In this digital age, in which screens are the norm, the charm of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or just adding an individual touch to your home, printables for free have become an invaluable resource. For this piece, we'll dive into the sphere of "Tax Exemption For House Loan Which Is Under Construction," exploring the different types of printables, where to find them and how they can enrich various aspects of your life.

Get Latest Tax Exemption For House Loan Which Is Under Construction Below

Tax Exemption For House Loan Which Is Under Construction

Tax Exemption For House Loan Which Is Under Construction -

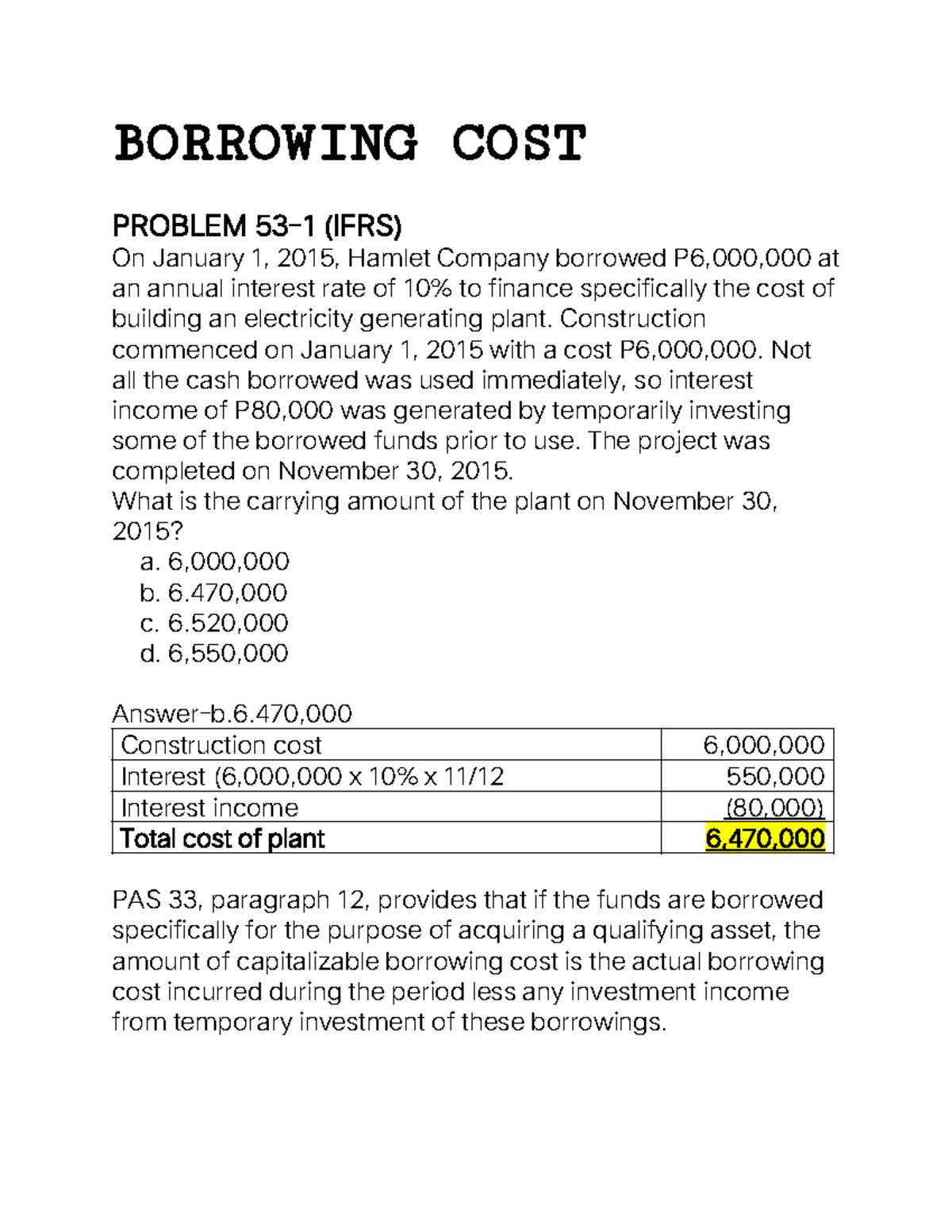

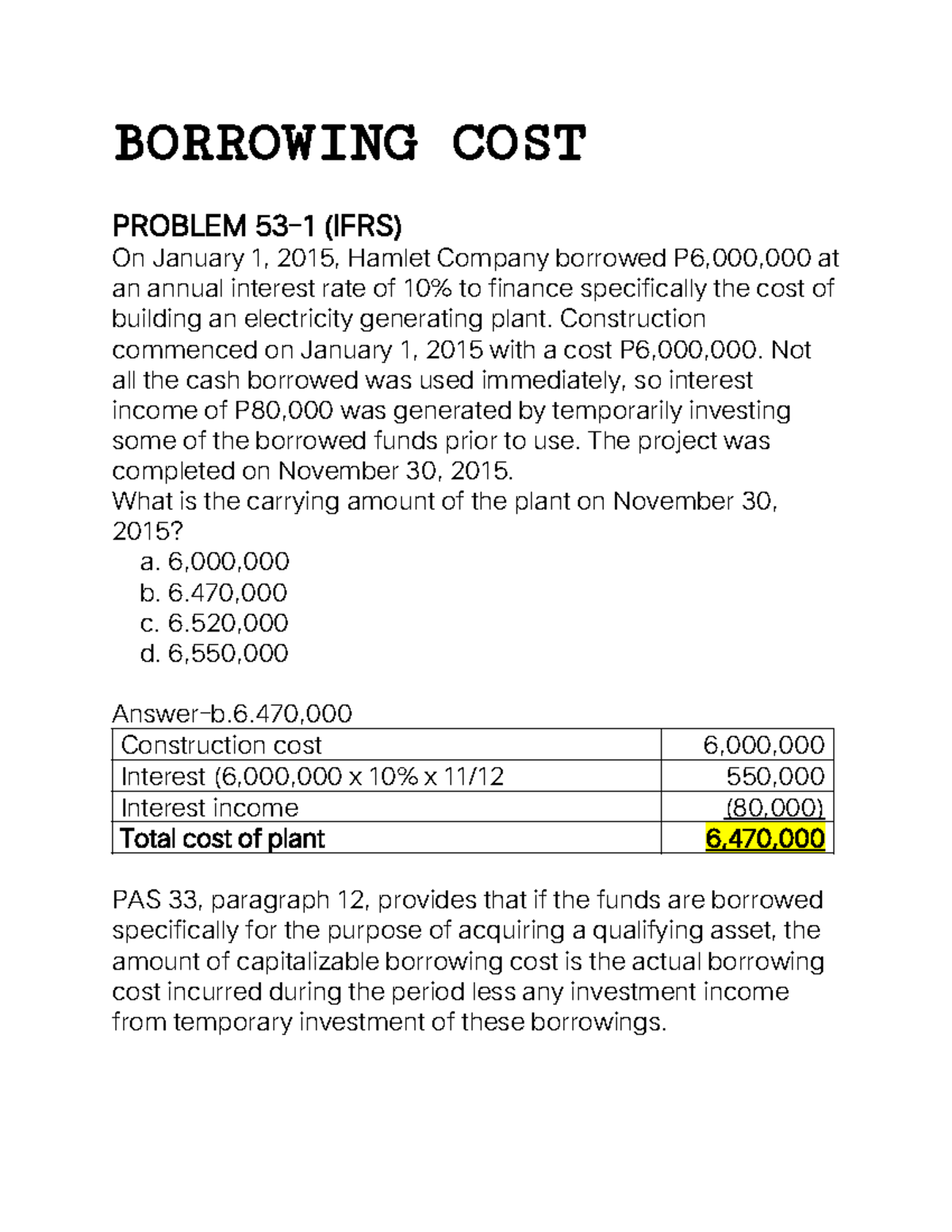

In case of a Home Loan availed of to buy a ready to move in property one can claim tax exemption up to a maximum of Rs 2 Lakh per year under this section of the Income Tax Act In the case of under construction properties one can claim tax exemption on the payments made towards interest repayment while the construction

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of the house is completed Once it is completed you can claim an aggregate of interest paid for the period prior to the year of taking possession in five equal instalments from the year

Tax Exemption For House Loan Which Is Under Construction offer a wide range of printable, free resources available online for download at no cost. They come in many formats, such as worksheets, templates, coloring pages and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tax Exemption For House Loan Which Is Under Construction

Phu Quoc Island Visa Exemption For Indians 2023 In Which Cases Indian

Phu Quoc Island Visa Exemption For Indians 2023 In Which Cases Indian

House property income deductions like standard deduction municipal taxes home loan interest and pre construction interest can minimize taxable income Pre construction interest applies to interest paid while a property is under construction Taxpayers can claim it after construction

Tax Benefit for a Property Under Construction Loan Individuals cannot claim tax benefits on home loan repayment till their property is fully constructed However that does not mean one cannot claim any tax benefit

The Tax Exemption For House Loan Which Is Under Construction have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization The Customization feature lets you tailor designs to suit your personal needs whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational Value: These Tax Exemption For House Loan Which Is Under Construction are designed to appeal to students from all ages, making them a great resource for educators and parents.

-

Affordability: Quick access to an array of designs and templates will save you time and effort.

Where to Find more Tax Exemption For House Loan Which Is Under Construction

Mismanaged Idle SSS Assets Justifies Tax Exemption Says BMP The

Mismanaged Idle SSS Assets Justifies Tax Exemption Says BMP The

Although you have begun repaying the housing loan through EMIs you are not eligible to claim these tax benefits during the pre construction phase i e a house under construction cannot be claimed as a tax deduction There can be problems with the building s construction or completion

Section 24 of the Income Tax Act for Under Construction Property Under section 24B of the Income Tax Act 1961 homeowners can claim a tax deduction of up to Rs 2 lakh per financial year on the interest paid for

Now that we've piqued your curiosity about Tax Exemption For House Loan Which Is Under Construction We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Tax Exemption For House Loan Which Is Under Construction for a variety uses.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad spectrum of interests, starting from DIY projects to planning a party.

Maximizing Tax Exemption For House Loan Which Is Under Construction

Here are some fresh ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home and in class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Exemption For House Loan Which Is Under Construction are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and interest. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the vast array of Tax Exemption For House Loan Which Is Under Construction right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print these materials for free.

-

Can I make use of free printables in commercial projects?

- It's based on the rules of usage. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations on usage. Check the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using the printer, or go to the local print shops for superior prints.

-

What program do I require to view printables that are free?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software, such as Adobe Reader.

New House Under Construction GharExpert

Loan Management In Open HRMS In Islamabad HRMS In Islamabad

Check more sample of Tax Exemption For House Loan Which Is Under Construction below

Contoh Surat Akuan Sumpah Tidak Bekerja Ptptn Permohonan Pengecualian

Stamp Duty Exemption For The Year 2023

PH WB Seal 370 M Loan For Land Reform

China Bank Savings Loan How Much You May Borrow Under Personal Loan

Tax Exempt Sales Use And Lodging Certification Standardized As Of Jan

https://cleartax.in/s/home-loan-tax-benefit

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of the house is completed Once it is completed you can claim an aggregate of interest paid for the period prior to the year of taking possession in five equal instalments from the year

https://www.tatacapital.com/blog/loan-for-home/can...

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a year and deductions of up to Rs 1 50 000 on the principal amount paid under Section 80C of the Income Tax Act ITA

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of the house is completed Once it is completed you can claim an aggregate of interest paid for the period prior to the year of taking possession in five equal instalments from the year

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a year and deductions of up to Rs 1 50 000 on the principal amount paid under Section 80C of the Income Tax Act ITA

China Bank Savings Loan How Much You May Borrow Under Personal Loan

Stamp Duty Exemption For The Year 2023

Tax Exempt Sales Use And Lodging Certification Standardized As Of Jan

HSBC Vietnam Rolls Out The First Green Financing For Duy Tan Plastics

Shriram Finance Raises 100 Million From Adb Chennai News Times Of

Shriram Finance Raises 100 Million From Adb Chennai News Times Of

The Fringe Benefits Tax Exemption For Electric Cars Explained PioneerNewz