In the age of digital, with screens dominating our lives, the charm of tangible printed materials isn't diminishing. Be it for educational use, creative projects, or simply adding a personal touch to your space, Tax Exemption On Medical Expenses are now a vital source. In this article, we'll dive into the sphere of "Tax Exemption On Medical Expenses," exploring the benefits of them, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Tax Exemption On Medical Expenses Below

Tax Exemption On Medical Expenses

Tax Exemption On Medical Expenses -

The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

Tax Exemption On Medical Expenses provide a diverse range of downloadable, printable materials available online at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and much more. The great thing about Tax Exemption On Medical Expenses is in their variety and accessibility.

More of Tax Exemption On Medical Expenses

Medical Expenses Icon Royalty Free Vector Image

Medical Expenses Icon Royalty Free Vector Image

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

Tax Exemption On Medical Expenses have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization We can customize printables to your specific needs such as designing invitations making your schedule, or decorating your home.

-

Educational Worth: The free educational worksheets can be used by students of all ages. This makes the perfect instrument for parents and teachers.

-

Convenience: Fast access an array of designs and templates is time-saving and saves effort.

Where to Find more Tax Exemption On Medical Expenses

Tax Refund Claim Your Tax Refund On Medical Expenses Today

Tax Refund Claim Your Tax Refund On Medical Expenses Today

Publication 502 explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 including What expenses and

Deducting medical expenses How to claim medical expense deductions Medical expense deductions checklist Key Takeaways You can only deduct unreimbursed medical

If we've already piqued your interest in printables for free Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of goals.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning materials.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide selection of subjects, starting from DIY projects to party planning.

Maximizing Tax Exemption On Medical Expenses

Here are some ways to make the most of Tax Exemption On Medical Expenses:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Exemption On Medical Expenses are a treasure trove of practical and innovative resources that cater to various needs and hobbies. Their access and versatility makes them an essential part of both professional and personal life. Explore the many options of Tax Exemption On Medical Expenses today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can print and download these resources at no cost.

-

Can I download free printables to make commercial products?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables might have limitations on use. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home with your printer or visit a local print shop for premium prints.

-

What software do I need to open printables free of charge?

- The majority of printables are as PDF files, which can be opened with free software such as Adobe Reader.

How To Save On Medical Expenses Small Steps With Big Results Hosbeg

7 Surprising Medical Expenses That Are Tax Deductible GoodRx

Check more sample of Tax Exemption On Medical Expenses below

Medical Expenses Islamicmyte

Medical Expenses You Can Claim Back From Tax Momentum Multiply Blog

Report Consumers Out of pocket Medical Expenses Rising

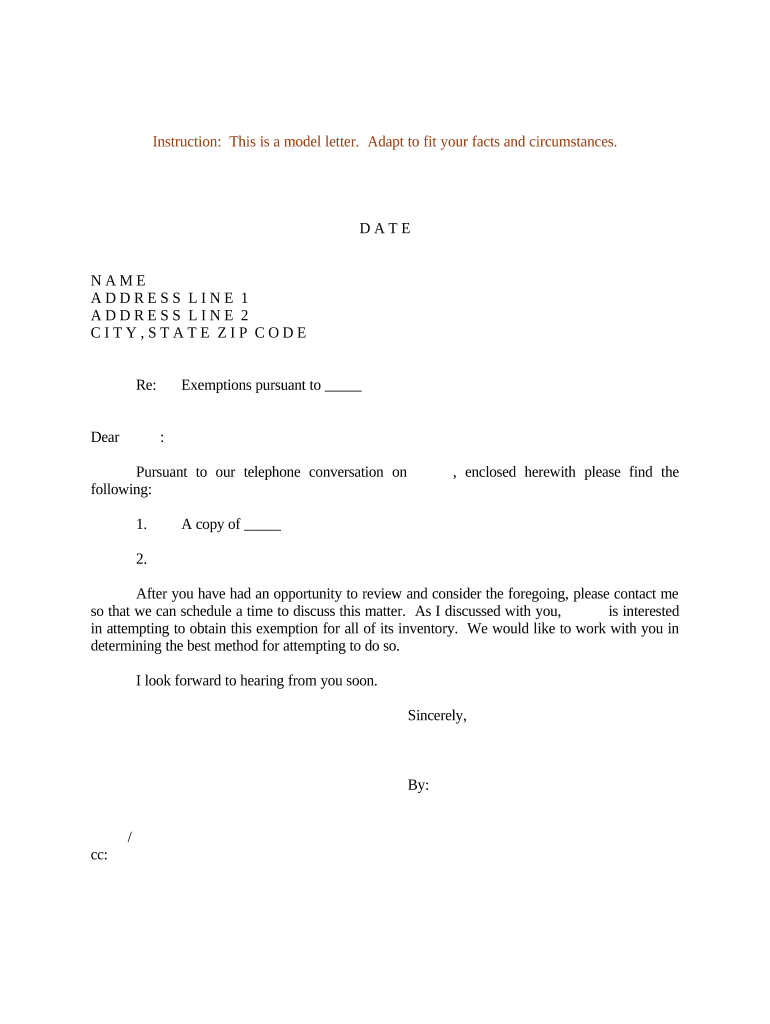

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

50 Secrets Maximizing Tax Deductions On Medical Expenses 2023

Tax Exemption And Tax Return Concept Businessman Hold Money Return

https://cleartax.in/s/income-tax-benefit-employee...

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

https://tax2win.in/guide/section-80ddb

Section 80DDB provides that if an individual or a HUF has incurred medical expenses for treatment of a specified disease or ailment such expense is allowed as a deduction subject to such conditions and capped at such amount as specified under Section 80DDB of the Income Tax Act Let us know more below Deduction Under

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

Section 80DDB provides that if an individual or a HUF has incurred medical expenses for treatment of a specified disease or ailment such expense is allowed as a deduction subject to such conditions and capped at such amount as specified under Section 80DDB of the Income Tax Act Let us know more below Deduction Under

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Medical Expenses You Can Claim Back From Tax Momentum Multiply Blog

50 Secrets Maximizing Tax Deductions On Medical Expenses 2023

Tax Exemption And Tax Return Concept Businessman Hold Money Return

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

All About Tax Exemption On Medical Reimbursement

All About Tax Exemption On Medical Reimbursement

Aero Marine Tax Professionals Assisted Tristate Careflight An Air