Today, when screens dominate our lives and the appeal of physical printed objects isn't diminished. Whether it's for educational purposes for creative projects, simply to add an individual touch to your space, Tax Incentives For Renewable Energy are now a vital resource. For this piece, we'll take a dive into the world "Tax Incentives For Renewable Energy," exploring what they are, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Tax Incentives For Renewable Energy Below

Tax Incentives For Renewable Energy

Tax Incentives For Renewable Energy -

Consumers can find financial incentives and assistance for energy efficient and renewable energy products and improvements in the form of rebates tax credits or financing programs Visit the following sections to search for incentives in your area and to learn more about financing options

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

Printables for free cover a broad collection of printable items that are available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages, and much more. The benefit of Tax Incentives For Renewable Energy lies in their versatility and accessibility.

More of Tax Incentives For Renewable Energy

Tax Incentives For Renewable Energy Finance LifeStyle

Tax Incentives For Renewable Energy Finance LifeStyle

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On this page How it works Who qualifies Qualified expenses Qualified clean energy property How to claim the credit Related resources

Of the 4 billion tax credits 1 5 billion supports projects in historic energy communities These projects will create good paying jobs lower energy costs and support the climate supply chain and energy security goals of the Biden Harris Administration s Investing in America agenda

Tax Incentives For Renewable Energy have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization: They can make printed materials to meet your requirements whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational value: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a great instrument for parents and teachers.

-

An easy way to access HTML0: You have instant access numerous designs and templates reduces time and effort.

Where to Find more Tax Incentives For Renewable Energy

Biden Administration Proposes Extended And Expanded Tax Incentives For

Biden Administration Proposes Extended And Expanded Tax Incentives For

This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation technologies

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing

Since we've got your interest in Tax Incentives For Renewable Energy Let's look into where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Tax Incentives For Renewable Energy for a variety applications.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs are a vast array of topics, ranging that range from DIY projects to party planning.

Maximizing Tax Incentives For Renewable Energy

Here are some innovative ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Incentives For Renewable Energy are a treasure trove of fun and practical tools for a variety of needs and passions. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the plethora of Tax Incentives For Renewable Energy to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printables in commercial projects?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may contain restrictions regarding usage. Check the terms and conditions provided by the designer.

-

How can I print Tax Incentives For Renewable Energy?

- You can print them at home with an printer, or go to the local print shops for high-quality prints.

-

What program must I use to open printables at no cost?

- Most PDF-based printables are available in PDF format, which can be opened with free programs like Adobe Reader.

Which Natural Resource Was Abundantly Available To The Northwest Indians

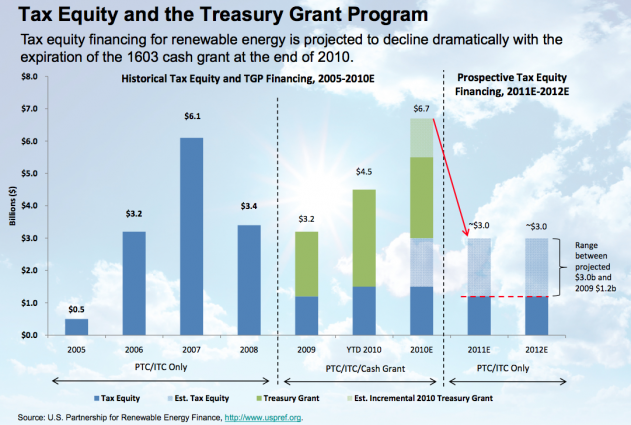

Federal Tax Credits Handcuff Clean Energy Development Institute For

Check more sample of Tax Incentives For Renewable Energy below

Solar Power Batteries

Clean Energy Policy Tracker NARUC

![]()

Legislation Solar sc gov

Tax Incentives Strengthen The Renewable Energy Investment Case For

Voici Pourquoi Cape Town Doit Faire Approuver Ses Onduleurs Par La

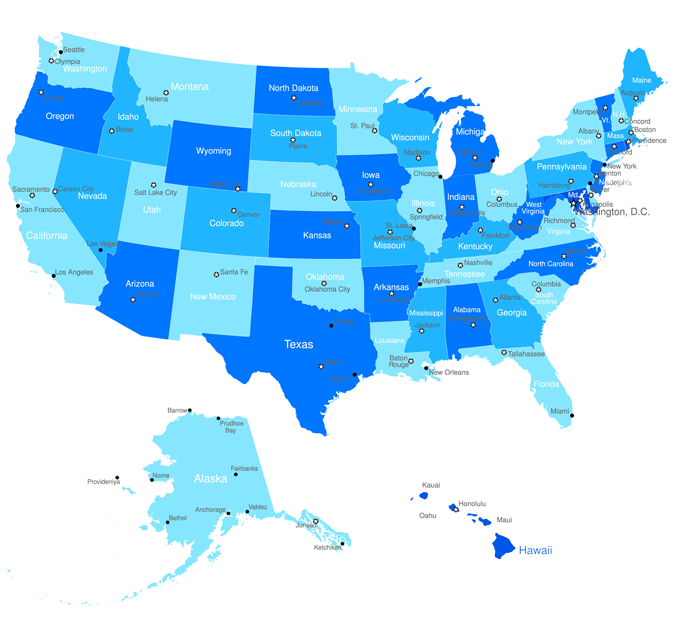

Current Federal And State Tax Incentives For Renewable Energy In The U S

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

https://tax.thomsonreuters.com/blog/renewable-energy-tax-credits...

Jump to How do renewable energy tax credits work What renewable energy tax incentives does the IRS offer for individuals vs businesses Overview of clean energy credits by energy type Helping clients with renewable energy credits

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

Jump to How do renewable energy tax credits work What renewable energy tax incentives does the IRS offer for individuals vs businesses Overview of clean energy credits by energy type Helping clients with renewable energy credits

Tax Incentives Strengthen The Renewable Energy Investment Case For

Clean Energy Policy Tracker NARUC

Voici Pourquoi Cape Town Doit Faire Approuver Ses Onduleurs Par La

Current Federal And State Tax Incentives For Renewable Energy In The U S

Loadshedding Tax Incentives For Energy Efficiency And Alternative

Tax Incentives For Renewable Energy Impacts And Analyses Nova

Tax Incentives For Renewable Energy Impacts And Analyses Nova

The Bajan Reporter ST KITTS LOOKS TO GEOTHERMAL AS AN ALTERNATIVE