In the digital age, where screens dominate our lives yet the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or just adding an extra personal touch to your home, printables for free have become an invaluable source. For this piece, we'll dive to the depths of "Tax Exemption On Home Loan Interest 2022 23," exploring their purpose, where to get them, as well as ways they can help you improve many aspects of your lives.

Get Latest Tax Exemption On Home Loan Interest 2022 23 Below

Tax Exemption On Home Loan Interest 2022 23

Tax Exemption On Home Loan Interest 2022 23 -

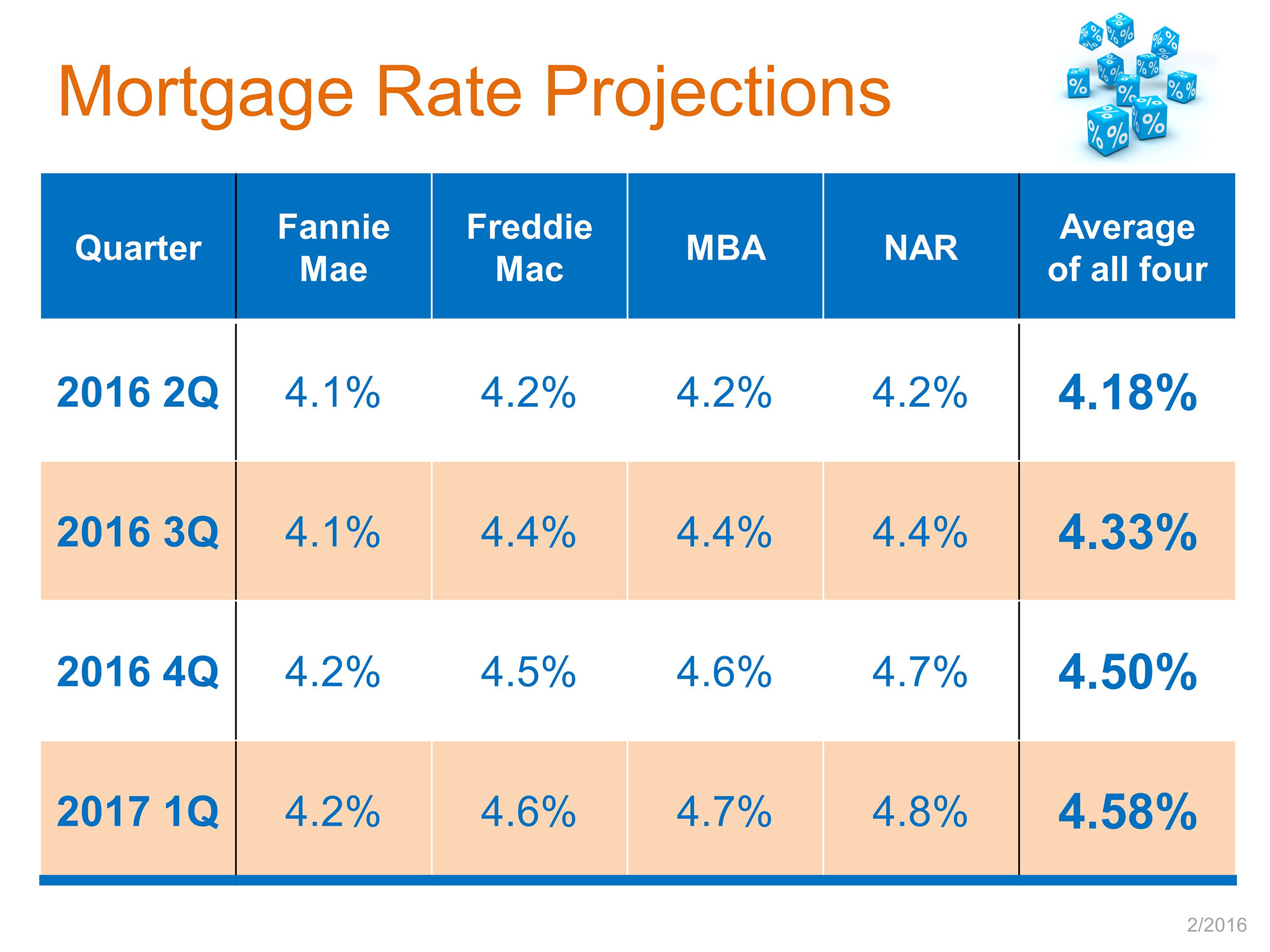

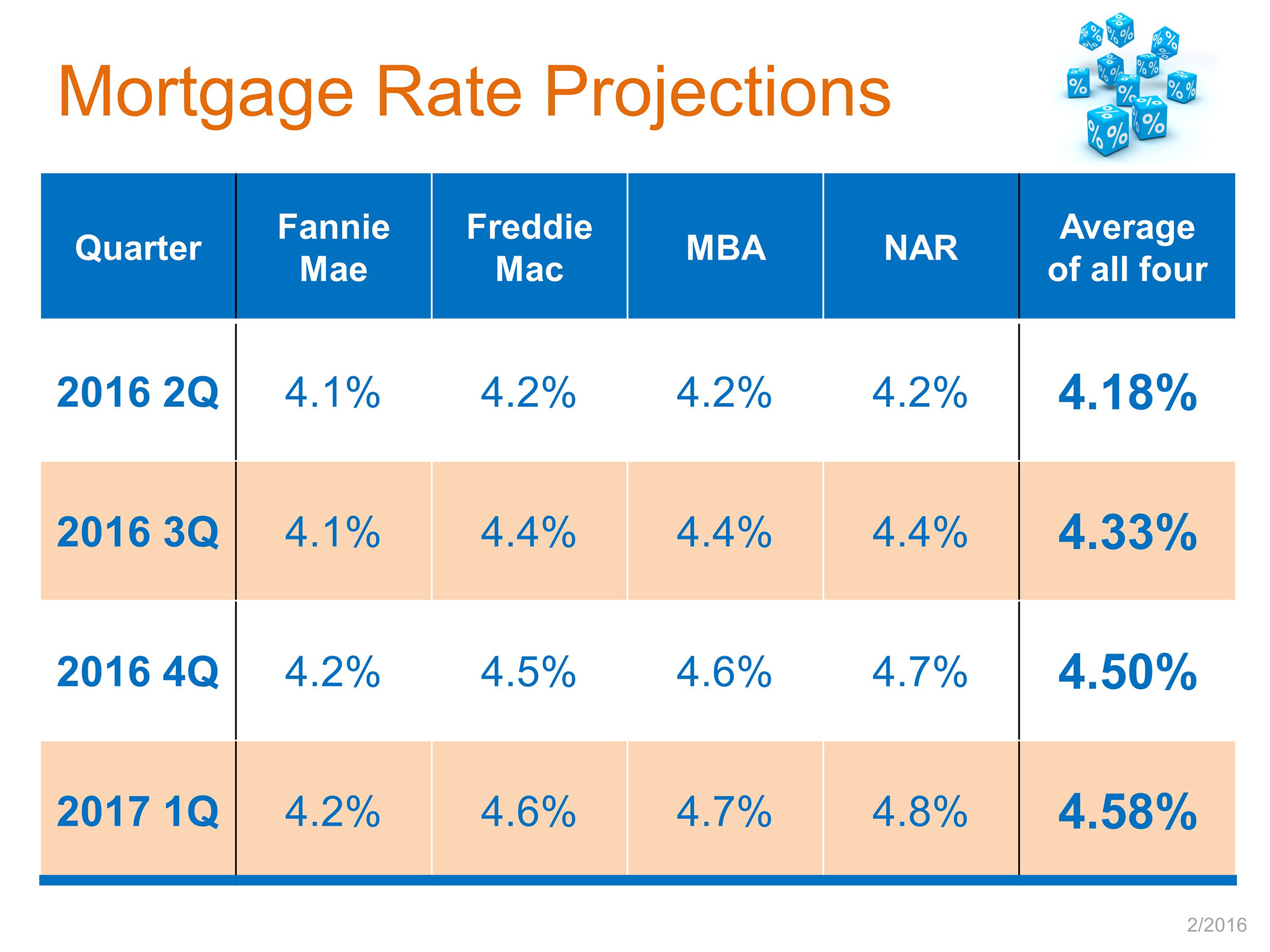

Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act 1961 which

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to

Tax Exemption On Home Loan Interest 2022 23 encompass a wide range of printable, free content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages, and much more. The appealingness of Tax Exemption On Home Loan Interest 2022 23 lies in their versatility and accessibility.

More of Tax Exemption On Home Loan Interest 2022 23

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can

The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of Income Tax This is being phased in from 6 April 2017 and will be fully in

The Tax Exemption On Home Loan Interest 2022 23 have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: You can tailor printables to your specific needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: Education-related printables at no charge cater to learners of all ages, making them a useful device for teachers and parents.

-

The convenience of immediate access an array of designs and templates reduces time and effort.

Where to Find more Tax Exemption On Home Loan Interest 2022 23

Income Tax Deduction Of Rs 5 Lakh On Home Loan Interest 2022 Budget

Income Tax Deduction Of Rs 5 Lakh On Home Loan Interest 2022 Budget

The good news is that the tax benefit of interest paid on a home loan for both the pre construction and post construction periods can be claimed by you Deduction for the

Deduction of Interest on Home Loan for the property House Property owners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family reside in the

We've now piqued your interest in Tax Exemption On Home Loan Interest 2022 23, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of purposes.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a wide selection of subjects, from DIY projects to planning a party.

Maximizing Tax Exemption On Home Loan Interest 2022 23

Here are some inventive ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Exemption On Home Loan Interest 2022 23 are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and preferences. Their access and versatility makes them a great addition to your professional and personal life. Explore the vast array that is Tax Exemption On Home Loan Interest 2022 23 today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use the free printables for commercial use?

- It's determined by the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables could be restricted regarding usage. Be sure to read the terms and conditions provided by the author.

-

How do I print Tax Exemption On Home Loan Interest 2022 23?

- You can print them at home using printing equipment or visit a local print shop for better quality prints.

-

What program do I require to open printables that are free?

- The majority of PDF documents are provided with PDF formats, which can be opened using free programs like Adobe Reader.

Homestead Exemption

Under construction House How To Claim Tax Deduction On Home Loan

Check more sample of Tax Exemption On Home Loan Interest 2022 23 below

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

Home Loan Tax Benefit Tax Deductions And Exemption Accoxi

Real Estate ReLakhs

All About Section 80EEA For Deduction On Home Loan Interest

Home Loan Interest Home Loan Interest Update

https://www.paisabazaar.com › home-loan › home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to

https://www.aavas.in › blog

Home loan tax benefits include deductions on principal interest payments under sections 80C 24 b of Income Tax Act reducing overall tax liability for owners

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to

Home loan tax benefits include deductions on principal interest payments under sections 80C 24 b of Income Tax Act reducing overall tax liability for owners

Real Estate ReLakhs

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

All About Section 80EEA For Deduction On Home Loan Interest

Home Loan Interest Home Loan Interest Update

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

PPT Section 80E Tax Exemption On Interest On Education Loan

PPT Section 80E Tax Exemption On Interest On Education Loan

Income Tax Exemption On Interest Of Education Loan YouTube