax Exemption For Donation We'll take a look around to see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Tax Exemption For Donation suitable for many purposes.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast array of topics, ranging all the way from DIY projects to party planning.

Maximizing Tax Exemption For Donation

Here are some ideas create the maximum value of Tax Exemption For Donation:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Exemption For Donation are a treasure trove of innovative and useful resources that meet a variety of needs and interest. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the vast world of Tax Exemption For Donation today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can print and download these files for free.

-

Can I download free printing templates for commercial purposes?

- It's all dependent on the conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables might have limitations regarding usage. You should read the conditions and terms of use provided by the creator.

-

How do I print Tax Exemption For Donation?

- You can print them at home using an printer, or go to the local print shop for high-quality prints.

-

What software do I require to open printables for free?

- The majority of printables are in PDF format. These can be opened using free programs like Adobe Reader.

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Donor Tax Receipt Template Premium Printable Receipt Templates

Check more sample of Tax Exemption For Donation below

Blank Fillable Ohio Tax Exempt Form Printable Forms Free Online

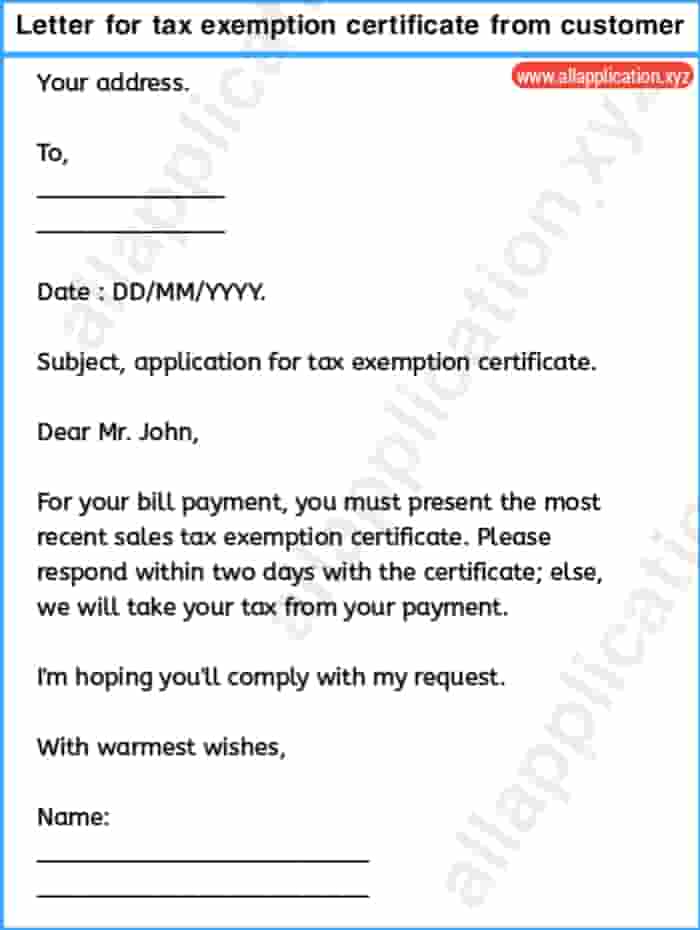

Letter Requesting Tax Exemption Certificate From Customer

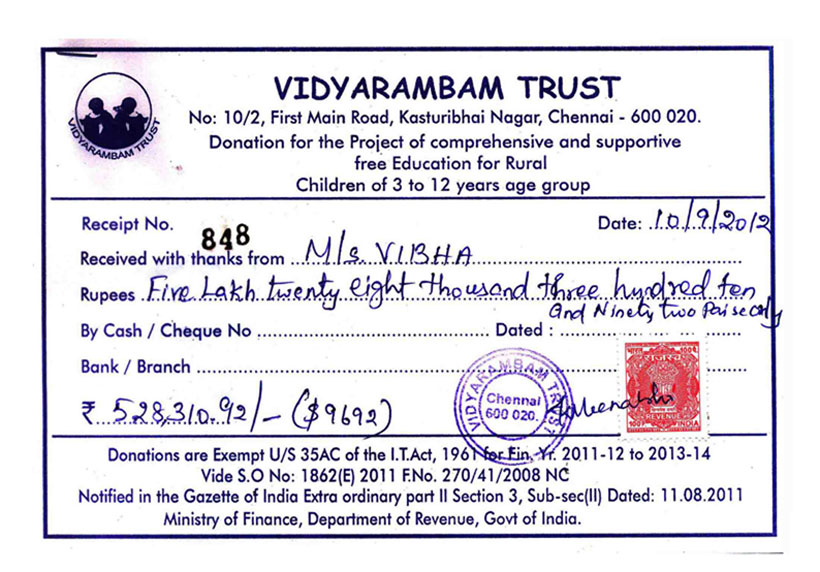

The Donation Receipt For Donations Is Shown In This Document Which

Request Letter For Tax Exemption And Certificate SemiOffice Com

Printable Purchase Exempt Form Printable Forms Free Online

Free Goodwill Donation Receipt Template PDF EForms

https://fbattorneys.co.tz/taxability-of-donation-amounts

The Income Tax Act of 2004 allows you to donate to charitable institutions However the Act caps the amount you are allowed to deduct from your profit and loss statement

https://www.tra.go.tz/index.php/vat-exemptions-on...

VAT exemption on projects funded by government or donors Print Email The Commissioner General may upon application by an applicant in the prescribed form exempt value added tax on

The Income Tax Act of 2004 allows you to donate to charitable institutions However the Act caps the amount you are allowed to deduct from your profit and loss statement

VAT exemption on projects funded by government or donors Print Email The Commissioner General may upon application by an applicant in the prescribed form exempt value added tax on

Request Letter For Tax Exemption And Certificate SemiOffice Com

Letter Requesting Tax Exemption Certificate From Customer

Printable Purchase Exempt Form Printable Forms Free Online

Free Goodwill Donation Receipt Template PDF EForms

Tax Exemption 80G Certificate

Individual Mail In Donation Form Thank You For Your Contribution

Individual Mail In Donation Form Thank You For Your Contribution

Donation Exemption For Income Tax Malaysia Tax Exemption For Ngos