In this day and age when screens dominate our lives and the appeal of physical printed objects isn't diminished. In the case of educational materials as well as creative projects or just adding an extra personal touch to your home, printables for free are now a useful resource. Here, we'll take a dive to the depths of "Tax Exemption For Mediclaim Policy," exploring what they are, where to find them, and how they can enhance various aspects of your lives.

Get Latest Tax Exemption For Mediclaim Policy Below

Tax Exemption For Mediclaim Policy

Tax Exemption For Mediclaim Policy -

Section 80D offers tax deductions on health insurance premiums of up to a maximum limit of 25 000 in a financial year You can claim deductions for a policy bought for yourself your spouse and your dependent children

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes a 5 000 deduction for any expenses paid towards preventative health check ups

Tax Exemption For Mediclaim Policy cover a large selection of printable and downloadable items that are available online at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and much more. The great thing about Tax Exemption For Mediclaim Policy lies in their versatility and accessibility.

More of Tax Exemption For Mediclaim Policy

Mediclaim For Family How To Choose Best Mediclaim Policy For Family

Mediclaim For Family How To Choose Best Mediclaim Policy For Family

You can claim tax deductions on mediclaim plans provided by your employer or on policies taken by you independent of your employment The tax deduction is applicable on both health insurance and mediclaim policies

Section 80D Deduction on Medical insurance comes under Income Tax Know how you can claim a deduction under Section 80D Its maximum limit to save tax

Tax Exemption For Mediclaim Policy have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: There is the possibility of tailoring printables to your specific needs whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students from all ages, making them a vital source for educators and parents.

-

Convenience: Fast access an array of designs and templates will save you time and effort.

Where to Find more Tax Exemption For Mediclaim Policy

Health Insurance And The Importance Of Mediclaim Policy

Health Insurance And The Importance Of Mediclaim Policy

Section 80D provides for deduction towards mediclaim payment and preventive health check up payment There are lot of confusion as to whether the limit is Rs 25000 OR Rs 50 000 Further the doubt is there as to whether payment has to be done in cheque only or it can be done in cash also

You can claim a tax deduction for the medical insurance premium paid for your parents whether they are dependent on you or not The condition of dependency of parents is eliminated w e f A Y 2009 10

Now that we've piqued your interest in printables for free we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Tax Exemption For Mediclaim Policy for various applications.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing including flashcards, learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast spectrum of interests, ranging from DIY projects to party planning.

Maximizing Tax Exemption For Mediclaim Policy

Here are some fresh ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Exemption For Mediclaim Policy are a treasure trove filled with creative and practical information catering to different needs and desires. Their accessibility and versatility make them a fantastic addition to both professional and personal life. Explore the endless world of Tax Exemption For Mediclaim Policy to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can download and print these tools for free.

-

Can I download free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright rights issues with Tax Exemption For Mediclaim Policy?

- Certain printables might have limitations in use. Always read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using either a printer or go to any local print store for top quality prints.

-

What software do I need to run printables for free?

- The majority of printables are in PDF format. They is open with no cost software such as Adobe Reader.

Deduction For Mediclaim And Preventive Health Checkup Under Income Tax

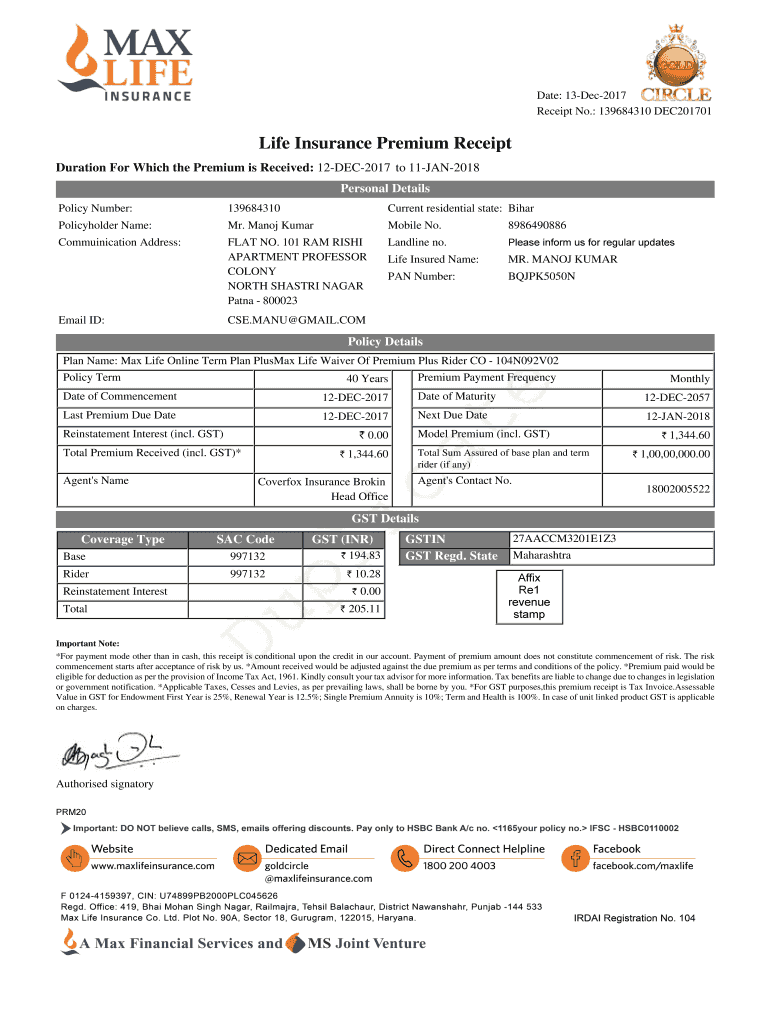

Premium Receipt Fill Out And Sign Printable PDF Template SignNow

Check more sample of Tax Exemption For Mediclaim Policy below

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Tax Exemption Limit For Mediclaim In Budget 2023

Preventive Check Up 80d Wkcn

Benefits Of Cashless Mediclaim Policy For Family And Individuals

Varistha Mediclaim Policy National Insurance Premium

Mediclaim Policy And Health Insurance At Rs 5000 person Medical

https://www.policybazaar.com/health-insurance/...

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes a 5 000 deduction for any expenses paid towards preventative health check ups

https://taxguru.in/income-tax/all-about-deduction...

Deduction Under Section 80D in respect of Medical Insurance Premium Mediclaim paid to keep in force insurance by individual either on his own health or on the health of spouse parents and dependent children or HUF on

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes a 5 000 deduction for any expenses paid towards preventative health check ups

Deduction Under Section 80D in respect of Medical Insurance Premium Mediclaim paid to keep in force insurance by individual either on his own health or on the health of spouse parents and dependent children or HUF on

Benefits Of Cashless Mediclaim Policy For Family And Individuals

Tax Exemption Limit For Mediclaim In Budget 2023

Varistha Mediclaim Policy National Insurance Premium

Mediclaim Policy And Health Insurance At Rs 5000 person Medical

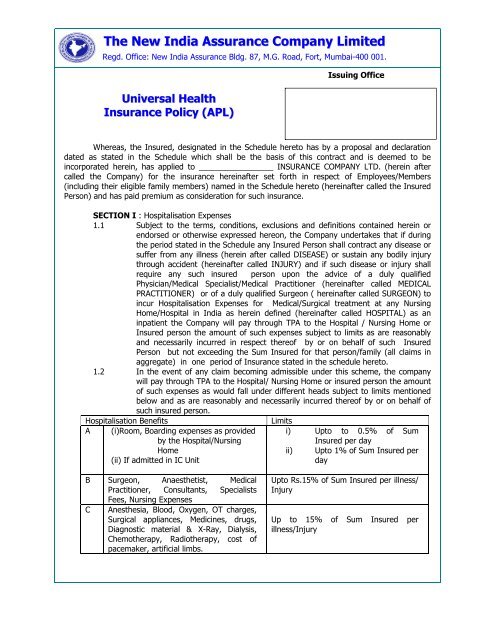

Group Mediclaim Policy The New India Assurance Co Ltd

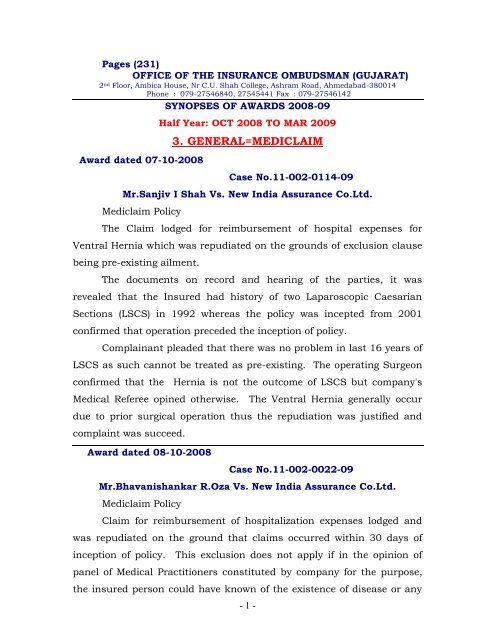

MEDICAL MEDICLAIM POLICY Insurance Ombudsman

MEDICAL MEDICLAIM POLICY Insurance Ombudsman

How Mortgage Automation Streamlines Mortgage Underwriting Journal