Today, in which screens are the norm yet the appeal of tangible printed products hasn't decreased. If it's to aid in education or creative projects, or just adding an individual touch to your area, Tax Exemption On Donation have become a valuable resource. Through this post, we'll take a dive into the sphere of "Tax Exemption On Donation," exploring what they are, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Tax Exemption On Donation Below

Tax Exemption On Donation

Tax Exemption On Donation -

Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging

Taxable gifts and tax exempt gifts You are liable to pay tax on a gift worth at least 5 000 You are also liable to pay tax if the same donor gives you several gifts in the course of 3 years and

Printables for free include a vast assortment of printable material that is available online at no cost. They are available in numerous styles, from worksheets to coloring pages, templates and much more. The great thing about Tax Exemption On Donation is their versatility and accessibility.

More of Tax Exemption On Donation

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief

Section 80G of Indian Income Tax Act allows tax deductions for donations made to charitable trusts or NGOs Charitable institutions play a crucial role in social welfare and

The Tax Exemption On Donation have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: We can customize designs to suit your personal needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Value The free educational worksheets cater to learners of all ages. This makes them an essential source for educators and parents.

-

Affordability: Fast access various designs and templates cuts down on time and efforts.

Where to Find more Tax Exemption On Donation

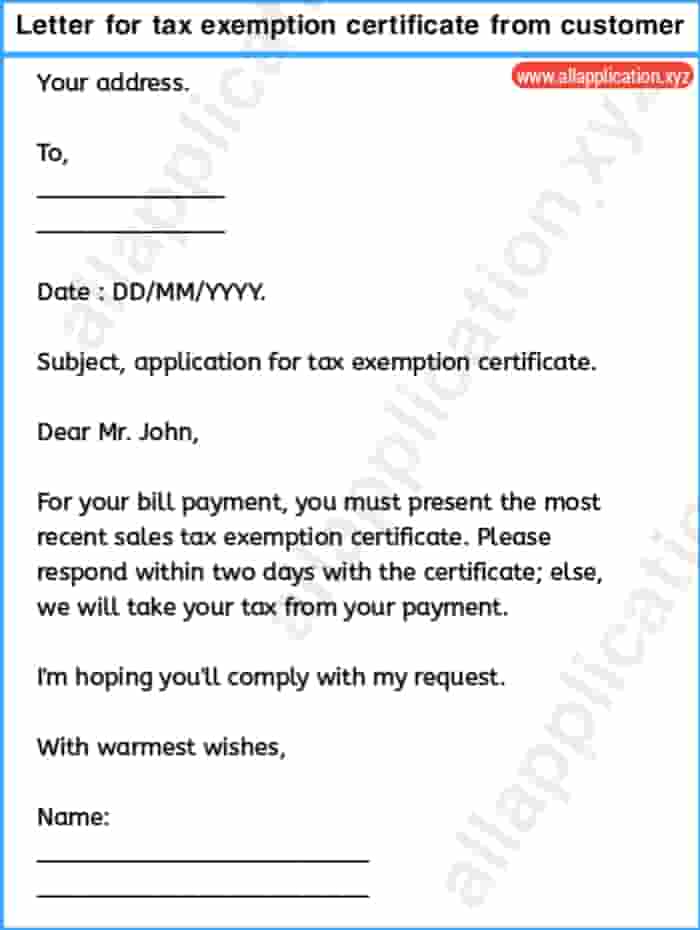

Tax Exempt Form Request Letter Inspirational Agreement With Regard To

Tax Exempt Form Request Letter Inspirational Agreement With Regard To

Will I get a tax exemption on my donation NRI Non Resident Indian donors who are Indian citizens holding an Indian passport are eligible to tax exemption under section 80 G of the

For companies the deduction under Section 80G can be claimed on the amount donated to eligible institutions or funds up to a maximum of 50 or 100 of the donated

Now that we've ignited your curiosity about Tax Exemption On Donation Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Tax Exemption On Donation for a variety applications.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad range of topics, that range from DIY projects to party planning.

Maximizing Tax Exemption On Donation

Here are some creative ways create the maximum value of Tax Exemption On Donation:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Exemption On Donation are an abundance of fun and practical tools that cater to various needs and interests. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the vast world that is Tax Exemption On Donation today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Exemption On Donation truly absolutely free?

- Yes, they are! You can print and download the resources for free.

-

Can I use free printables to make commercial products?

- It's based on the terms of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions in use. You should read these terms and conditions as set out by the creator.

-

How do I print Tax Exemption On Donation?

- You can print them at home using a printer or visit a local print shop to purchase higher quality prints.

-

What program do I require to view printables that are free?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software like Adobe Reader.

Vijay Fined Rs 1 Lakh For Seeking Tax Exemption On Rs 7 95 Crore Rolls

Letter Requesting Tax Exemption Certificate From Customer

Check more sample of Tax Exemption On Donation below

Request Letter For Tax Exemption And Certificate SemiOffice Com

Ohio Tax Exempt Form 2020 2022 Fill And Sign Printable Template

Exemption U s 80G Can t Be Granted If Expenditure Of Religious Nature

CBDT Notifies Income Tax Exemption On California Public Employees

Tax Exemption 80G Certificate

Increased Limit For Tax Exemption On Leave Encashment For Non govt

https://www.vero.fi/en/individuals/property/gifts/...

Taxable gifts and tax exempt gifts You are liable to pay tax on a gift worth at least 5 000 You are also liable to pay tax if the same donor gives you several gifts in the course of 3 years and

https://cleartax.in/s/donation-under-section-80g-and-80gga

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section

Taxable gifts and tax exempt gifts You are liable to pay tax on a gift worth at least 5 000 You are also liable to pay tax if the same donor gives you several gifts in the course of 3 years and

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section

CBDT Notifies Income Tax Exemption On California Public Employees

Ohio Tax Exempt Form 2020 2022 Fill And Sign Printable Template

Tax Exemption 80G Certificate

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Free Goodwill Donation Receipt Template PDF EForms

How To Qualify For Tax Exemption On Your Vehicle Purchase Door To

How To Qualify For Tax Exemption On Your Vehicle Purchase Door To

Section 54EC Exemption On Long Term Capital Gain