Today, in which screens are the norm, the charm of tangible printed items hasn't gone away. For educational purposes as well as creative projects or just adding an individual touch to the area, Tax Exemption For First Time Home Buyers are now a useful resource. The following article is a take a dive deep into the realm of "Tax Exemption For First Time Home Buyers," exploring the benefits of them, where to find them and how they can enhance various aspects of your life.

Get Latest Tax Exemption For First Time Home Buyers Below

Tax Exemption For First Time Home Buyers

Tax Exemption For First Time Home Buyers -

First time home buyers who meet certain criteria such as being 18 39 years old and acquiring at least a 50 per cent stake in the property will be exempt from the tax until year end

Even though the exemption from asset transfer tax for first time home buyers was discontinued at the start of the year there are still many other incentives As a result of lower prices first time home buyers can still find a home for cheaper than in years

Tax Exemption For First Time Home Buyers cover a large array of printable items that are available online at no cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and more. The benefit of Tax Exemption For First Time Home Buyers is their versatility and accessibility.

More of Tax Exemption For First Time Home Buyers

The HVAC Checklist For First Time Home Buyers Comfort Institute

The HVAC Checklist For First Time Home Buyers Comfort Institute

The only costs the homeowner can deduct are state and local real estate taxes subject to the 10 000 limit home mortgage interest within the allowed limits mortgage insurance premiums

Contributions are generally tax deductible and withdrawals for the purpose of buying or building a qualifying home are tax free Existing measures for first time home buyers Home Buyers Plan HBP The HBP could allow you to withdraw up to 35 000 from your registered retirement savings plan RRSP to buy or build a home for yourself or a

Tax Exemption For First Time Home Buyers have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization The Customization feature lets you tailor printables to your specific needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value: The free educational worksheets cater to learners of all ages. This makes them an invaluable device for teachers and parents.

-

Easy to use: The instant accessibility to numerous designs and templates cuts down on time and efforts.

Where to Find more Tax Exemption For First Time Home Buyers

5 Vital Tips For First Time Home Buyers Omaha Mortgage Pub

5 Vital Tips For First Time Home Buyers Omaha Mortgage Pub

First Time Home Buyers Exemption Threshold Increased The recent budget announcement has brought a welcome change the exemption threshold will increase from a fair market value of 500 000 to 835 000 effective April 1 2024 This exemption will be available for purchase of a residential Property by First time home

Firstly the threshold to be eligible for the first time homebuyers exemption will be increased from a fair market value of 500 000 to 835 000 with the first 500 000 exempt from the tax

We've now piqued your interest in printables for free, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of applications.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Tax Exemption For First Time Home Buyers

Here are some fresh ways how you could make the most use of Tax Exemption For First Time Home Buyers:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home, or even in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Tax Exemption For First Time Home Buyers are an abundance of practical and innovative resources that cater to various needs and interests. Their accessibility and flexibility make them a valuable addition to the professional and personal lives of both. Explore the vast collection of Tax Exemption For First Time Home Buyers today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes you can! You can print and download these resources at no cost.

-

Can I utilize free printables to make commercial products?

- It's based on the rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions in their usage. Always read the terms and conditions offered by the author.

-

How do I print Tax Exemption For First Time Home Buyers?

- You can print them at home using either a printer at home or in a local print shop to purchase higher quality prints.

-

What software do I need to run printables for free?

- Most PDF-based printables are available with PDF formats, which can be opened using free programs like Adobe Reader.

Harris County Homestead Exemption Form ExemptForm

First Time Home Buyers Tips For 2023 Ottawa Real Estate

Check more sample of Tax Exemption For First Time Home Buyers below

5 Mortgage Tips For First Time Home Buyers Moreira Team Mortgage

Oregon First Time Home Buyer Savings Account Akzeptabel

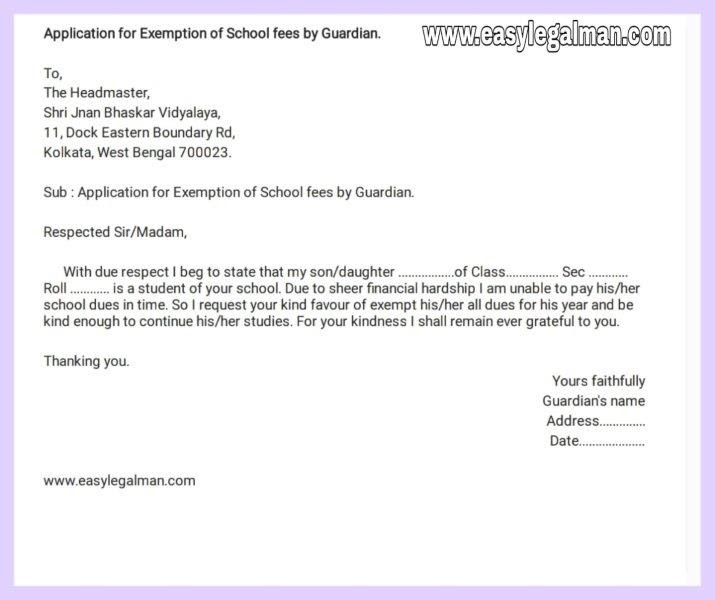

How To Write An Application For Exemption Of School Fees By Guardian

Mortgage Loans For First Time Home Buyers

First Time Home Buyer Programs Single Mothers Bad Credit GayatriAimen

First Time Buyer Exemption Great For Buyers But Hard On The Treasury

https://www.nordea.fi/en/personal/your-life/home/buying-your-first-home

Even though the exemption from asset transfer tax for first time home buyers was discontinued at the start of the year there are still many other incentives As a result of lower prices first time home buyers can still find a home for cheaper than in years

https://yle.fi/a/74-20054997

First time buyers are exempt from this tax if they are between the ages of 18 and 39 and purchasing at least 50 percent of a home In 2022 the transfer tax exemption for first time buyers applied to roughly 23 000 sales of housing company stock and 13 000 sales of residential property

Even though the exemption from asset transfer tax for first time home buyers was discontinued at the start of the year there are still many other incentives As a result of lower prices first time home buyers can still find a home for cheaper than in years

First time buyers are exempt from this tax if they are between the ages of 18 and 39 and purchasing at least 50 percent of a home In 2022 the transfer tax exemption for first time buyers applied to roughly 23 000 sales of housing company stock and 13 000 sales of residential property

Mortgage Loans For First Time Home Buyers

Oregon First Time Home Buyer Savings Account Akzeptabel

First Time Home Buyer Programs Single Mothers Bad Credit GayatriAimen

First Time Buyer Exemption Great For Buyers But Hard On The Treasury

Bill Passed For First Time Home Buyers Guysinsweatpantz

Seminole County First Time Home Buyer Down Payment Assistance Buy Walls

Seminole County First Time Home Buyer Down Payment Assistance Buy Walls

Options For First Time Home Buyers Foxen Realty