In this day and age when screens dominate our lives and the appeal of physical printed objects hasn't waned. For educational purposes in creative or artistic projects, or simply to add a personal touch to your area, Tax Exemption On Nps Contribution By Employee have proven to be a valuable source. Here, we'll take a dive deep into the realm of "Tax Exemption On Nps Contribution By Employee," exploring what they are, where to find them, and how they can improve various aspects of your life.

Get Latest Tax Exemption On Nps Contribution By Employee Below

Tax Exemption On Nps Contribution By Employee

Tax Exemption On Nps Contribution By Employee -

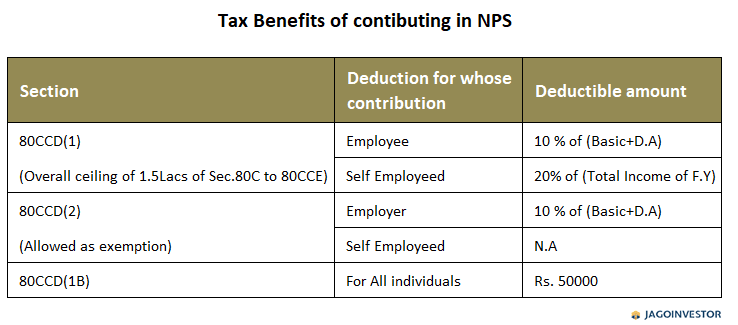

Tax Deduction under 80CCD 1 on NPS investment by Salaried individual except Central Govt employees An Employee can contribute to Government notified Pension Schemes like National Pension Scheme NPS The contributions can be upto 10 of the salary salaried individuals

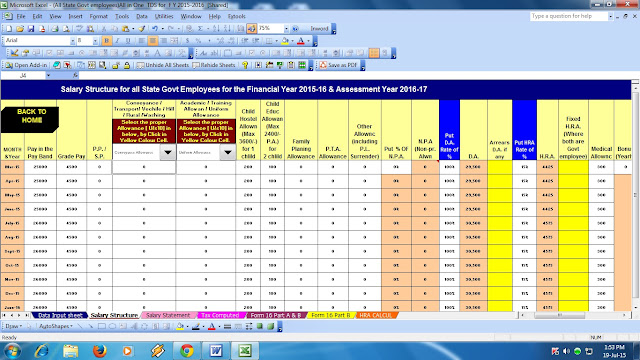

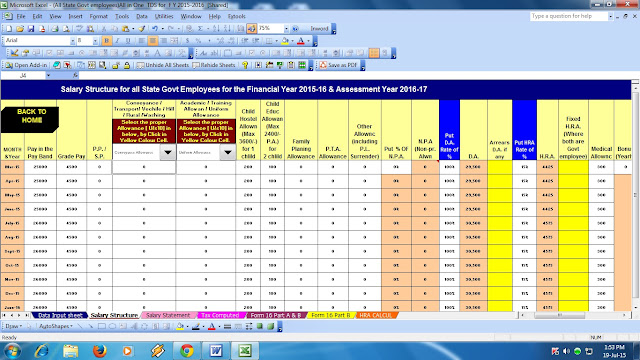

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2 thereby nullifying the effect FInd out if you should include employer s contribution to NPS in your taxable salary

Tax Exemption On Nps Contribution By Employee offer a wide array of printable items that are available online at no cost. These resources come in various kinds, including worksheets templates, coloring pages and many more. The beauty of Tax Exemption On Nps Contribution By Employee lies in their versatility and accessibility.

More of Tax Exemption On Nps Contribution By Employee

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s Contribution towards NPS up to 10 of salary Basic DA can be deducted as Business Expense from their Profit Loss Account

Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling of

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization: It is possible to tailor the templates to meet your individual needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Impact: Free educational printables cater to learners from all ages, making them an invaluable tool for parents and educators.

-

An easy way to access HTML0: Access to a plethora of designs and templates saves time and effort.

Where to Find more Tax Exemption On Nps Contribution By Employee

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

This comes under the overall Rs 1 5 lakh limit of Section 80C If you are an employee contributing to NPS then the above deduction is capped at 10 of salary Basic DA If you are self employed then it is further capped at 20 of the gross annual income

Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income Tax Act up to 10 of salary Basic DA This is within the overall ceiling of Rs 1 50 Lacs under Sec 80 CCE of the Income Tax Act

Now that we've ignited your interest in Tax Exemption On Nps Contribution By Employee we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Tax Exemption On Nps Contribution By Employee for different uses.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide range of topics, that range from DIY projects to planning a party.

Maximizing Tax Exemption On Nps Contribution By Employee

Here are some innovative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Exemption On Nps Contribution By Employee are a treasure trove of useful and creative resources catering to different needs and hobbies. Their access and versatility makes them a wonderful addition to both professional and personal life. Explore the endless world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can print and download the resources for free.

-

Can I use free printouts for commercial usage?

- It's based on the terms of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright concerns with Tax Exemption On Nps Contribution By Employee?

- Some printables could have limitations concerning their use. Check the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using printing equipment or visit a local print shop to purchase high-quality prints.

-

What software is required to open printables for free?

- Most PDF-based printables are available in PDF format. They can be opened using free programs like Adobe Reader.

What Is The Tax Exemption On The Maturity Of The National Pension

Nps Contribution By Employee Werohmedia

Check more sample of Tax Exemption On Nps Contribution By Employee below

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

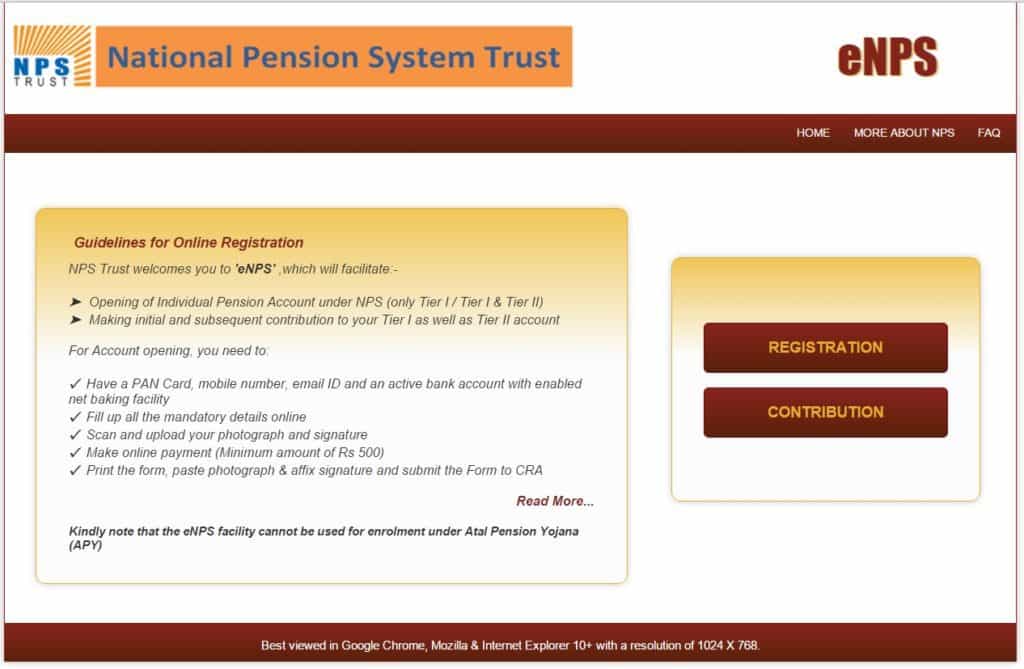

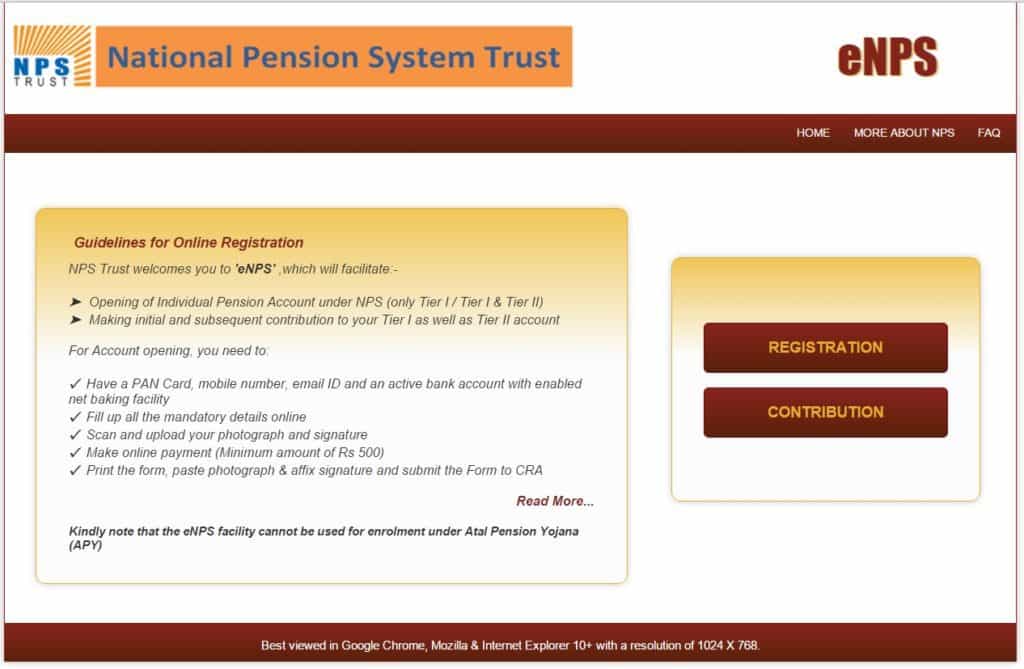

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Employer Contribution May Be Tax Free Under National Pension Scheme

Budget 2022 NPS Update Budget 2022 Hikes Tax Exemption On Employer s

Additional Income Tax Exemption Under Section 80 CCD 1 For

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

https://cleartax.in/s/taxability-on-nps-employers-contribution

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2 thereby nullifying the effect FInd out if you should include employer s contribution to NPS in your taxable salary

https://www.etmoney.com/learn/nps/nps-tax-benefit

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction of upto 0 of your salary Basic DA If government employees invtest in NPS then this limit is 14 for them

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2 thereby nullifying the effect FInd out if you should include employer s contribution to NPS in your taxable salary

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction of upto 0 of your salary Basic DA If government employees invtest in NPS then this limit is 14 for them

Budget 2022 NPS Update Budget 2022 Hikes Tax Exemption On Employer s

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Additional Income Tax Exemption Under Section 80 CCD 1 For

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

Budget 2022 NPS

NPS Contribution With UPI Online Payment At ENPS Portal

NPS Contribution With UPI Online Payment At ENPS Portal

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh Taxed