In this day and age where screens have become the dominant feature of our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education and creative work, or simply adding an individual touch to the space, Tax Exemption On Life Insurance Policy Under Section 10 10d are now a vital source. In this article, we'll dive in the world of "Tax Exemption On Life Insurance Policy Under Section 10 10d," exploring what they are, how to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Exemption On Life Insurance Policy Under Section 10 10d Below

Tax Exemption On Life Insurance Policy Under Section 10 10d

Tax Exemption On Life Insurance Policy Under Section 10 10d -

Ninth proviso to clause 10D of section 10 of the Act also empowers the Central Board of Direct Taxes Board to issue guidelines with the previous approval of the Central Government in order to remove any difficulty

According to the Finance Bill of 2021 any ULIP plan purchased on and after February 2021 which exceeds an aggregate annual premium of Rs 2 50 000 will not receive

Printables for free cover a broad range of downloadable, printable content that can be downloaded from the internet at no cost. They come in many forms, like worksheets coloring pages, templates and much more. The beauty of Tax Exemption On Life Insurance Policy Under Section 10 10d lies in their versatility as well as accessibility.

More of Tax Exemption On Life Insurance Policy Under Section 10 10d

Section 10 10D Of The Income Tax Act Benefits And Exemptions Max

Section 10 10D Of The Income Tax Act Benefits And Exemptions Max

According to Section 10 10D any sum received under a life insurance policy including bonuses is typically exempt from taxation provided certain conditions are met This means that maturity proceeds or death benefits from a life

Section 10 10D provides an exemption with respect to any sum received under the life insurance policy However no exemption is allowed if the premium payable for any of the years during the term of the policy exceeds

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization There is the possibility of tailoring printables to fit your particular needs for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational Benefits: Free educational printables can be used by students of all ages, making them an invaluable resource for educators and parents.

-

Accessibility: Access to an array of designs and templates can save you time and energy.

Where to Find more Tax Exemption On Life Insurance Policy Under Section 10 10d

Section 10D Of Income Tax Act 1961 Section 10d Income Tax 1961

Section 10D Of Income Tax Act 1961 Section 10d Income Tax 1961

Find out how section 10 of Income Tax Act reduces your income tax liability for payouts from ULIPs term plans endowment plans and other insurance policies

Section 10 10D of the Income Tax Act 1961 deals with tax exemption on the returns earned on maturity of a life insurance policy or on the death of the insured This section allows

We hope we've stimulated your curiosity about Tax Exemption On Life Insurance Policy Under Section 10 10d and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Tax Exemption On Life Insurance Policy Under Section 10 10d for various needs.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Tax Exemption On Life Insurance Policy Under Section 10 10d

Here are some creative ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Tax Exemption On Life Insurance Policy Under Section 10 10d are an abundance of practical and innovative resources for a variety of needs and desires. Their accessibility and flexibility make them an essential part of both professional and personal lives. Explore the vast world of Tax Exemption On Life Insurance Policy Under Section 10 10d to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these files for free.

-

Does it allow me to use free templates for commercial use?

- It depends on the specific rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may have restrictions regarding their use. Make sure you read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer at home or in a local print shop for top quality prints.

-

What program is required to open printables that are free?

- Most PDF-based printables are available in PDF format. They can be opened with free software like Adobe Reader.

How To Get Tax Exemption Under Section 10 10D Canara HSBC Life

Section 10 10D Of Income Tax Act LIP Amount Received From LIP Taxable

Check more sample of Tax Exemption On Life Insurance Policy Under Section 10 10d below

Income Tax Calculator How Your Life Insurance Policies Are Taxed

Exemption Under Section 10 10d

Guidelines Under Clause 10D Section 10 Of The IT Act Exemption On

Section 10 Of Income Tax Act Guide To Section 10 IIFL Insurance

Understanding Section 10 10D Of The Income Tax Act

Is Your Life Insurance Maturity Amount Always Tax free

https://www.hdfclife.com › ... › tax-saving-insurance

According to the Finance Bill of 2021 any ULIP plan purchased on and after February 2021 which exceeds an aggregate annual premium of Rs 2 50 000 will not receive

https://www2.deloitte.com › content › dam › Deloitte › in...

Where the sum is received under the life insurance policy during the FY subsequent to the first FY the income chargeable to tax in the subsequent FY shall be computed as

According to the Finance Bill of 2021 any ULIP plan purchased on and after February 2021 which exceeds an aggregate annual premium of Rs 2 50 000 will not receive

Where the sum is received under the life insurance policy during the FY subsequent to the first FY the income chargeable to tax in the subsequent FY shall be computed as

Section 10 Of Income Tax Act Guide To Section 10 IIFL Insurance

Exemption Under Section 10 10d

Understanding Section 10 10D Of The Income Tax Act

Is Your Life Insurance Maturity Amount Always Tax free

Section 10 Of Income Tax Act Know Section 10 10d Benefits

Section 10 10D Exemption Towards Amount Received Under A Life

Section 10 10D Exemption Towards Amount Received Under A Life

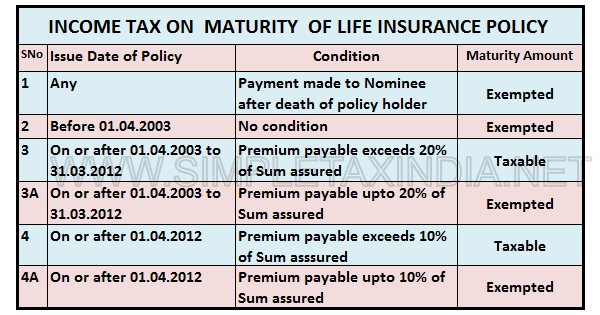

INCOME TAX ON MATURITY OF LIFE INSURANCE POLICY SIMPLE TAX INDIA