In the age of digital, with screens dominating our lives and the appeal of physical, printed materials hasn't diminished. In the case of educational materials in creative or artistic projects, or just adding the personal touch to your area, Tax Exemption On Interest Paid On Home Loan are now an essential source. Through this post, we'll dive into the world "Tax Exemption On Interest Paid On Home Loan," exploring the different types of printables, where to find them, and how they can improve various aspects of your daily life.

Get Latest Tax Exemption On Interest Paid On Home Loan Below

Tax Exemption On Interest Paid On Home Loan

Tax Exemption On Interest Paid On Home Loan -

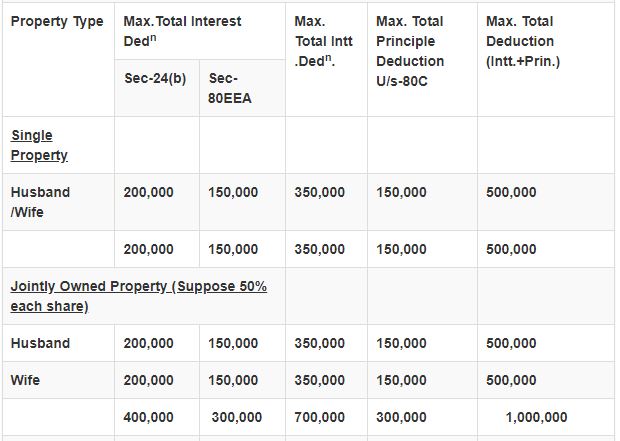

The total tax deduction for home loans for two homes cannot exceed Rs 2 lakhs in a fiscal year Additional deduction on buying an affordable house An additional

For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on your

Tax Exemption On Interest Paid On Home Loan provide a diverse assortment of printable materials that are accessible online for free cost. These resources come in many forms, like worksheets templates, coloring pages and more. The appealingness of Tax Exemption On Interest Paid On Home Loan is in their variety and accessibility.

More of Tax Exemption On Interest Paid On Home Loan

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Income Tax Malaysia 2022 Deadline Extension Latest News Update

You can claim deductions of up to Rs 30 000 per year on the interest paid on personal loan Home purchase or construction If you take a loan for purchase or

You can claim a deduction under your interest category of up to Rs 2 lakh under Section 24 The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule

Tax Exemption On Interest Paid On Home Loan have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize printables to fit your particular needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: The free educational worksheets provide for students from all ages, making the perfect resource for educators and parents.

-

Affordability: Fast access numerous designs and templates can save you time and energy.

Where to Find more Tax Exemption On Interest Paid On Home Loan

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Deductions allowed on home loan interest Deductions under Section 24 B Deduction under Section 24 is also available to buyers who do not use home loan How to maximise tax rebate under Section

Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages of up to 1 million A mortgage calculator

We hope we've stimulated your interest in Tax Exemption On Interest Paid On Home Loan Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Tax Exemption On Interest Paid On Home Loan for all applications.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Tax Exemption On Interest Paid On Home Loan

Here are some innovative ways create the maximum value use of Tax Exemption On Interest Paid On Home Loan:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Tax Exemption On Interest Paid On Home Loan are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the wide world of Tax Exemption On Interest Paid On Home Loan today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can print and download these materials for free.

-

Can I download free printables for commercial use?

- It's dependent on the particular rules of usage. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues in Tax Exemption On Interest Paid On Home Loan?

- Some printables could have limitations in their usage. You should read the terms of service and conditions provided by the author.

-

How can I print Tax Exemption On Interest Paid On Home Loan?

- Print them at home using either a printer at home or in the local print shops for better quality prints.

-

What program is required to open printables at no cost?

- The majority of printed documents are in PDF format, which can be opened with free software like Adobe Reader.

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Housing Loan Tax Exemption On Interest Paid On Housing Loan

Check more sample of Tax Exemption On Interest Paid On Home Loan below

Realty Sector Pins High Hopes On Budget FY 24

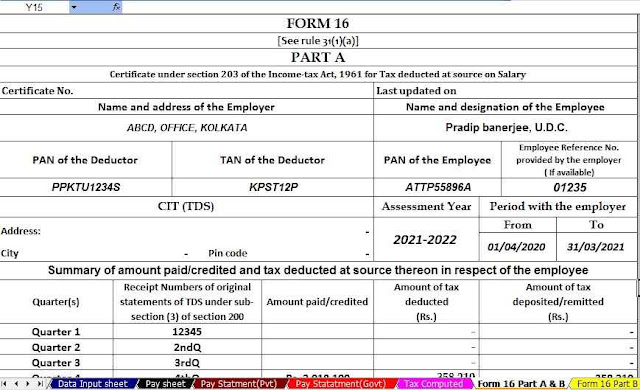

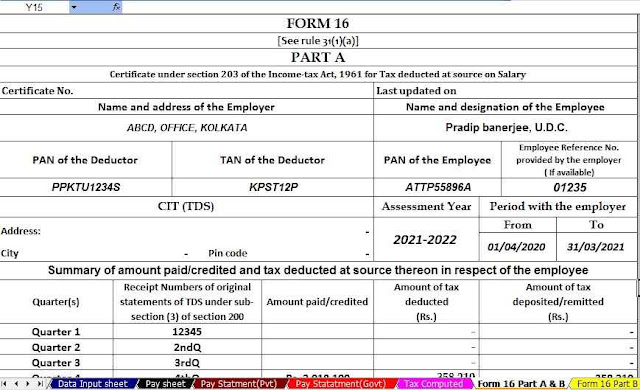

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Types Of Mortgages To Choose From Know The Many Options Available To You

Expectation From Budget 2023 Manish Mehan CEO And MD Of TK Elevator

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

https://cleartax.in/s/home-loan-tax-benefits

For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on your

https://www.nerdwallet.com/article/tax…

In general yes You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married

For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on your

In general yes You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married

Types Of Mortgages To Choose From Know The Many Options Available To You

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Expectation From Budget 2023 Manish Mehan CEO And MD Of TK Elevator

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

Expectation From Budget 2023 Manish Mehan CEO And MD Of TK Elevator

Income Tax Exemption On Interest Of Education Loan YouTube

Income Tax Exemption On Interest Of Education Loan YouTube

CREDAI s Recommendations For Union Budget 2023 24 Focus On Sustaining