In this age of technology, where screens dominate our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons such as creative projects or simply to add some personal flair to your space, Tax Exemption Limit On Medical Bills have become a valuable source. For this piece, we'll take a dive in the world of "Tax Exemption Limit On Medical Bills," exploring what they are, where to find them and how they can be used to enhance different aspects of your life.

Get Latest Tax Exemption Limit On Medical Bills Below

Tax Exemption Limit On Medical Bills

Tax Exemption Limit On Medical Bills -

You do not have to pay tax on up to Rs 15 000 in a financial year if you submit medical bills for the same amount to the employer The main conditions for claiming this exemption are Medical bills incurred for self

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

Tax Exemption Limit On Medical Bills offer a wide collection of printable materials available online at no cost. These resources come in many forms, including worksheets, templates, coloring pages, and many more. One of the advantages of Tax Exemption Limit On Medical Bills is their versatility and accessibility.

More of Tax Exemption Limit On Medical Bills

Income Tax Declaration Form For Employee Fy 2022 19 2023 Employeeform

Income Tax Declaration Form For Employee Fy 2022 19 2023 Employeeform

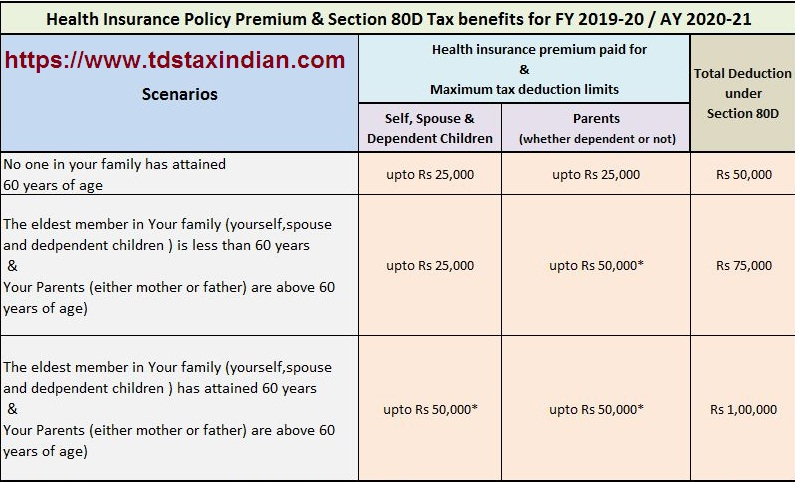

Learn how to claim medical bills under Section 80D of the Income Tax Act Know the benefits limits and tax savings for health insurance premiums

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are

Tax Exemption Limit On Medical Bills have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Flexible: We can customize printing templates to your own specific requirements be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: These Tax Exemption Limit On Medical Bills are designed to appeal to students of all ages, which makes them a vital tool for parents and teachers.

-

The convenience of You have instant access a plethora of designs and templates saves time and effort.

Where to Find more Tax Exemption Limit On Medical Bills

Know About The Basic ITR Filing Exemption Limit For Taxpayers

Know About The Basic ITR Filing Exemption Limit For Taxpayers

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by

Unlike allowance medical reimbursements are exempt from tax to a certain extent Currently reimbursements up to Rs 15 000 each year is exempt from taxation To

Now that we've piqued your interest in printables for free Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of reasons.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a wide range of interests, starting from DIY projects to party planning.

Maximizing Tax Exemption Limit On Medical Bills

Here are some unique ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Tax Exemption Limit On Medical Bills are an abundance of practical and imaginative resources which cater to a wide range of needs and interest. Their accessibility and flexibility make they a beneficial addition to any professional or personal life. Explore the vast world of Tax Exemption Limit On Medical Bills to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Exemption Limit On Medical Bills really free?

- Yes, they are! You can download and print these resources at no cost.

-

Does it allow me to use free printing templates for commercial purposes?

- It's determined by the specific rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with Tax Exemption Limit On Medical Bills?

- Certain printables may be subject to restrictions in their usage. Make sure to read the terms and regulations provided by the designer.

-

How can I print printables for free?

- Print them at home with a printer or visit the local print shops for the highest quality prints.

-

What software do I require to view printables that are free?

- The majority are printed in the PDF format, and is open with no cost software like Adobe Reader.

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

Check more sample of Tax Exemption Limit On Medical Bills below

A K Bhattacharya Time To Revert To Rs 3 5 Lakh As Tax Exemption Limit

CBDT Increases Income Tax Exemption Limit On Leave Encashment For Non

Hike Tax Exemption Limit For Small Units

Pay Commission 7th CPC News Income Tax Exemption Limit Under 80C

Income Tax Exemption Limit Likely To Be Enhanced In Budget

Assocham For Raising Tax Exemption Limit The Hitavada

https://cleartax.in/s/income-tax-benefit-employee...

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

https://tax2win.in/guide/section-80d-ded…

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn

Pay Commission 7th CPC News Income Tax Exemption Limit Under 80C

CBDT Increases Income Tax Exemption Limit On Leave Encashment For Non

Income Tax Exemption Limit Likely To Be Enhanced In Budget

Assocham For Raising Tax Exemption Limit The Hitavada

2023 Indian Military Veterans

01 Tax

01 Tax

Income Tax Exemption