In this age of electronic devices, where screens rule our lives The appeal of tangible printed objects hasn't waned. Be it for educational use project ideas, artistic or simply to add some personal flair to your space, Tax Rebate For Individual Rm400 are now an essential resource. The following article is a dive in the world of "Tax Rebate For Individual Rm400," exploring their purpose, where they are, and how they can improve various aspects of your daily life.

Get Latest Tax Rebate For Individual Rm400 Below

Tax Rebate For Individual Rm400

Tax Rebate For Individual Rm400 -

This means that your tax rate is 8 and the total income tax that you must pay is RM1 380 RM600 RM780 However if you re able to claim RM13 500 in tax deductions and tax reliefs then your chargeable income will drop to RM34 500 which means that your tax rate too will be lowered to 3

There are the types of tax rebates available Individual for chargeable income less until RM35 000 can get a tax rebate of RM400 Wife Husband separate assessment can each get a tax rebate of RM400 if both have chargeable income of less than RM35 000 Wife Husband joint assessment can get a tax rebate of RM800 for joint income until

Printables for free include a vast range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and much more. The great thing about Tax Rebate For Individual Rm400 lies in their versatility and accessibility.

More of Tax Rebate For Individual Rm400

2022 South Carolina Tax Rebate What You Need To Know Wltx

2022 South Carolina Tax Rebate What You Need To Know Wltx

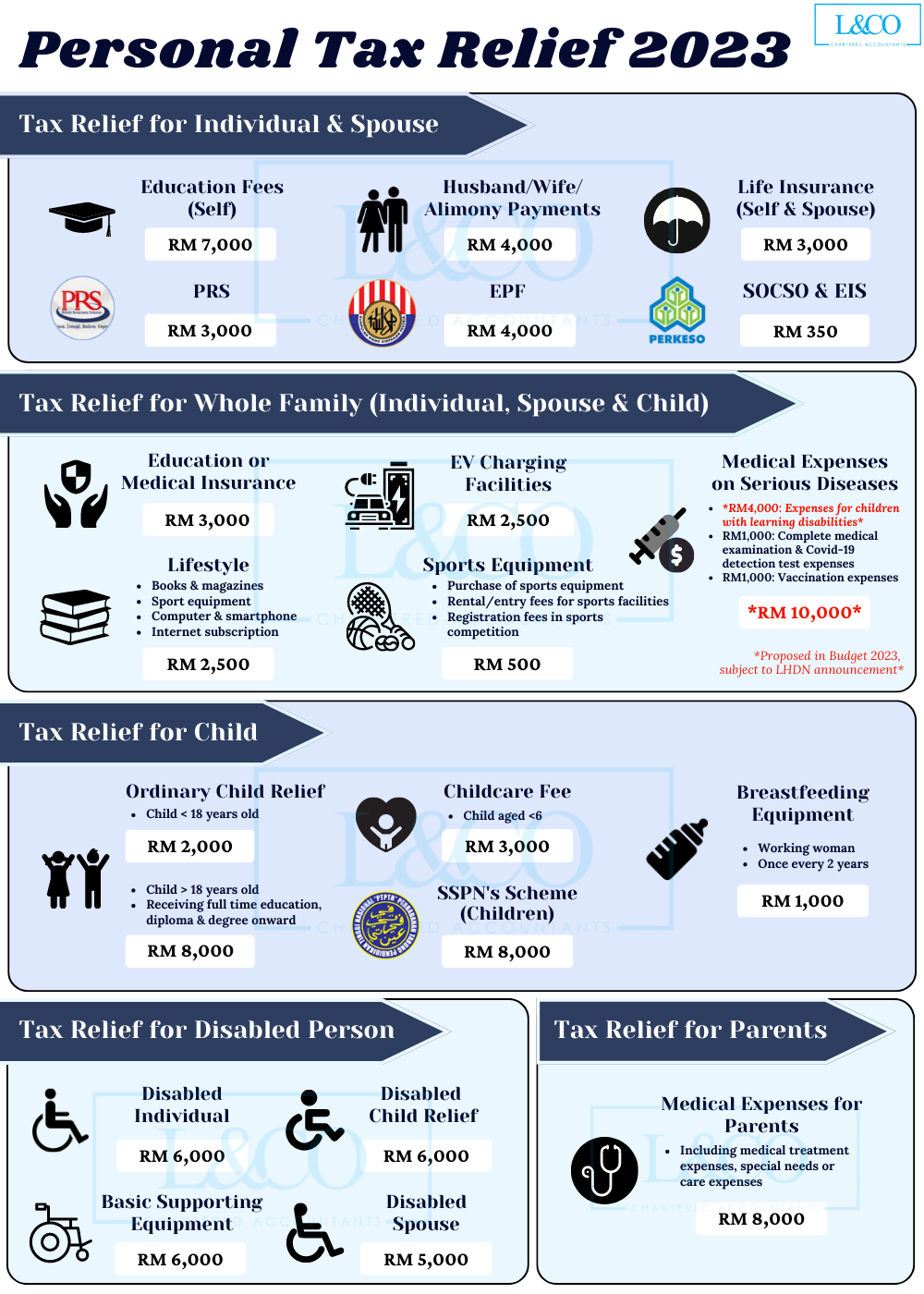

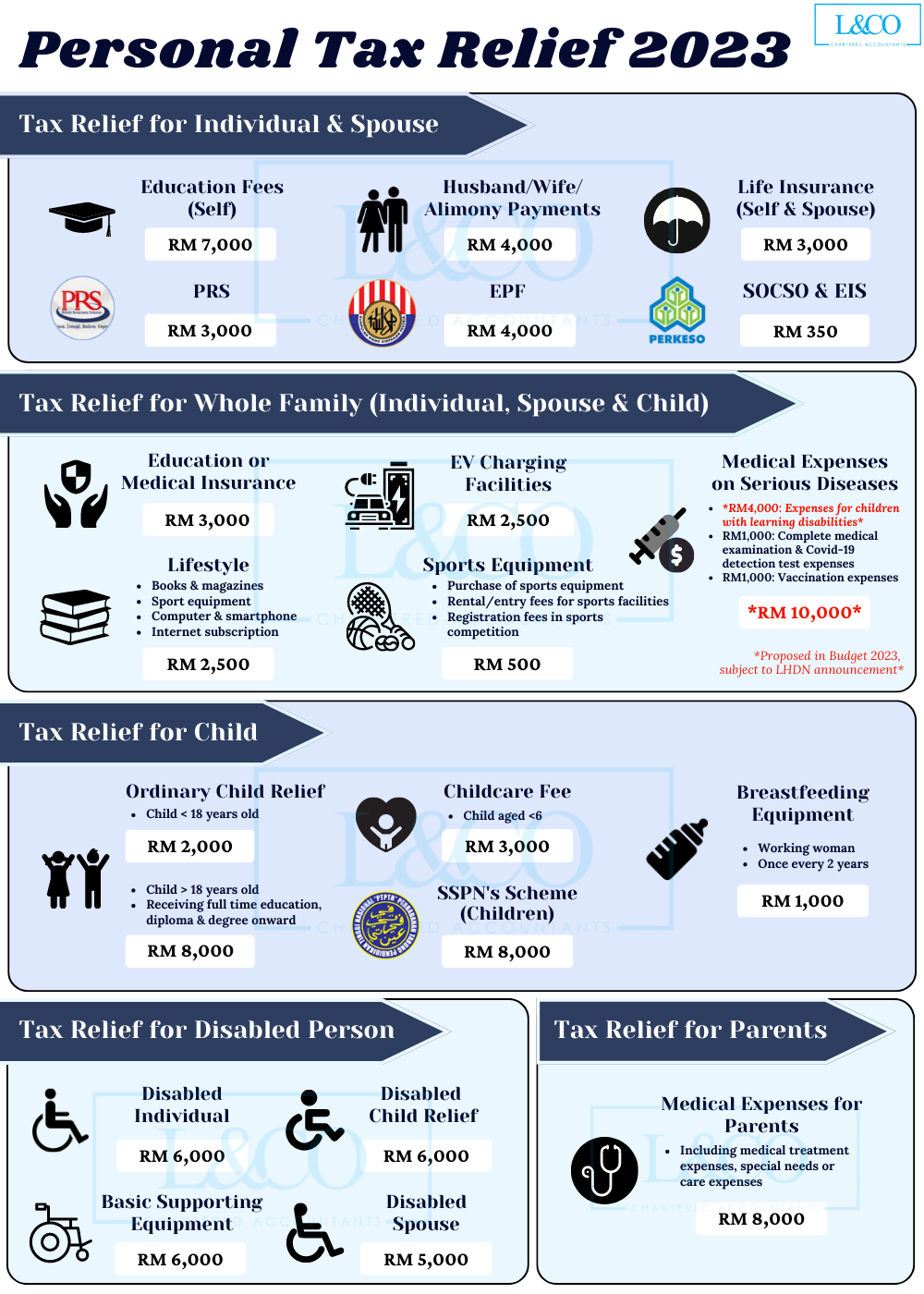

Tax Rebates YA 2023 Tax Reliefs Deductions Rebates In Detail This section is for you if you re seeking clarity on the details of each tax relief deduction or refund because as is to be expected many of them have requirements and conditions that must be met in order to be claimed

Subsection 6A 2 of the ITA provides that the tax rebate can be claimed by an individual who is resident and has chargeable income for the basis year for a YA as follows a A rebate of RM400 is granted to an individual who has been allowed a deduction for self and dependent relatives under paragraph 46 1 a of

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: Your HTML0 customization options allow you to customize designs to suit your personal needs such as designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Education-related printables at no charge are designed to appeal to students of all ages. This makes them a valuable tool for parents and teachers.

-

The convenience of You have instant access many designs and templates saves time and effort.

Where to Find more Tax Rebate For Individual Rm400

Tax Rebate For Individuals Swaper Investing Blog

Tax Rebate For Individuals Swaper Investing Blog

The amount of tax charged on your changeable income is RM755 Since your chargeable income is below RM35 000 you can claim a RM400 tax rebate So your total tax after tax rebate is RM755 RM400 RM355 Related Malaysia Income Tax e Filing Guide For Newbies Types of tax relief you can claim Here are some tax relief categories that

Rebates for Individuals with Chargeable Income not exceeding RM35 000 A rebate of RM400 is available to individuals with an annual chargeable income not exceeding RM35 000 Where the spouse does not receive an income or is jointly assessed a further RM400 rebate can be claimed Rebate on Departure Levy for performing Umrah and

Since we've got your curiosity about Tax Rebate For Individual Rm400 We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Tax Rebate For Individual Rm400 to suit a variety of uses.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing including flashcards, learning materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a broad spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Tax Rebate For Individual Rm400

Here are some innovative ways to make the most use of Tax Rebate For Individual Rm400:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Tax Rebate For Individual Rm400 are an abundance of innovative and useful resources catering to different needs and hobbies. Their accessibility and flexibility make these printables a useful addition to each day life. Explore the vast collection of Tax Rebate For Individual Rm400 now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these tools for free.

-

Are there any free printables in commercial projects?

- It's based on specific rules of usage. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may have restrictions regarding usage. Make sure to read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with any printer or head to a local print shop to purchase premium prints.

-

What software will I need to access printables for free?

- The majority of PDF documents are provided in PDF format, which can be opened with free software like Adobe Reader.

Samsung Is Offering An RM400 Rebate Off The Galaxy Note9 Just In Time

LHDN IRB Personal Income Tax Rebate 2022

Check more sample of Tax Rebate For Individual Rm400 below

Tax Cut By 2 Ppts For RM50 000 RM100 000 Income Group Raised To 25

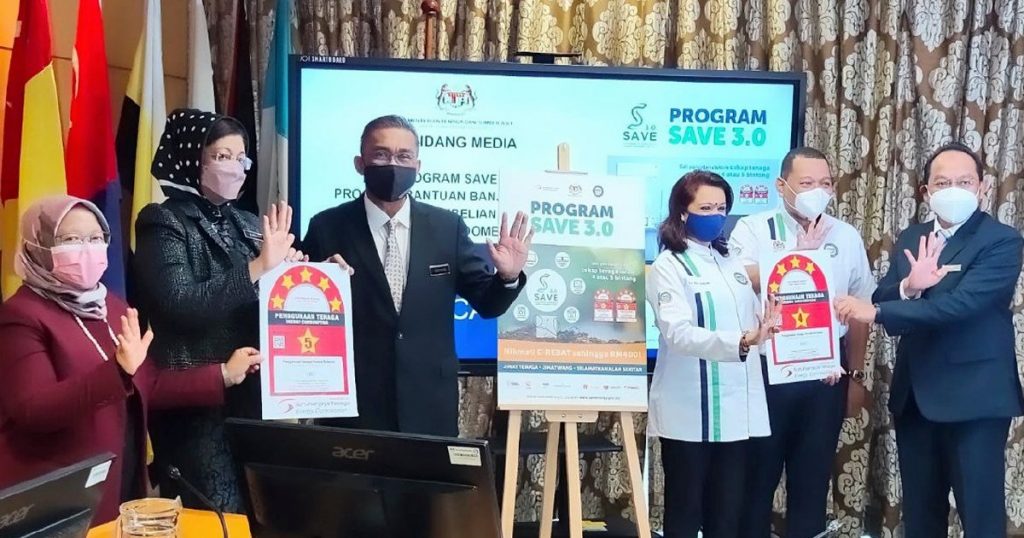

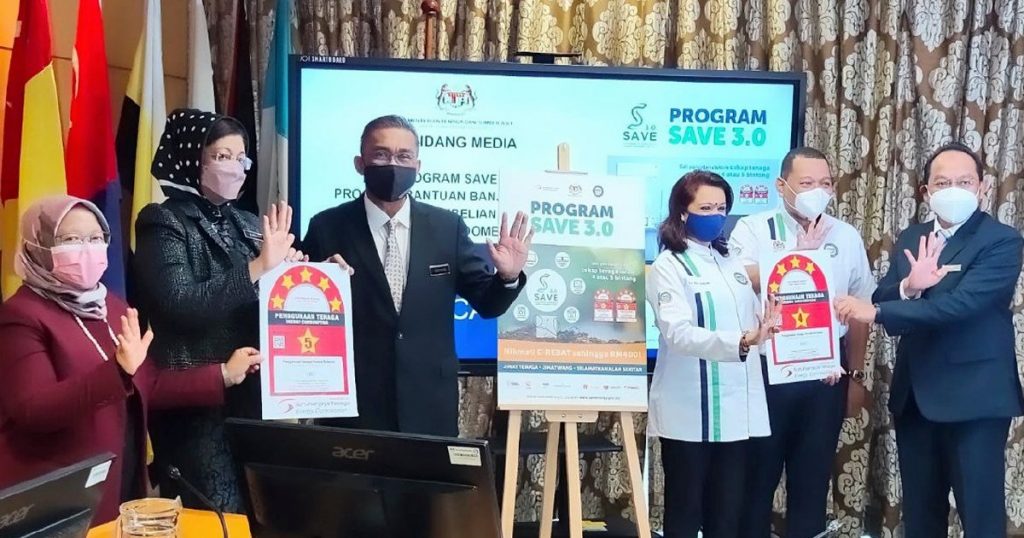

SAVE 3 0 Offers Up To RM400 Rebate To Buy Energy efficient Electrical

Tax Cut By 2 Ppts For RM50 000 RM100 000 Income Group Raised To 25

Govt Collects More Than RM400 Mln In Digital Service Tax

Claim A Tax Rebate For Your Uniform Rmt

2022 Property Tax Rebate Application For Seniors Braedon Clark

https://www.imoney.my/.../what-is-tax-rebate

There are the types of tax rebates available Individual for chargeable income less until RM35 000 can get a tax rebate of RM400 Wife Husband separate assessment can each get a tax rebate of RM400 if both have chargeable income of less than RM35 000 Wife Husband joint assessment can get a tax rebate of RM800 for joint income until

https://www.hasil.gov.my/en/individual/individual...

Tax Rebates Year Of Assessment 2001 2008 RM Year Of Assessment 2009 Onwards RM a Separate Assessment Wife Husband 350 350 400 400 b Joint Assessment Wife Husband 350 350 400 400 Total 700 800 b Asessment Where Husband Or Wife Does Not Has Any Total Income Wife Husband 350 350 400 400 Total 700 800

There are the types of tax rebates available Individual for chargeable income less until RM35 000 can get a tax rebate of RM400 Wife Husband separate assessment can each get a tax rebate of RM400 if both have chargeable income of less than RM35 000 Wife Husband joint assessment can get a tax rebate of RM800 for joint income until

Tax Rebates Year Of Assessment 2001 2008 RM Year Of Assessment 2009 Onwards RM a Separate Assessment Wife Husband 350 350 400 400 b Joint Assessment Wife Husband 350 350 400 400 Total 700 800 b Asessment Where Husband Or Wife Does Not Has Any Total Income Wife Husband 350 350 400 400 Total 700 800

Govt Collects More Than RM400 Mln In Digital Service Tax

SAVE 3 0 Offers Up To RM400 Rebate To Buy Energy efficient Electrical

Claim A Tax Rebate For Your Uniform Rmt

2022 Property Tax Rebate Application For Seniors Braedon Clark

M sians Claim Rebate Up To RM400 With Save 3 0 Here s How

Personal Tax Relief Y A 2023 L Co Accountants

Personal Tax Relief Y A 2023 L Co Accountants

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh