In this digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. If it's to aid in education as well as creative projects or just adding the personal touch to your home, printables for free can be an excellent source. The following article is a take a dive deep into the realm of "Tax Rebate Budget 2023," exploring the different types of printables, where they are, and how they can enhance various aspects of your daily life.

Get Latest Tax Rebate Budget 2023 Below

Tax Rebate Budget 2023

Tax Rebate Budget 2023 -

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your

As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5 lakh The highest surcharge rate has been reduced to 25 percent from 37 percent in the new slab FM said

Tax Rebate Budget 2023 provide a diverse selection of printable and downloadable content that can be downloaded from the internet at no cost. These resources come in many formats, such as worksheets, coloring pages, templates and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Tax Rebate Budget 2023

Budget 2023 Summary Of Direct Tax Proposals

Budget 2023 Summary Of Direct Tax Proposals

Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with incomes over Rs 7 lakh will have to pay tax as per the slabs of the new tax regime

The Section 87A rebate has been increased under the new tax regime for taxable incomes up to Rs 7 lakh Individuals with taxable income of less than Rs 7 lakh will not have to pay any taxes if they choose the new tax regime in FY 2023 24 Any changes were made in the old tax regime for FY 2023 24

Tax Rebate Budget 2023 have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization The Customization feature lets you tailor printed materials to meet your requirements whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Education Value Printing educational materials for no cost cater to learners of all ages, which makes them a vital tool for parents and teachers.

-

The convenience of Access to many designs and templates, which saves time as well as effort.

Where to Find more Tax Rebate Budget 2023

Tax Rebate Budget Approved News At 08 00 February 22 2023

Tax Rebate Budget Approved News At 08 00 February 22 2023

What s new in the new income tax regime Basic exemption limit is hiked to 3 lakh from 2 5 currently under the new income tax regime in Budget 2023 24 Rebate under Section 87A

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

We've now piqued your curiosity about Tax Rebate Budget 2023, let's explore where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of purposes.

- Explore categories like decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching tools.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing Tax Rebate Budget 2023

Here are some ways for you to get the best use of Tax Rebate Budget 2023:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Rebate Budget 2023 are a treasure trove of practical and innovative resources that cater to various needs and pursuits. Their accessibility and versatility make them a fantastic addition to each day life. Explore the plethora of Tax Rebate Budget 2023 today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate Budget 2023 really for free?

- Yes they are! You can download and print these materials for free.

-

Can I use free printouts for commercial usage?

- It depends on the specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions on usage. Be sure to read the terms and regulations provided by the creator.

-

How can I print Tax Rebate Budget 2023?

- You can print them at home using your printer or visit a local print shop for better quality prints.

-

What software do I require to view printables that are free?

- The majority of printables are in the PDF format, and can be opened using free programs like Adobe Reader.

Corporate Tax Rebate Budget 2022 Rebate2022

Gov Gianforte Signs Package Of Tax Rebate Budget Bills

Check more sample of Tax Rebate Budget 2023 below

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

Sop For Option To New Tax Regime Has Been Introduced Union Budget 2023

Gov Gianforte Signs Package Of Tax Rebate Budget Bills YouTube

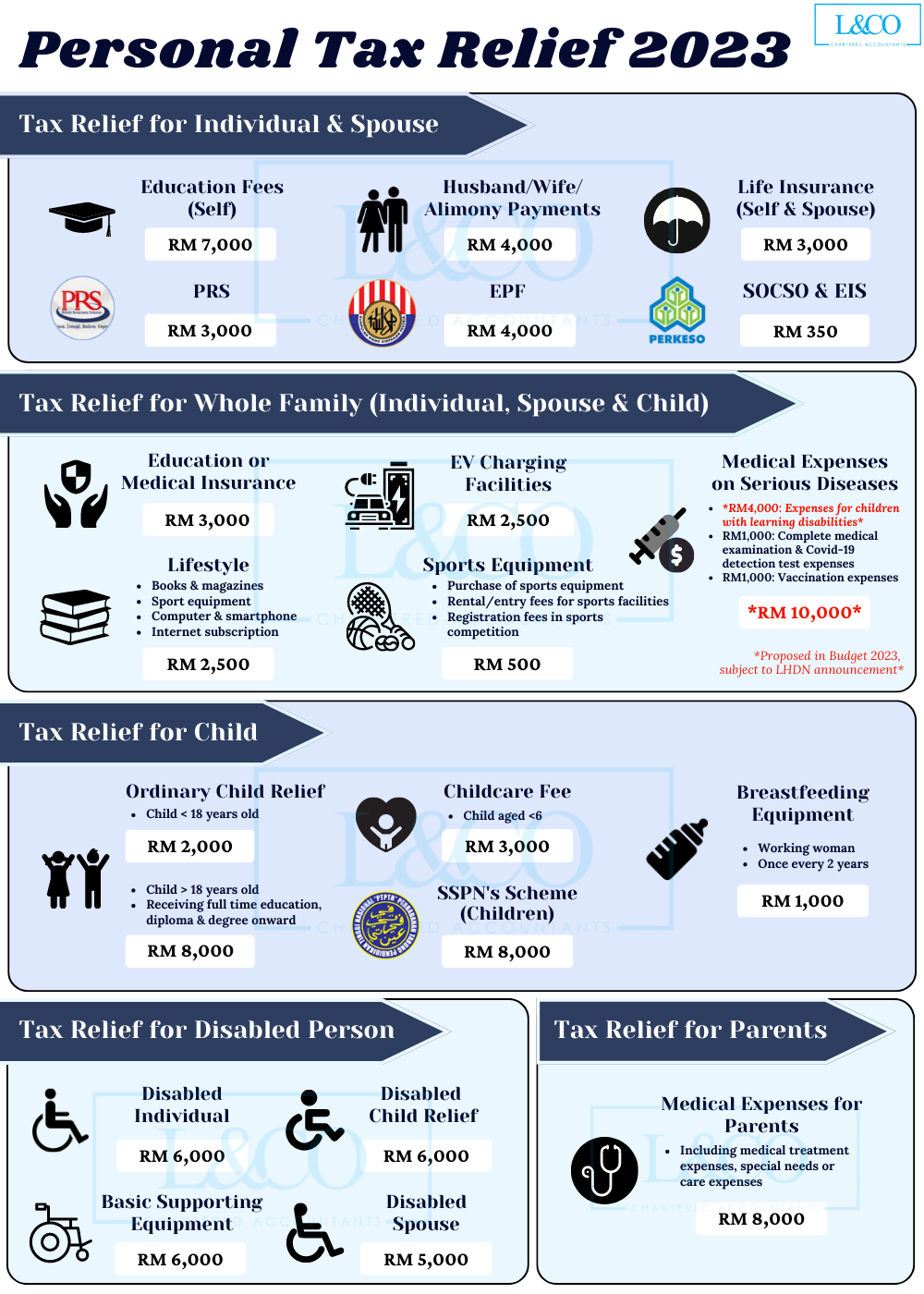

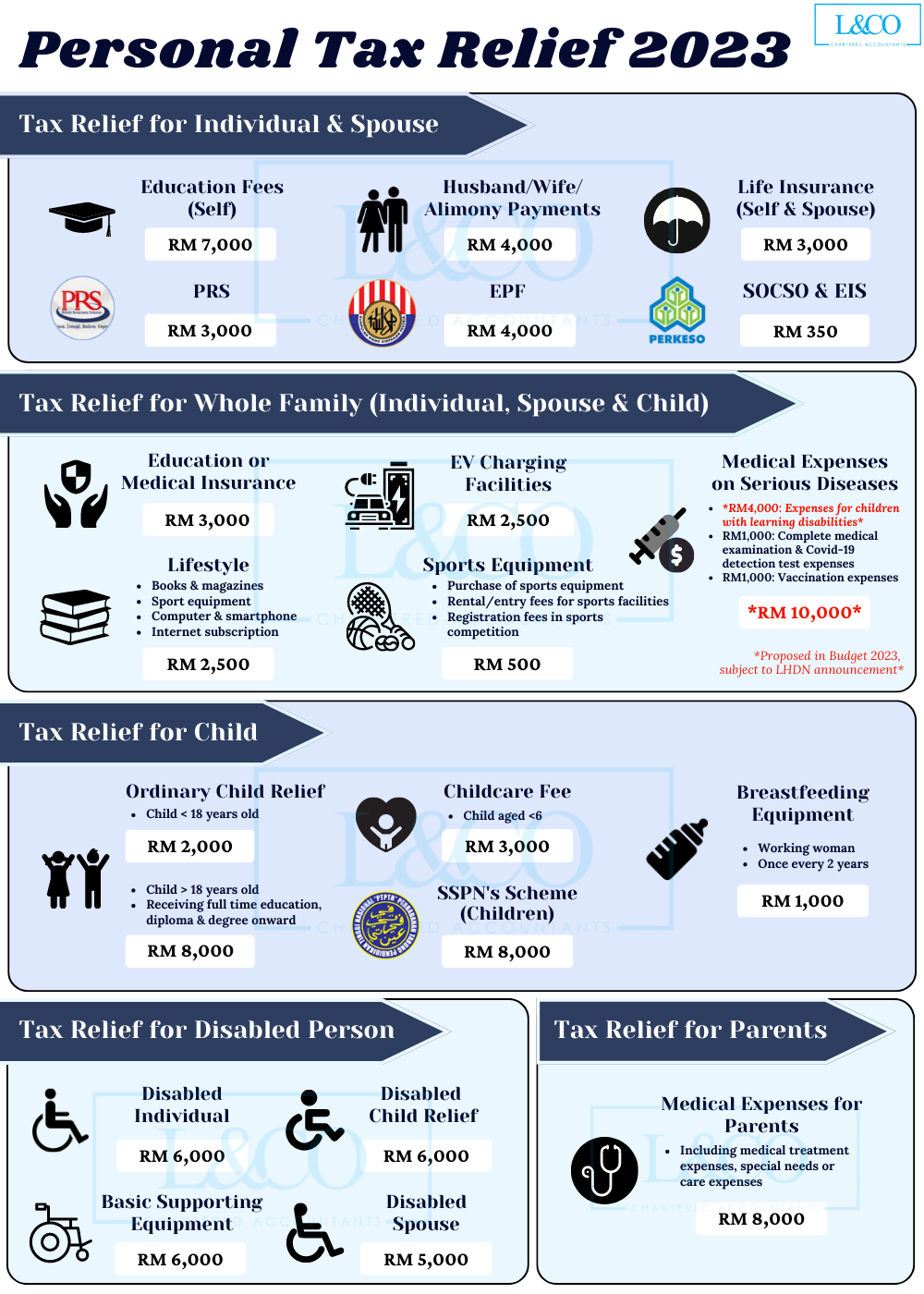

Personal Tax Relief Y A 2023 L Co Accountants

How To Claim Working From Home Tax Relief On Self Assessment

Park Service Moves Ahead On Coltsville National Historical Park

https://www.cnbctv18.com/personal-finance/budget...

As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5 lakh The highest surcharge rate has been reduced to 25 percent from 37 percent in the new slab FM said

https://cleartax.in/s/budget-2023-highlights

Tax rebate on an income of up to 7 lakhs has been introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all Standard deduction Salary income 50 000 standard deduction under the new tax regime as well Effectively 7 5 lakhs is your tax free income under the new

As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5 lakh The highest surcharge rate has been reduced to 25 percent from 37 percent in the new slab FM said

Tax rebate on an income of up to 7 lakhs has been introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all Standard deduction Salary income 50 000 standard deduction under the new tax regime as well Effectively 7 5 lakhs is your tax free income under the new

Personal Tax Relief Y A 2023 L Co Accountants

Sop For Option To New Tax Regime Has Been Introduced Union Budget 2023

How To Claim Working From Home Tax Relief On Self Assessment

Park Service Moves Ahead On Coltsville National Historical Park

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

India Plans Changes In Capital Gains Tax In Next Budget Official

India Plans Changes In Capital Gains Tax In Next Budget Official

Budget 2023 No Income Tax Up To 7 Lakh Revised Tax Slabs For New